The slide of Tesla

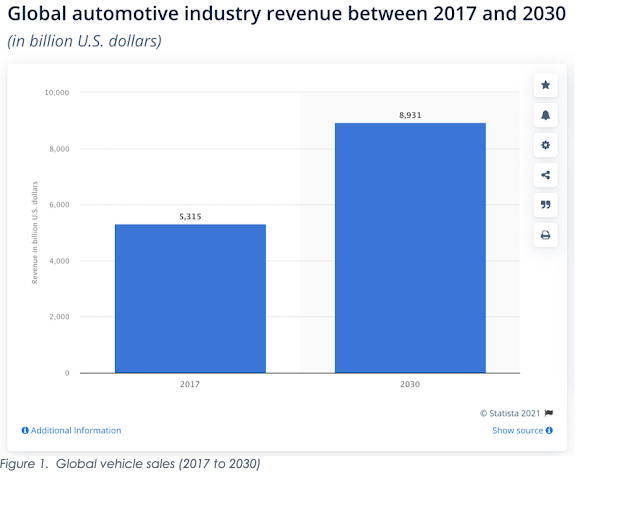

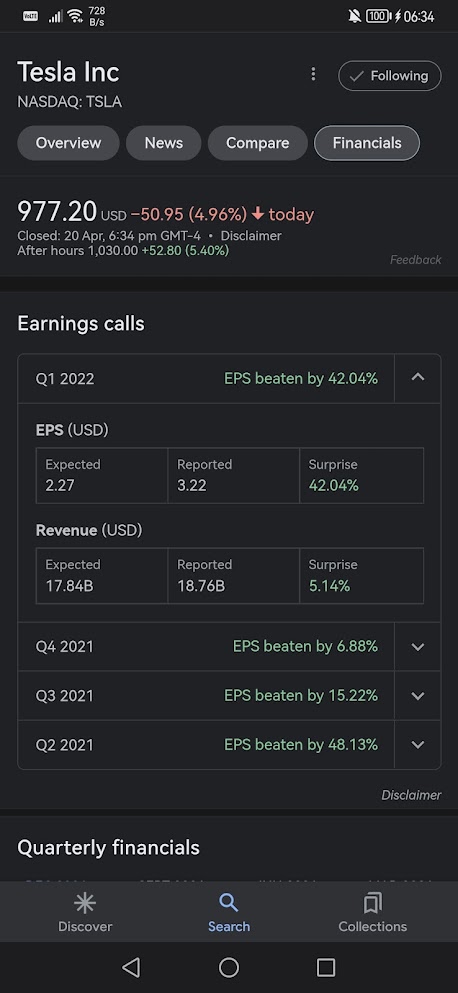

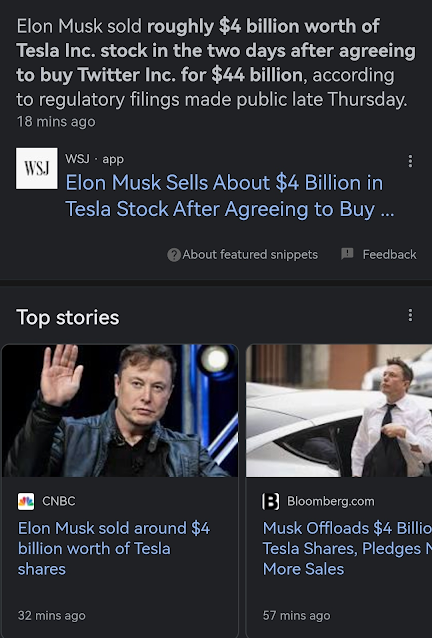

Tesla closed the trading day 28Apr2022 at a price of $877.35. During the after-hours, the price continues to slide with a 2% loss. Some Tesla News: Elon sold $4 billion worth of Tesla shares as announced on late Thursday.sales to fund his Twitter purchase. According to sources, this should be his only sale required for the purchase of Twitter. News of Elon selling $4 Billion of Tesla Shares From Twitter user Sawyer Merritt: Tesla was more profitable than GM in Q1 2022 despite delivering 78% less vehicles. Total Q1 vehicle sales: • GM: 1,427,000 (down -19.5% YoY) • Tesla: 310,048 (up +67.7% YoY) Total Q1 net income: • Tesla: $3.3B (+607% YoY) • GM: $2.9B (-3% YoY) 1D chart of Tesla as per 7.28am SGT From the 1D chart above, we can see that Technical indicators of Stochastic and MACD point to a downward trend. 1H chart of Tesla as per 2pm SGT From the 1H chart above, it looks like the downtrend should continue as per Stochastic and MACD indicators. Technical analysis of Tesla with 1D