Review of Tesla's Q1/2022 earnings - will Tesla's growth be slowed down by global supply chain

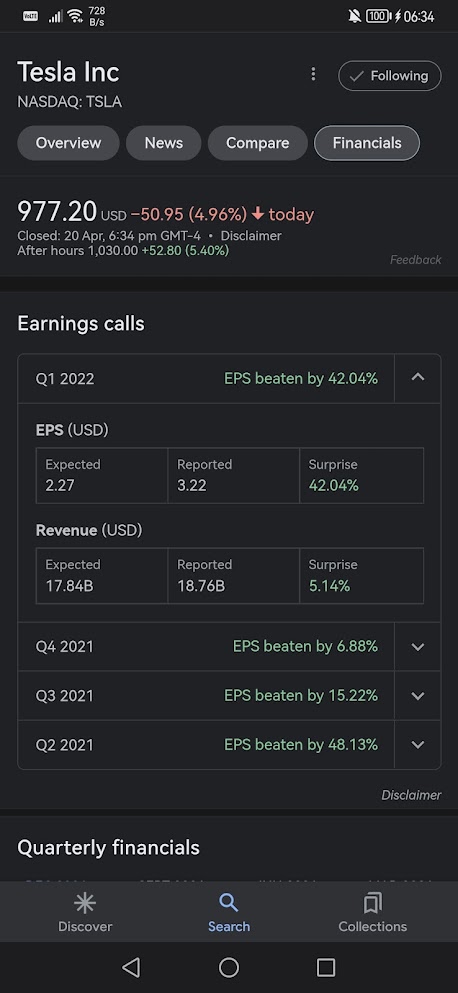

Tesla released their earnings with a solid beating of the estimates:

Summary

EPS 3.22 Vs 2.27

Revenue 18.76B Vs 17.84B

| ||

Earnings Summary from Investing.com

|

From the table above, we can see the strong growth of Tesla's revenue from the start in 2009. The growth looks to be compounding over the years.

Tesla's stock has risen over 5% post-market as earnings updates unfold.

There is much optimism with insurance growth, Optimus humanoid & FSD and the ramp up production of the 2 new GigaFactories (Berlin & Texas) would provide more reasons to be bullish about $TSLA. FSD is expected to go live by 2023.

Extract from Tesla's Shareholder deck dated 20 Apr 2022

OVERVIEWCashOperating cash flow less CAPEX (free cash flow) of $2.2B in Q1 Total debt ex. vehicle and energy product financing under $0.1BProfitability$3.6B GAAP operating income; 19.2% operating margin in Q1$3.3B GAAP net income; $3.7B non-GAAP net income (ex-SBC1) in Q1 32.9% GAAP Automotive gross margin in Q1OperationsProduction & Deliveries started from Gigafactory Berlin in March 2022 Production & Deliveries started from Gigafactory Texas in April 2022FINANCIAL SUMMARYRevenueTotal revenue grew 81% YoY in Q1 to $18.8B. YoY, revenue was impacted by the following items:+ growth in vehicle deliveries+ increased average selling price (ASP) + growth in other parts of the businessProfitabilityOur operating income improved to $3.6B in Q1, resulting in a 19.2% operating margin. This profit level was reached while incurring SBC expense attributable to the 2018 CEO award of $48M in Q1. YoY, operating income was primarily impacted by the following items:+ growth in vehicle deliveries+ increased ASP+ reduced cost (COGS) per vehicle despite inflationary pressures + lower stock-based compensation expense+ increase in regulatory credit sales- rising raw material, commodity, logistics and expedite costs- increase in operating expensesCashQuarter-end cash, cash equivalents and short-term marketable securities increased sequentially by $0.3B to $18.0B in Q1, driven mainly by free cash flow of $2.2B, partially offset by debt repayments of $2.1B. Our total debt excluding vehicle and energy product financing fell to less than $0.1B at the end of Q1.

Now, let us do a deep dive into the financials for the improvements, observations and concerns.

|

| Financial Summary |

- YoY (Q1-2022 vs Q1-2021) automotive revenue grew 87% and total revenue growth is 81%. Yet the operating expenses grew only by 15%. This means good costs control, making more profit for every revenue dollar.

- YoY (Q1-2022 vs Q1-2021) Free Cash Flow (FCF) grew 660%

- YoY (Q1-2022 vs Q1-2021) Total vehicle production (Model S/X & 3/Y) grew 69% to 305,407 units and Total deliveries grew 68% to 310,048. Without the expansion of Shanghai and the 2 new GigaFactories, Tesla is on track to hit 1.2 million vehicle production and deliveries. However, the Shanghai lockdown will continue to cast concerns over this though the plant is back to partial capacity as of 19 Apr 2022.

- Global vehicle inventory (days of supply) is down YoY (Q1-2022 vs Q1-2021) from 8 to 3. This implies that market demand is STRONGER than Tesla's production. This implies that every Tesla vehicle will sit on the "shelf" for no more than 3 days. This is a good sign especially after Tesla has to increase their prices to meet the surge in material, supply chain and production costs.

- YoY (Q1-2022 vs Q1-2021) Solar deployment has dropped by 48% though the storage deployed (MWh) has increased by 90%. The solar reduction was caused by import delays from the supply chain challenges.

- YoY (Q1-2022 vs Q1-2021) Mobile service fleet has increased 35% to support any breakdowns. This is a cost centre but is growing slower than the 81% total revenue. This needs to be monitored to ensure that Tesla drivers can get "quality and prompt" service and support as part of their experience. This can also boil down to the quality of the vehicles that require "lesser" support.

- YoY (Q1-2022 vs Q1-2021) Supercharger stations grew 38% and supercharger connectors by 37%. The concern is similar but this would be in effect for long-distance drives as most Tesla users would commute short distances and thus could charge at home.

- Challenges that have limited their plants from running at full production capacity are due to:

- global supply chain

- transportation

- labour

- other manufacturing challenges

- 4680 in house-made cells are starting in Texas and Berlin is using a mix of 2170 and 4680.

- FSD Beta is to be released to all US FSD users by end of 2022 with Canada's initial release of FSD Beta starting in March 2022.

- Improvements of software for climate control and charging time estimate > better user experience

- The battery is mostly LFP that does not contain nickel or cobalt, giving a Model 3 (LFP battery pack) a 267-mile EPA range. This is important for better price control and material demand as the price of these commodities have soared over time.

- Ramping up of production for Energy storage at the Megapack Factory.

- The insurance business has expanded with recent launches in Colorado, Oregon and Virginia. Thus, Q1-2022 saw services coming close to breakeven.

- Tesla's goal of vehicular production remains a 50% average annual growth rate over the coming years. However, Tesla has admitted this could be affected by equipment capacity, operational efficiency and supply chain challenges.

From the table above, we can be encouraged that Tesla has continued to deliver, meeting its milestones. In the pipelines, there are much more opportunities for growth with products such as insurance, Optimus humanoid, FSD and more.

The PE Compression of Tesla. Tesla PE fell from 196x to 133x. This is PE compression at its best. This means that the earnings growth of the business is faster than the price increase of the stock. For every dollar we invest, we receive more earnings in growth. In layman's terms, Tesla is crushing it.

CONCLUSION

From the chart above, though MACD is on a downtrend, we can expect the market to respond positively to the good earnings report.

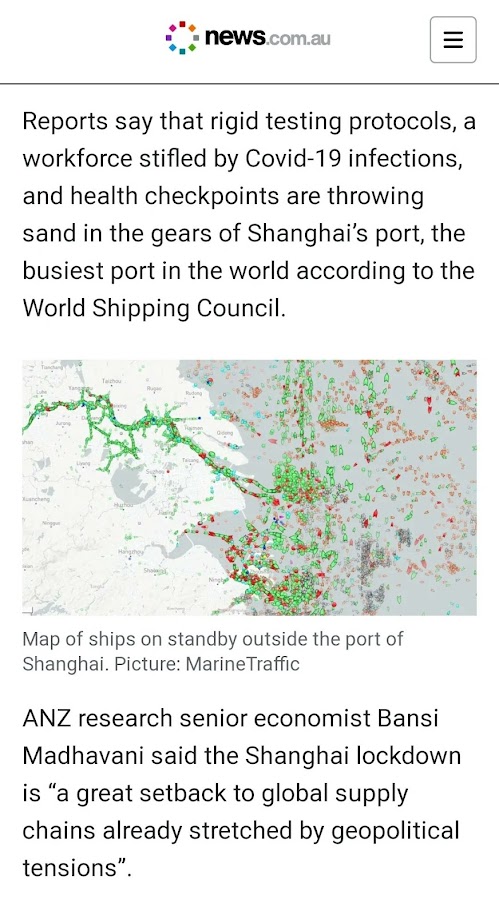

Situation in Shanghai

|

| Shanghai lockdown looks to impact the global supply chain. The impact will be felt in a few weeks. |

As per 19 Apr 2022 news:

The number of cargo ships waiting outside the port of Shanghai has 4x due to challenges arising from the city’s lockdown.

The global impact will be felt in weeks following the bottleneck of one of the biggest manufacturing hubs in the world.

|

| Tesla 1D chart as of 21Apr22 |

From the chart above, though MACD is on a downtrend, we can expect the market to respond positively to the good earnings report.

Tesla has put up another strong quarter. Financial fundamentals are in place and with much more growth, it is not hard to remain bullish for the company. But the challenges of the global supply chain, the Ukraine crisis and rising costs of materials will be the expected headwind. These will affect most businesses but thus far, Tesla has managed their supply chain and chip supplies much better than the competition. With more product offerings, we can expect the overall growth to be strong. Challenges in solar supplies will continue to limit the growth of solar deployment.

As always, let us research before investing.

Comments

Post a Comment