The surge in oil price and is there any easing in sight?

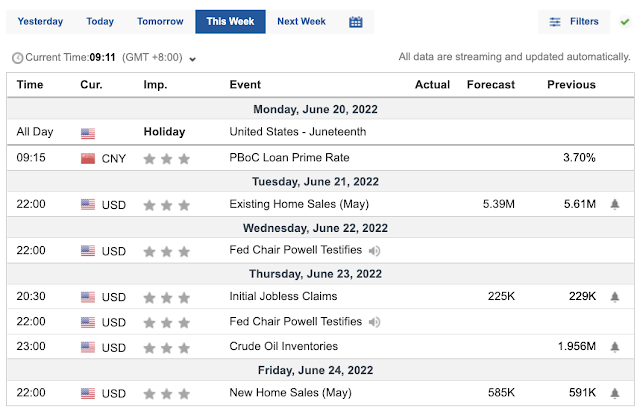

Surge in Oil prices Oil sits at the start of inflation as the energy resources go into every part of the market. Fuel costs cascades down into the energy, utilities, supply chain and then into products & services. For businesses that can pass additional costs to customers, they will pass the costs increase to the customers. Let us look at oil for a start and how this commodity can create an inflationary impact whenever the crude oil price surges: Oil price increase > fuel price increase > utilities cost increase > supply chain costs increase > goods and services price increase. (This leads to inflation as costs go up.) We need to understand that the challenge in the USA is not really due to the oil supplies but rather the bottleneck in the refinery capacity. US petroleum consumption will reach 20.51 million bpd (barrels per day) in 2022 US refinery capacity is short by 1 million barrels per day as per EIA chart above To meet the shortfall in refinery capacity, can