Is China the car production capital of the world? The case for EV looks strong

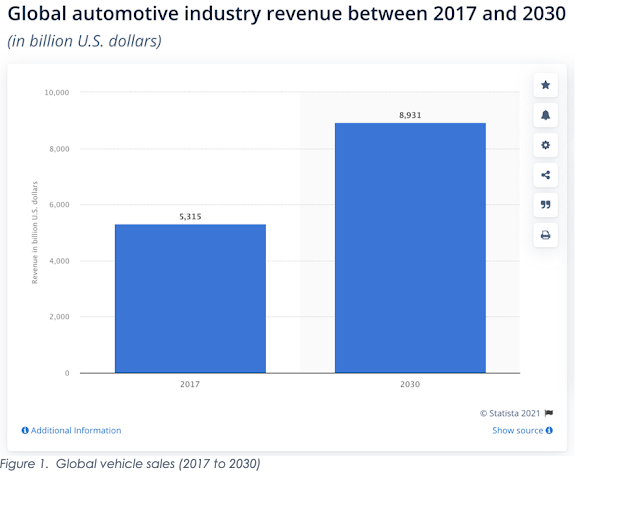

Published by Mathilde Carlier Aug 5, 2021It is projected that the global automotive industry will grow to just under nine trillion U.S. dollars by 2030. It is anticipated that new vehicle sales will account for about 38 percent of this value. This means that USD$3,393.7 billion will be spent on new vehicles in 2030.

Automotive technology will change considerably in the next decade. One in five new car sales globally are expected to be battery electric vehicles, and millions of new self-driving cars will be added to the world’s fleet.

Technological advancements begin to affect the type of parts that are required to complete the finished product. This allows for further segmentation in the auto supplier industry, particularly of electrical components. The biggest changes to the automotive industry currently are automation and electrification. As autonomous and electric vehicles take over the market, other industries will boom in demand such as automotive semiconductors. China will likely lead in the development of driverless and battery electric technology.

Global sales of automobiles are forecast to fall to just under 70 million units in 2021, down from a peak of almost 80 million units in 2017. The auto industry's most important industry segments include commercial vehicles and passenger cars. China is counted among the largest automobile markets worldwide, both in terms of sales and production. Car sales in China dipped for the first time in 2018 - the market cratered in February 2020 but bounced back shortly after. The global market is poised for a recovery in 2022.77.7m units of motor vehicles were sold in 2020China was the largest automobile market worldwide in 202024m units of commercial vehicles were sold in 2020 (30.8%)https://www.statista.com/topics/1487/automotive-industry/#dossier-chapter2

Automakers continue to roll out new production facilities in China with Audi making the announcement after BMW. Audi breaks ground on first facility dedicated to pure electric vehicle production in China. The project, with a design capacity of 150,000 vehicles per year, is scheduled to start production by the end of 2024.On January 18, 2021, Audi, Volkswagen and FAW announced that Audi-FAW will be set in Changchun, with Audi and Volkswagen holding a 60 percent stake in the joint venture and FAW holding the other 40 percent.Audi-FAW will invest RMB 15.8 billion in the initial phase, and the first phase will include the production of Audi Q6L e-tron (eQ5), Q6L e-tron Sportback (eQ6) pure electric SUV models and E6L Limousine pure electric sedan on the PPE platform, according to local media Chinastarmarket's report at the end of last year. The joint venture was expected to receive a permit to build the plant in December last year, but the plan has since encountered delays.

In January this year, BYD invested an additional RMB 20 billion to build the second phase of the auto industrial park, according to Shenzhen Economic Daily. The investment in the two phases of the project will total RMB 25 billion, and the annual output value is expected to exceed RMB 100 billion when all production is reached, according to the report.

BYD stopped production and sales of traditional internal combustion engine (ICE) vehicles in March to focus on battery electric vehicles (BEVs) and plug-in hybrid vehicles (PHEVs). It sold 114,943 vehicles in May, marking the third consecutive month of more than 100,000 units. From January to May, BYD sold 507,314 units, up 348.11 percent from 113,213 units in the same period last year.

BYD wins new land parcel of over 550,000 sqm in Shenzhen for parts project-BYD's order backlog is as high as 600,000 units, with a delivery cycle of five to six months, National Business Daily said earlier this month, citing minutes of the company's shareholders' meeting. BYD expects China's new energy vehicle penetration rate to exceed 35 percent this year and could reach 40 percent, local media Cailian reported in late March, citing minutes of the company's investor meeting. In a conservative scenario, BYD expects it to sell 1.5 million units in 2022, or 2 million if supply chain conditions improve, according to the minutes.

BMW

With a total investment of RMB 15 billion ($2.24 billion), the project is BMW's largest single investment in China to date and reflects the BMW Group's long-term confidence in and commitment to the Chinese market, the company said in a press release.The Lydia plant has an electrification-oriented production system for up to 100 percent electric vehicle production capacity, and BMW's first all-electric midsize sports sedan, the BMW i3, is already in production here, the company said.With the climb in capacity at the Lydia plant, the Shenyang site's production capacity increased to 830,000 vehicles per year, BMW said.

Comments

Post a Comment