My investing muse - how to trade near earnings reports? (14Feb2022)

The market usually gets excited (or worried) leading to the business earnings.

There are investors who buy the stock before the earnings anticipating that the stock would go up or down after the earnings were released. While we may gather much information from various sources, it would still be difficult for us to ascertain how the market will "react" to the news. In the earnings reports, there are 3 components that are crucial. For this, let us use Walmart $Wal-Mart(WMT)$ as an example:

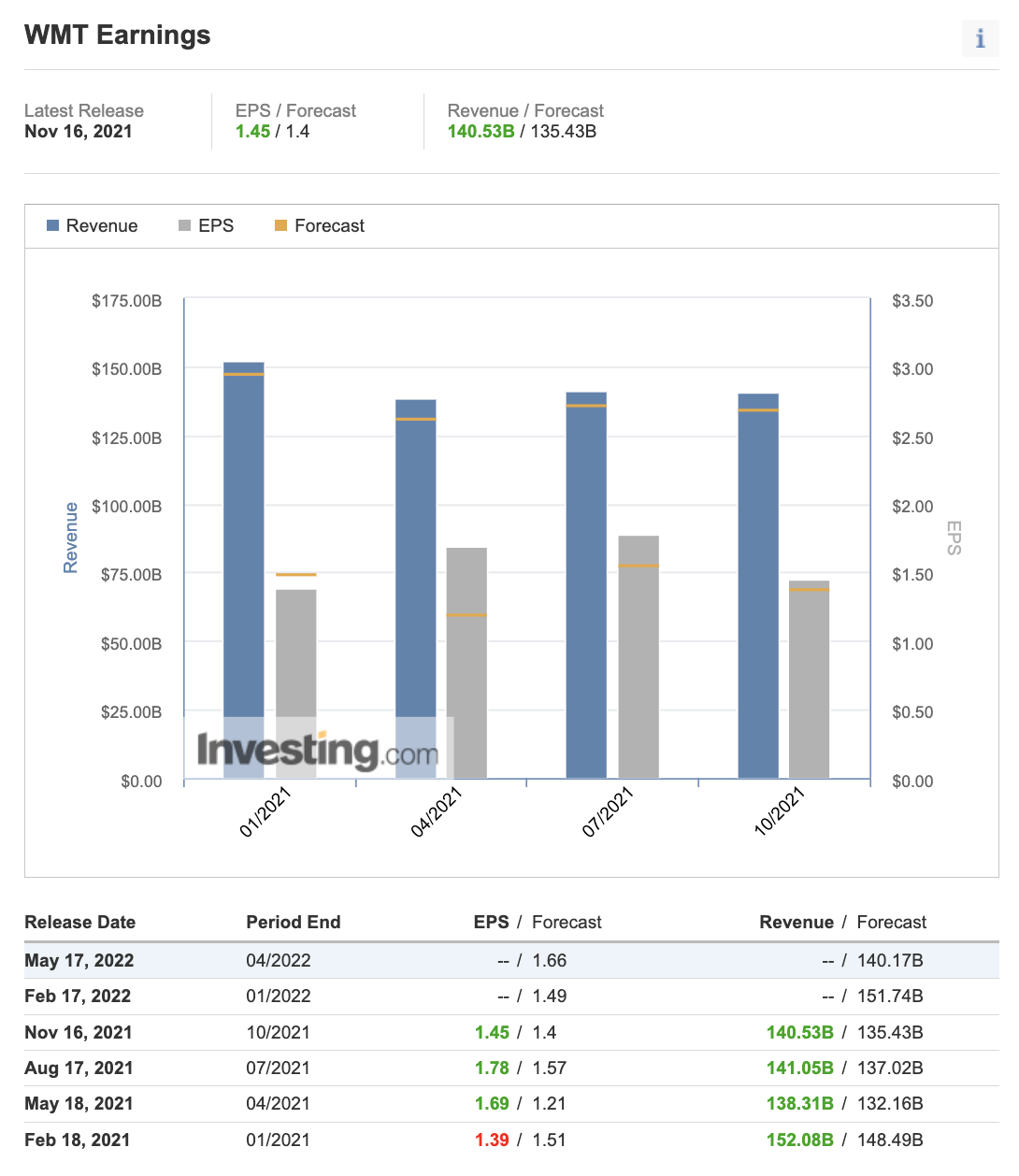

From the earnings forecast above (from www.investing.com), we see that there are 2 components highlighted namely, the Revenue and EPS (earnings per share).

For the period ending 01/2022, the market is expecting Walmart to meet or beat $1.49 for EPS and $151.74B for revenue. Why would the price fall when both EPS and revenue beat the market? Assuming that the drop is not a market-wide fall, the 3rd component that affects the stock price after earnings is likely the guidance provided by the company. If the guidance is weak, the price may not rise despite beating both EPS and revenue in the quarterly earnings. If guidance is bullish, the price may rise even if one of the components (revenue or EPS) fail to beat the forecast. We will usually find the guidance in the Earnings Report itself. There are also other components that will affect the outlook of the business: daily users, monthly users, new subscriptions, delay in key product development (eg Tesla pushing back the rollout of the $25K car), investment loss (in subsidiaries), failure to buy over another business, etc. All these form part of the market sentiment towards the stock.

Using the 1 Day chart, the technical indicators are indicating a downward trend of the current prices (as seen from both Stochastic and MACD in the chart above). A death cross is spotted in the last week of Jan 2022 (when moving average 50 line cuts moving average 200 line from above), usually a bearish signal. However, the trend can easily change following strong earnings and guidance for 2022. There is an important support level that is around $135 for Walmart.

Given the above info, how can we trade around the earnings?

First, after qualification that the company is great (with durable competitive advantages, sound finances and strong growth) we can invest in the business when this company is available at good discounts. Personally, I would include "technical indicators" when these are in my favour (using 1 Day time frame). If the technical indicators reveal a current downtrend, I can afford to wait for the reversal and buy after dip (BAD). This purchase can happen anytime, and not just near earnings.

Next, I recommend Post-Earnings Trading (PET) as part of a potential short term trade. If I do not know enough of a business's performance, I would usually buy "after" the news. Taking a position before earnings seem (overly) speculative in nature. The market can swing to "extremes" - leading to overbuying or overselling of stocks. It may require us to wait for a few days/weeks but it would allow us to avoid the volatility and potential losses. Let us not forget to "manage" our risks on the downside. We would lose over 30% if we bought $Meta Platforms, Inc.(FB)$ just before their most recent earnings.

Without a good knowledge of the performance of the business, buying before earnings would be more like the flipping of a coin. To manage our risk, we do our research in the company and time our purchase to optimize our profits. I may miss out on big breakouts but I can also avoid big losses with this approach.

Comments

Post a Comment