Weekly preview (31 Oct 2022) - will Cheniere $LNG continues its rise?

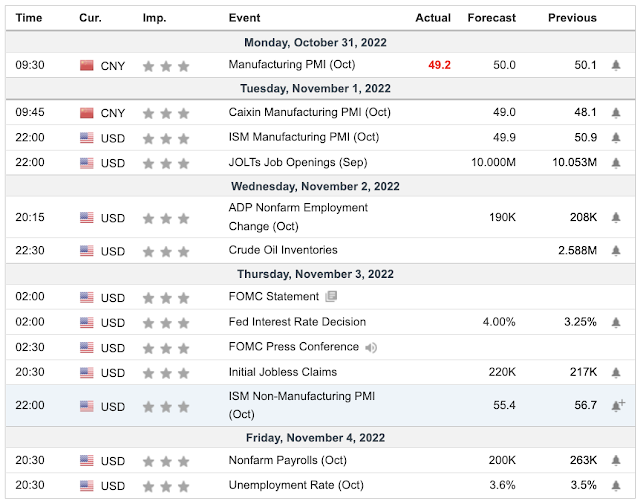

Public Holidays Nil - Singapore, Hong Kong, China & the USA Economic Calendar Economic Calendar of the week starting 31 Oct 2022 Some of the things to look out for: The week started with China's manufacturing PMI (Oct) falling to 49.2 against a forecast of 50.0. As China remains the world's factory, this will bring concern about the weakening demand of the rest of the global market. US ISM manufacturing PMI (Oct) will be announced. This represents the outlook of the producers/manufacturers. If this continues to be on a downtrend, the market demand looks to be bearish. Crude Oil Inventories, this is one the leading indicators (for me) coming to inflation and consumer demand. If the inventory is more than the forecast amount, this implies a weakening demand (seen from the oil producers). Initial jobless claims, nonfarm payrolls and the unemployment rate will be important data points for the Fed to take into consideration for the last rate hike of the year. If the unemploy