Weekly preview (31 Oct 2022) - will Cheniere $LNG continues its rise?

Public Holidays

Nil - Singapore, Hong Kong, China & the USA

Nil - Singapore, Hong Kong, China & the USA

Economic Calendar

|

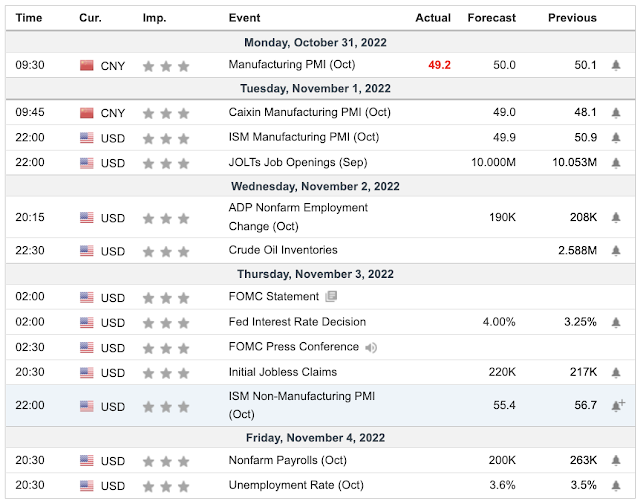

| Economic Calendar of the week starting 31 Oct 2022 |

Some of the things to look out for:

- The week started with China's manufacturing PMI (Oct) falling to 49.2 against a forecast of 50.0. As China remains the world's factory, this will bring concern about the weakening demand of the rest of the global market.

- US ISM manufacturing PMI (Oct) will be announced. This represents the outlook of the producers/manufacturers. If this continues to be on a downtrend, the market demand looks to be bearish.

- Crude Oil Inventories, this is one the leading indicators (for me) coming to inflation and consumer demand. If the inventory is more than the forecast amount, this implies a weakening demand (seen from the oil producers).

- Initial jobless claims, nonfarm payrolls and the unemployment rate will be important data points for the Fed to take into consideration for the last rate hike of the year. If the unemployment rate remained low, the Fed should be able to continue its hawkish approach.

- The most important decision of the week will have to be the Fed interest rate decision during Asia's late night. The market was hoping for the Fed to pivot towards a less hawkish stand but the recent inflation and GDP figures have probably encouraged the Fed to remain hawkish. 75 basis is widely anticipated but we should not be surprised if the Fed introduces a more aggressive 100 basis points for the interest rate.

Earnings Calendar

|

| earnings starting 31 Oct 2022 |

One of the promises made by President Biden was to support Europe with LNG from the US following the Ukraine conflict. While Russia remains the biggest gas supplier to Europe, they will appreciate all non-Russian sources. Thus, this is one company which has been making "good" profits during this crisis.

Cheniere's stock has risen to 174.48, close to the 52-week high of 178.62. The price has risen 68.74% from a year ago.

For the coming earnings, Cheniere has a forecast of 5.21 and 7.37B for its EPS and revenue respectively. Will the stock continue its rise as winter approaches? Will the growth be sustainable?

- <NPR.org> U.S. is experiencing one of the biggest shortages of diesel since 2008. Currently, there are only 25 days of supply left, and that number is dropping fast.

- <WSJ> US has chalked up record credit card debt.

- <Bloomberg> The US Diesel Crisis Is Here and It's Spreading Along the East Coast. Prices spike in areas with delivery delays and truck shortage. Supplier requires 72-hr notice for fuel delivery in Southeast

- The market should rally after we see a resolution to the Ukraine conflict. We could use our pens to end this conflict instead of bullets.

- The market is not good at incorporating human atrocities and maybe more of the secondary impact of the economics involved.

- During a bull market, overbought is the tendency. During a bear market, oversold is the tendency.

- <investing> With the latest GDP (QoQ) data on 27 Oct 2022 showing 2.6% growth, does this imply that the Fed Reserve can remain its hawkish stand?

- FAANG+ have largely disappointed with their latest earnings. What else does the market have to pivot upon for a rally for the rest of the earnings? The downturn looks unavoidable for now. Brace for impact.

- <CNBC> Buy now, pay later is a type of leverage. Let's spend within our means as it can lead to financial ruins.

- <CNBC> Wave of LNG tankers is overwhelming Europe in energy crisis and hitting natural gas prices. The underlying infrastructure issue is a lack of European regasification capacity due to a shortage of regasification plants and pipelines.

- <CNBC> Logistics managers are dusting off their plans for a possible railroad strike in November that could wreak havoc on the supply chain and cost the U.S. economy up to $2 billion a day.

- <CNBC> The latest data in the CNBC Supply Chain Heat Map shows China is losing more manufacturing to Vietnam, Malaysia, Bangladesh, India, and Taiwan.

Market Outlook

Technical analysis of the S&P500 1D chart:

- The Stochastic indicator - looks to have peaked and the market may take a dip in the coming days.

- The MACD indicator - looks to be on uptrend.

- Exponential Moving Averages (EMA) lines have shown a reversal from the downtrend, and demonstrates an uptrend.

- Moving Averages (MA) lines are showing downtrend. MA200 (long term) looks to be on a downtrend. MA50 (short & mid term trend) is on a downtrend.

- The candle has cut the MA50 has it could be going either way.

From the above, the indicators are showing potential of S&P500 going up or down. Personally, the Fed Reserve will have a say when the interest rate is announced on Wednesday. The market could be going sideways and being volatile at the mean time.

My investing Muse

|

| FAANG+ as at 26 Oct 2022 market close |

Following 26th Oct 2022, most of the FAANG+ stocks recorded a less than favourable YTD performance as per the above. As such, we would expect the market to be taking a dip last week as Big Tech commands a good 25% of the S&P500 market cap. However, it is interesting to note that S&P500 did not end "lower" following the earnings of Big Tech. In fact, S&P500 ended the week on a higher note.

During the last few years, the growth of S&P500 are powered by Big Tech and yet, despite the "largely" disappointing earnings, the market has not buckle under the pressure. Does this spell the "loss of influence" of these growth stocks or are they going to be "value" stocks after years of strong performance.

Personally, FAANG+ is a thing of the past. I think that Google & Microsoft are the 2 strongest. Many may argue that Apple will continue to do well and Amazon has an amazing AWS growth story. What is interesting that Meta (formerly known as Facebook) looks to be going down. Will Mark's investment into the metaverse pays off in the coming future? From the recent stock plunge, it seems clear that there are investors who do not share the same sentiment. Be it virtual, augmented or mixed reality, humans are made to connect in person. Metaverse should remain a work around but there is great potential with applications in training, education.

Elon has finally completed the purchase of Twitter, firing the C suite on his first day at work. Coming to Free Speech, Elon claims to be an absolutist. Elon has the potential to turn the business around. He has a proven track record in sustainable innovations but social media can be a different beast. It is not to claim that Twitter is doomed but it can be too early to say. Free Speech is a double edged sword and some aspects of language can be interpreted differently by different cultures. This can potentially add more conflict arising from the difference in value, perspective, culture and morality. Looking at the recent 6th Jan, Capitol Hill riot, will this add to the evident division surfacing in America. While some see Russia and China as threats to the American Dream but the greatest enemy may arise from USA itself. In this world, we need more cooperation and less division as we battle the crisis of finance, food and fuel.

With Eurozone hitting an inflation of 10.7%, the approaching winter would simply compound their woes. With energy/gas crisis, they have been hit by extreme weather, leading to less than favourable harvest. The increase in interest rates to battle inflation would continue to affect both disposable income, loans and demand.

While some hope for the Fed to pivot, the recent GDP growth, low unemployment and heightened inflation would continue to fuel their hawkish stand. 75 basis points is expected and probably factored in but we should not be surprised by 100 basis points. The housing market has been hit hard with mortgage rate hitting 7.1% and not many family would be able to afford such increase with mortgage taking up a recommended 40+/-% of the total household spending. Would the housing market give in with some families walking out of new homes and half built houses?

Ukraine continues to remain an area of concern. As per the "All in Podcast", it is hard to see the market posting strong rallies till the Ukraine conflict is resolved. Unfortunately, the countries look to be further from a peace deal with non-conventional weapons being taunted. Should President Putin feels that Russia's survival is under threat, resorting to nuclear remains a viable option. When one is backed into a corner, desperate times will call for desperate measures. Rather than assuming "using nuclear as a bluff", it may be prudent to assume all possible scenarios. There is still time to use pen instead of bullets to close out this matter.

With record household debts, inflation, weather extremities and a political storm in the coming mid term election, we can expect the media to be pumping out various news. Let us look beyond the delivery, content and also question the intent. We owe it to ourselves to be objective so that we can do what is best for ourselves, our loved ones during this challenging time. Let us spend within our means, do not leverage, invest with what we can afford to lose. Let us consider setting aside some cash for crash so that we can purchase great companies at good discounts.

Comments

Post a Comment