10 Things You Should Know About Bear Markets (Hartford Funds)

I have stumbled upon this great article "10 things you should know about bear markets".

Source of the article:

https://www.hartfordfunds.com/practice-management/client-conversations/bear-markets.html

Excellent observations about the market by Hartford Funds.

- Watch for 20%: Market cycles are measured from peak to trough, so a stock index officially reaches bear territory when the closing price drops at least 20% from its most recent high (whereas a correction is a drop of 10%-19.9%). A new bull market begins when the closing price gains 20% from its low.

- Stocks lose 36% on average in a bear market. By contrast, stocks gain 114% on average during a bull market.

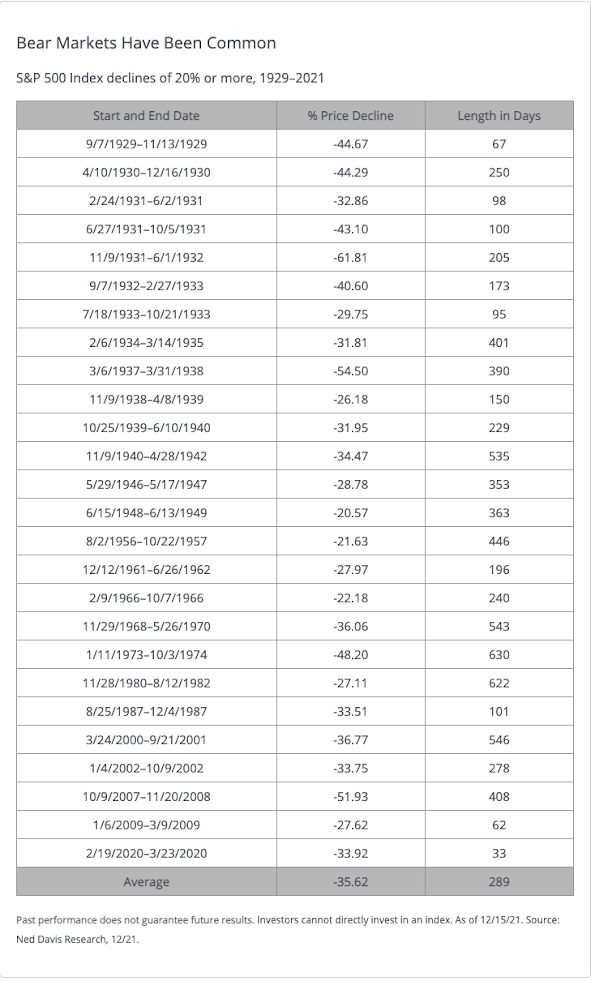

- Bear markets are normal. There have been 26 bear markets in the S&P 500 Index since 1928. However, there have also been 27 bull markets—and stocks have risen significantly over the long term.

- Bear markets tend to be short-lived. The average length of a bear market is 289 days, or about 9.6 months. That’s significantly shorter than the average length of a bull market, which is 991 days or 2.7 years.

- Every 3.6 years: That’s the long-term average frequency between bear markets. Though many consider the bull market that ended in 2020 to be the longest on record, the bull that ran from December 1987 until the dot-com crash in March 2000 is technically the longest (a drop of 19.9% in 1990 nearly derailed that bull, but just missed the bear threshold).

- Bear markets have been less frequent since World War II. Between 1928 and 1945 there were 12 bear markets, or one about every 1.4 years. Since 1945, there have been 14—one about every 5.4 years.

- Half of the S&P 500 Index’s strongest days in the last 20 years occurred during a bear market. Another 34% of the market’s best days took place in the first two months of a bull market—before it was clear a bull market had begun.2 In other words, the best way to weather a downturn could be to stay invested since it’s difficult to time the market’s recovery.

- A bear market doesn’t necessarily indicate an economic recession. There have been 26 bear markets since 1929, but only 15 recessions during that time.3 Bear markets often go hand in hand with a slowing economy, but a declining market doesn’t necessarily mean a recession is looming.

- Assuming a 50-year investment horizon, you can expect to live through about 14 bear markets, give or take. Although it can be difficult to watch your portfolio dip with the market, it’s important to keep in mind that downturns have always been a temporary part of the process.

- Bear markets can be painful, but overall, markets are positive the majority of the time. Of the last 92 years of market history, bear markets have comprised only about 20.6 of those years. Put another way, stocks have been on the rise 78% of the time.

My investing muse

So long we maintain a long term investing timeframe, we can outlive the bear markets. In the last 92 years, 20.6% are bear markets and the market is on the rise 78% of the time.

Time in the market is more important than timing the market. Thus, dollar-cost averaging (DCA) can be a good strategy for those who do not have time to research the market.

The trend is our friend but time is our multiplier.

When the bears show up, the people hide when it is time to load up.

Comments

Post a Comment