Preview of the week starting 20 Jun 2022

Public Holidays (USA, China & Hong Kong)

20 June 2022 - Juneteenth holiday in USA

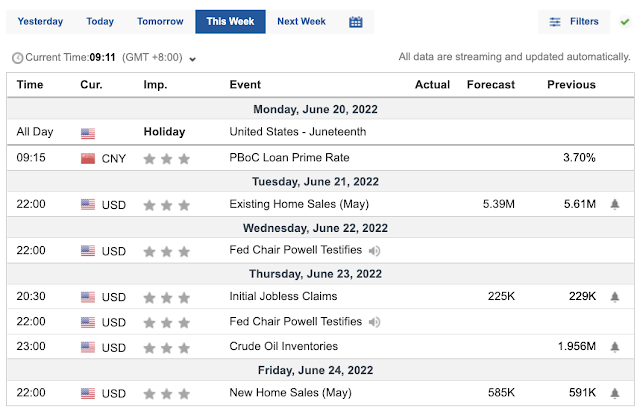

Economic Calendar

Though last week's 75 basis point interest rate hike stole most of the timeline, it is still important for us to monitor some of the economic updates this week.

China will be announcing their Loan Prime Rate this week.

For the US, we have important indicators coming out for both new and existing home sales (May). This will be a crucial indicator of the market's recovery from the market but more affordability the demand and supply for the red hot real estate market.

The initial jobless claims will form part of the key considerations for the Fed as they monitor the success of their various actions (rate hike and sale of their purchased assets). These will form the basis for the next rate hike. Will it be 50, 75 or more basis points?

The last important data is the crude oil inventories. This is a forward indicator that the producers expect for the coming weeks of consumption. The consumption of crude oil will need to be processed and turned into raw materials before going into the production of goods and services. Thus, this always renders a preview of how the manufacturers see the consumption in the coming weeks.

Earnings Calendar

FedEx

FedEx Corporation (FedEx) provides a portfolio of transportation, e-commerce and business services through companies competing collectively and operating independently, under the FedEx brand. The Company's segments include FedEx Express, FedEx Ground, FedEx Freight and FedEx Services.

Accenture

Accenture plc is a professional services company, providing a range of services in strategy and consulting, interactive, technology and operations. It also provides network engineering, operations and services. Its segments include Communications, Media and Technology; Financial Services; Health and Public Service; Products, and Resources. The Communications, Media & Technology segment serves communications, electronics, technology, media and entertainment industries.

For Accenture, the forecast of their coming EPS and Revenue stands at $2.85 and 16.04B respectively.

<The above information and charts are extracted from investing dot com>

News Summary

The strong inflation data (14Jun22) shocked the corporate as aggressive rate hike is expected from the Fed in response. The cost of insuring against potential defaults rose sharply, in a sign of risk aversion.

Australia could be hit by blackouts in 5 States as per latest news (dated 14Jun22).

More than 90% of stocks in the S&P 500 declined today (17Jun22). It's the 5th time in the past 7 days. Since 1928, there have been exactly 0 precedents. This is the most overwhelming display of selling in history.

Laos hit by fuel shortages and growing default risk.

the recession will hit the demographics differently. For those who have lesser disposable income, these would be affected the worst. With US's economy driven by consumption, the GDP will be taking a significant hit. It is time for the government to plan for social safety nets.

China and India buys oil from Russia as the war drags on as per news from Nikkei on 8 Jun 2022 news article. China and India buy more Russian oil, blunting Western sanctions. Both countries take advantage of discounts as buyers disappear.

Market Outlook

From the 1D S&P chart above, the stochastic looks to a potential reversal but the MACD indicator shows that the downtrend still continues. From the EMA lines above, we see that all 3 lines are still spreading outwards, without signs of convergences. This thus supports the MACD indicator of the likely continuing of the downtrend in the coming week.

There are no major "earnings" that could potentially lift the market. With the USA releasing 45 million barrels of oil from their oil reserve, this would not bring any relief to the rising fuel price unless they are able to increase their supply and refinery capacity. Fuel price increase will also lead to utilities cost increasing - this will add on to the costs of supplies (both goods and services), supply chain. Hopefully, there will be lesser climate-related extremities or this will weigh heavy on the agricultural produce strain.

In essence, we should be part of the recession and a crash is expected. With the recent decline of crypto assets, it is needful for us to review our portfolio and prepare to identify great companies available at good discounts.

Let us spend within our means, invest what we can afford to lose and set aside "cash for crash".

Comments

Post a Comment