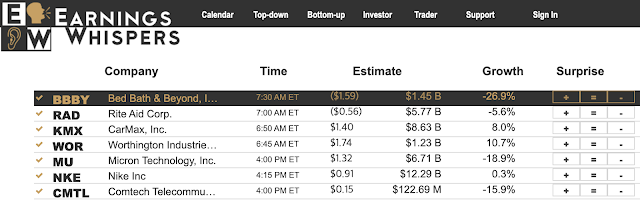

Preview of week 26Sep22 - Micron and Nike report their earnings this week

Public Holidays None - Singapore, Hong Kong, China & the USA Earnings Calendar In. the coming week, the above will be some of the earnings of interest on 29 Sep 2022 (Thursday). Personally, both Micron and Nike will be interesting. Micron Micron's 1-year overview Micron has fallen 32.34% from a year ago after hitting a 52-week high of 98.45. Unfortunately, it remains close to the 52-week low of 48.46. The company seems to be on a downtrend. With the coming earnings, will Micron's slide continue given the bearish market outlook following Fed's recent hawkish rate hikes? The forecast of its earnings and revenue stood at $1.32 and $6.71B respectively. Nike Nike's 1-year overview Nike has fallen 35.14% from a year ago. It once scaled the height of 179.10 but now was ranging sideways with potential for further slip. Currently, the stock lingers near the 52-week low of 95.35 and with the recent outlook, we could foresee potential volatility and downside...