Preview of the week starting 12Sep22 - will inflation data lead to a rally?

Public Holidays

China and Hong Kong will be closed on 12 Sep 2022 as they celebrate Mid Autumn Festival.

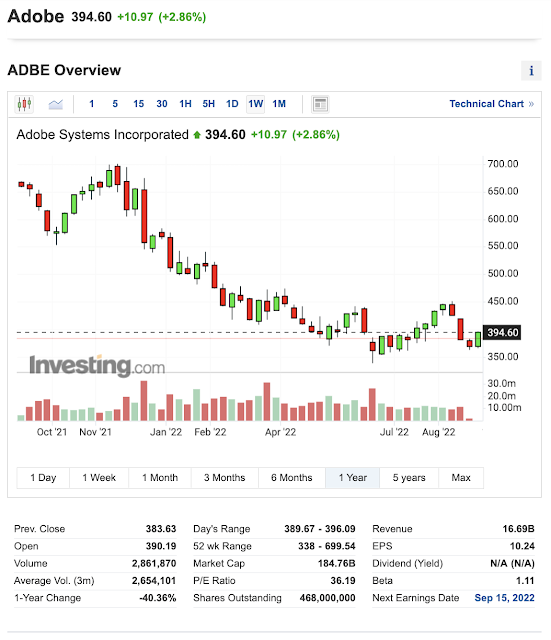

Earnings Calendar - Adobe

Adobe will share its earnings report this coming week on 15 Sep 2022.

Economic Calendar

There are a few important updates in the coming week:

China and Hong Kong will be closed on 12 Sep 2022 as they celebrate Mid Autumn Festival.

Earnings Calendar - Adobe

Adobe will share its earnings report this coming week on 15 Sep 2022.

Adobe stock has fallen 40.36% from a year ago. Within the last 52 weeks, it reached a height of 699.54 and a recent low of 338.

The forecast of its earnings is 3.34 and 4.44B for EPS and revenue accordingly. The other factor which can affect the stock movement is the outlook provided by the company. Will the company continue to beat the forecast and break out from its recent lows? With Adobe be able to break out from the downtrend?

Economic Calendar

|

| Economic Calendar for the week starting 12 Sep 22 |

There are a few important updates in the coming week:

US will share the important CPI (Aug) figure - this will be an important data point for Fed's coming interest rate adjustment plans. With the falling pump prices, we should be able to expect some "relief" - however, we need to know if this is sufficient for the Fed to take a less hawkish approach via the interest rate.

PPI (Aug) is also an important indicator that we need to look into as it addresses the "inflation" affecting the producers before it reaches the consumer/market.

Initial Jobless Claims will be the other important indicator that the Federal Reserve will need to consider before

Focus on Crude Oil Inventory

Crude oil inventory is an important forward-looking indicator. As oil is the raw product that enters the market after refining, process and production. Thus, if the demand for oil weakens, it is a sign of a weakening demand (that should surface months later).

|

| Crude Oil inventories |

The Energy Information Administration's (EIA) Crude Oil Inventories measures the weekly change in the number of barrels of commercial crude oil held by US firms. The level of inventories influences the price of petroleum products, which can have an impact on inflation.If the increase in crude inventories is more than expected, it implies weaker demand and is bearish for crude prices. The same can be said if a decline in inventories is less than expected.If the increase in crude is less than expected, it implies greater demand and is bullish for crude prices. The same can be said if a decline in inventories is more than expected.

Personally, I see crude oil inventory as the leading indicator of market demand, before we look at PPI to identify inflation which will eventually hit the consumers in the form of CPI.

If there is a trend of excess crude oil inventories, it is a sign of weakening demand that is bearish for the market.

From the 8th Sep 2022 update, there is a forecast of negative 0.250M crude oil inventories but we saw an actual 8.844M crude oil inventories. A "weakening" of production to meet the coming "weakened" demand.

Thus, I monitor this figure closely as this points to a general weakening of demand as market slowdown continues to manifest her claws.

News and my muse

Another dent to the supply chain?? Let's monitor. Reuters - U.S. freight railroads prepare for potential strike disruption http://reut.rs/3RFvj1W

BBC - North Korea declares itself a nuclear weapons state. Leader Kim Jong-un says this is "irreversible" and rules out the possibility of denuclearisation.

Resource, Food and Fuel (energy) could trigger for the next big wars.

BYD signs a land deal for plant with annual capacity of 150,000 EVs in Thailand. BYD's plant is expected to start operations in 2024 and the vehicles will be exported to ASEAN countries and Europe.

The news may affect price in the short term but in the end, it is always about the value of the company in the long run. How many years do you wish for investors to keep their faith if your claims of competency & capability were not backed by profitability?

Junk loan default concerns.

(Bloomberg) -- Switzerland and Finland joined Germany in offering credit facilities to energy companies as the worsening supply crunch and surging prices threatens

when the people can take it no more (from the challenges in fuel, food and finances), change will come from the bottom and the top would lose its place. For those on top, change while you still have time or you may be changed.

Climate extremities are adding to the energy crisis. Extreme heat has caused drought, harvest loss & low levels of water. This leads to the loss of hydro-powered electricity. People turn up their air conditioners to beat the heat. A multi-whammy.

CNBC - OPEC and non-OPEC partners, an influential energy alliance known as OPEC+, decided to cut production targets by about 100,000 barrels per day from October (2022).

Market Outlook

Market Outlook

|

| 1D chart of S&P500 |

From the 1D chart above (dated 10 Sep 2022), here are my observations:

- the Stochastic indicator is showing an uptrend and we should expect this uptrend to continue.

- the MACD indicator is showing a downtrend but there seems to be a reversal coming up.

- Interestingly, I was unable to find much info about volume for some of the recent days. Thus, I am unable to advise on the strength of the trend.

- The last candle has cut the MA50 line and thus, it implies a potentially bullish run. However, the candle remains below MA200 line and thus

- MA50 line is on an uptrend (bullish in short/mid term)

- MA200 line is on a downtrend (bearish in long term)

- EMA lines are still showing a downtrend and have yet to merge (into reversal for an uptrend).

There are a few resistance levels of 4,200 and 4,300 that we need to monitor for the S&P 500.

EMA - exponential moving averages

MA - moving averages

My thoughts (which are not financial advices):

The world looks at challenging crises from finance, food and fuel (energy) as Russia's Nord stream was down for maintenance. From the streets of Ukraine, there is a new energy war that is being fought over gas pipelines, energy and utilities. This can only lead to more inflationary effects on the market as Europe recovers from Covid19. There are other "health" concerns raised with MonkeyPox and more lingering on the sides. It looks like winter will arrive early for many as their utility fees will continue to burn into their disposable income. We can expect more volatility and the weather is not helping.

Weather extremities will add to the complications. The drought and heat waves are adding to the power grid's strain. Record low water levels have brought a significant drop in the hydro generated electricity. We can anticipate agricultural harvests to be affected.

With challenges in real estate and a hawkish fed, the market looks to be pricing in the anticipated interest rate increments. While we can expect a brief rally but it is likely that the magnitude of the rally to be lesser than the magnitude of drops in the current bearish market.

Let us spend within our means, invest with what we can afford to lose and save "cash for crash" to invest in great companies at good discounts. I echo the sentiments of Michael Burry, Katy Woods and more on a bearish market downturn.

While the market is likely to collapse, we can expect the market to recover eventually. We need TIME to be given her runway to perform her compounding magic as we buy into great companies.

I am in the midst of shortlisting great companies for future investments. As always, let us research before investing.

Comments

Post a Comment