Preview of week 26Sep22 - Micron and Nike report their earnings this week

Public Holidays

None - Singapore, Hong Kong, China & the USA

None - Singapore, Hong Kong, China & the USA

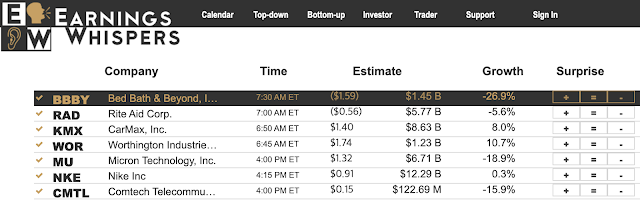

Earnings Calendar

Personally, both Micron and Nike will be interesting.

Micron

|

| Micron's 1-year overview |

Micron has fallen 32.34% from a year ago after hitting a 52-week high of 98.45. Unfortunately, it remains close to the 52-week low of 48.46. The company seems to be on a downtrend. With the coming earnings, will Micron's slide continue given the bearish market outlook following Fed's recent hawkish rate hikes? The forecast of its earnings and revenue stood at $1.32 and $6.71B respectively.

Nike

|

| Nike's 1-year overview |

Personally, there is potential for decline for both companies as the market finds her footing following the hawkish Fed and a bearish surrounding. Sometimes, no trade can be the best trade.

Economic Calendar

- There will be more updates from the Fed and this is important for the market to understand the coming steps that the Fed plans to take. While we are still a distance away from the 3rd Nov 2022 interest rate announcement, we can expect the Fed to remain hawkish in its attempt to tame the inflation beast.

- CB Consumer Confidence (Sep) - this will be an important outlook of how the consumers view the market. Typically bearish sentiment will imply a reduction in spending in the coming weeks.

- Home sales (new and pending) will reveal the health of the "overheated" property market as rising mortgages continue to strain American families.

- Crude Oil Inventories are always a forward indicator of how the oil producers view the potential demand for consumption. Oil is a key component of any economy. Though there is a strong push toward green energy, the market still needs to find affordable and reliable substitutes for oil and its product family of tar, bitumen, grease, plastic and more.

- There will also be an update of the Q2 GDP that will illustrate the health of the economy

- The initial Jobless claims will be an important consideration for the Fed as they balance between inflation and unemployment.

- China's manufacturing PMI will be an important indicator of global demand as China is the world's factory for most products that we use and consume.

With the above, we can get a better grasp of the coming market developments. These are important data points and cumulatively provide a good macro feel of the market. There are not many companies that are able to move "against" the general market trend. As the focus shift to macro, it is needful to understand some of the price movements are due to external factors and not necessarily the business fundamentals of the individual companies. As a part of the market and the economy, such factors do lead to volatility.

News and my muse

History is a guide and reference, not the only basis of investing. Let's do our due diligence but the similarity (between 2008 & 2022) is ... uncanny.

Sometimes, no trade can also be a good trade.

Investing is like surfing. We do not know exactly the time or magnitude of the next wave. However, we need to paddle out so that we can try to catch the waves. We do not need to catch every wave but we need to be in the sea.

"Oil Prices Dip As Inventories Build Across The Board". The chief executive of Aramco Amin Nasser warned that oil prices are about to start rising because of the looming shortage of the commodity, resulting from years of underinvestment.

BBC "UK may already be in recession - Bank of England". The signs were showing for months.

Bloomberg - “I’m a major skeptic on crypto tokens, which you call currency, like Bitcoin,” the JPMorgan Chase & Co. chief executive officer said in congressional testimony Wednesday. “They are decentralized Ponzi schemes.”

WSJ - Debt & leverage are roads to financial ruin. Citrix Debt Deal Prices With Large Losses For Banks. The banks ultimately agreed to take on around $6 billion of debt themselves instead of trying to sell it to investors

WSJ - The average annual % rate on a credit card increased from 16.17% in early March to 18%+ in September, according to Bankrate. The average household carrying a $8,942 balance can pay $14 extra in interest according to WalletHub.

WSJ - Omair Sharif of Inflation Insights said in a note: "If the Fed hit their 2023 unemployment rate projection of 4.4%, then, all else equal, it would mean 1.235 million more unemployed people."

Splash247 - Hard landing expected for freight rates. What goes up must come down.

Market Outlook

The week ended in red last Friday.

Investing - Wall Street's main indexes suffered heavy losses last week with the Nasdaq dropping 5.03% - its second straight week falling by more than 5% - while the S&P 500 ended down 4.77% and the Dow shed 4%. The Dow only narrowly avoided joining the S&P 500 and the Nasdaq in a bear market.

The inverted yield curve has been a good indicator of recession (periods shaded in grey). It is not a time to overleverage or overspend. Let's be prudent and get ready 'cash for crash".

What can we observe from the 1D S&P500 chart?

[MA - moving average; EMA - exponential moving average]

- the Stochastic indicator looks to be in a downtrend though there could be a potential for reversal.

- the MACD indicator looks to be in a downtrend.

- the MA50 looks to be on an uptrend but the candles are under the MA50 line. This also indicates a bearish (short/mid-term) outlook.

- the MA200 looks to be on a downtrend and with the candles under the MA200 line, this indicates a bearish (long-term) outlook.

- the EMA are on a downward trend and is in a fan-shaped movement. This implies that the current downtrend should continue.

With the above technical indicators, they point to a "bearish" outlook.

My investing muse ...

Fed's 75 basis rate height was anticipated but the hawkish stand of the Federal Reserve was not. This was the reason for the market's fall since the Interest Rate announcement on 21 Sep 2022. With Russia mobilising 300,000 reserves for their Ukraine operations, the market continues to remain volatile as the war looks to drag on.

At the same time, there are also other hotspots of conflicts involving countries of Israel, Syria, Armenia and more. How will these affect the global market sentiment, supplies and supply chain?

Though there is a massive drop in freight rates, there are still issues with the supply chain. The trade imbalance between US and Asia will leave the USA with "emptied" container boxes needed badly by Asia for their export shipments. Let us monitor closely the situation rail, truckers, warehouse space and fuel costs continue to post challenges. We should see the regular "surge" due to Thanksgiving and Christmas. The number of ships and containers heading to the USA will be a good indication of the expected spending by the US.

The recent harvest forecast for US & Ukraine has posted some concerns. Recent weather extremities have created more challenges that affected beyond harvest but also strained the power grid. With the hurricane season on the way with Hurricane Fiona battling Canada and more towards Florida, the coming weeks can remain challenging as people stock up and hunker down. These are situations that may open more challenges. With so many parts of the world facing crises in fuel, food and finance, the world needs to work together to solve these problems and not remain divided.

We are probably going to see more decline and with the earnings season restarting in October 2022, we can expect a volatile time. With the October earnings, what is of concern is not just the typical EPS and revenue but the outlook of the company and market would likely impose itself strongly as the market looks to accept recession. With the acceptance, we can expect families to take the necessary measure to reduce their spending, save and delay bigger budget items like renovations, holidays, houses & cars.

Let us spend within our means, do not leverage and invest in great companies which are available at good discounts. Personally, I prefer to watch and start shortlisting great companies for now.

Comments

Post a Comment