Preview of week starting 19Sep22 - Will the rate hike spook the market again?

Public Holidays

Nil for China, Hong Kong, USA and Singapore

Nil for China, Hong Kong, USA and Singapore

Earnings Calendar

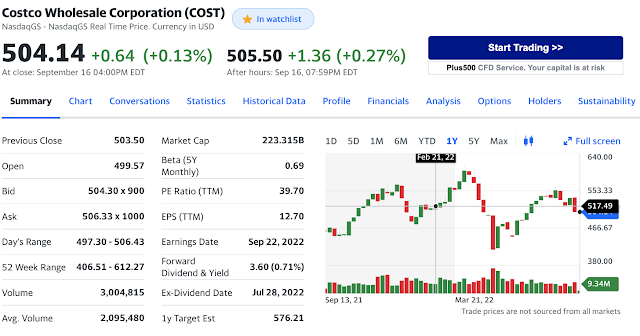

FedEx's worrisome market outlook (about recession) has brought the market down. Apart from FedEx, the other one of interest is for Costco. Costco's earning will be released on 22nd Sep 2022. Being one of the big discount stores in the zector(s) of Consumer Defensive, they employ 288,000 full time employees.

For the last one year, the price fluctuation was between 406 and 612. The price rose 9% from a year ago and is currently on a downtrend as per chart above.

|

| Analyts recommendations (Yahoo Finance) |

From the 29 analysts (above), Costco remains a buy rating (2.1 out of 5 as per above) with the following recommendations:

7 - strong buy

11 - buy

11 - hold

|

| Investing dot com - Forecast for earnings of Costco |

For the coming earnings, the market forecast is 4.15 and 71.64B for EPS and revenue accordingly.

On 26 Jul 2022, the nation's largest retailer Walmart says the rampant rise in prices is changing consumer habits, causing an inventory pileup and aggressive markdowns. <Washington Post>

What is of more importance for me is the guidance and outlook that they will provide. This would have more impact than just the recent earnings. Let us monitor closely.

Economic Calendar

|

| Economic Calendar starting 19 Sep 2022 |

In the coming week, the most watched announcement will be the FOMC announcement of the Fed Interest rate decision. The market could be tentative leading up to the news.

However, there are other important economic news that we should pay attention too:

Initial jobless claims - this is an important indicator on how Fed should balance the interest rate changes. This is a tough job to balance both inflation and unemployment - honestly, a tough place to be in.

The other one which I would pay attention to is the crude oil inventories as this is a "forecast" of future demand.

Home sales (Aug) will reveal the trend of the current housing market. Would it continue its decline?

News and my muse

News and my muse

Another hot spot between Azerbaijan and Armenia.

Goldman’s loss rate on credit card loans is the worst among big U.S. card issuers and “well above subprime lenders” at 2.93%, according to a Sept. 6 note from JPMorgan.

It is impossible to time the market in terms of catching the top or bottom. But the market does move in cycles and trends.

Bridgewater warns of bubble in the stock market. Is this a concern or is this just being overly cautious?

It is ever crucial for countries to collaborate in dealing with challenges of climate, inflation, fuel (energy), food, finances & supply chain.

There can be quick relief between China & America if they can scale back on trade tariffs.

The consumer price index edged up 0.1% last month after being unchanged in July. Though consumers got some relief from a 10.6% decline in gasoline prices, they had to dig deeper to pay for food, rent, healthcare, electricity & natural gas. Food prices rose 0.8%, with the cost of food consumed at home increasing 0.7%. Food prices surged 11.4% over the last year. Healthcare costs rose 0.7%, with prices for hospital services increasing 0.7% & prescription medication gaining 0.4%. New motor prices vehicles increased 0.8%. But there were decreases in the costs of airline fares, communication & used cars and trucks. Prices for hotel and motel rooms were unchanged.

when the market sells, it is usually oversold. when the market buys, it is usually overbought.

Steep declines in investment banking activities, especially IPOs & junk debt issuance, created the conditions for the first significant layoffs on Wall Street since the pandemic began in 2020, CNBC reported in June.

Drought looks to lower the supplies of US corn and soy. Corn production is down 8% from last year, forecast at 13.9 billion bushels; soybean growers are expected to decrease their production 1% from 2021; cotton production is down 21% from 2021.

Ukraine's 2022 grain harvest is expected to fall to 50 million tonnes from a record 86 million tonnes in 2021. The harvest could include 19 million tonnes of wheat, half of which would be exported & 25+ million tonnes of corn.

White House steps in to try to avert the railroad strike that could cost $2 billion a day and more empty shelves in the days to come.

Container ship backlog outside Los Angeles almost cleared as of 31Aug2022.

USA has excess empty containers needed by countries such as China for their exports.

Amazon cuts back on warehousing as per recent news reported by Bloomberg.

Nearly half of Australian homeowners are under mortgage stress, with 45% of households spending more than they are earning. Reserve Bank’s decision raised the national interest rate by 50 basis points to 1.85% to curb inflation. Source: brokernews

Outlook for the week

- The stochastic indicator still points to a down trend though it could be bottoming up soon.

- The MACD indicator points to a downtrend.

- The trading volume on 16Sep22 is 4.36B that is way above the average of 3.68B. The volume is an indicator of the strength of the trend and this strong volume may see the momentum continuing in the coming days.

- 50MA line is going upwards (short/mid term)

- 200MA line is still trending downwards (long term)

- the candles of the last few days are under both 200MA and 50MA - implying a bearish trend in short, mid and long term.

- EMA lines are downward point and spreading - this implies that the current downtrend is still having momentum and may not have reversal soon.

MA - moving average

EMA - exponential moving average

From the various indicators above, it is likely that the S&P500 1D chart should continue its downtrend.

the most important event would be FOMC's announcement of the new interest rate hike. The market is expecting a 75 basis points but we should not be shock if this ends up 100 basis points.

the most important event would be FOMC's announcement of the new interest rate hike. The market is expecting a 75 basis points but we should not be shock if this ends up 100 basis points.

Despite Ukraine making ground to recover their lost grounds, the battle looks to be dragging out. A battle into Winter could seriously drag this out even further. From the initial reports, Ukraine is expecting a grain harvest of 50 million tons, down from 86 million tons a year ago. This could spike the price of grain further in the coming days.

I expect the market to be hesitant over the next few days and a clearer trend will be obvious after the rate hike. Let us spend within our means, invest with what we can afford to lose and also save "cash for crash" to buy great companies at good discounts.

Comments

Post a Comment