Quick Financial Review of BlackBerry ($BB)

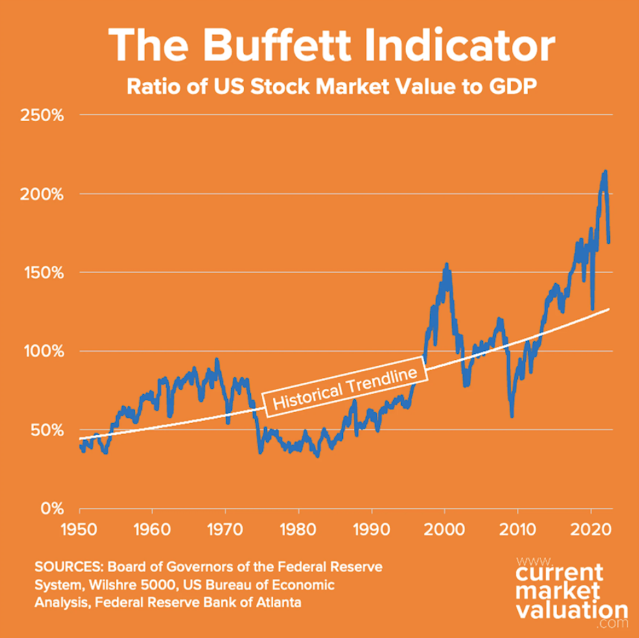

This is a short (Flash) financial review of the company Blackberry. Dropping revenue ... 2022 looks good thus far as we have only passed Q1. but I have concerns about operating profit FCF is only 8.8% from 10 years. based on PE of 315.9, it does seem overvalued Income statement - profits (2022) came from non-core business - that is other non-operating income. thus, I do have some concerns about the core business. Though 2022 has 1Q, though there is good gross profit and GP margin, there are concerns about operating expenses. Net assets are dropping and retained earnings are dropping. The common stock is increasing - share dilution > not good. The cash flow > cash from operations has been dropping, it managed to barely touch black because of cash from investing $222M. This is just based on a short review of the financials - will need to jump into their annual and quarterly reports to better qualify other aspects like market, solutions development...