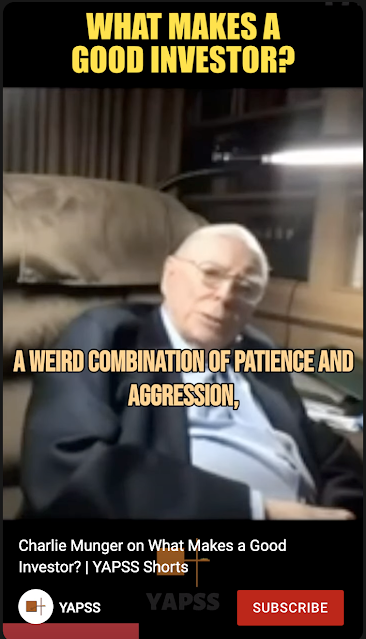

what makes a good investor - Charlie Munger

Charlie Munger - What makes a good investor? <Transcription with some minor grammatical changes> Charlie Munger shares about traits of a good investor (YAPSS) Obviously, you have to know a lot but partly it is temperament. Partly, it's delayed gratification. you got to be willing to wait. It's weird - good investing requires a weird combination of patience and aggression. And not many people have it. Also, it has to require a big amount of self-awareness of how much you know and how much you do not know. You have to know the edge of your own competency. (But) a lot of people are no good at knowing the edge of their own competency. They think that they are way smarter than they are. Of course, that is dangerous and causes trouble. Source: YAPSS Shorts https://www.youtube.com/shorts/IDU0BlbagZs