News - 61% of Americans who are living paycheck to paycheck - what should one prepare for potential tough times?

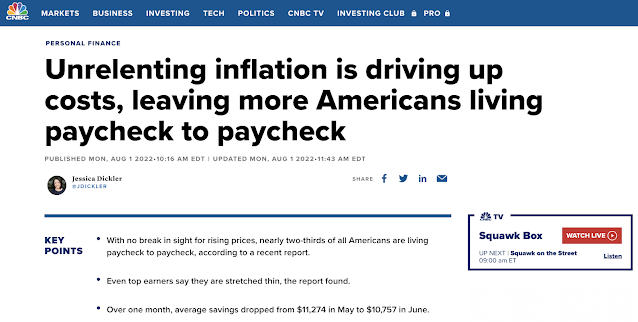

CNBC reported on 1st Aug 2022 that we have 61% of Americans who are living paycheck to paycheck.

Inflation has been causing economic hardship for workers across all income levels. As of June, 61% of Americans — roughly 157 million adults — lived paycheck to paycheck, according to a new LendingClub report. That’s up from 58% who reported living paycheck to paycheck in May. A year ago, the number of adults who felt stretched too thin was 55%.Even top earners have been struggling to make ends meet, the report found. Of those earning $200,000 or more, 36% reported living paycheck to paycheck, a jump from the previous month. Another recent survey, from consulting firm Willis Towers Watson, estimated 36% of those earning $100,000 or more said they were living paycheck to paycheck.

Reduced spending (from consumers) leads to reduced earnings for companies, leads to reduced production for companies, and leads to retrenchment, and the cycle repeats.

With nearly a quarter of American households without emergency savings, the loss of income could lead to a "drastic" impact quickly. While we have low levels of unemployment, the decrease in average savings meant that the average household is not making ends meet.

A bank manager who has lost his/her job may not be able to take up the available jobs (in F&B or hospitality) as their expenses could be much more than their income. With exception of a career switch, the bank manager may not be able to take up the job opportunities available. There are 2 considerations:

- the jobs need to be suitable (matching the skillsets with the job needs)

- the jobs need to be sufficient for them to meet their living expenses.

During a crisis, people can resort to desperate measures, taking up (whatever) job opportunities to put food on the table.

Conclusions

We should set aside emergency funds for 6 months before we start investing.

Spend within our means, do not leverage, and invest with what we can afford to lose.

Update the income and revenue expenses of the household.

We should review the expenses on hand and categorize them into categories of "needs" and "wants". We can start to cut down some of the expenses.

If we have any investments that can be liquidated, we can consider these to tide over the season.

If we have any investments that can be liquidated, we can consider these to tide over the season.

We can review the investments and consider taking losses for some of the stocks whose fundamentals have been less than convincing. This can be part of tax loss harvesting. Forbes defines tax loss harvesting as the following:

Tax loss harvesting is when you sell some investments at a loss to offset gains you've realized by selling other stocks at a profit. The result is that you only pay taxes on your net profit, or the amount you've gained minus the amount you lost, thereby reducing your tax bill.As always, let us research before investing.

Comments

Post a Comment