Preview of the week starting 29Aug2022 - will BYD's decline stop with her coming earning?

Public Holidays

Nil for Singapore, China, Hong Kong and USA.

Earnings Calendar

Earnings Calendar

|

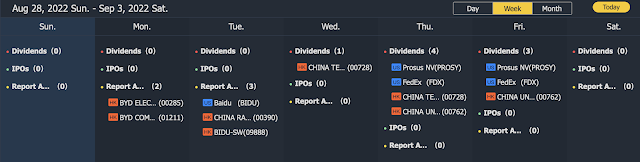

| Some of the earnings for the coming week starting 29 Aug 2022 |

Personally, the most anticipated earning for the coming week is for BYD (1211.HK or BYDDY - US OTC). BYD is of the most vertically integrated EV manufacturers in the world. To me, BYD is a "worthy" competitor to Tesla. With in-house production of batteries and electronics, Tesla has gone on to become one of the top producers of EV batteries too. BYD is expanding aggressively and was venturing into mining (for raw materials). At the same time, BYD is supplying its safe and affordable LFP batteries to several car makers (where Tesla is rumoured to be one of them).

From the chart above, BYD has been in decline since the recent high in July 2022. Despite the decline, it has gained 3.35% compared to a year ago and it remains in the upper half of the 52-week range of 165 to 333.

For the coming forecast, the market is expecting BYD to achieve 0.58 and 73.25B for its EPS and revenue accordingly. Will BYD be able to reverse its current downtrend following the earnings? Let us monitor accordingly.

Economic Calendar

| |

|

- CB consumer confidence (Aug) - this is a good bearing on the market sentiments - if the confidence is lesser than expected, we can expect the market to be more bearish

- China's Manufacturing PMI (Aug) - with China being the world's factory, a lesser than expected figure will imply that the demand is lesser, a typically bearish sign.

- Crude Oil Inventories - as per my previous, oil is forward-looking. If there are excess inventories than anticipated, it implies a dwindling demand as the producer did not consume as much of the inventories (than anticipated).

- Initial jobless claims - this will be an important that the Fed uses to

News and my muse

if we sell or buy stocks based on another's opinion, we need a better strategy. 1 reason to buy and 1 million reasons to sell. we cannot invest based on borrowed convictions. Let us do our due diligence and research before investing.

The China Securities Regulatory Commission (CSRC), the Ministry of Finance and the US Public Company Accounting Oversight Board (PCAOB) signed an audit supervision cooperation agreement on August 26, which will be launched in the near future.

Is there a slowdown for the cloud with the cancellation of new data centres?

New variants of COVID-19 have increased remote work opportunities. Despite an economic recovery in 2021, economic conditions deteriorated in 2022. The office vacancy rate is expected to continue to rise in 2022 to 17.9%.

A wave of layoffs has swept across American businesses in 2022 due to slower business growth & rising labor costs. The layoffs span across industries, from mortgage lending to digital-payment processing. Source: BusinessInsider

Wholesale gas prices are up 350% year-on-year. High prices are expected to continue this year and next. Rising wholesale energy costs are passed on to consumers.

Market outlook

- from the Stochastic indicator, there could be a reversal coming as it reached the oversold region

- from the MACD indicator, a downtrend has been confirmed following the crossover.

- from the moving averages (MA) lines, we have the following. MA50 shows that there is an "uptrend" in the short/mid-term. MA200 shows a decline in the long term.

- from the exponential moving averages (EMA), the lines are merging and a reversal into a downtrend should be confirmed over the next few days.

- For the last 5 days of the week, the daily trading volumes are lesser than the average trading volume of 3,679,830,322. The volume does imply the strength of the trend and it could be that the trend (down) is weak.

Following Jackson Hole, the market fell following the hawkish comments from Powell, leading to a bearish response. There are concerns raised over food, fuel and finances in various economies. The analysts seemed to be split on whether it is a recovery or part of the bearish decline. Personally, there are concerns noted in:

- the real estate (with news of people exiting from the home purchase due to the mortgage costs),

- Crypto market - more with withdrawal issues

- Weather - drought swept across the earth affecting the Americas, Europe and China. All these will affect cropping and thus, more food insecurity is anticipated.

- More hot spots (with wars and rumours of wars)

Personally, I remain cautious about the market as the macro continues to weigh heavily on the market. I lean towards bearish in my outlook and recommend watching out for bull traps. Let us spend within our means, invest with what we can afford to lose and invest into great companies at good discounts.

Comments

Post a Comment