Preview of the week starting 04 Dec 2023 - Can NIO rise again?

Public Holidays

No public holidays in the coming week for Hong Kong, China, Singapore and the USA.

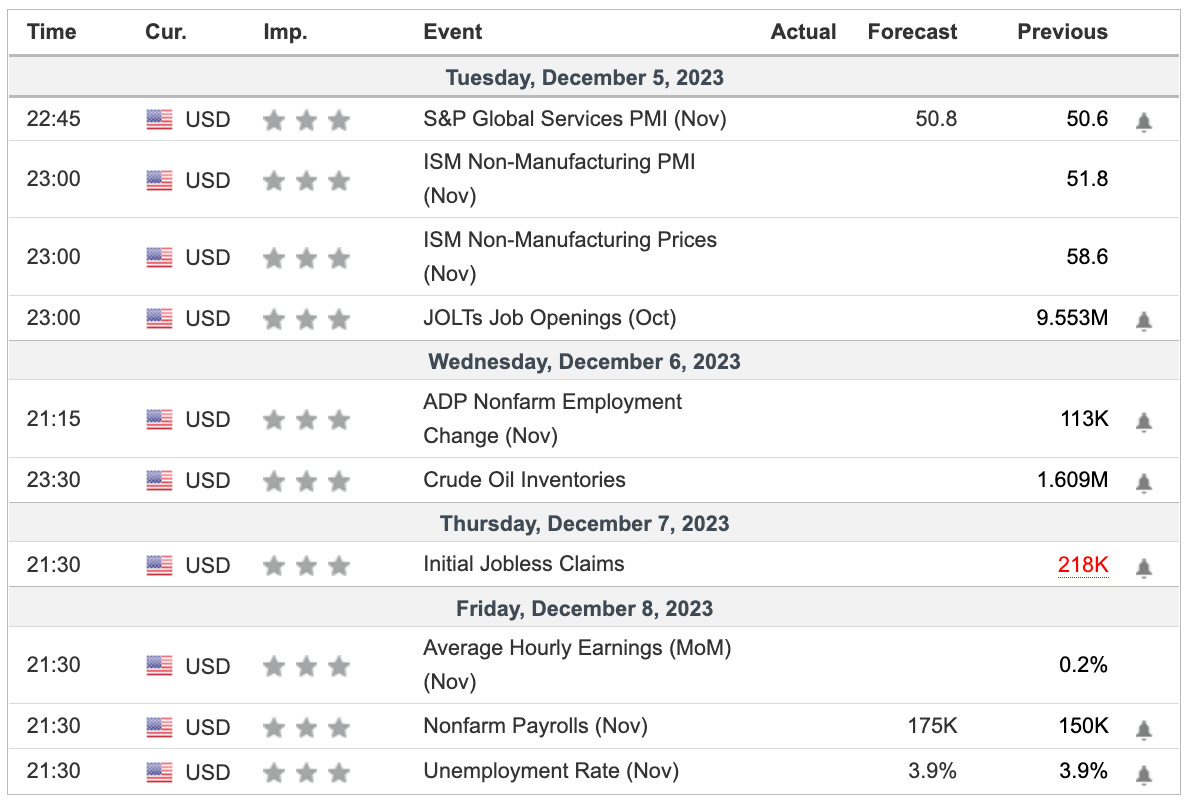

Economic Calendar (04 Dec 2023)

Notable Highlights

- Jobs. JOLTs Job Opening, ADP Nonfarm Employment change, Average Hourly Earnings, and Nonfarm payroll data will shed light on the employment and market jobs outlook. These will form part of the considerations for the Fed in their interest rate

- S&P Global services PMI will shed light on the outlook of services industry in the USA.

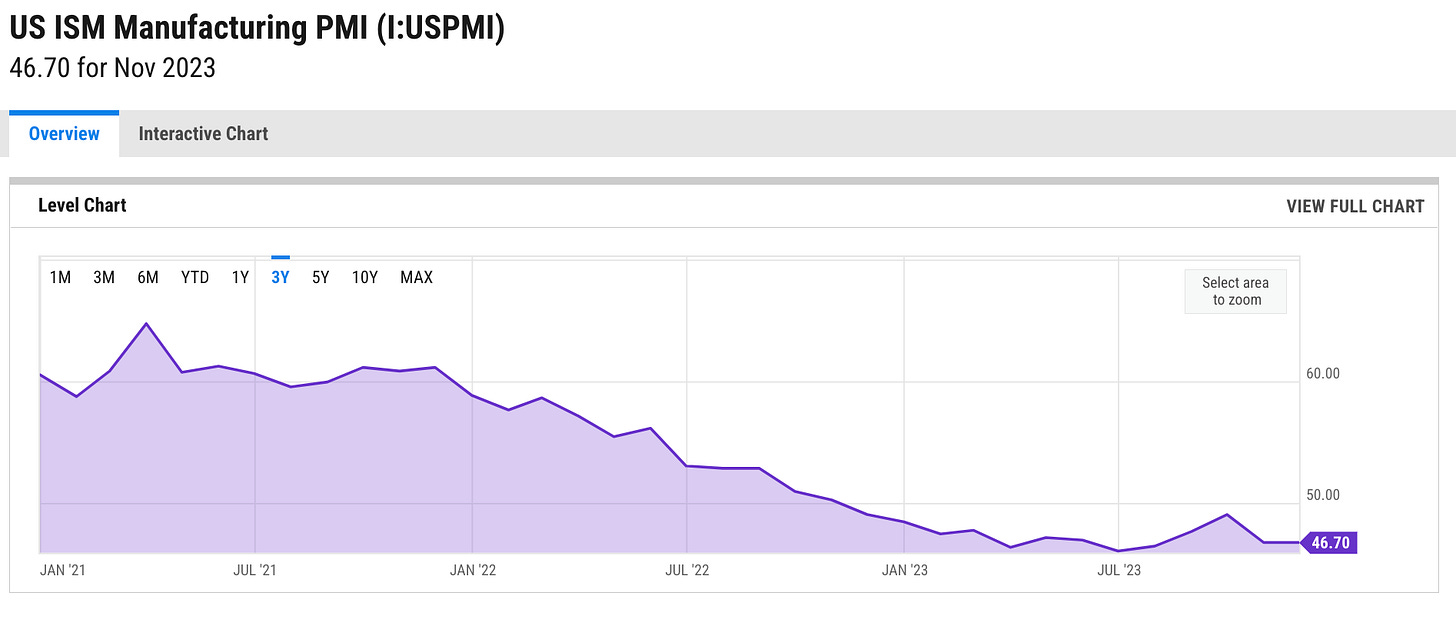

- ISM Non-manufacturing PMI & Prices can shed some light on the manufacturing in the USA. Manufacturing has been contracting for over a year in the USA. Can there be some turnaround?

- Initial Jobless Claims will be released in the coming week. This is another important data point for the Fed’s coming interest rate decision as they seek to balance inflation and unemployment. Together with the Unemployment rate, this will be part of the Fed’s consideration for the coming interest rate. decision.

- Crude Oil Inventories can be seen as forward indicators of market demand and consumption. If the trend of excess inventories continues, demand erosion can lead to reduced production & weakening consumer spending.

Earnings Calendar (04 Dec 2023)

In the coming week, these are the few earnings of interest: NIO, Campbell’s, Dollar General, and Lululemon.

Let us look at NIO in detail.

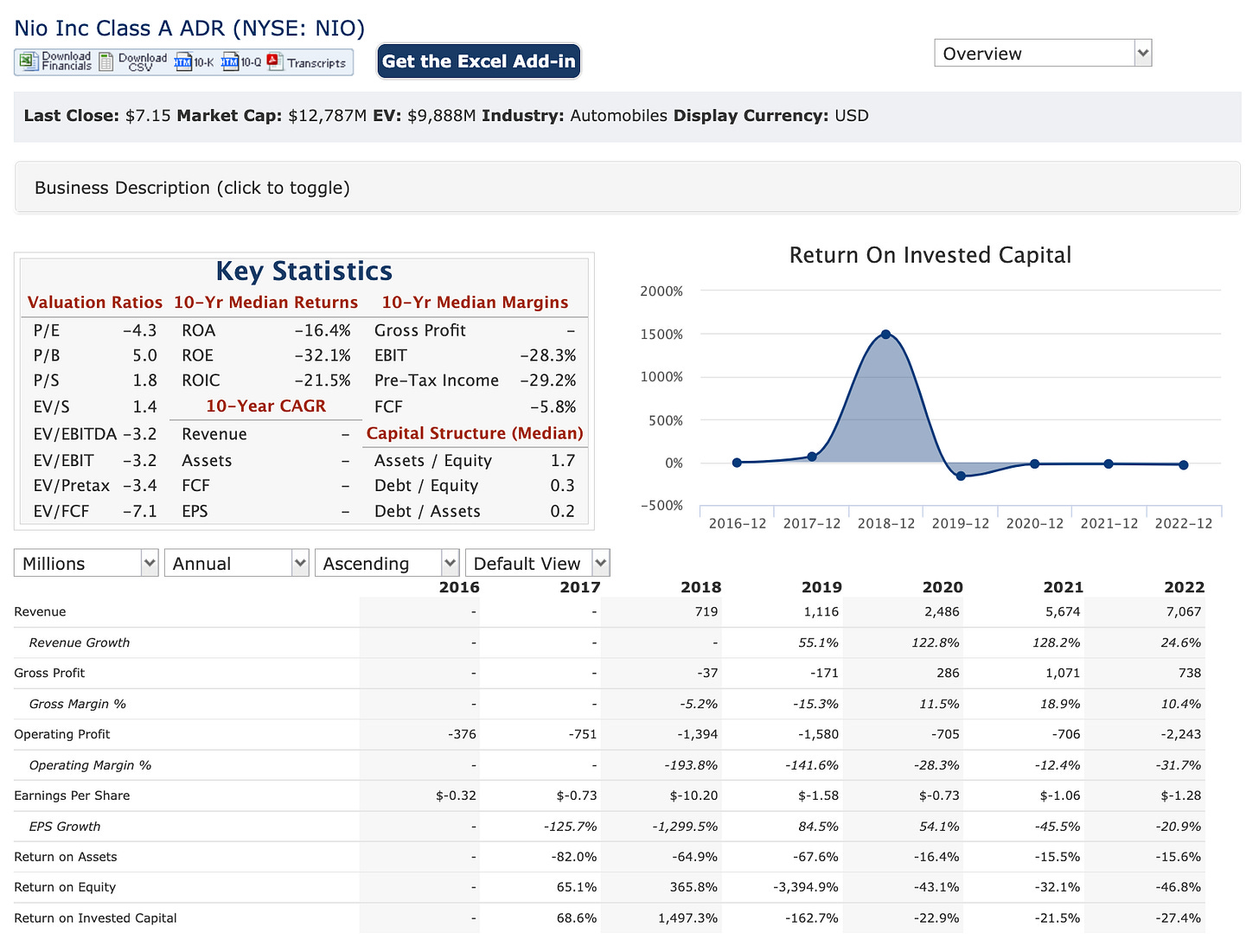

Observations of NIO:

- The trend of revenue growth from $719M (2018) to $7,067M (2022).

However, the business continues to suffer losses. Despite the growing revenue, the operating margin losses suffered have continued to grow from $376M (2016) to $2,243 (2022).

The EPS has worsened from -$0.32 (2016) to -$1.28 (2022).

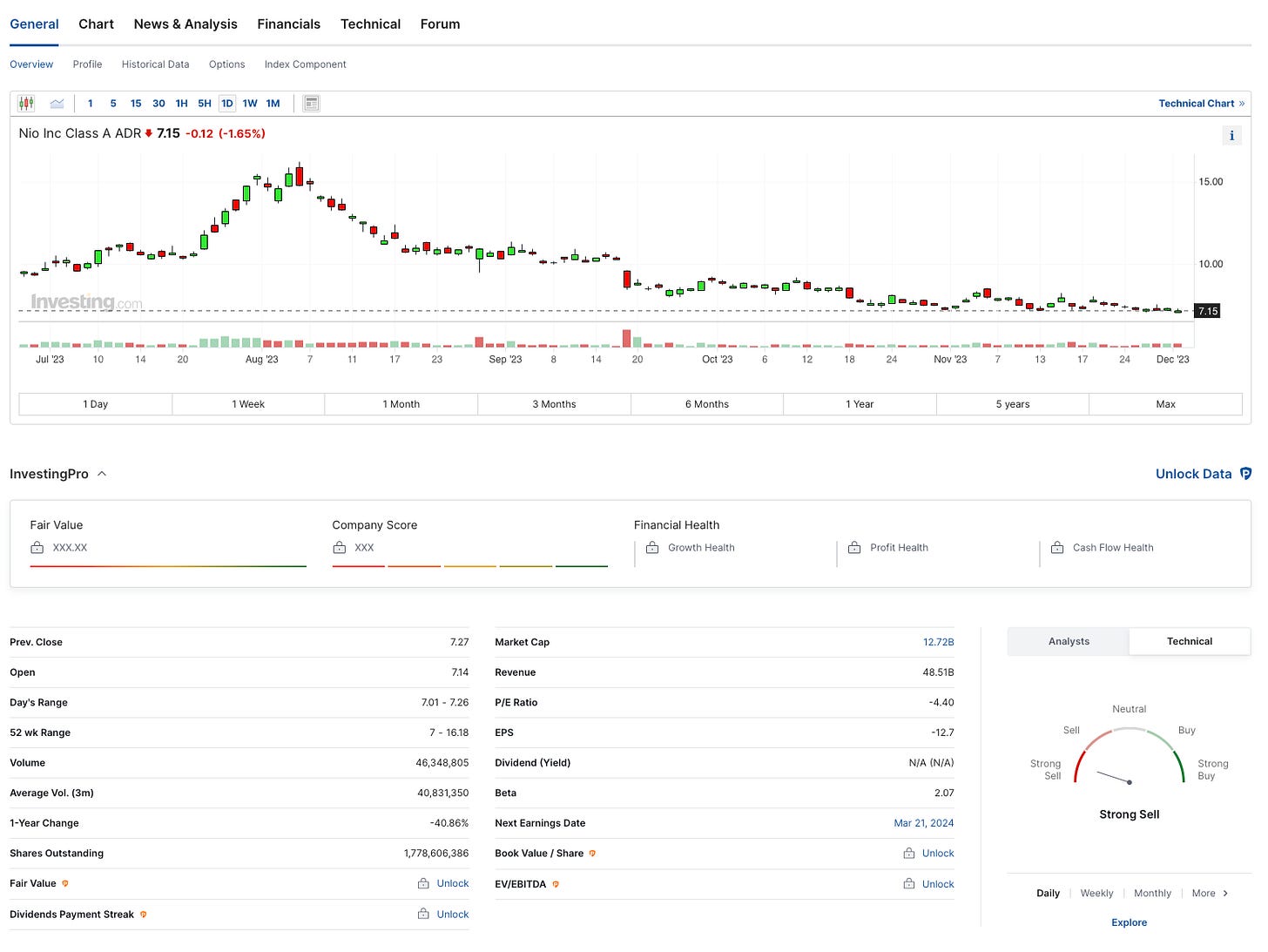

NIO has fallen over 40% from a year ago. Investing has a “Strong Sell” recommendation for NIO.

For the coming earnings, the forecast of EPS and revenue are -2.63 and $19.37B respectively.

(Investing may have a glitch in their forecast data).

I prefer to monitor the company and would consider after the company has broken even.

Market Outlook - 04 Dec 2023

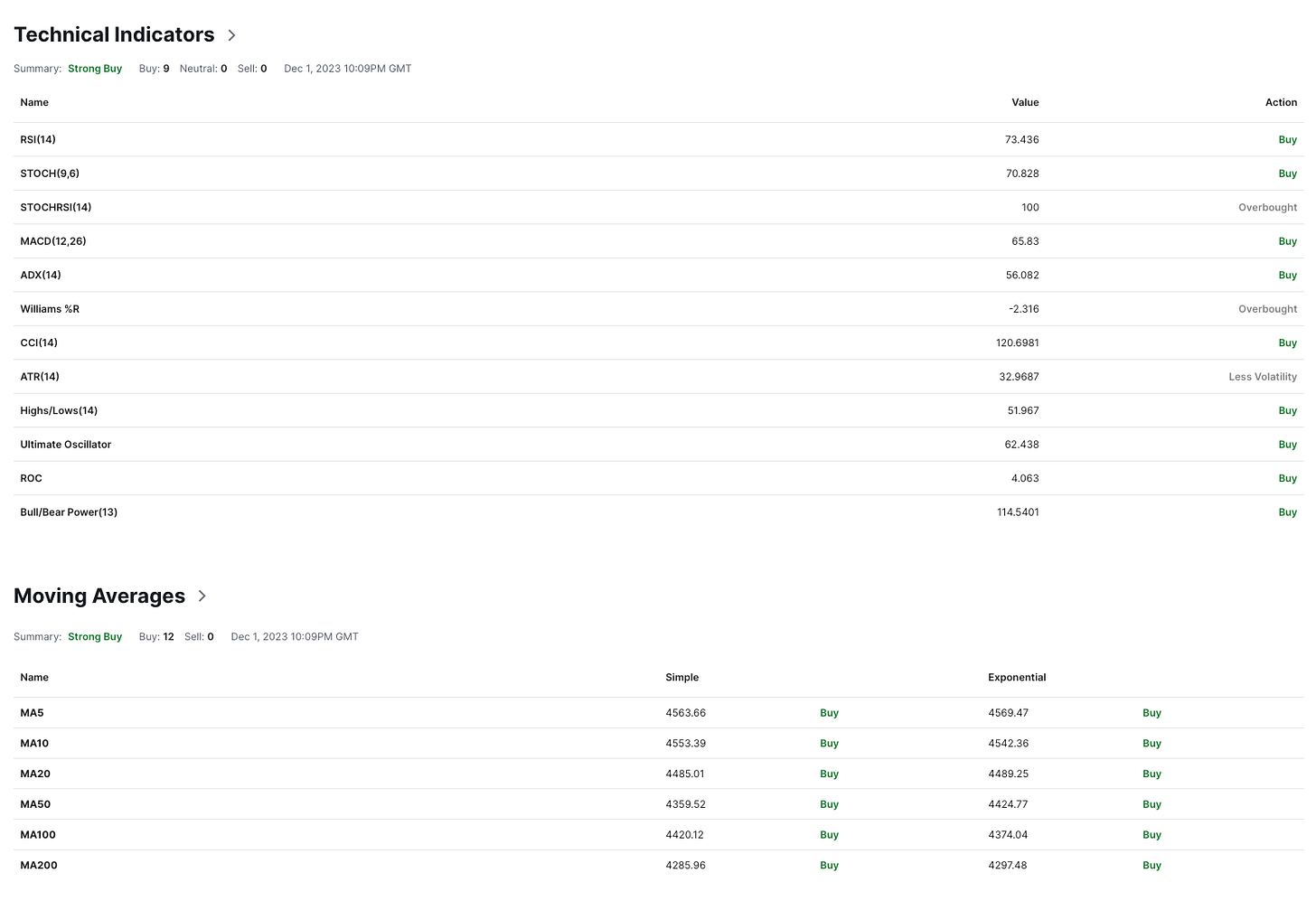

Technical observations of the S&P500 1D chart:

- The Stochastic indicator has completed a top crossover and should start a downtrend soon.

- The MACD indicator is on an uptrend with a top crossover setup.

- Moving Averages (MA). Both the MA50 line and the MA200 line are on an uptrend. The last candle is above both the MA 50 line and the MA 200 line. Thus, it could be read as bullish for the long-term and mid-term. As the 2 lines move closer, there is a chance of forming a death cross - typically, a bearish indicator. This could take weeks before this death cross is formed and changes are possible.

- Exponential Moving Averages (EMA). All 3 EMA lines are moving upwards and thus, implying an uptrend.

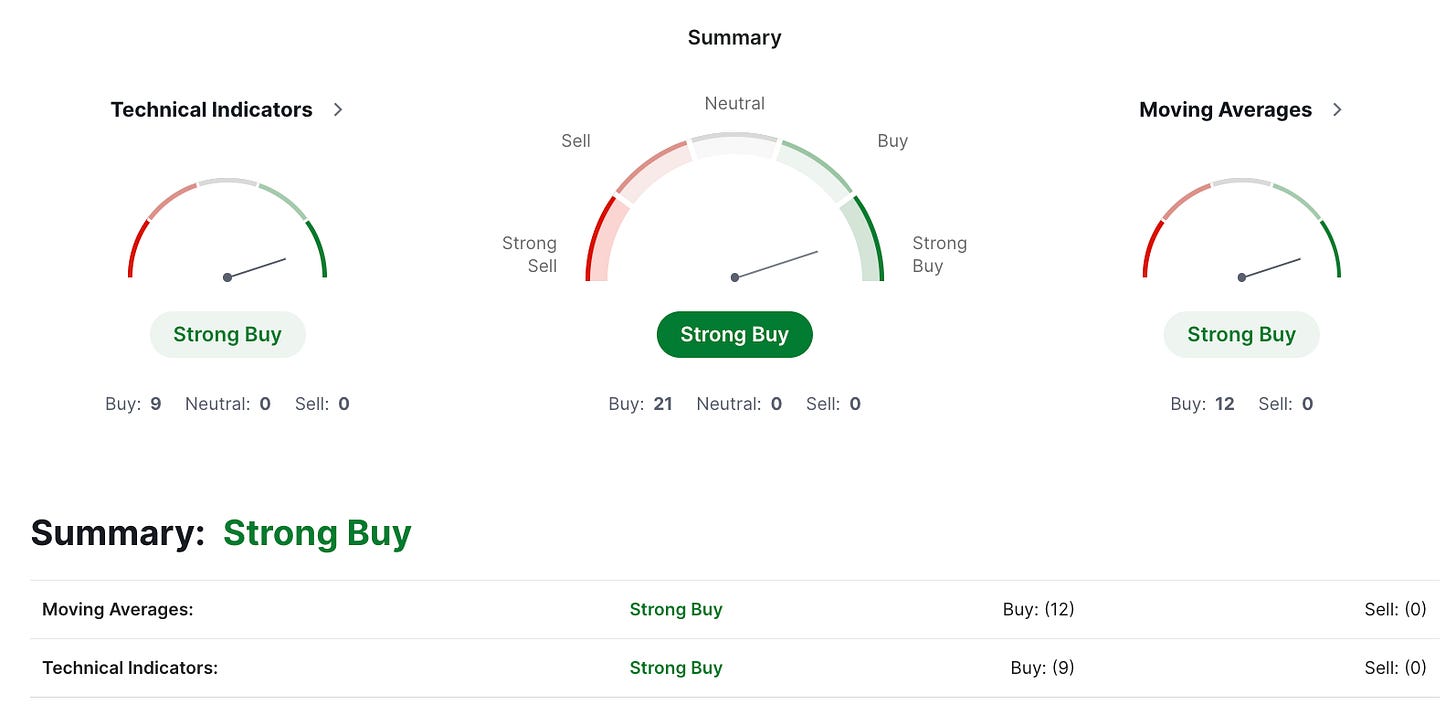

From the 1D technical indicators above, there are a total of 21 (Buy), 0 (Sell) and 0 (Neutral). Investing recommends the “STRONG BUY” recommendation based on the technical indicators above (1D chart for S&P500).

From the data above, the market should continue to rally into the coming week. Note that a few indicators show “overbought” for the S&P500.

News and my thoughts from the last week (04 Dec 2023)

- Consumers extended their budgets by leaning on buy-now, pay-later options, which climbed by 72% from the week before Thanksgiving.

- Most of these short-term loans are not reported to the three main credit bureaus. Consumers appreciate that because the loans don't affect their credit scores. But this is the feature can lead to “loan-stacking”. - WUSA9

- On top of the Texas supply problem, developers face a credit crunch as construction loans mature, forcing them to either sell their projects or refinance, which are increasingly difficult due to higher debt costs and lowered rental incomes. Many properties bought during 2021 and 2022, especially Class B and C value-add properties, have seen a sharp decline in value. Rising renovation costs and dropping rents have further complicated these investments.

- A survey by Klarna found nearly half of those surveyed worried that they would not be able to pay off credit card bills in full from holiday spending. - Reuters

We have lost a giant amongst us. Thank you Mr Charlie Munger for your wisdom and wits - one of my biggest investing influences. I wish that I had the chance to thank you in person. My condolences to the family.

Layoffs in the news today: TikTok, WMWare & Citi.

"It's not brilliance. It's just avoiding stupidity."

- Buffet noted "Charlie's inspiration (and) wisdom" in a statement. "We give up things over time." - Charlie Munger

- A mild recession could hit the U.S. in the first half of 2024, Deutsche Bank analysts have pointed toward softening economic data. The lagged impact of interest-rate hikes will trigger a recession, though it won't be a severe one, they said. - Barron’s

- Can some black swan events be created by media silence?

- “There are a lot of elderly folks living in the neighbourhood and some are really struggling. They can’t afford to even pay $1 – this is the reality. Sometimes, I just accept a few cents from them or give them bread for free,” he shares. - 8 Days SG

- “A lot of things out there are dangerous and inflationary. Be prepared,” he said at the 2023 New York Times DealBook Summit in New York. “Interest rates may go up and that might lead to recession.” - CNN

- Tax loss harvesting and portfolio balancing are coming up.

My investing muse

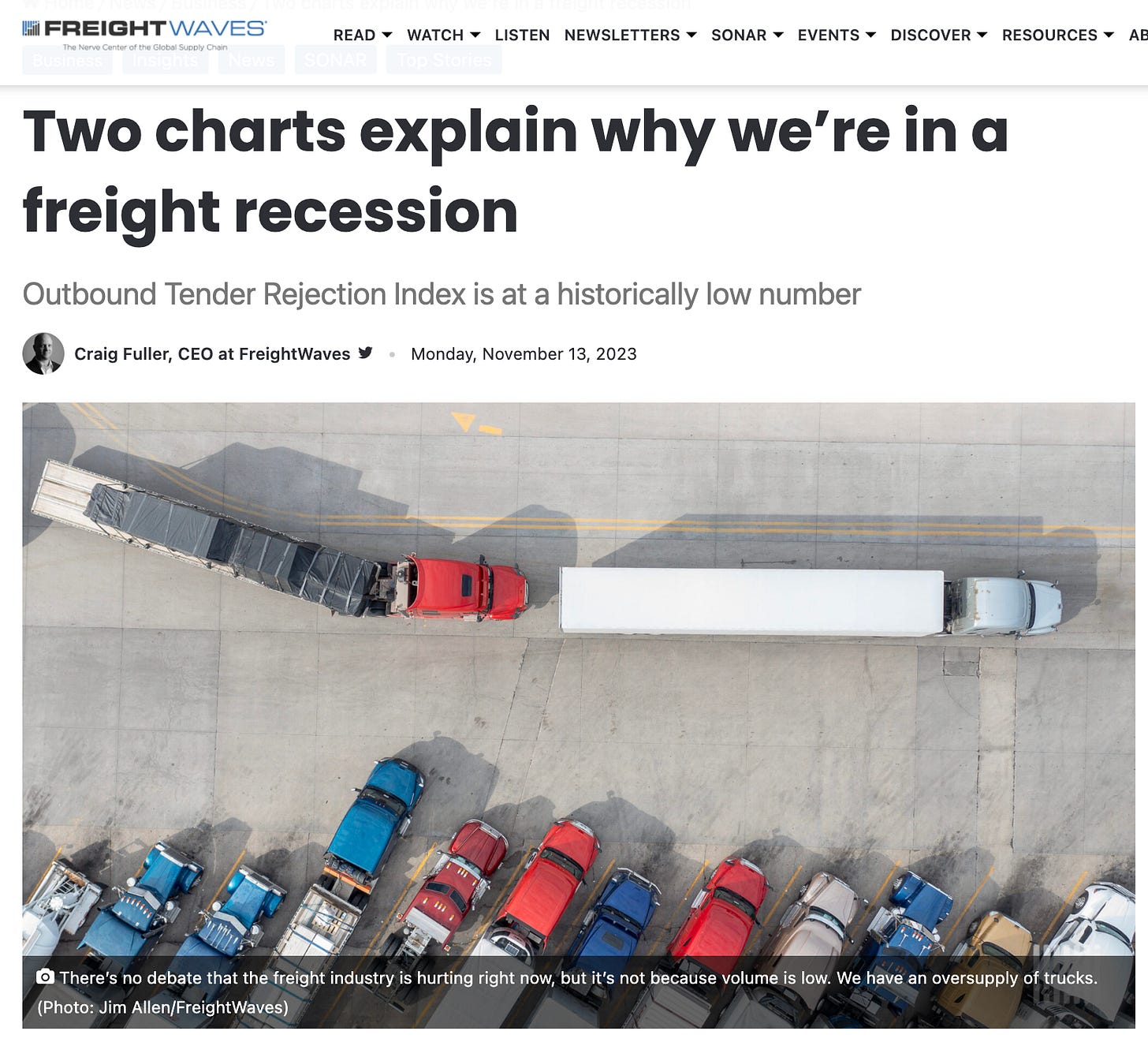

The freight recession in the US is worsening with overcapacity. The CRE and banking industries are buying time. Should there be a black Swan, it can turn band quickly.

Let us monitor the banks. When the regional banks are affected, the impact can be more immediate.

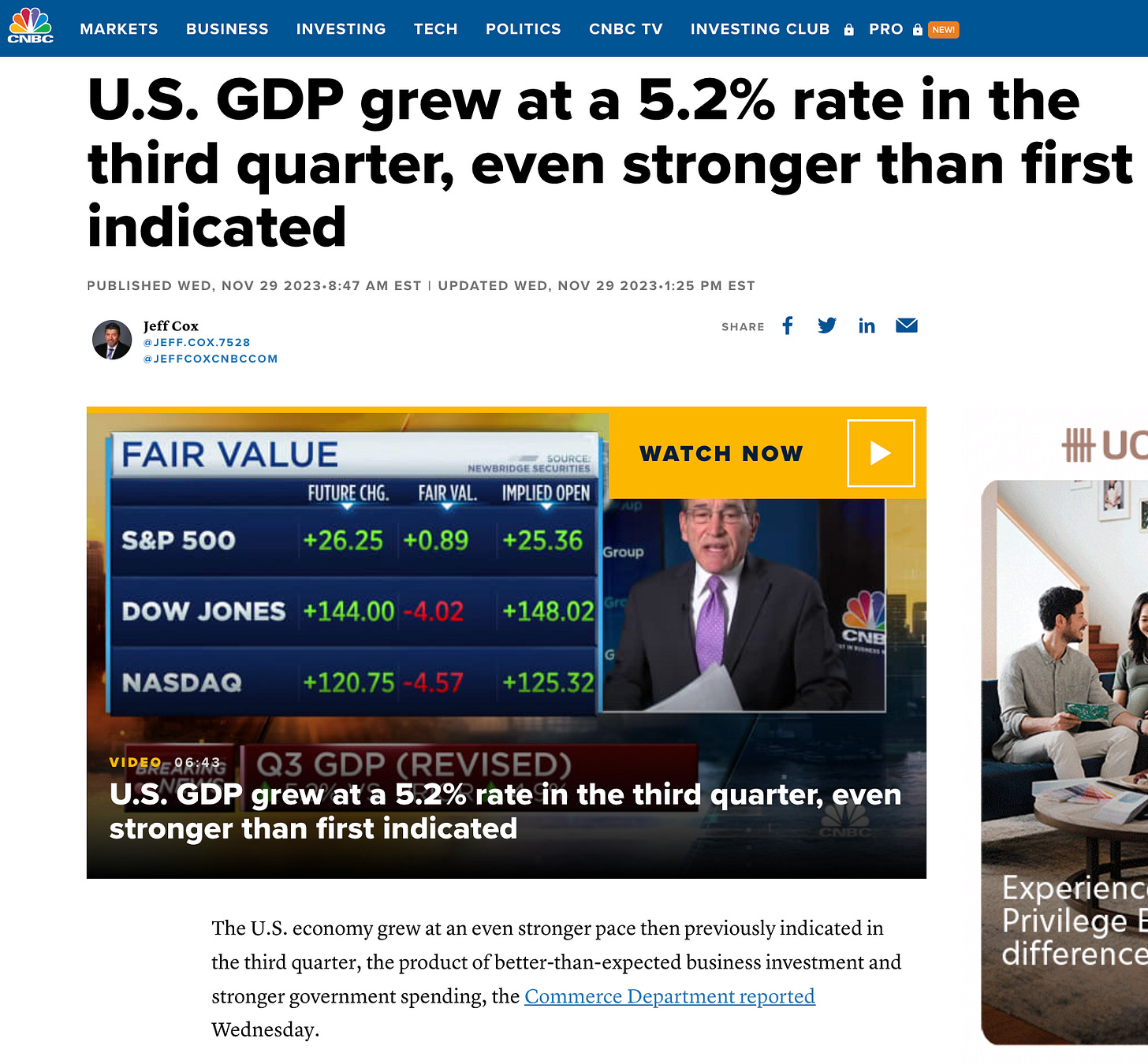

US GDP

US Q2 GDP growth has revised upwards from 4.9% to 5.2% with the latest updates. This should be good news but implies that the Fed may have to be more aggressive with the coming interest rates. With this, we should be getting bullish for the outlook right? Unfortunately, debt is used to finance the spending from consumers, businesses and the Federal government. At the current interest rates, can the economy withstand the burden of debt? Let us study the economy via the Trade deficit and Supply Chain.

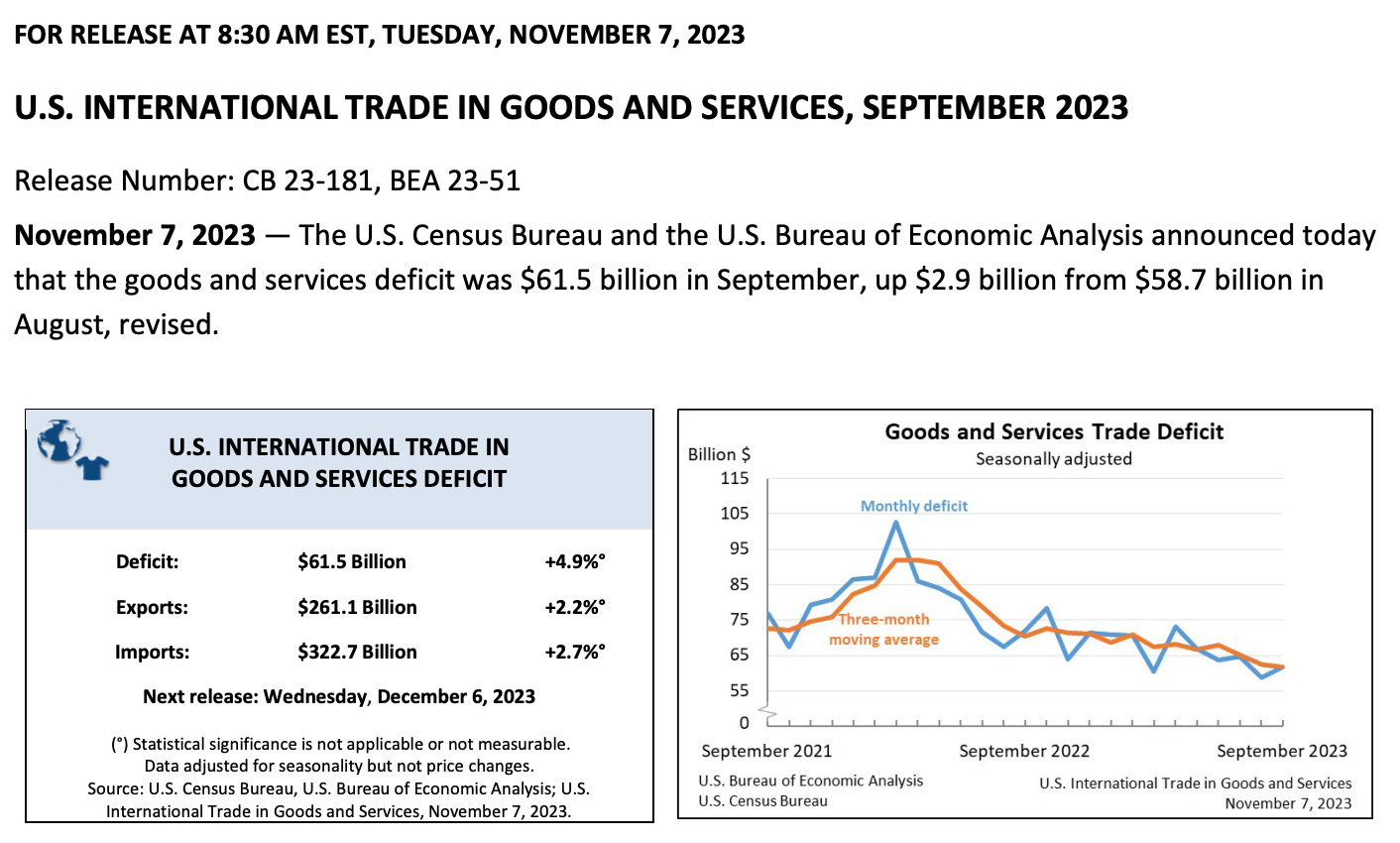

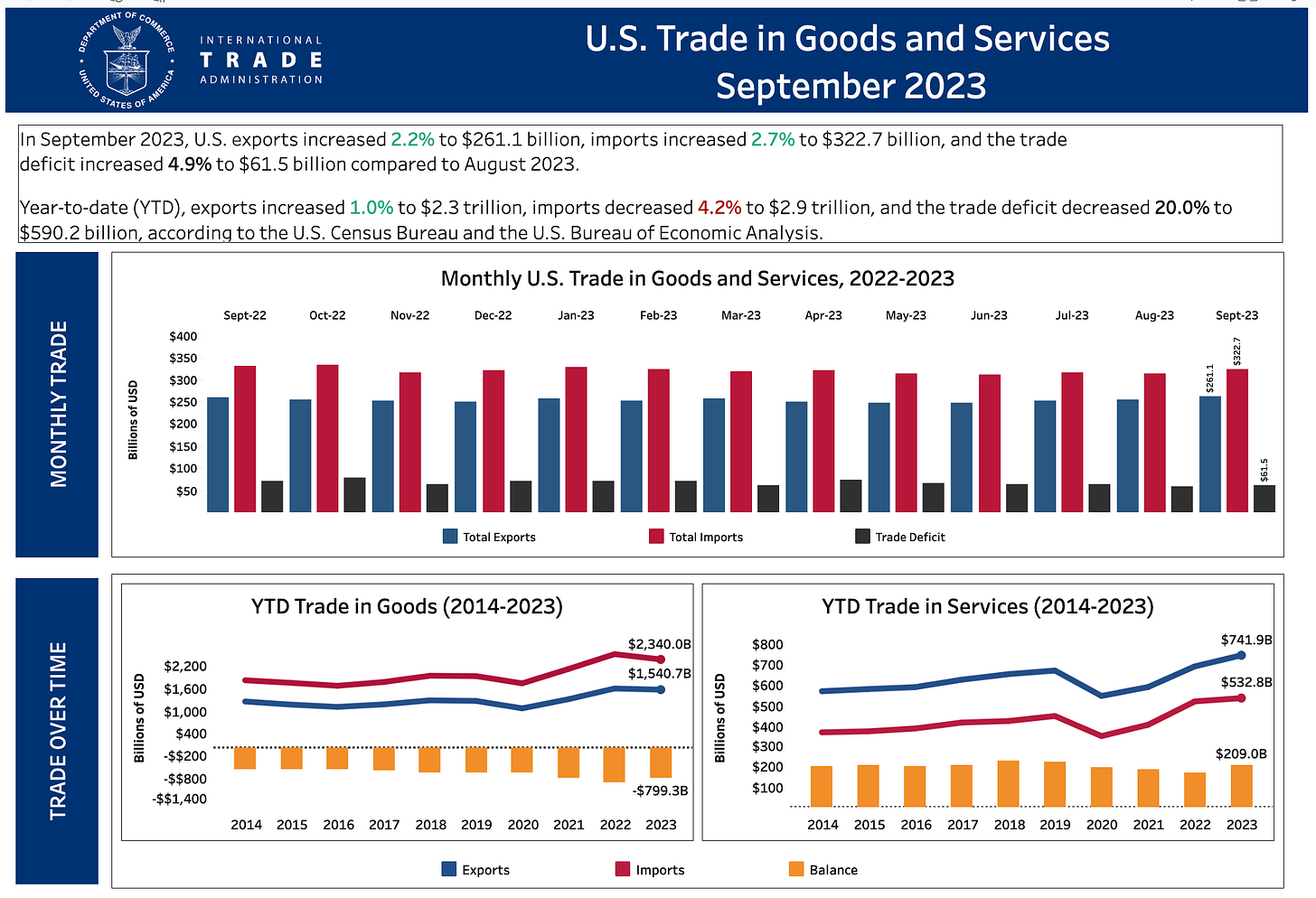

US Trade Deficit

The trade deficit has grown from $58.7B (August 2023) to $61.5B (Sep 2023). Note the growth in “Trade in Services” and the decline in “Trade in Goods”.

US Manufacturing has been contracting since November 2022 as per the ISM PMI chart data.

Freight Recession

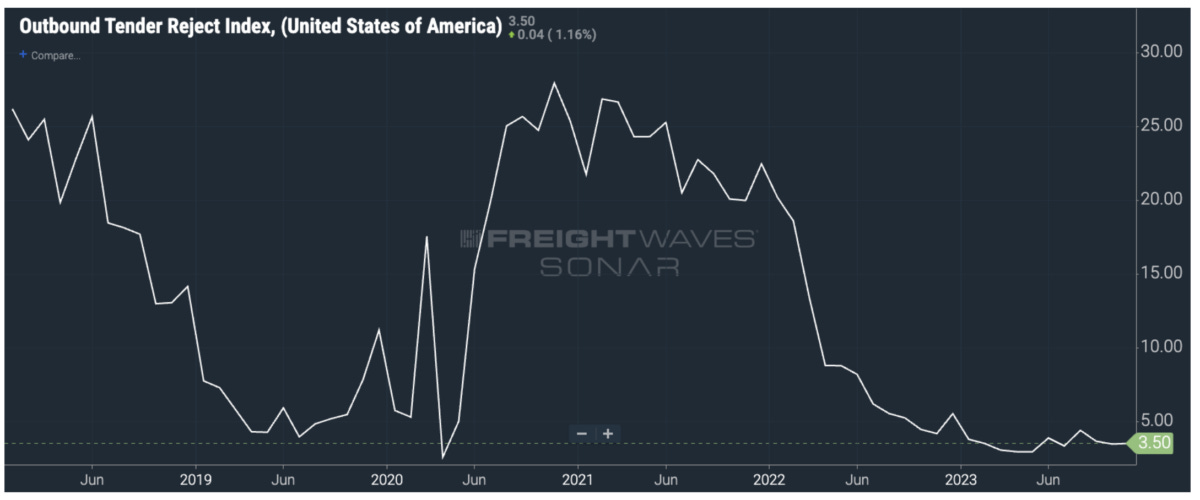

From the Freightwaves article:

But while there are certainly a number of problems, the “freight recession” is due primarily to too much capacity — or for the layperson, too many trucks for the amount of freight being moved.

From the above Freightwaves article,

FreightWaves developed the Outbound Tender Rejection Index, or OTRI. The index measures the number of truckload orders rejected during the previous week. And whatever the state of the economy, there has always been and will always be a level of rejection in the market. But with the data OTRI provides, there is an indicator for how full the truckload order book is at any moment in time.

Since FreightWaves first published the OTRI in 2018, it has ranged from 2.5% to 30%. Currently, SONAR’s OTRI is at 3.5% — low by historical standards.

The above implies that there is insufficient work. Should this continue, more supply chain players will go under.

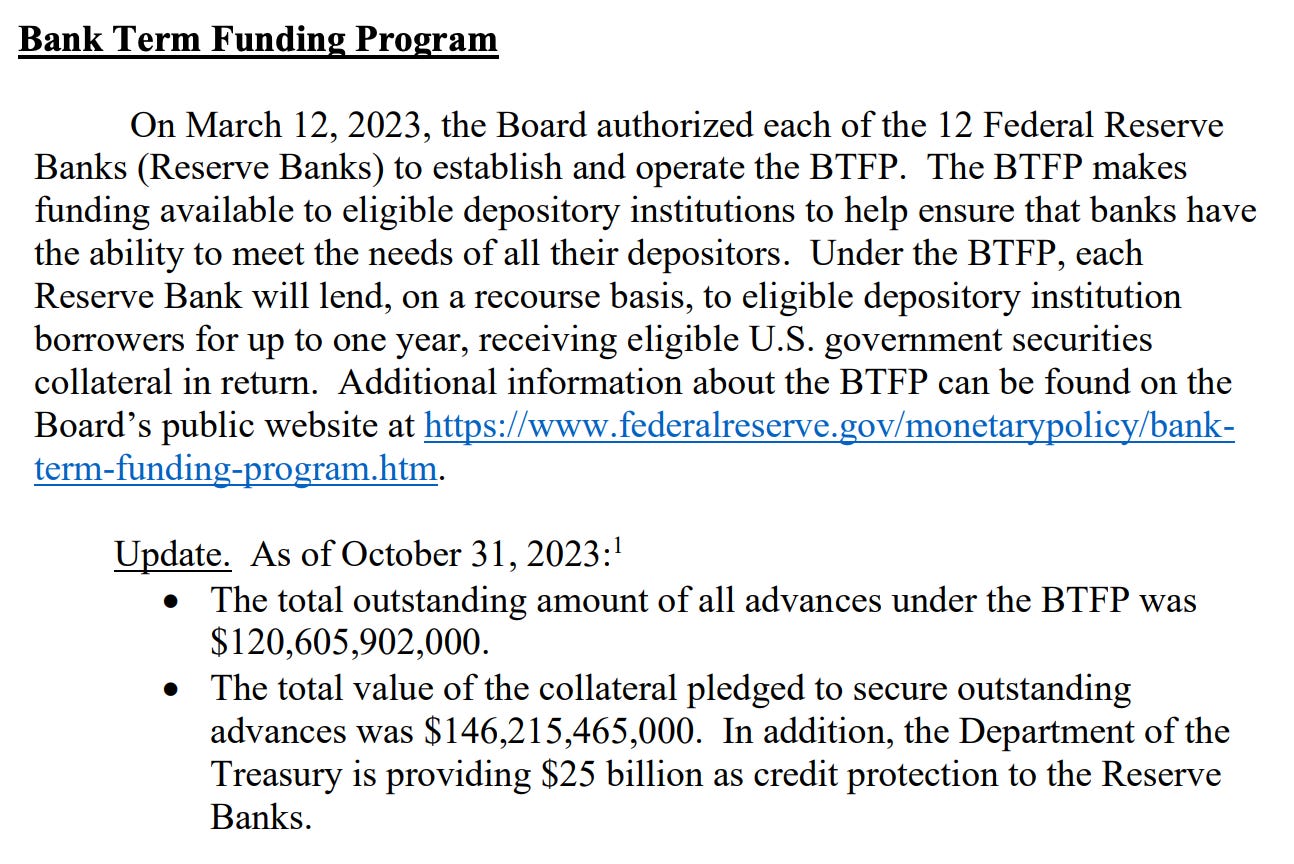

BTF Program

There is an increase of $1.5B in the total outstanding amount of all advances from a month ago. This continuous requirement of BTFP loans implies that banks suffer from insufficient funding to eligible depository institutions to meet the needs of all their depositors.

Conclusion

The latest Q2 GDP update is good news, but to be funded by debt, it is a concern at the current interest rates.

S&P500 can hit an all-time high. With more turning to debt and credit facilities, the outlook is concerning. Let us consider hedging in the coming months.

Comments

Post a Comment