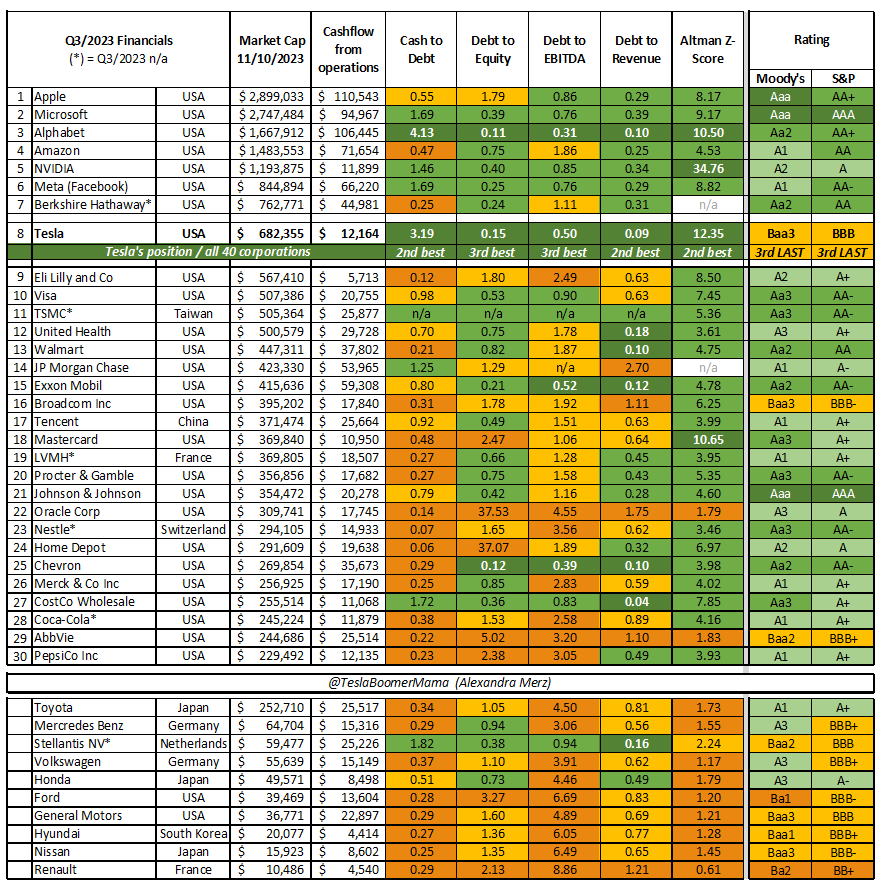

Q3/2023 Financials overview of Magnificent 7 and more - How is Tesla faring?

This summary is taken from a post by Twitter (X) user TeslaboomerMama. This provides a good summary of some of the leading global companies.

Items covered included country of origin, market cap (as of 10 Nov 2023), Cashflow from Operations (USD), cash to debt ratio, Debt to equity, Debt to EBITDA, Debt to revenue, Altman Z-Score and Rating from both S&P and Moody’s.

How we should interpret these data:

A healthy cash-to-debt ratio would generally fall between 1.0 and 2.0, with anything above 2.0 being considered very strong. This indicates that the company has more than enough operational cash flow to cover its total debt. (Carbon Collective)

The optimal D/E ratio varies by industry, but it should not be above a level of 2.0. A D/E ratio of 2 indicates the company derives two-thirds of its capital financing from debt and one-third from shareholder equity. (Investopedia)

Generally, net debt-to-EBITDA ratios of less than 3 are considered acceptable. The lower the ratio, the higher the probability of the firm successfully paying off its debt. Ratios higher than 3 or 4 serve as “red flags” and indicate that the company may be financially distressed in the future. (Corporate Finance Institute)

In general, many investors look for a company to have a debt-to-revenue ratio between 0.3 and 0.6. From a pure risk perspective, debt ratios of 0.4 or lower are considered better, while a debt ratio of 0.6 or higher makes it more difficult to borrow money. (Investopedia)

An Altman Z-score below 1.8 signals the company is likely headed for bankruptcy, while companies with scores above 3 are not likely to go bankrupt. Investors may consider purchasing a stock if its Altman Z-Score value is closer to 3 and selling, or shorting, a stock if the value is closer to 1.8. (Investopedia)

Why is the table important?

In our current environment of high interest rates, companies with more debts would be incurring higher interest expenses. These companies with more debts would earn lesser profits compared to companies with lesser debts. In this case, we need to look into their debts with greater scrutiny. If the companies continue to take on huge debts with current high-interest rates, they would be much more vulnerable compared to the rest.

Amongst the Magnficicent 7, Alphabet is looking strong together with Tesla. Does this imply that there is a chance for an improved investing rating of Tesla? An improvement in rating implies that more corporate and sovereign country funds can consider buying Tesla as part of their management.

The Magnificent 7 comprises Apple, Microsoft, Alphabet, Amazon, NVIDIA, Meta, and Tesla.

Observations:

Apart from Tesla looking good, we should keep a lookout for the companies that are showing weaknesses namely, Oracle, AbbVie, and Renault.

Shouldn't there be concerns for Toyota, Volkswagen, Ford, GM, Hyundai & Nissan too?

Outside of the Magnificent 7, we can consider Berkshire, Costco, ExxonMobil, and Chevron. Debt alone cannot be the sole criterion to shortlist a company. Let us look into their recent performances, revenue, net profit, free cash flow, net assets, retained earnings, and share dilution among other factors. We should also look into other non-quantitative factors like product pipeline, branding, and other factors.

If we were pitting Tesla against the other automakers, we would have made a big mistake. Tesla is way more than an automaker. Tesla is one of the top innovative, AI-driven, and sustainable companies with a wide range of solutions from mobility, solar energy, energy storage, autonomous driving, AI, insurance, infrastructure, materials, and more.

To beat Tesla, we need more than a better car, we need a better factory.

Comments

Post a Comment