Portfolio updates of top investors - Munger, Spier, Pabrai, Marks & more (14Nov2023)

Some of the top investors have filed their Q3/2023 13F - holdings of various portfolios of stocks listed in the USA.

Let us look at some of the top investors, their portfolios, and their activities (made up of sales and purchases).

As a growing and learning investor, it is hard for me to skip the materials shared by folks like Charlie Munger, Mohnish Pabrai, Guy Spier, and Howard Marks. I have spent them watching their interviews, reading their articles, and digesting their books. There are other folks like Peter Lynch and Warren Buffett who have shaped my investing paradigm tremendously.

Despite the great admiration, it is not good for me (personally) to copy their positions without doing my own due diligence. As we resonate with their principles and stories, we may have different investing time horizons, risk-reward tolerance, and perspectives. Over the recent months, I have added macro into my considerations.

Thus, I do use their positions as a reference or a filter. My own research is needed. As we have different circles of competence, I may stay away from banks even though some of them invest in this industry. Now, let us look at some of these seasoned investors.

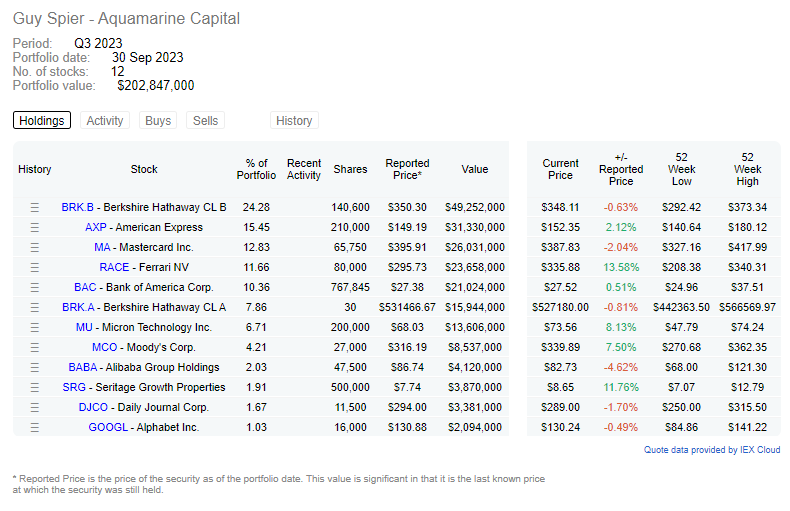

Guy Spier - Aquamarine Capital

Observations:

- There were no sales or purchases.

- Despite the recent downtrend of Baba, there were no sales. Is there still value and potential in this company?

- Aquamarine is still holding on to Seritage Growth Properties despite the fall in price. Is there still value in the company despite the tension surrounding real estate (especially commercial real estate)?

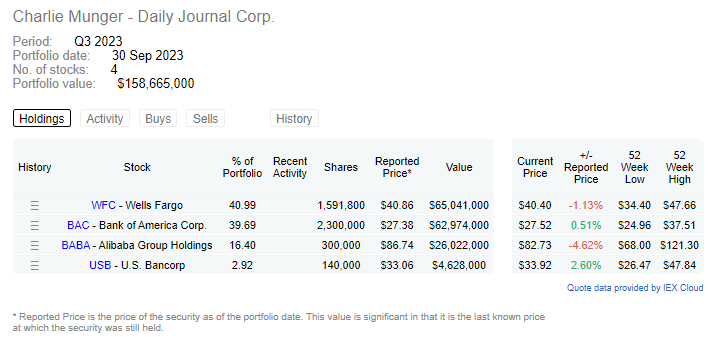

Charlie Munger - Daily Journal Corp.

Observations:

- There are no new sales and purchases according to the recent 13F.

- Despite the recent banking saga, Mr Munger has held on to these 3 banking stocks.

- Mr Munger is still holding on to BABA without any new sales or purchases. No news can also be good news. For this, I view this as Baba still having potential.

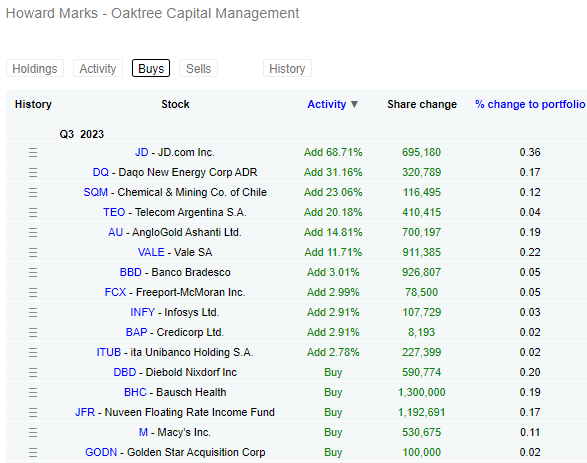

Howard Marks - Oaktree Capital Management

Here is the list of sales and purchases from Howard Marks.

Observations:

- The new positions are interesting with new purchases into companies like Macy’s and Bausch Health. Personally, the new position at Macy's is of great interest. With a “threatening” recession, I must have missed some great opportunities like Macy’s. It is maybe time to look at some of the retail stocks. Has the recovery started? Is this a value buy for a great company currently at a good discount?

- Howard Marks has also added a number of non-USA positions with the likes of JD (China), SQM (Chile) & TEO (Argentina).

- With the “trade tension” between China and the USA, it is intriguing that Howard Marks would add a Chinese stock to his portfolio. JD has proven to be a strong competitor to the likes of Alibaba in China and this stock deserves another look.

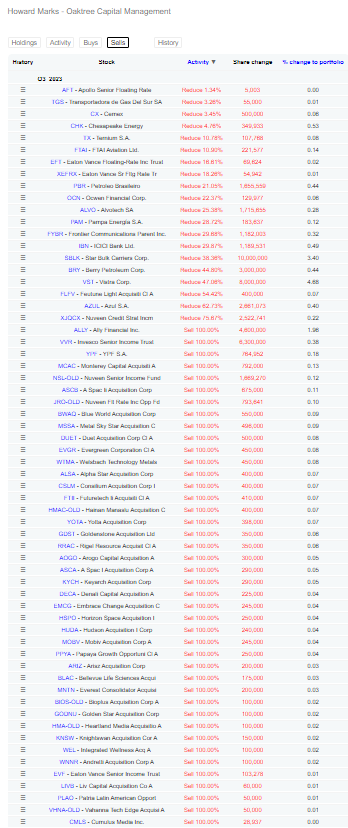

Observations:

- Oaktree has sold 100% of several companies. One such company is MCAC Fundamentals. This is the description from TradingView:

Monterey Capital Acquisition Corp. is a blank check company. It was formed for the purpose of acquiring, merging with, engaging in capital stock exchange with, purchasing all or substantially all the assets of, engaging in contractual arrangements, or engaging in any other similar business combination with a single operating entity, or one or more related or unrelated operating entities operating in any sector. The company was founded in 2021 and is headquartered in Monterey, CA.

- There are such similar companies that were sold (100%).

- I am unable to ascertain if the exit is due to weakening of the business fundamentals, profit taking or stop loss. This is something that we may wish to explore if we have holdings of such a blank check company.

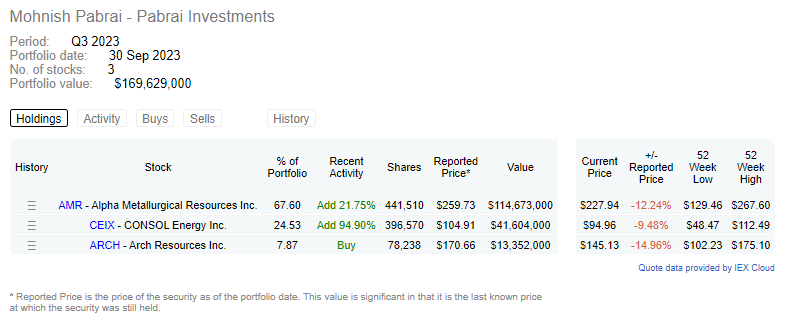

Mohnish Pabrai from Pabrai Investments

Observations:

- A new position was opened for ARCH 0.00%↑ where about $13 million was invested.

- He has also added to AMR and CEIX (an energy company).

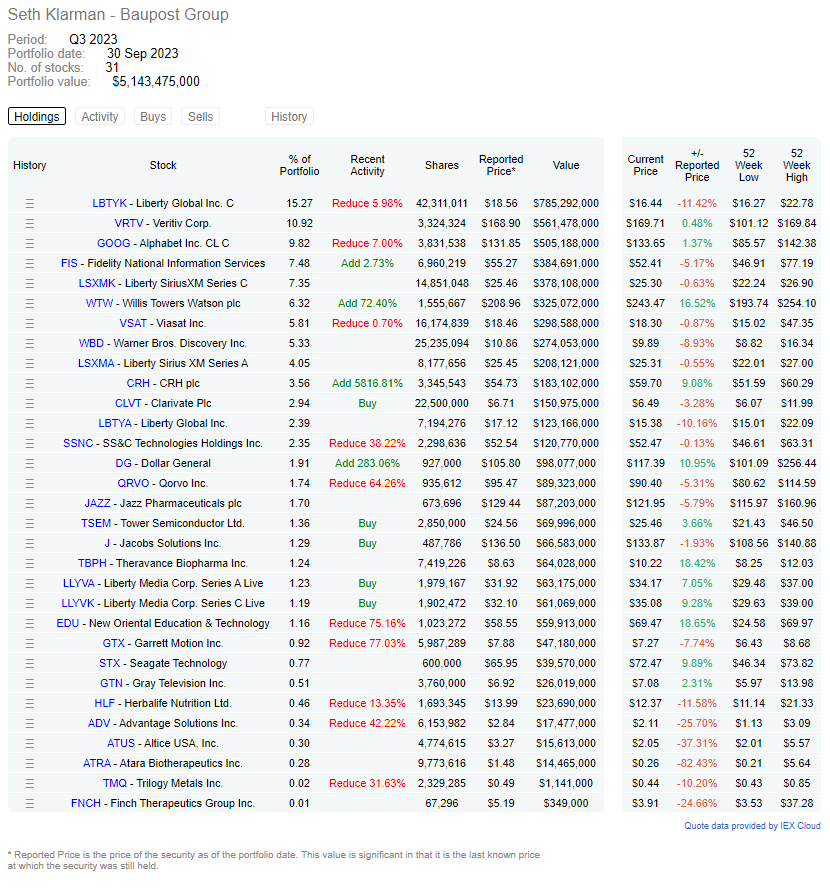

Seth Klarman - Baupost Group

Observations

- It is interesting for Baupost to sell out Amazon and Union Pacific. Are there any fundamental changes for Amazon and UNP?

- Baupost has added new positions in Clarivate, Tower Semiconductor, Liberty Media Corps, and Jacobs Solutions. These companies are largely unheard of for me.

- Baupost has added to existing holdings CRH, Dollar General, Willis Towers Watson, and Fidelity National Information Services. 2 stocks stood out. A whopping 5,816% of news shares were added for CRH and 283% for Dollar General. Maybe we can look into CRH and Dollar General again.

- Interestingly, Baupost has reduced its holdings of Google (Alphabet) shares by 7%. Is it for profit-taking or portfolio balancing?

Conclusion

I recommend using these as a reference and filter for investing leads that need to be further qualified. To blindly clone their trades are not recommended as they may have different strategy. Let us not be surprised if some of these investors close some losing positions. This could be due to a change in investing beliefs or tax loss harvesting.

According to Investopedia, Tax-loss harvesting is the timely selling of securities at a loss to offset the amount of capital gains tax owed from selling profitable assets. As always, let us research before investing.

Comments

Post a Comment