Latest US CPI data (14 Nov 2023) - have we defeated inflation?

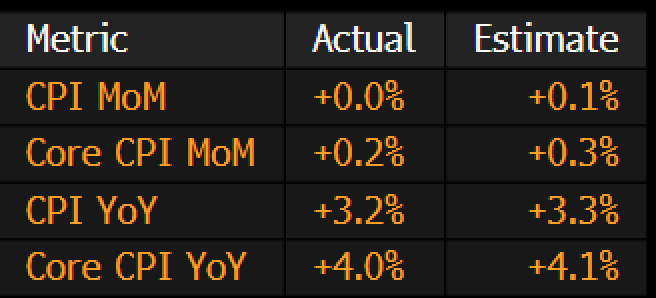

Latest US CPI Data on 14 Nov 2023:

From the data, the CPI MoM has remained. The Core CPI MoM increased by 0.2% (compared to the estimate of 0.3%). Core CPI YoY is 4.0% compared to the estimate of 4.1%.

Core inflation continues to grow though at a lesser rate. So, this is the summary that sends the pre-market into green. With this data, the market is hopeful that there should not be a rate cut in the coming Dec 2023 FOMC.

What can the Fed do following the CPI data?

Fed's inflation target is 2%. they can pause the rate increase and wait for inflation to drop. Or, they can raise the rates if they anticipate that their actions are inadequate to contain the inflation. They can consider dropping the interest rate if they feel that inflation is better managed.

Personally, the Fed has a tough job of balancing inflation and unemployment. There is the probability of inflation remaining sticky. Tomorrow’s PPI can provide a good reference as this precedes CPI. PPI shows the inflation that hits the producer before it is “passed on” to the consumers subsequently.

Note that the Fed's preferred inflation data is PCE, not CPI.

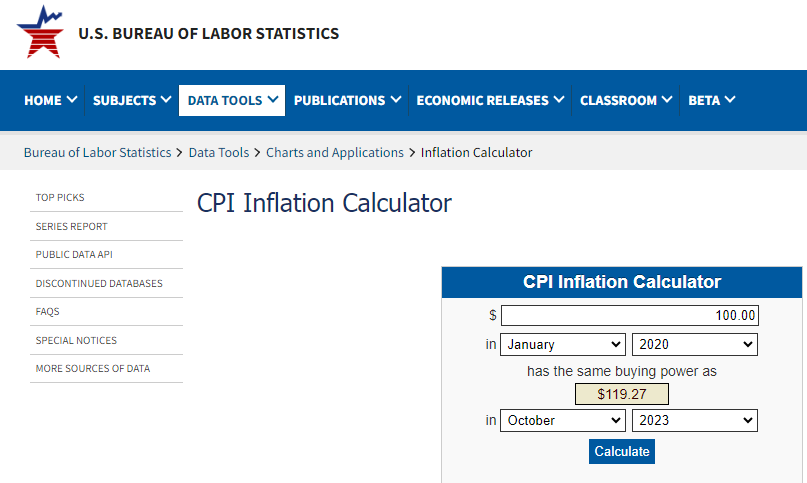

In context, the cumulative inflation from Jan 2020 to Oct 2023 is about 19.27%. So long the people are earning more than the inflation over the same period, it would be manageable. Is this the sentiment of the average American household?

From a recent tweet by Kobeissi Letter:

Annualized interest expense on US debt is now at $1.027 trillion and is quickly rising. Just 2 years ago, annual interest expense on US debt was at $450 billion. That's a 128% jump in interest expense and we didn't even enter a recession yet. Since 2020, total US debt is up ~$10 trillion and set to hit $35 trillion in 2024. That's a ~45% jump in US debt and the Fed is still calling for a "soft landing."

The debt situation in both households and the Federal government seems to be worsening.

Conclusion

The recent strikes from auto workers to healthcare workers and teachers have highlighted the “costs of living” crisis that is affecting many households. This led some to turn to credit cards and other credit facilities. While there seems to be some turnaround in inflation, the American family needs to earn more than its expenditures so as not to incur debt. The debt is funding inflation with credit card interest rates above 20%.

Looking at the Core Inflation, things continue to get more expensive. Let us continue to monitor closely, spend within our means, and avoid leverage.

Comments

Post a Comment