Can the competition catch up with Nvidia?

Latest earnings from Nvidia

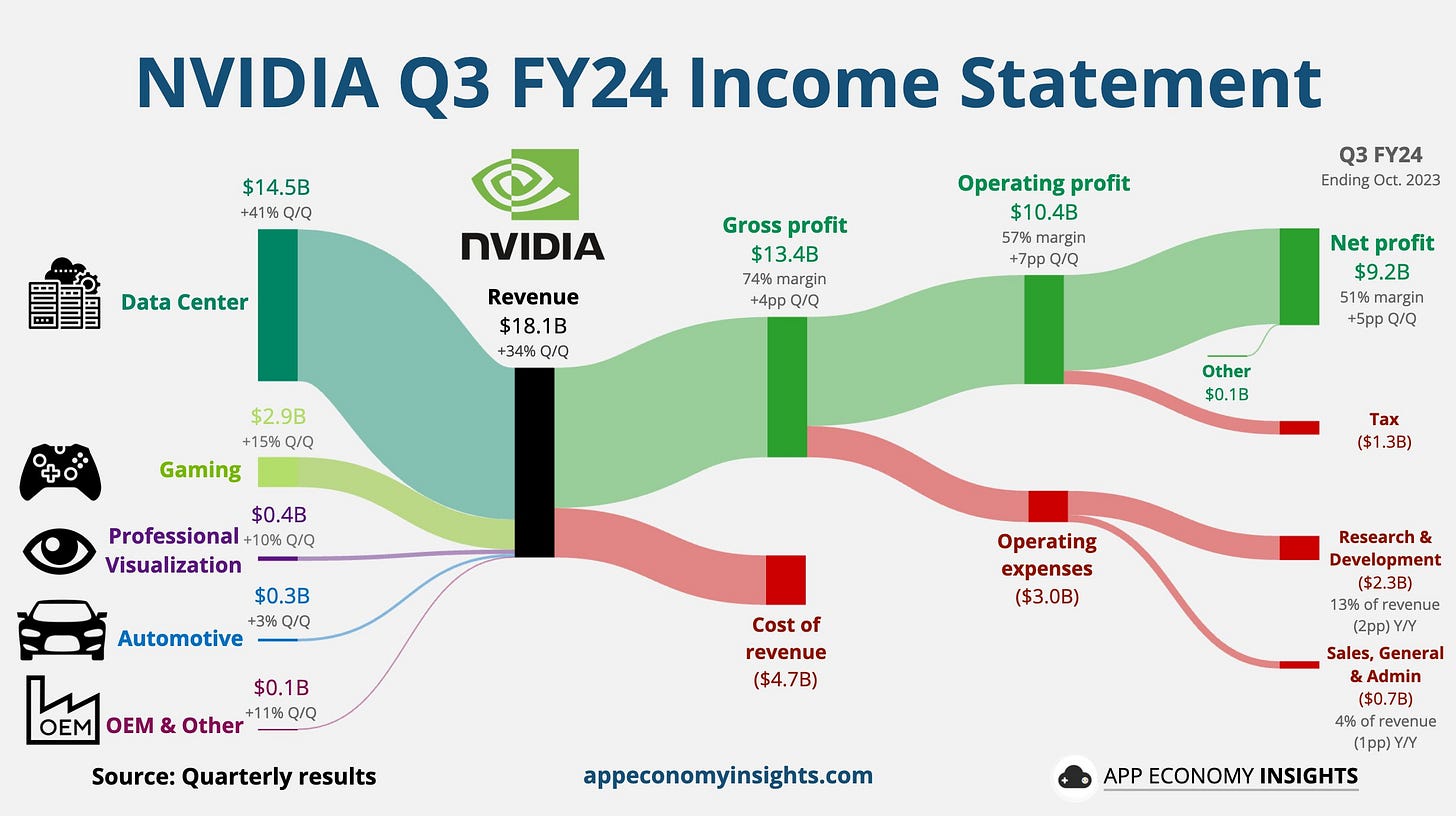

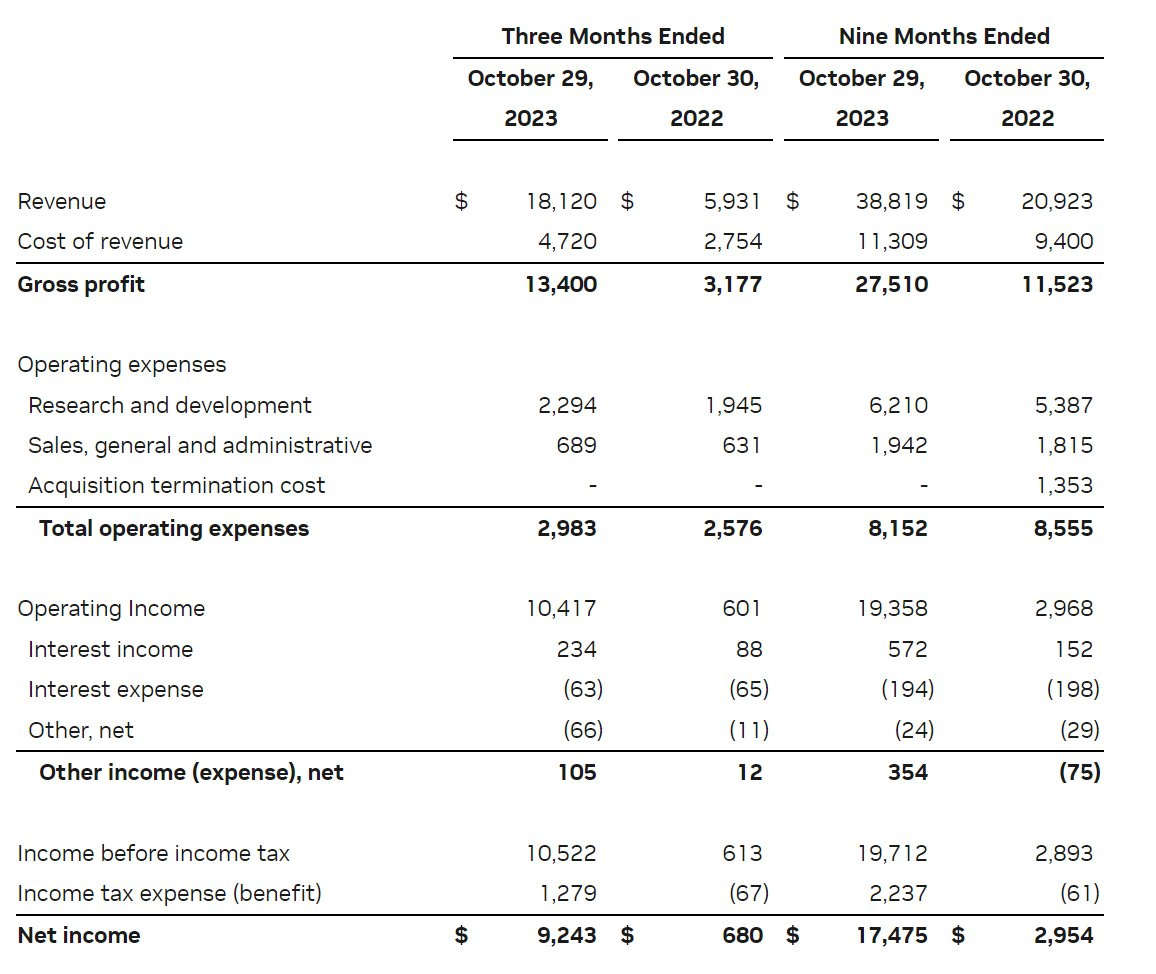

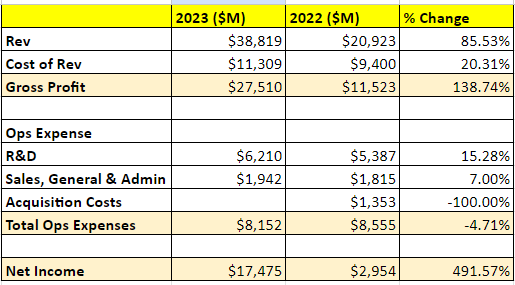

Observations from the recent earnings (comparing YoY growth, 9 months ended):

- Revenue grew 85.53%.

- Cost of Revenue grew 20.31%.

- Gross Profit grew 138.74%

- R&D expenses grew 15.28%

- Sales, general & Admin expenses grew 7%.

- Total expenses contracted by 4.71%

- Net income grew 491.57%

- The costs management of Nvidia is impressive. When revenue grew over 85%, the costs of revenue grew only 20.3%.

- Total expenses has in fact contracted by 4.71% despite a strong 85% growth in revenue.

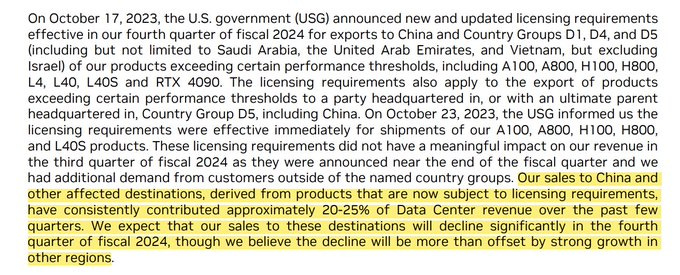

Despite these strong earnings, the market has concerns due to the outlook as per the transcript above. With the recent President Xi’s visit to the USA, will there be an easing of the licensing requirements? Can the trade tension ease?

Given the current semiconductor products, how many years it may take for the competition to catch up with Nvidia?

The following is the answer provided by Google Bard:

Predicting the exact time it will take for the competition to catch up with Nvidia is challenging due to the dynamic nature of the semiconductor industry and the continuous advancements in technology. However, based on current trends and industry insights, it is estimated that it could take anywhere from 5 to 10 years for competitors to significantly close the gap with Nvidia in terms of AI chip performance and market share.

Nvidia has established a dominant position in the AI chip market, holding over 70% of the market share. This dominance is attributed to several factors, including:

Early recognition of AI's potential: Nvidia recognized the potential of AI early on and focused its efforts on developing AI-specific GPUs.

Strong focus on software development: Nvidia has developed a comprehensive software ecosystem, including CUDA and cuDNN, which make it easier for developers to create AI applications on Nvidia GPUs.

Continuous innovation: Nvidia has consistently invested heavily in research and development, resulting in a steady stream of new and improved AI chip products.

While Nvidia holds a significant lead, competitors are not standing still. Companies like AMD, Intel, and Google are making substantial investments in AI chip development and are slowly gaining ground. For instance, AMD's recent Radeon 7900 XTX GPU has demonstrated significant performance improvements in generative AI applications.

However, catching up to Nvidia will not be an easy task. Nvidia's lead is substantial, and the company continues to innovate at a rapid pace. Moreover, the development of AI chips requires significant investments in research, engineering, and manufacturing.

Overall, it is likely to take several years for the competition to close the gap with Nvidia. However, the AI chip market is rapidly growing, and there is room for multiple players to succeed.

My final thoughts

Nvidia has put in another strong earnings performance. This affirms their position as one of the industry leaders and an important role in the growth of Artificial Intelligence (AI). AI is the future and Nvidia is expected to play a big part in the immediate future.

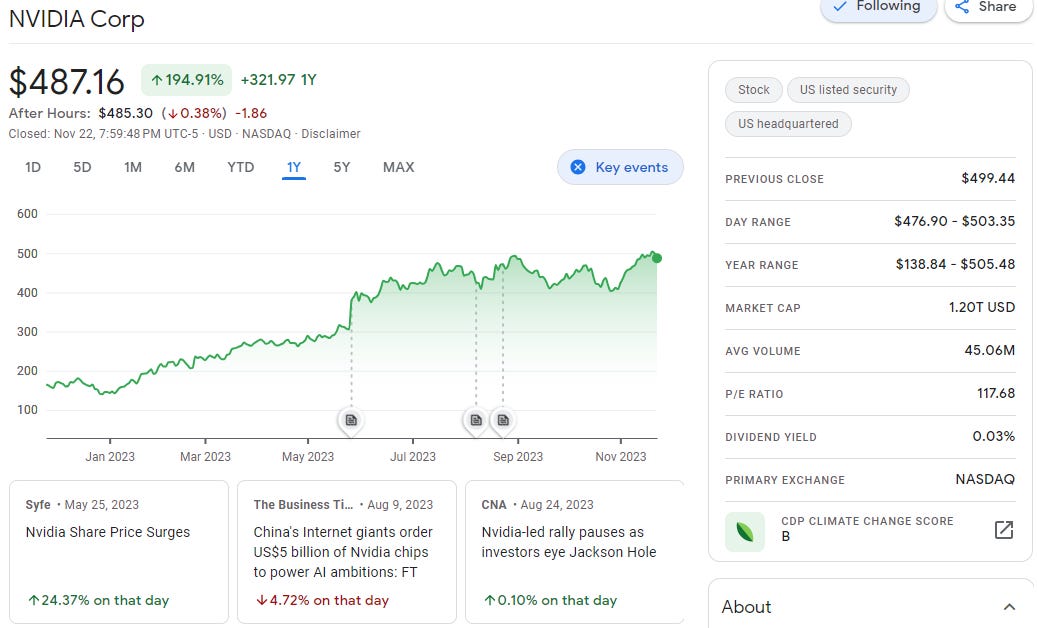

Nvidia is one of the “Magnificent 7” with a current market cap of USD$1.20T. With a P/E ratio of 117.68, is this stock too expensive? If Nvidia enjoys monopolistic presence in the market, wouldn’t the price be attractive?

My concerns remain that macro would play a bigger impact over monopoly. With the US market cracking under debt, I recommend caution.

Comments

Post a Comment