WeWork is unable to make interest payment to Bondholders - a CRE casualty?

WeWork Skips $95 Million Interest Payment to Bondholders to Start Debt Talks

The co-working company says it may make up the missed payment during a 30-day grace period

By Ben Glickman on Oct. 2, 2023 5:29 pm ET|WSJ PRO

Who is WeWork?

(The following section is extracted from their website)

WeWork was founded in 2010 with the vision to create environments where people and companies come together and do their best work. Since opening our first location in New York City, we’ve grown into a global flexible space provider committed to delivering technology-driven flexible solutions, inspiring spaces, and community experiences. Today, we’re constantly reimagining how the workplace can help everyone, from freelancers to Fortune 500s, be more motivated, productive, and connected.

Our network

700+ locations globally

39 countries

682,000 physical memberships

70,000 All Access memberships

*As of December, 2022

The following is an extract from Wikipedia on the commercial real estate footprint of WeWork:

As of December 31, 2022, the company operated 43.9 million square feet (4,080,000 m2) of space, including 18.3 million square feet (1,700,000 m2) in the United States and Canada, in 779 locations in 39 countries, and had 547,000 members, with a weighted average commitment term of 19 months. WeWork Inc.

Recent Performance of WeWork

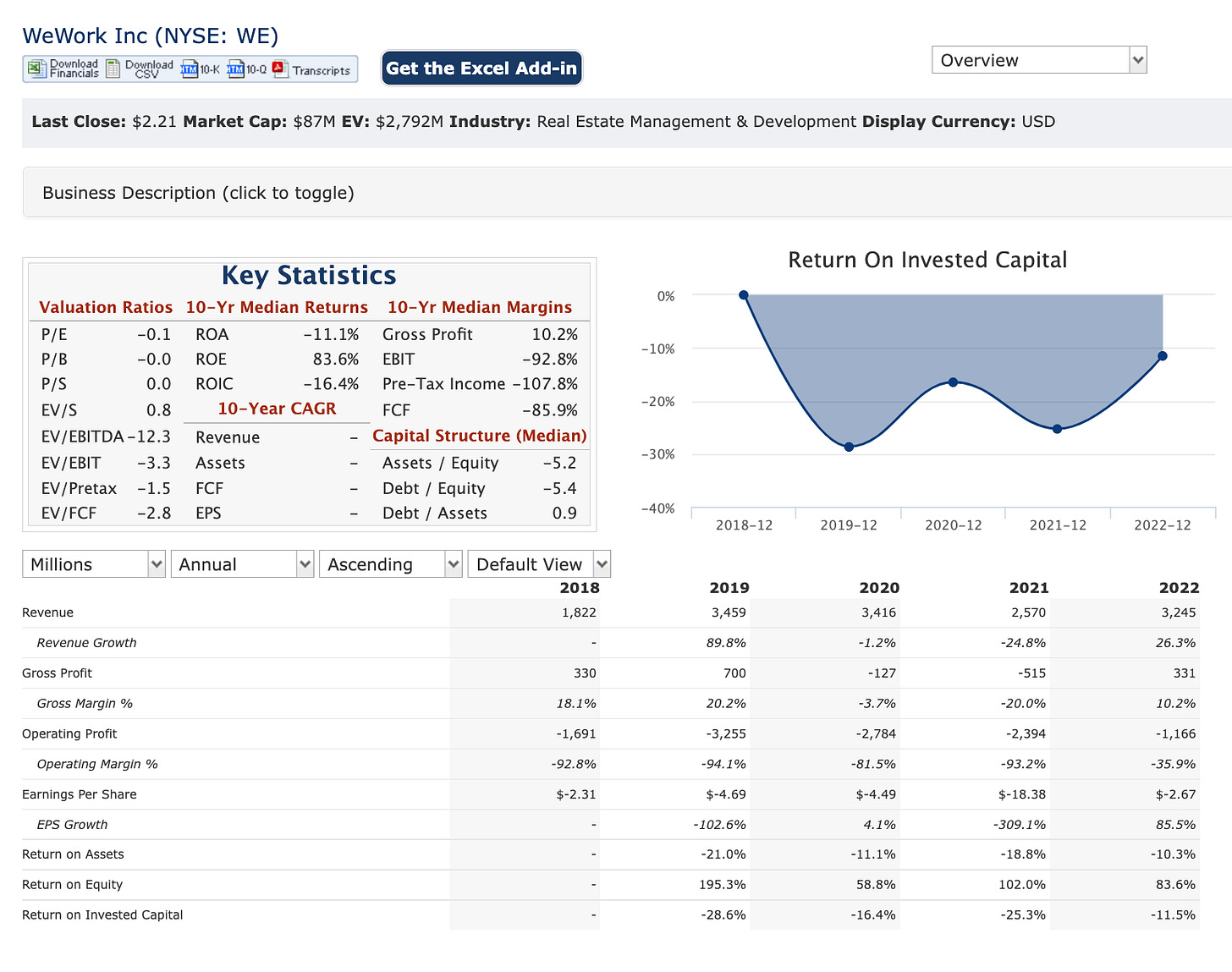

Observations of WeWork (2018 to 2022):

WeWork is fluctuating around an annual revenue of $3,300 million.

The Gross profit margin over the last few years was 10.2% but the company remains in the red. In 2022, it ended the year with the lowest loss of $1,166 million.

There was a good improvement in EPS from -$18.38 (2021) to -$2.67 (2022). Though it remains at a loss, the losses seem to be in decline.

Conclusion

For a company that once reached heights of $598.80, the company’s stock currently lingers around $2.20. With the latest news of missing interest payments, WeWork is displaying fundamental weaknesses and thus can be a risky position to hold.

It is time for us to review if we are still holding onto this stock. For them to take on more loans would be hard as they cannot break even. Thus, it can be prudent for us to cash out any positions we may have for this.

Comments

Post a Comment