Watch out for companies with Debts

With the current interest rates, companies which are not making profits and have higher debt exposure would run more risks. Thus, I have set up a screener in the S&P500 to identify some companies with such risks.

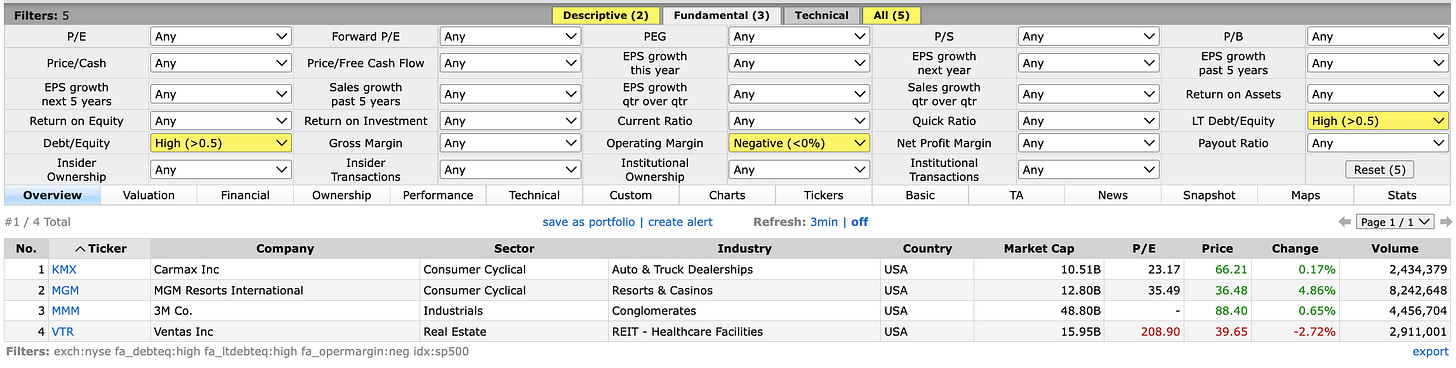

I have set up a screener using the following:

S&P500

High Debt/Equity (more than 0.5)

High Long-term Debt/Equity (more than 0.5)

Operating margin (negative) - that is running at operational losses.

From the above screener, there were a total of 4 companies namely Carmax Inc, MGM Resorts International, 3M Co and Verizon Inc. These companies are losing money (making losses) and have significant debts on hand. If these are sustained, the companies would be at risk.

This is just an initial screening and more needs to be done to qualify their fundamentals before we make the decision to buy, sell, hold or avoid.

Revenue, profit, good free cash flow, net debts and retained earnings will be the data that I screen first before I deep dive into other quantitative and qualitative aspects.

Let us take time to review our portfolio. It could be necessary to remove some non-performing and weak fundamental holdings. As always, let us research before investing.

Comments

Post a Comment