Quick Look - is LVMH worth a shot?

Who is LVMH?

This is the profile of LVMH from Yahoo Finance:

LVMH Moët Hennessy - Louis Vuitton, Société Européenne operates as a luxury goods company worldwide. The company offers champagnes, wines, and spirits under the Clos des Lambrays, Château d'Yquem, Dom Pérignon, Ruinart, Moët & Chandon, Hennessy, Veuve Clicquot, Château Galoupet, Ardbeg, Château Cheval Blanc, Glenmorangie, Krug, Mercier, Chandon, Cape Mentelle, Joseph Phelps, Newton Vineyard, Cloudy Bay, Belvedere, Terrazas de los Andes, Bodega Numanthia, Cheval des Andes, Woodinville, Ao Yun, Clos19, Volcan de mi Tierra, and Eminente brands; and fashion and leather products under the Loewe, Moynat, Louis Vuitton, Berluti, RIMOWA, Patou, Loro Piana, FENDI, Celine, Christian Dior, Emilio Pucci, Givenchy, Kenzo, and Marc Jacobs brands. It also provides perfumes and cosmetics under the Stella by Stella Mccartney, Officine Universelle Buly, Guerlain, Acqua di Parma, Parfums Christian Dior, Givenchy Parfums, Perfumes Loewe, Benefit Cosmetics, Make Up For Ever, Kenzo Parfums, Fresh, KVD Beauty, Maison Francis Kurkdjian, Cha Ling, Fenty Beauty by Rihanna, and Marc Jacobs brands; watches and jewelry under the Chaumet, Tiffany & Co., TAG Heuer, Zenith, Bulgari, Fred, Hublot, and Repossi brands; and custom-designed yachts under the Feadship and Cheval Blanc brand names, as well as designs and builds luxury yachts under the Royal Van Lent brand. In addition, the company offers daily newspapers under the Les Échos brand; Belmond, a luxury tourism service; home other activities under the Cova, Jardin d'Acclimatation, Le Parisien, Connaissance des Arts, Investir, and Radio Classique brands; and selective retailing products under the DFS, La Grande Epicerie de Paris, Le Bon Marché Rive Gauche, Sephora, and Starboard Cruise Services brands, as well as operates Jardin d'Acclimatation, a leisure and theme park. It operates 5,664 stores. LVMH Moët Hennessy - Louis Vuitton, Société Européenne was incorporated in 1923 and is headquartered in Paris, France

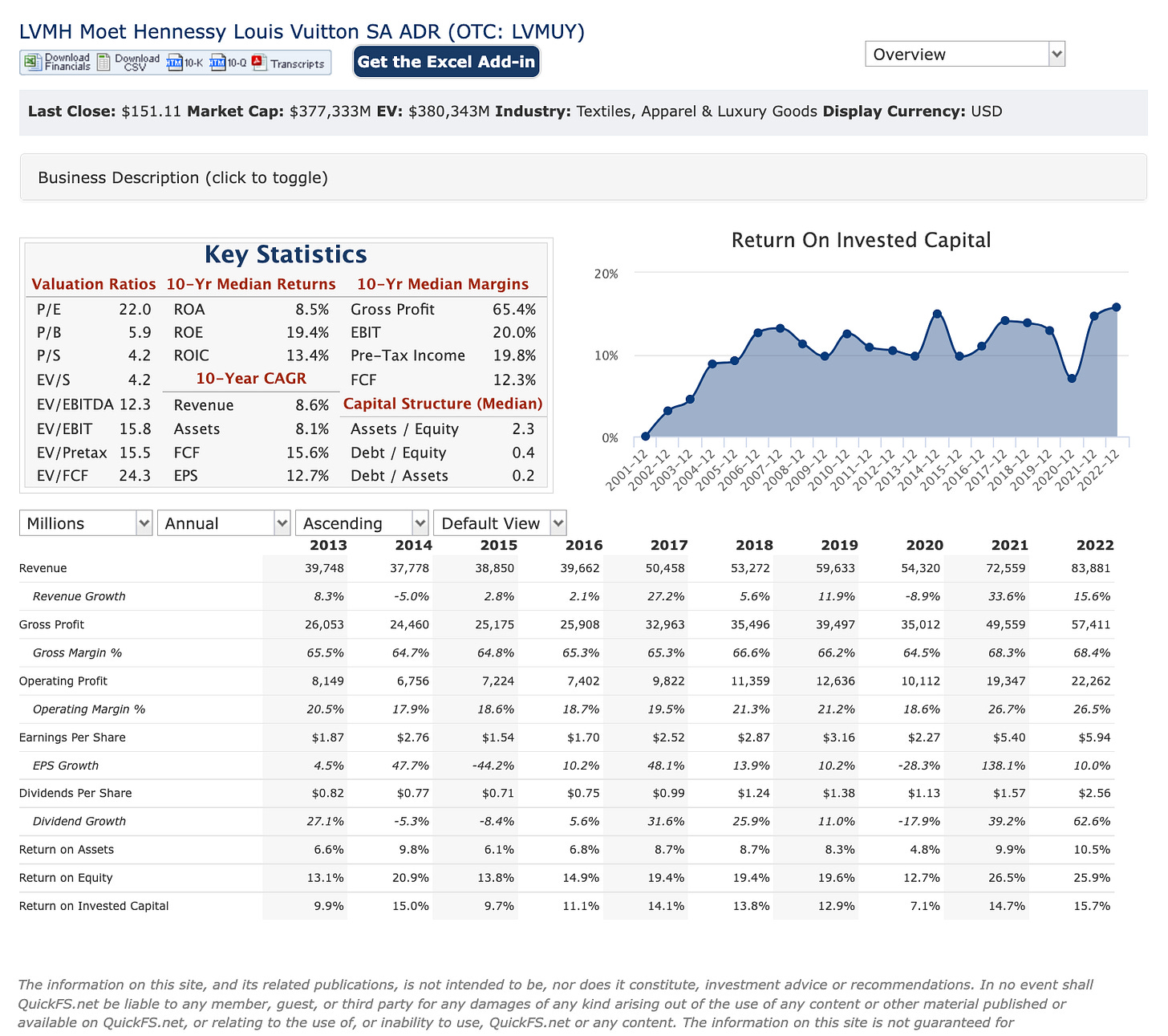

Let us take a quick look at LVMUY for the last 10 years as per the summary above:

The 10-year Median margin for gross profit is about 65.4%

The 10-year FCF is about 12.3%

It has health books with 2.3 for Assets/Equity, 0.4 Debt/Equity and 0.2 Debt/Assets ratio. This implies that LVMH is able to operate and grow the business with less debts.

Note the 217% growth in their annual EPS: $1.87 (2013) to $5.94 (2022).

Note the 111% growth in their annual revenue: $39.74B (2013) to 83.861B (2022).

Note the 173% growth in their operating profits: $8.149B (2013) to 22.262B (2022)

This is an excellent performance. With more revenue, LVMH has gained even more operating profits.

Technical Analysis of LVMH

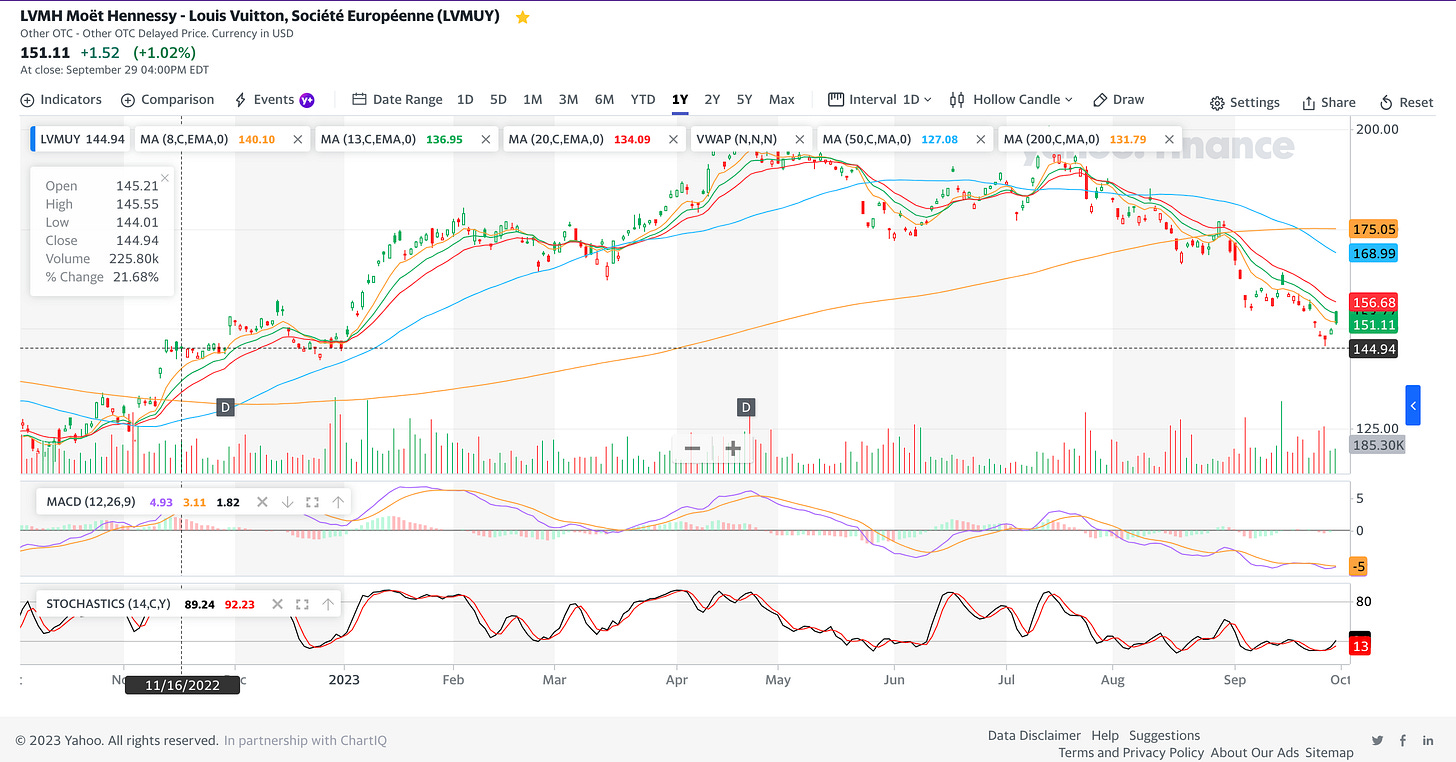

The above is the chart for LVMH Moët Hennessy - Louis Vuitton, Société Européenne (LVMUY). This is the OTC stock listed in USD.

As per the 1D chart dated 2nd Oct 2023, here are some technical observations for this stock:

A death cross has been created as per the crossover of MA50 with MA200 on 20 Sep 2023. It’s a bearish sign, indicating that the market may be heading toward a longer-term downtrend or bear market as per Britannica.

The Exponential Moving Averages (EMA 8, 13 & 20) lines are pointing to a downtrend.

The Stochastic indicator has completed a bottom crossover and it is currently indicating an uptrend.

The MACD indicator is about to complete a bottom cross and an uptrend should be confirmed in the coming days.

My investing muse

It seems that the luxury company has emerged strongly from the initial COVID-19 outbreak in 2020.

Is this a company that is worth a look? Let us do our own due diligence before investing.

Comments

Post a Comment