Preview of the week 23 Oct 2023 - can Microsoft lift the market?

Public Holidays

There are no public holidays for China, the USA & Singapore in the coming week.

Hong Kong is closed on 23 Oct 2023 (Mon) for Chung Yeung Day.

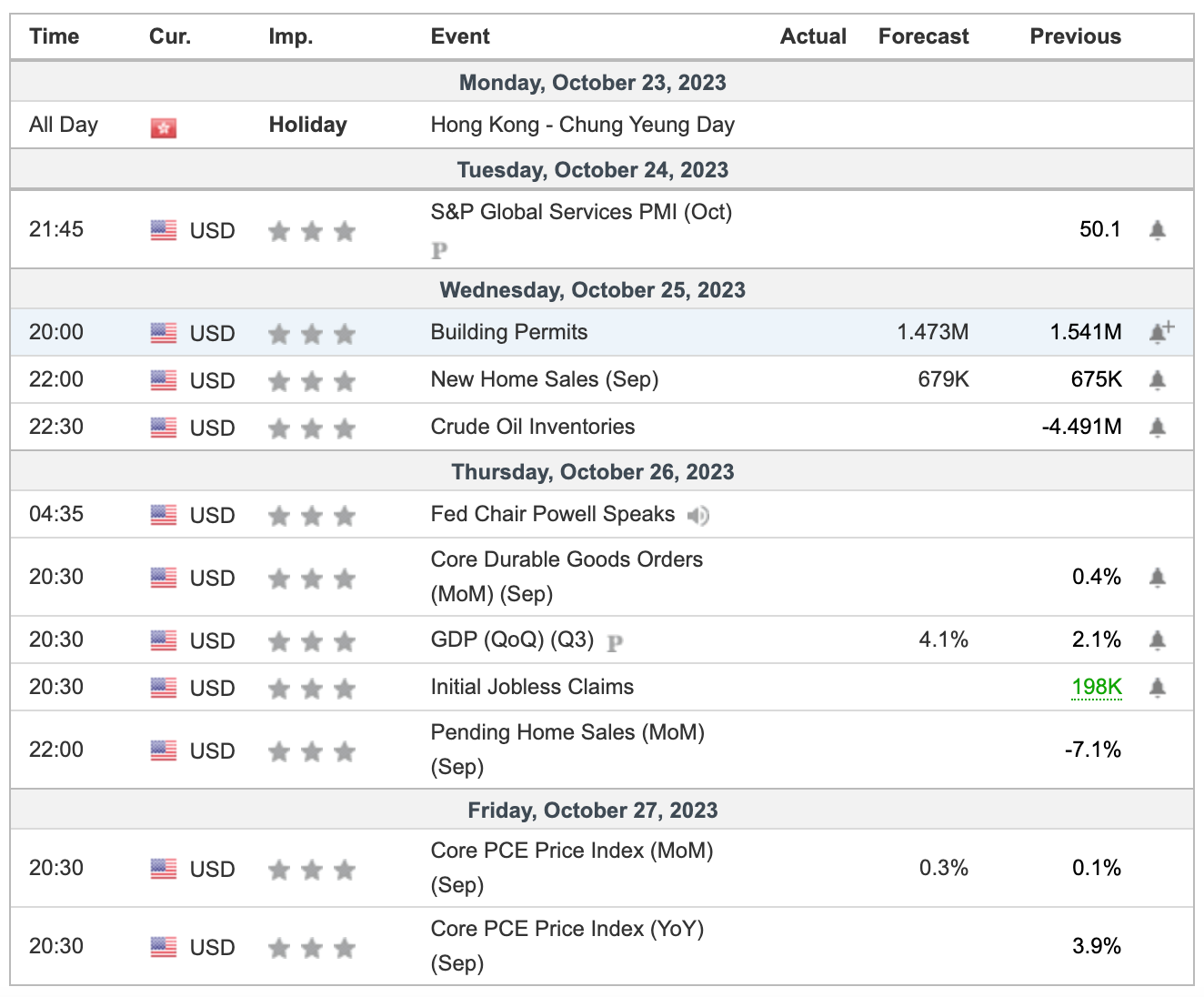

Economic Calendar (23Oct2023)

Notable Highlights

- GDP QoQ (Q3) data will be released where the market expects strong growth at 4.1%.

- PCE Price Index is the preferred indicator of inflation for the Fed. Thus, this would be a key data point for the Fed’s coming decision on interest rates. If PCE strengthens, the Fed may raise the coming interest rate.

- Core Durable Goods Orders data will be revealed. This will provide an understanding of the consumption within the US.

- Building Permits, New Home Sales & Pending Home Sales will be released in the coming week. These will be a good reference for the real estate in the USA. Property prices remain elevated due to the

- Initial Jobless Claims will be released in the coming week. This is another important data point for the Fed’s coming interest rate decision as they seek to balance inflation and unemployment.

- Crude Oil Inventories can be seen as forward indicators of market demand and consumption. If the trend of excess inventories continues, this implies demand erosion that can lead to reduced production & weakening consumer spending.

Earnings Calendar (23 Oct 2023) - can Microsoft lift the market?

For the coming, there are a couple of earnings of interest in the coming week. Personally, the earnings of the following companies are interesting namely Microsoft, Alphabet, Meta, Amazon, UPS and ExxonMobil.

Let us take a look at the earnings of Microsoft in detail.

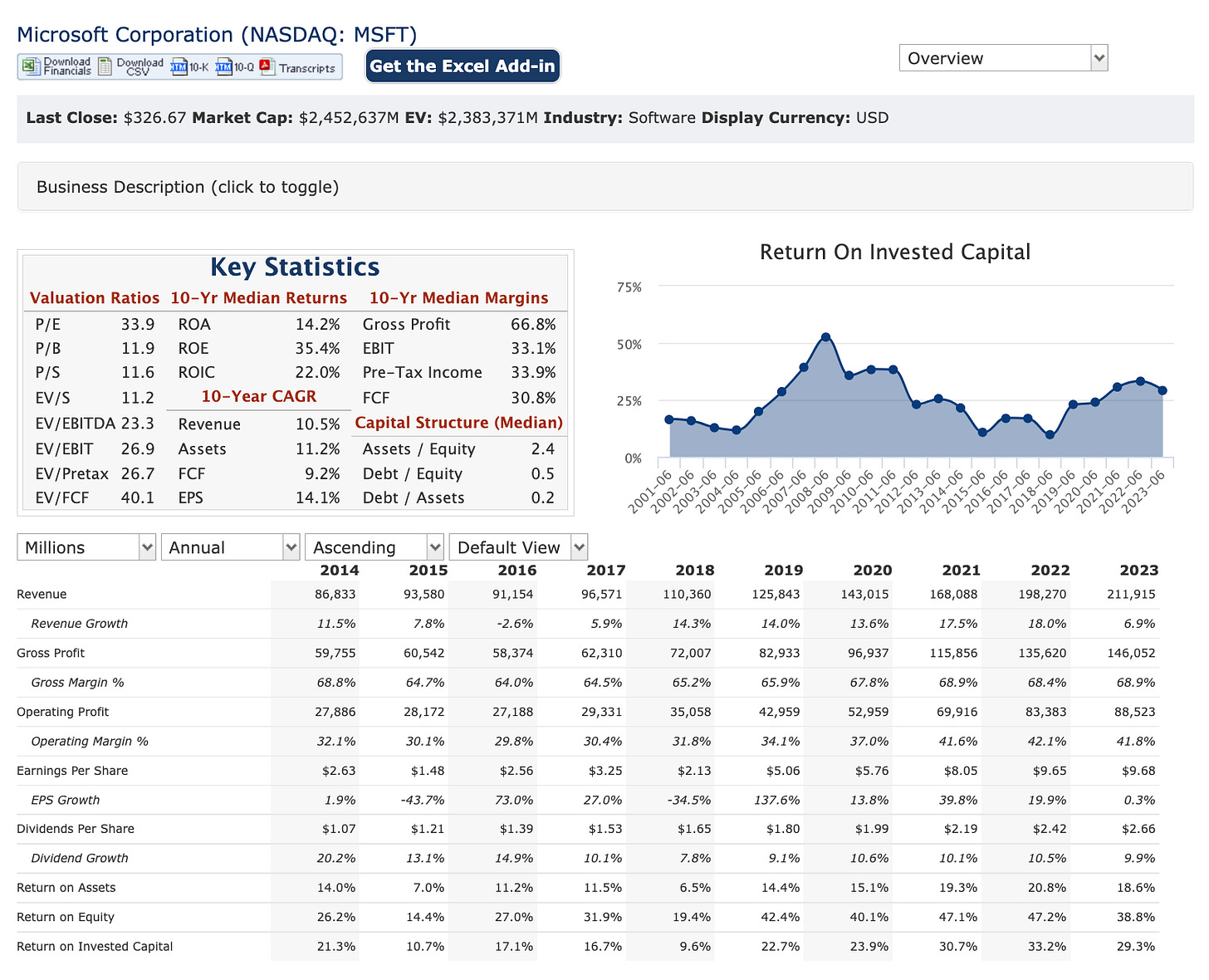

Earnings of Microsoft (MSFT)

Observations:

- Revenue has grown from $86B (2014) to $211B (2023)

- The gross profit (10-year median margin) stands at an impressive 66.8% and FCF is 30.8% (10-year median margin) or 9.2% (10-year CAGR).

- EPS grew from $2.63 (2014) to $9.68 (2023)

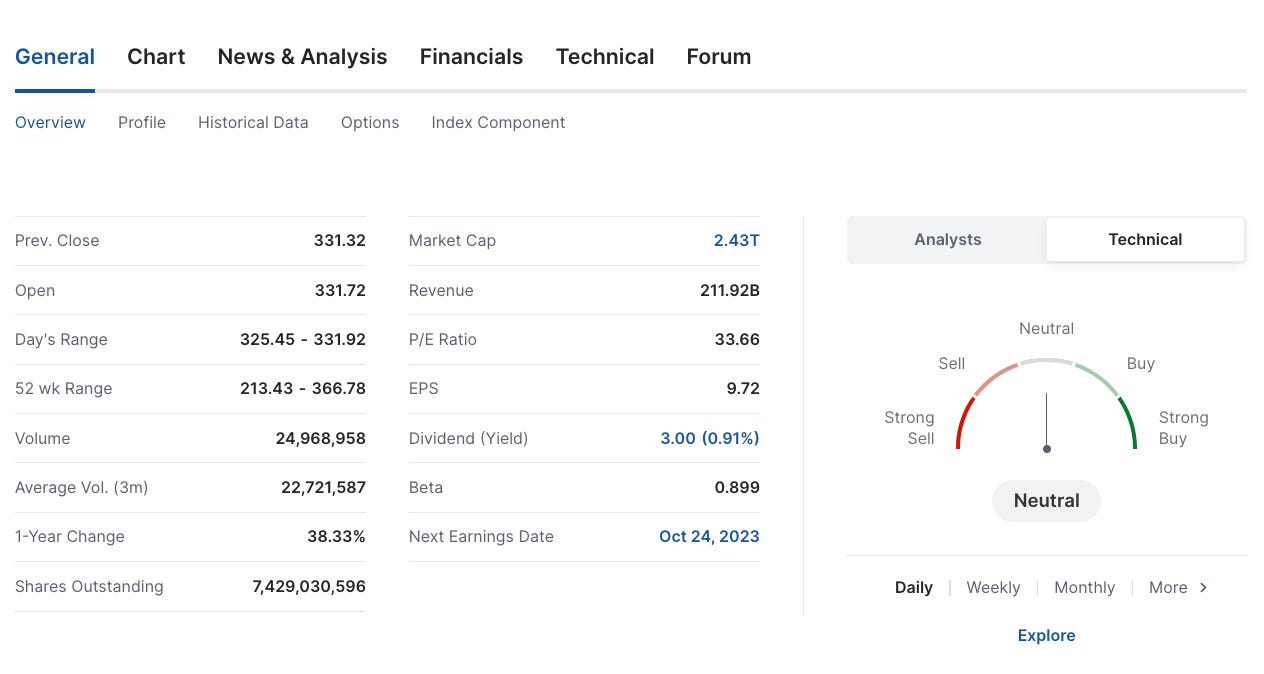

Microsoft has gained 38.33% from a year ago with a beta of 0.899

For the coming earnings, the forecast for Microsoft is 2.65 and $54.53B for the EPS and revenue respectively. Can Microsoft lift up the market?

Market Outlook - 23Oct2023

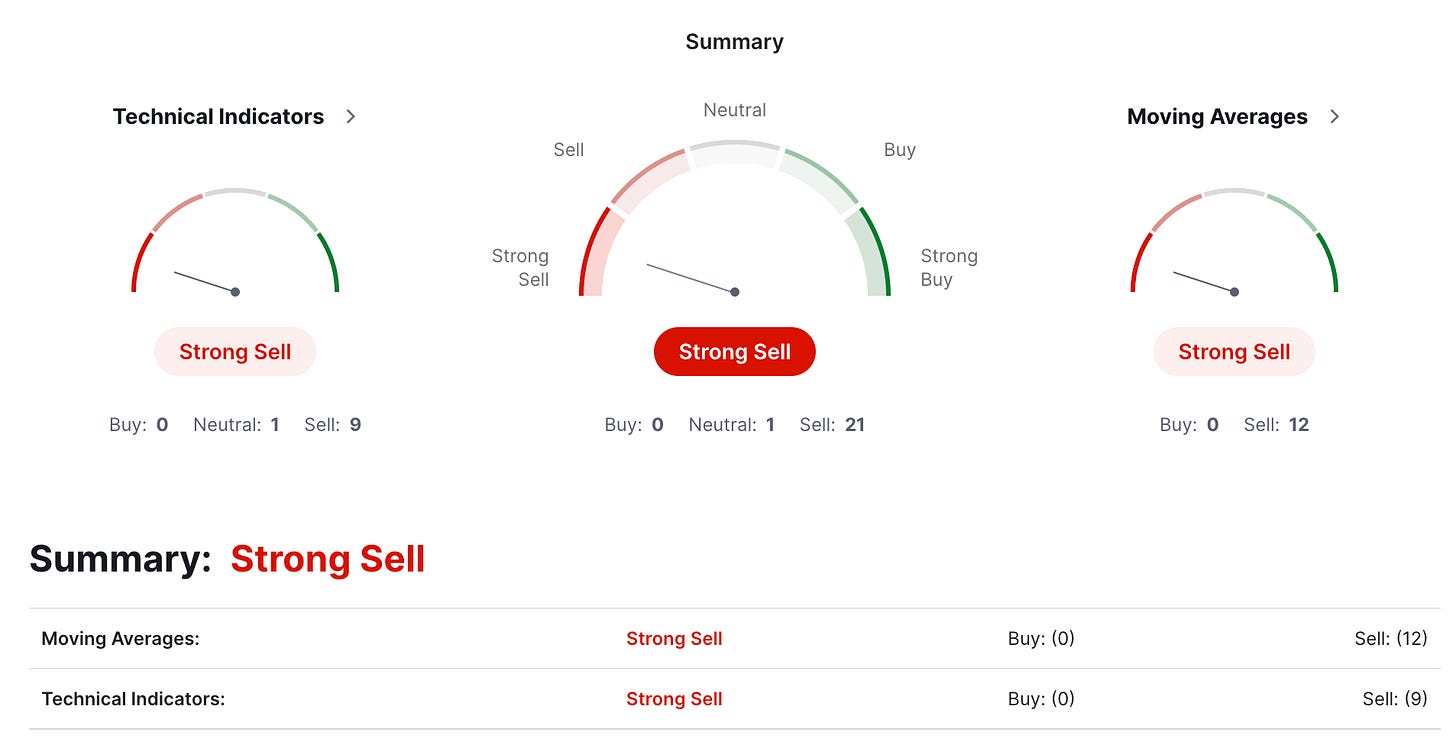

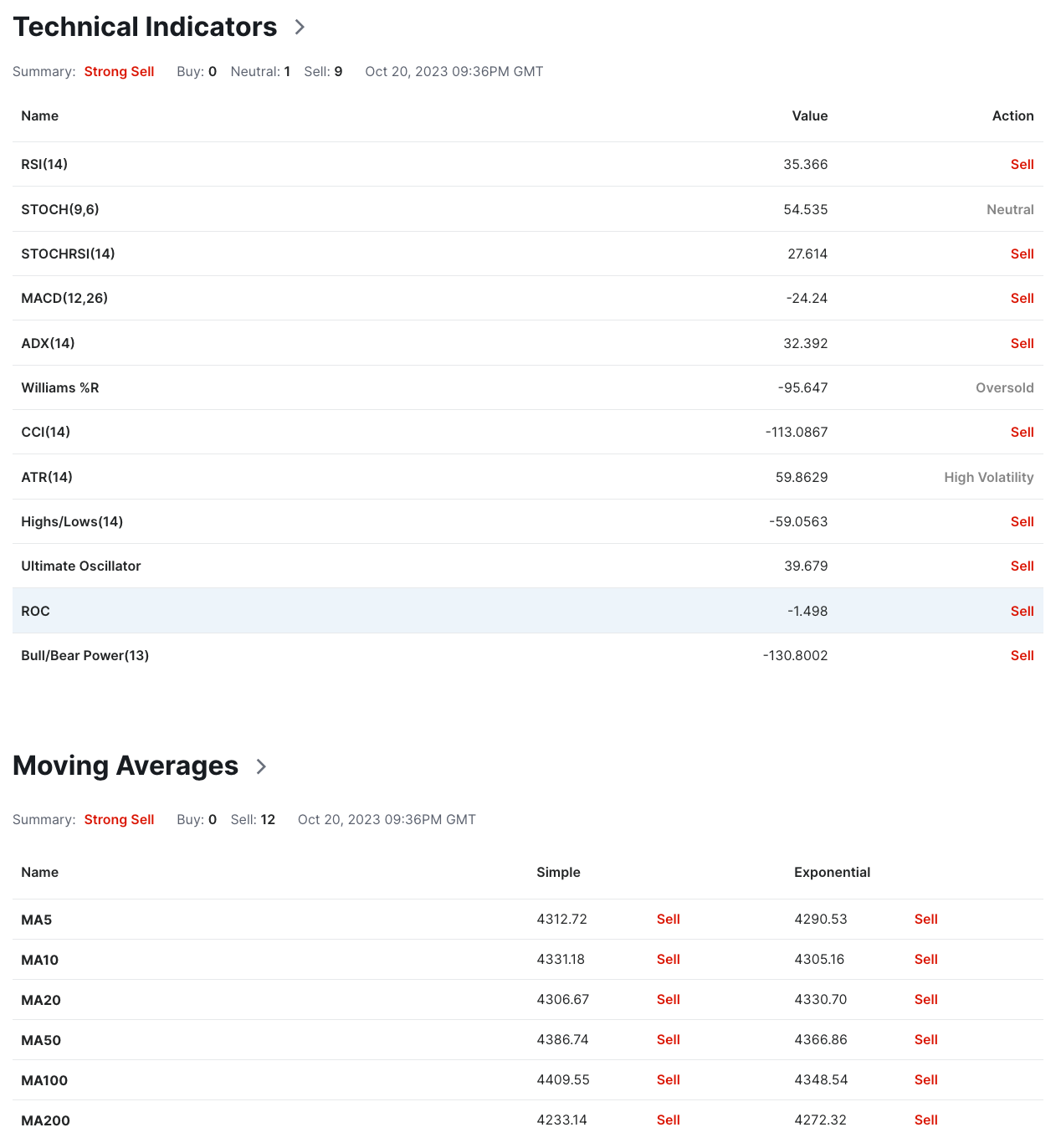

Technical observations of the S&P500 1D chart:

- The Stochastic indicator is showing a downtrend.

- The MACD indicator looks to complete a top crossover and this should be completed in the coming days.

- Moving Averages (MA). The MA50 line has started a downward trend and the MA200 line is on an uptrend. With the last candles below the MA50 line and cutting the MA200 line, the long-term outlook seems to be heading towards a downtrend in the coming days. For the mid-term, it is on a downtrend. As the 2 lines move closer, there is a chance of the formation of a death cross - typically, a bearish indicator. This could take weeks before this death cross is formed and changes are possible.

- Exponential Moving Averages (EMA). All the 3 EMA lines are indicating a downtrend.

From the 1D technical indicators above, there are a total of 0 (Buy), 21 (Sell) and 1 (Neutral). Investing recommends the “STRONG SELL” recommendation based on the technical indicators above (1D chart for S&P500).

This week should be a downtrend for the S&P500 though it is reaching an oversold region.

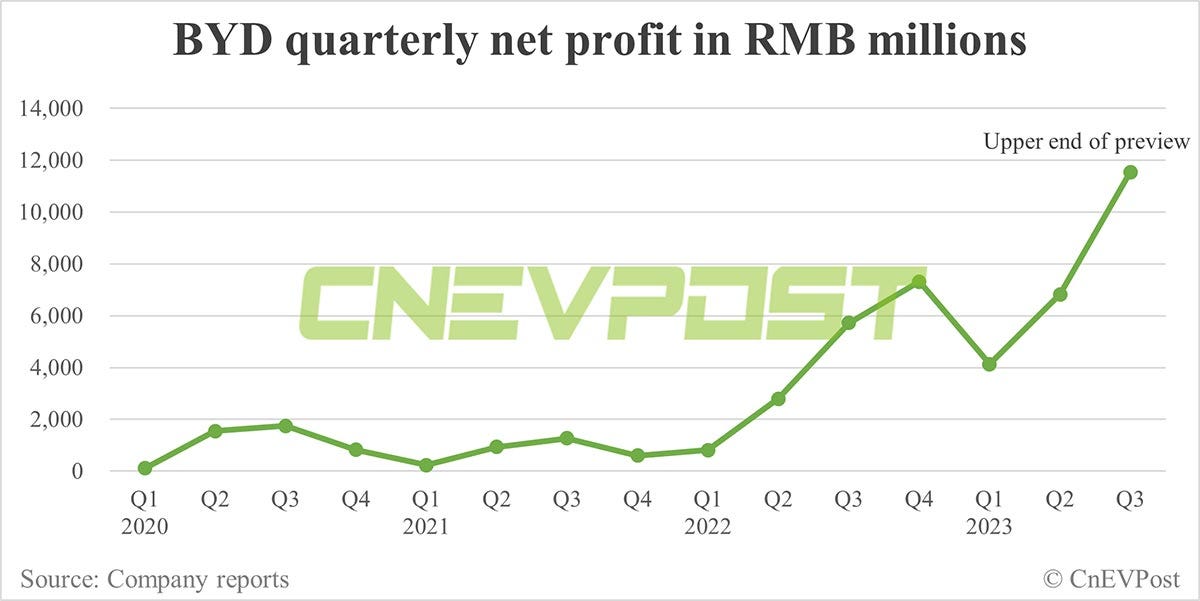

News and my thoughts from the last week (23Oct2023) - layoffs, bankruptcy & BYD

- The government tries to tank the economy by shoring up some of the challenging sectors. Without fixing the fundamentals, it becomes a delay, not a solution. The problems grow until they roll over. At that point, it could be too much & too big to save. Fix it while you can.

- SP Global > US corporate bankruptcies filed year-to-date have exceeded annual totals for both 2021 and 2022 as companies continue to face high-interest rates and a tight labor market.

- Layoffs. Retail layoffs in REI & Express. Biopharma Layoff Tracker 2023: Beam, Nkarta, Pfizer and More Cut Staff. LinkedIn to cut 668 jobs. KPMG to cut 100 jobs. Rolls-Royce to cut 2,500 jobs. Stack Overflow to cut 100 jobs. Nokia has revealed plans to shed up to 14,000 jobs following a slump in sales. In the facing of shrinking revenue, Qualcomm announced it would be laying off more than 1,200 workers in California in December, according to CNN. Ford announced 550 more layoffs, which brings the number of strike-related layoffs to 2,480. Citigroup layoffs: Firm fires 2,000 employees; total job cuts now 7,000

- CNBC > Pressured by the impact of higher interest rates on the mortgage business, Wall Street deal-making and funding costs, the next five largest U.S. banks have cut a combined 20,000 positions so far this year, according to company filings.

- Business Times > DHL Supply Chain to invest 350 million euros in South-east Asia, adding 3,000 job

- Fortune > Moynihan went on to support an observation made by Citigroup CEO Jane Fraser, who said “cracks” are beginning to show in consumer spending, particularly by lower-end consumers.

- Business Insider > Egypt issued yuan-denominated panda bonds for the first time amid a scramble to pay foreign debts.

- Three-year bonds worth 3.5 billion yuan, or about $479 million, were issued with a 3.5% interest rate.

- Bankruptcy can start with falling demand, increasing costs, liquidity, credit and collateral damages.

- For my American friends, isn't it time to start a movement to place American citizens as the priority? Citizen First Policy - can this be the main criteria for all political elections followed by fiscal responsibility?

Debts will be paid or defaulted. One man's debt is another's asset.

How much of this cost of living crisis is due to inflation, and how much is from corporate profiteering?

The 5 biggest companies in the S&P 500 Index - Apple, Microsoft, Alphabet, Amazon and Nvidia — account for about 25% of the benchmark’s market capitalization. Their earnings are projected to jump 34% from a year earlier on average.

(Reuters) -About 3,700 Detroit casino workers are set to strike on Tuesday noon, if a contract deal is not reached, the Detroit Casino Council (DCC) said on Monday.

Business Insider > The ratings agency says about $1.87 trillion of junk-rated debt is maturing between 2024 and 2028. That signifies a 27% jump from the $1.47 trillion recorded in last year's study for 2023-2027.

CNBC > Drugstore chain Rite Aid filed for Chapter 11 bankruptcy protection in New Jersey.

The company has been grappling with slowing sales, mounting debt and lawsuits alleging it contributed to the nation’s opioid epidemic.

Through scaling of innovations, technology can be deflationary as productivity improves.

My investing muse - US & Middle East, Market & GDP & Hedging

Can the US afford the Middle East conflict?

The US has found itself embroiled in another war front following Ukraine. With 2 of her aircraft carriers based in the region, the USA has warned other countries not to get involved.

According to a recent CNN article, concerns about sustainability have been raised.

Concern is growing within the Pentagon over the potential need to stretch its increasingly scarce ammunition stockpiles to support Ukraine and Israel in two separate wars, according to multiple US defense officials.

Several have questioned if the USA was able to support a second war front.

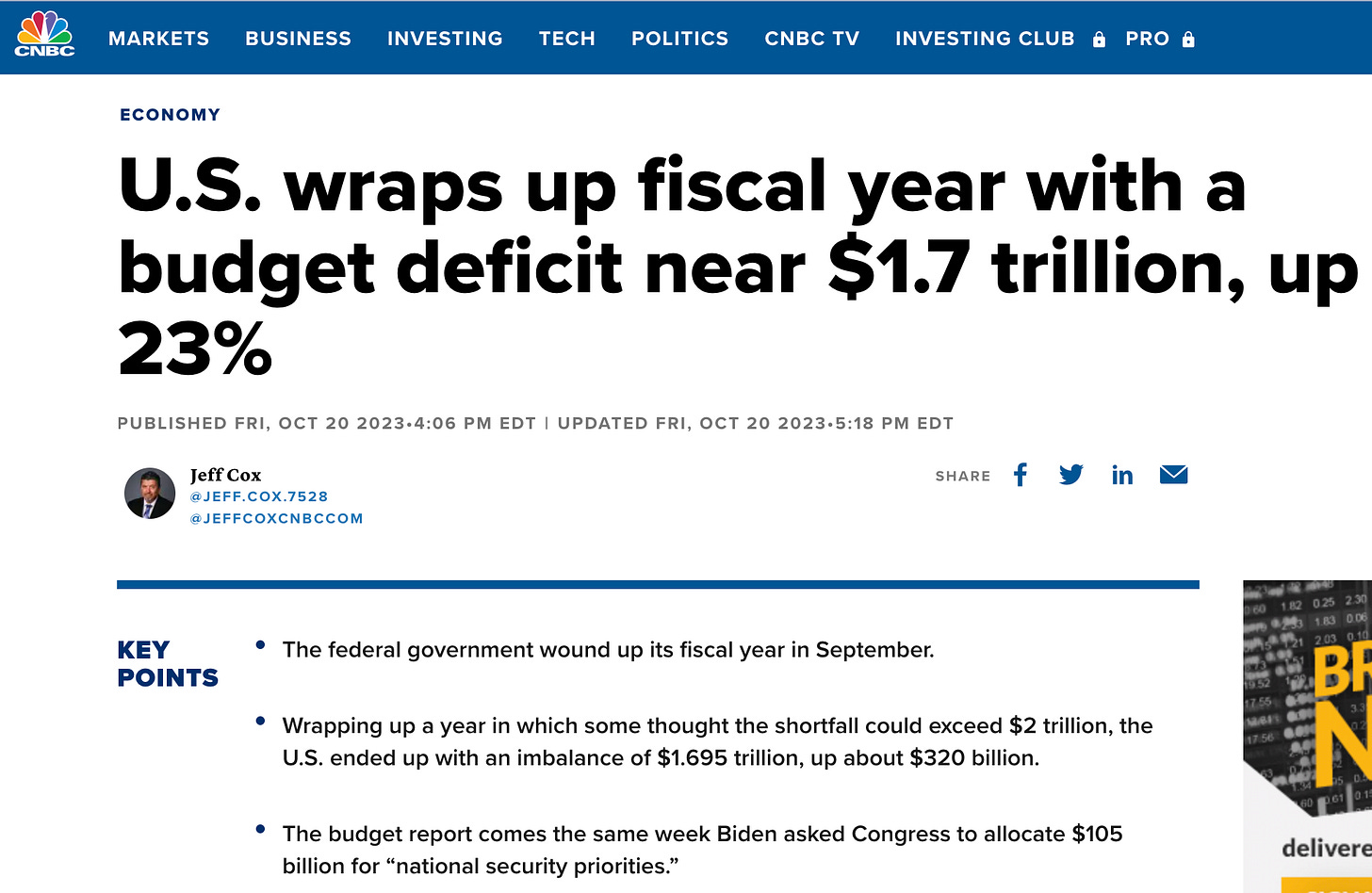

In the above CNBC article dated 20 Oct 23, the USA ended the fiscal year (ending on 30 September) with a deficit of nearly $1.7 trillion.

Extract from the article:

The federal government wound up its fiscal year in September with a deficit just shy of $1.7 trillion, the U.S. Department of the Treasury announced Friday.

Wrapping up a year in which some thought the shortfall could exceed $2 trillion, the U.S. ended up with an imbalance of $1.695 trillion, up about $320 billion, or 23.2%, from fiscal 2022.

The huge deficit came as revenue fell $457 billion from a year ago and expenses decreased by just $137 billion. Outlays for the year totaled $6.134 trillion.

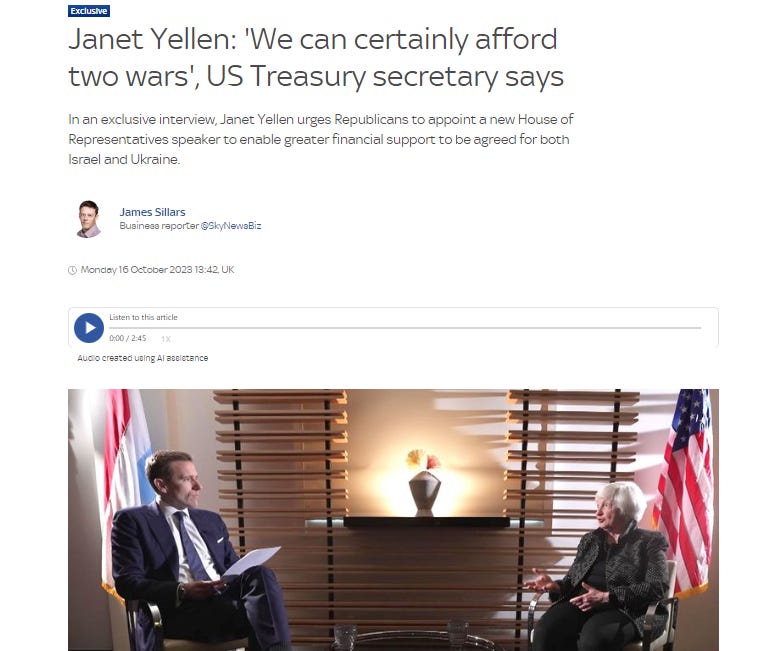

How much more deficit can the USA afford? Ms Janet Yellen has provided assurance that they are able to support. The recent Ukraine has revealed that the ammunition of the US would take months or years to stock up the inventory issued. Even if the USA is committed to supporting its allies, it would take a while for the manufacturing and supply chain to catch up. Should there be another war front, some critics have expressed that the USA may not be adequately equipped to be involved.

When Ms Janet spoke about affordability, she spoke with the assumption that she could borrow in lieu of the existing deficit. If the countries do not share their cause like the support of Israel, there could be lesser take up for the bonds. Shouldn't there be a citizen-first policy?

The market and US GDP

Actually, we are seeing the deterioration of the economy over time. The economy does not turn bad overnight. I am not surprised if we have a good GDP next week with a ranging or falling market. The big tech earnings would be key but they should do well.

How do we reconcile a deteriorating economy with "good GDP next week"? How can we reconcile "ranging or falling market" with "Big Tech doing well"?

The US economy is largely financed by consumer spending. In this case, is it surprising that it is funded by debts as the people cope with a cost of living challenge? The Big Tech forms a big part of the economy. The Big Tech could hold up the market though others struggle. Should the Magnificent 7 disappoint, the index could suffer.

The leading economic index sank 0.7% in September and was negative for the 18th month in a row — but the U.S. is still on track to post a sizable increase in economic growth in the third quarter. The Conference Board reported that the leading economic indicators have fallen over 18 consecutive months since Apr 2022 as per the 20 Oct 2023 report.

“Running a regression using WARN notices to predict unemployment shows that initial jobless claims in October will rise over the coming weeks to a level between 250K and 300K,” Slok said.

WSJ > U.S. Could See 4.5% Unemployment in 2024, Philadelphia Fed’s Harker Says. Harker said a 4% unemployment rate is what economists consider the “natural rate” that theoretically supports stable 2% inflation, which is the Fed’s inflation target.

With a prediction of increased unemployment in the coming months, the topic of recession has resurfaced again.

Conclusion

Reuters > "there’s still quite a few shoes to drop on the bad credit situation. Commercial real estate is in terrible shape. Credit card interest rates are usurious with over 20% interest rates, which, over time becomes extremely punishing." - Elon Musk

I recommend caution as the Q3 earnings will tell us more about the market and more importantly the outlook. I recommend caution. Let us consider hedging. Let us spend within our means, avoid leverage and research before investing.

Comments

Post a Comment