Preview of the week starting 30 Oct 2023 - can Apple lead the charge?

Public Holidays

There are no public holidays for China, Hong Kong, the USA & Singapore in the coming week.

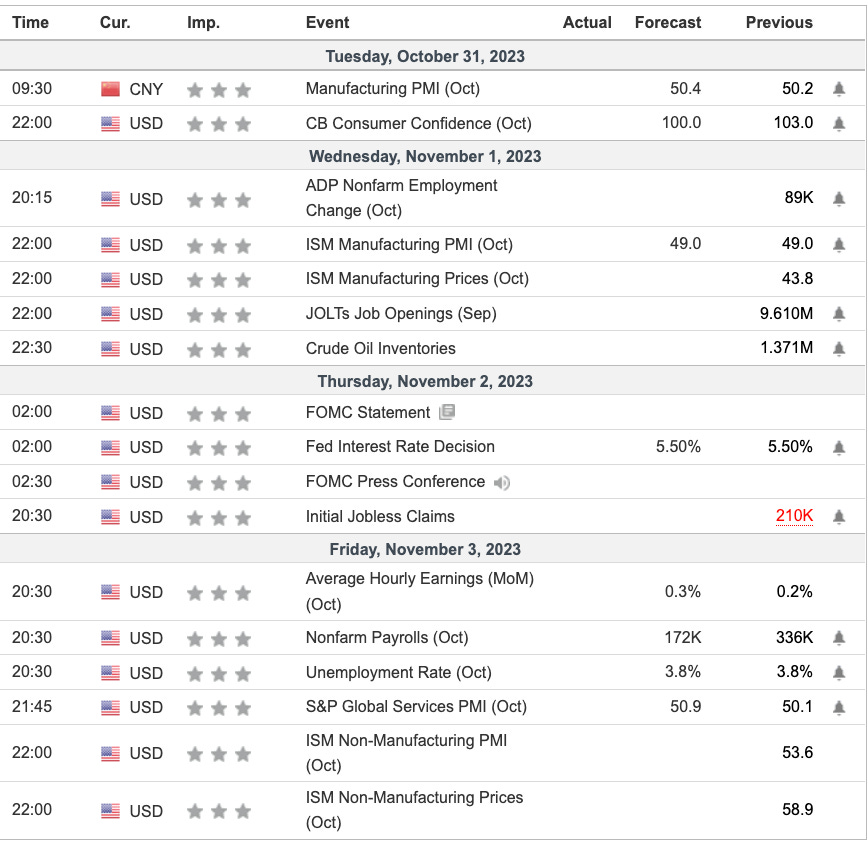

Economic Calendar (30Oct2023)

Notable Highlights

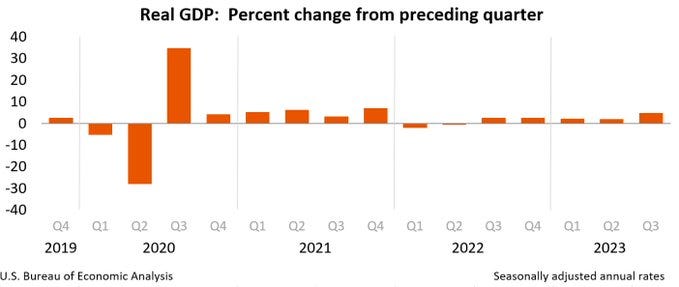

Fed’s interest rate decision should be a most watched event. An increase in the interest rate can be bearish though, the survey reckons that the Fed is expected to keep the interest rate the same. The surge in GDP for Q3 could be one of the reasons the Fed would consider increasing the rate as the economy gets hot.

Payroll & Jobs. JOLTs job opening, average hourly earnings, Nonfarm payroll, ADP nonfarm employment change will form part of the payroll data. If these are favourable, this can be the reason why the Fed may rise the coming interest rate.

CB consumer confidence (Oct) is a good indicator of the consumption in USA.

PMI. PMI for both US and China will be released this week. This will cast the outlook for the manufacturing sector. For USA, there will be a few of them that include ISM Manufacturing PMI, ISM non-Manufacturing PMI and S&P Global services PMI.

Initial Jobless Claims will be released in the coming week. This is another important data point for the Fed’s coming interest rate decision as they seek to balance inflation and unemployment. Together with the Unemployment rate, this will be part of the Fed’s consideration for the coming interest rate. decision.

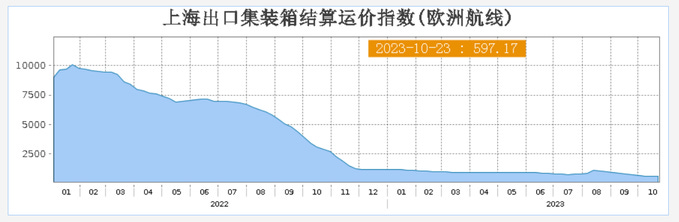

Crude Oil Inventories can be seen as forward indicators of market demand and consumption. If the trend of excess inventories continues, this implies demand erosion that can lead to reduced production & weakening consumer spending.

Earnings Calendar (30 Oct 2023) - can Apple lead the charge?

For the coming, there are a couple of earnings of interest in the coming week namely McDonald’s, AMD, Palantir & Apple.

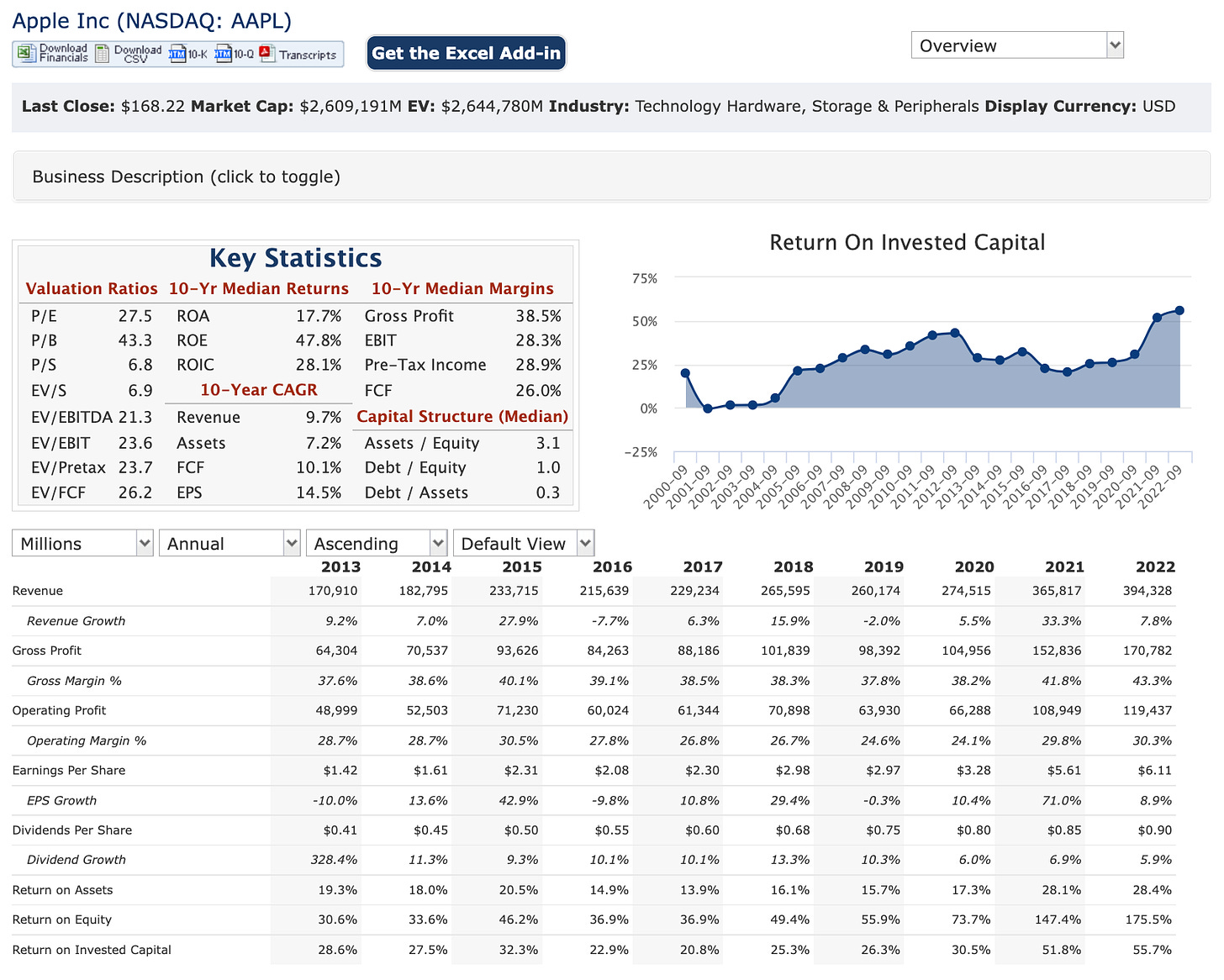

Let us take a look at the earnings of Apple in detail.

Observations:

Strong performance over 10 years median average averaging 38.5% for Gross Profit, 28.9% for pre-tax income and 26.0% for FCF.

Strong performance (10-year CAGR) can be found in growth in Revenue of 9.7% and 14.5% growth for EPS.

Revenue has grown from $170B (2013) to $394B (2022). However, the revenue growth of recent times is of concern with 2022 reaching only 7.8%.

Gross profit grew from $48B (2013) to $119B (2022).

EPS grew from $1.42 (2013) to $6.11 (2022).

For the coming earnings, the forecast for Apple’s EPS & revenue is 1.39 and 89.31B respectively. Will Apple be able to turn in another strong performance?

Market Outlook - 30Oct2023

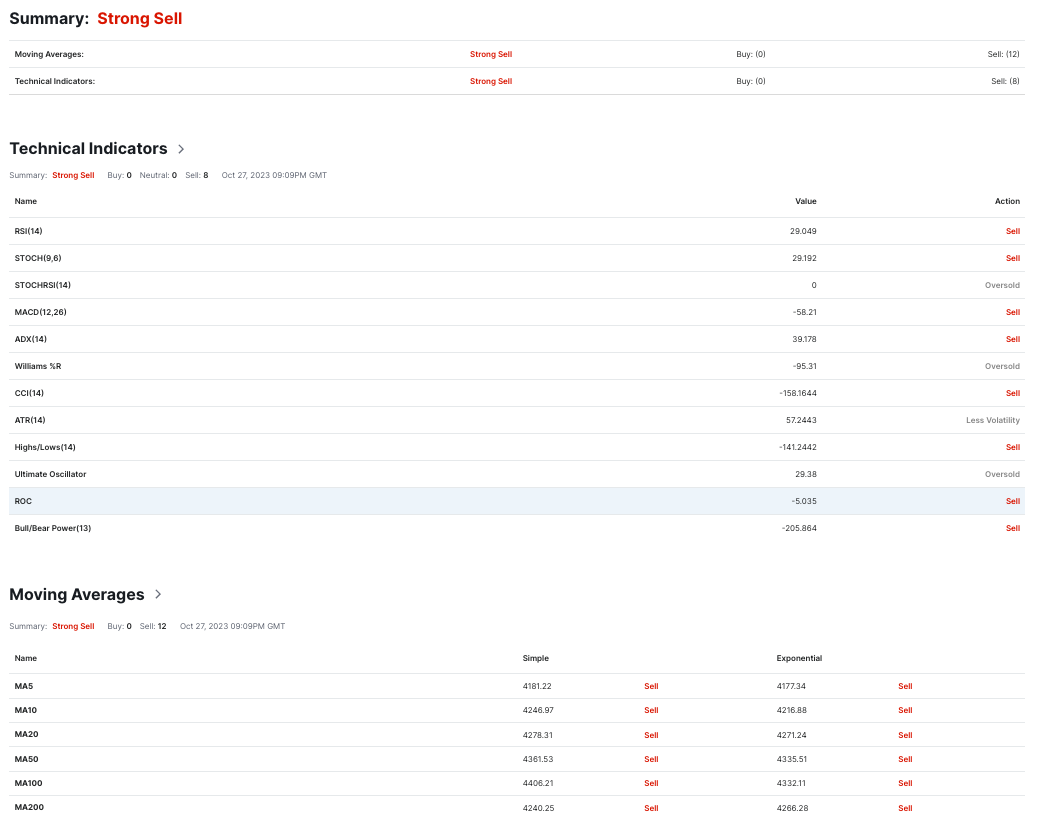

Technical observations of the S&P500 1D chart:

From the recent high to the last closing price, the drop is over 11%. This implies that the S&P500 is in correction territory.

The Stochastic indicator is showing a downtrend.

The MACD indicator is on a downtrend.

Moving Averages (MA). The MA50 line has started a downward trend and the MA200 line is on an uptrend. With the last candles below the MA50 line and the MA200 line, both mid-term & long-term outlooks are heading towards a downtrend. As the 2 lines move closer, there is a chance of the formation of a death cross - typically, a bearish indicator. This could take weeks before this death cross is formed and changes are possible.

Exponential Moving Averages (EMA). All the 3 EMA lines are indicating a downtrend.

From the 1D technical indicators above, there are a total of 0 (Buy), 20 (Sell) and 0 (Neutral). Investing recommends the “STRONG SELL” recommendation based on the technical indicators above (1D chart for S&P500).

This week should be a downtrend for the S&P500 though it is reaching an oversold region.

News and my thoughts from the last week (30Oct2023) - Federal Deficit, layoffs, strikes & Israel

Can the chips made outside Taiwan be affordable? Can the chips maintain the quality? Is the infrastructure adequate? Is the policy helping? Are affordable resources available? Is the supply chain sufficient?

dailyhodl > After crossing the $33 trillion mark on September 15th, total outstanding US debt now stands at $33.62 trillion – an increase of about $17.71 billion per day.

Reuters > After crossing the $33 trillion mark on September 15th, total outstanding US debt now stands at $33.62 trillion – an increase of about $17.71 billion per day.

A recession can be a good time to close out the gaps in the economy and purge non-performing businesses. If so, is this such a bad thing?

Some can be too big to fail. Could it end up being too big to save?

Could the biggest enemy of the state be from within? Could the democrats sneak in a victory from this situation?

Is this corporate America at its best?

It is important to see this with a new lens. The world is big enough for all to do well together. Trying to hold on to a pole position is not as important as taking care of your citizens first. Build bridges, not walls.

CNBC > “We know that to further drive down emissions, we must ensure those in our supply chain make the operational changes necessary to decarbonize their businesses,” Amazon said in the sustainability report.

Forbes > Big banks have collectively laid off over 20,000 employees, with more rumored to be on the way in the coming months. The news comes as several of the major banks have performed well financially in the third quarter.

Credit Suisse has told employees that job cuts will start on 6 November. Around 10% of roles within support functions are expected to be targeted.

Reuters > The overall global smartphone market contracted by 8% to its lowest third-quarter level in a decade on subdued demand for major brands. Huawei has sold 1.6 million of its Mate 60 series handsets in six weeks.

If the US goes overboard with the sanctions on China, a nationalistic movement may arise with China moving away from US brands. China is not just a supplier but also a consumer of US goods and services. This can't be good. Let's build bridges, not walls.

Fortune > From Fortune's lens, Tesla is a car manufacturer.

Unfortunately, Tesla has other products & services that include FSD, Tesla Bots, super computer Dojo, Insurance, charging network, Solar, energy storage, battery, Semi, Cybertruck and more.

CNBC> The UAW strike escalation includes roughly 5,000 workers at GM’s Arlington Assembly plant. The walkout came just hours after the automaker reported third-quarter earnings results that beat Wall Street’s expectations. The strike has affected 42% of GM's production capacity. Hopefully, this can be resolved soon.

We can always find data to back our narratives if we look hard enough. We can adjust the delivery to curate the narratives. Look out for the intent and not just the delivery. Data is neutral but narratives are intentional. Let's learn to question.

WSJ > For nearly a week, several U.S. bases have come under attack, including an attempted strike Monday on al-Tanf air base in Syria by two drones, in which no troops were injured, the Pentagon said.

Statista > The largest U.S. base in the Middle East is in Qatar. The country hosts around 13,000 U.S. troops. Located southwest of Doha, Al Udeid Air Base has proven crucial in the fight against ISIS (Jan 6, 2020). If Iran enters the war, all will be at risk.

DailyMail UK > Homeowners are sitting on a negative equity timebomb after losing $108.4 billion in their property values this year. The average borrower saw their home equity plummet by $5,400 in Q1 of 2023 compared to last year.

Business Insider > Ballooning government deficits could lead to failed Treasury auction soon, a Columbia Business School professor said, contributing to a sell-off in bonds. In a failed auction, the Fed would have to step in and buy US bonds, fanning inflation.

My investing muse - S&P500 outlook

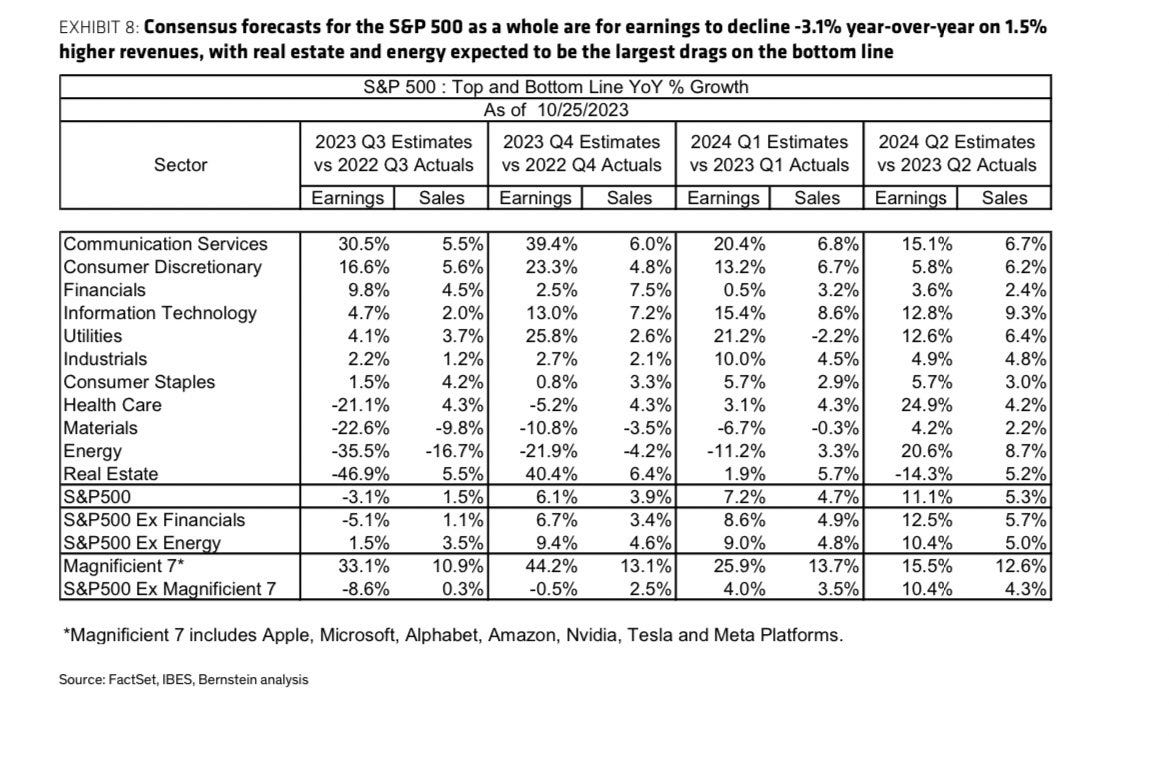

From BERNSTEIN’s recent tweet: “For the 29% of S&P 500 companies that have reported third-quarter results so far, earnings are up +11% .. but without the contributions of the ‘Magnificent 7’ stocks, index EPS growth would drop to -8.6% ..”

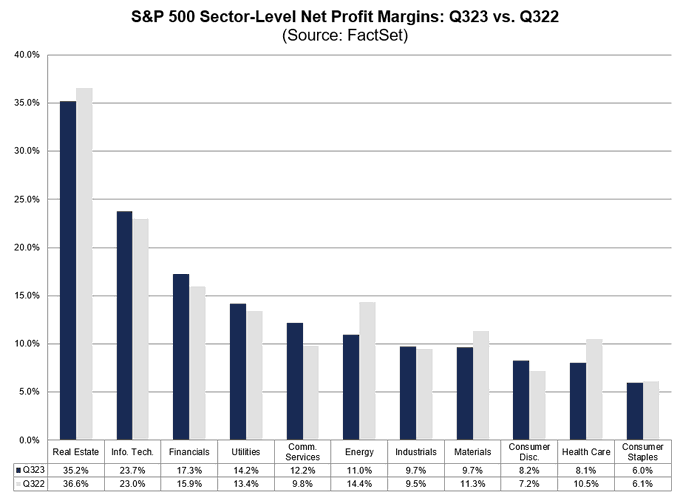

FactSet (25 Oct 2023) > 5 $SPX sectors are reporting a Y/Y decrease in net profit margins in Q3 2023 (vs. Q3 2022). How will this turn out over the earnings season? The above data is taken from the earnings forecast.

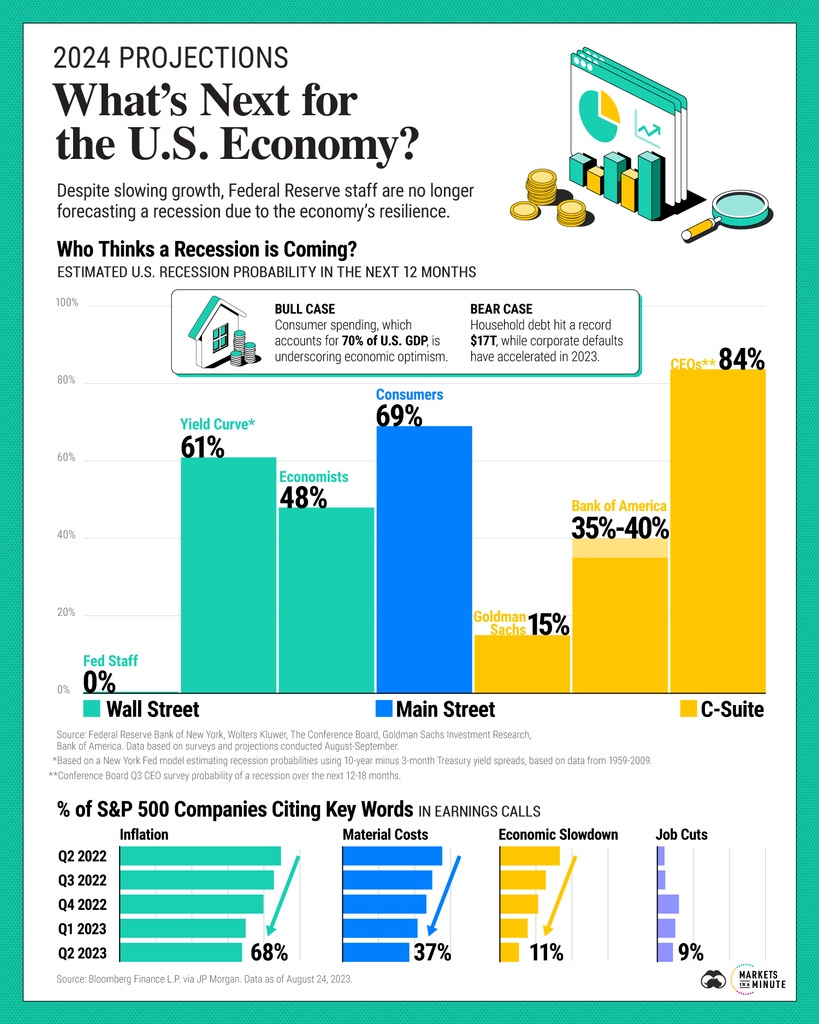

What does the CEO know that most of us do not see? 84% of the CEOs think that a recession is coming in the next 12 months and none of the Fed staff think so. Who has the bigger disconnect? Is this the reason why the Fed's actions are ineffective?

When Volcker fought inflation, the annual US Federal deficit was $41B (1979). When Volcker ended his tenure, the annual Federal deficit was $150B (1987). Powell has an annual deficit of $1,700B (2023). With a total deficit of $33T (at 5%+ interest rate), the problem is far greater.

The US GDP at a record 4.9% was largely driven by government spending and strong consumer spending.

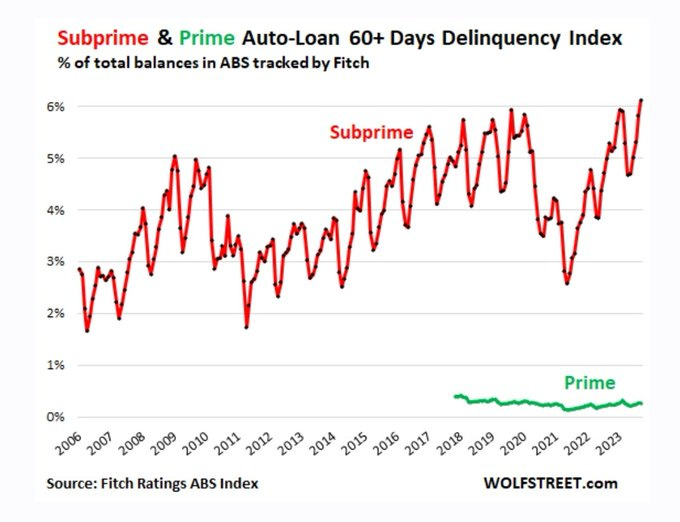

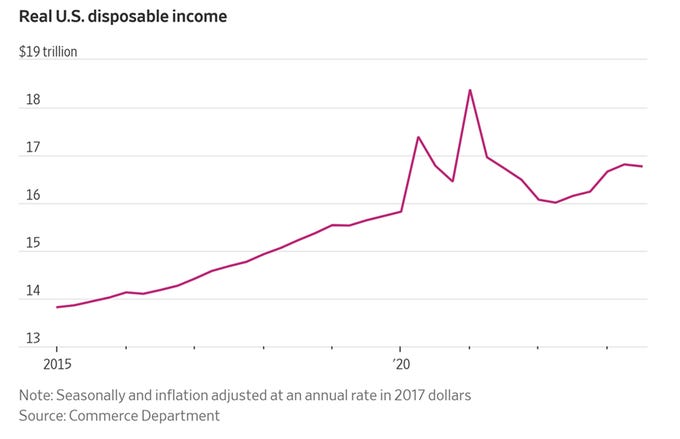

With real US disposable income in decline, could this be funded by people turning to credit facilities? The next update on credit card debt can shed some light on this matter. The last reported household credit card debt stands at over $1 trillion. With the credit card interest rate at over 20%, this meant that the annual interest paid out would be at least $200B, This can be translated into $16.67B per month or $555M per day (assuming a 30-day calendar month).

Conclusion

The Magnificent 7 has been tanking the S&P500. With Apple releasing its earnings in the coming week, will the S&P500 continue its drop or can it rise again? With Tesla and Google disappointing, can the Magnificent 7 hold up the market? With a forecast of falling profitability despite revenue growth, we need to be prepared for the market sentiments tipping towards caution or worse.

This may take weeks to play out. From the data, at least we will not have a technical recession in 2023. There is still time for us to turn things around. If we are uncertain, “not making any move” can be a good move too. We cannot be penalized or rewarded for trades that we do not make.

Comments

Post a Comment