Preview of the week starting 2nd Oct 2023 - Have we averted a US government shutdown?

Public Holidays

China is closed for the whole week as part of her Golden Week celebration.

Hong Kong will be closed on the following Monday (02 Oct 2023) for the National Day holiday.

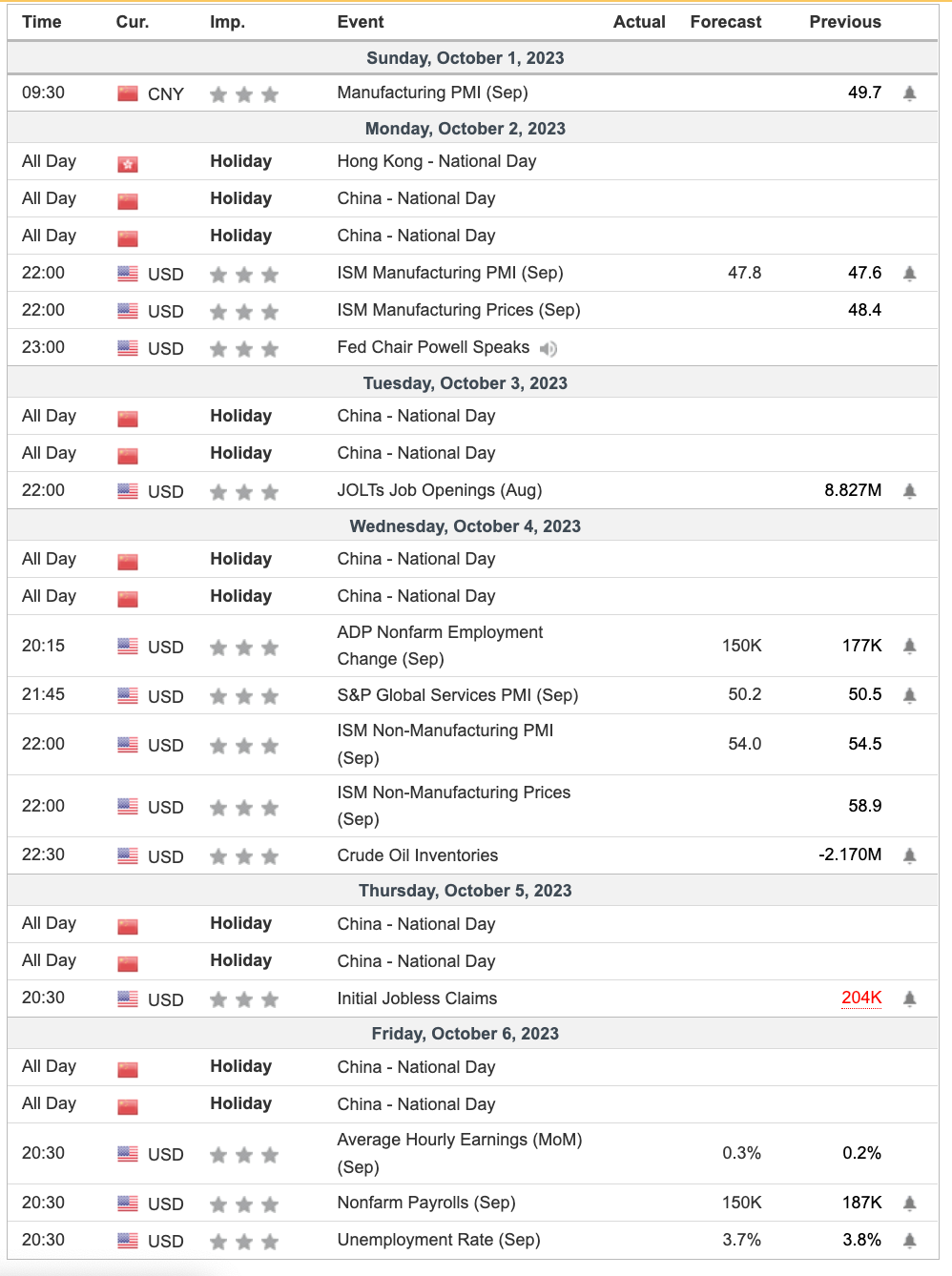

Economic Calendar (02Oct2023)

Notable Highlights

Jobs data. JOLTs job openings will be shared, listing the number of jobs available in the market.

PMI - China’s manufacturing PMI will be released, a good barometer on the manufacturing sector for China and the demand for consumption of the rest of the world. US will also be updating their ISM Manufacturing PMI, ISM non-manufacturing PMI.

Jobless claims. Initial jobless claims will be announced on Thursday. This would form critical data points for the Fed to decide on the next interest rate adjustment. This is part of the data consideration for the Fed in their coming interest rate decision.

Unemployment and Payroll. Nonfarm payroll and unemployment rate data will be released this coming week. These are important data points for the Fed for their coming interest rate decisions.

Crude Oil Inventories can be seen as forward indicators of market demand and consumption. If the trend of excess inventories continues, this implies demand erosion that can lead to reduced production & weakening consumer spending.

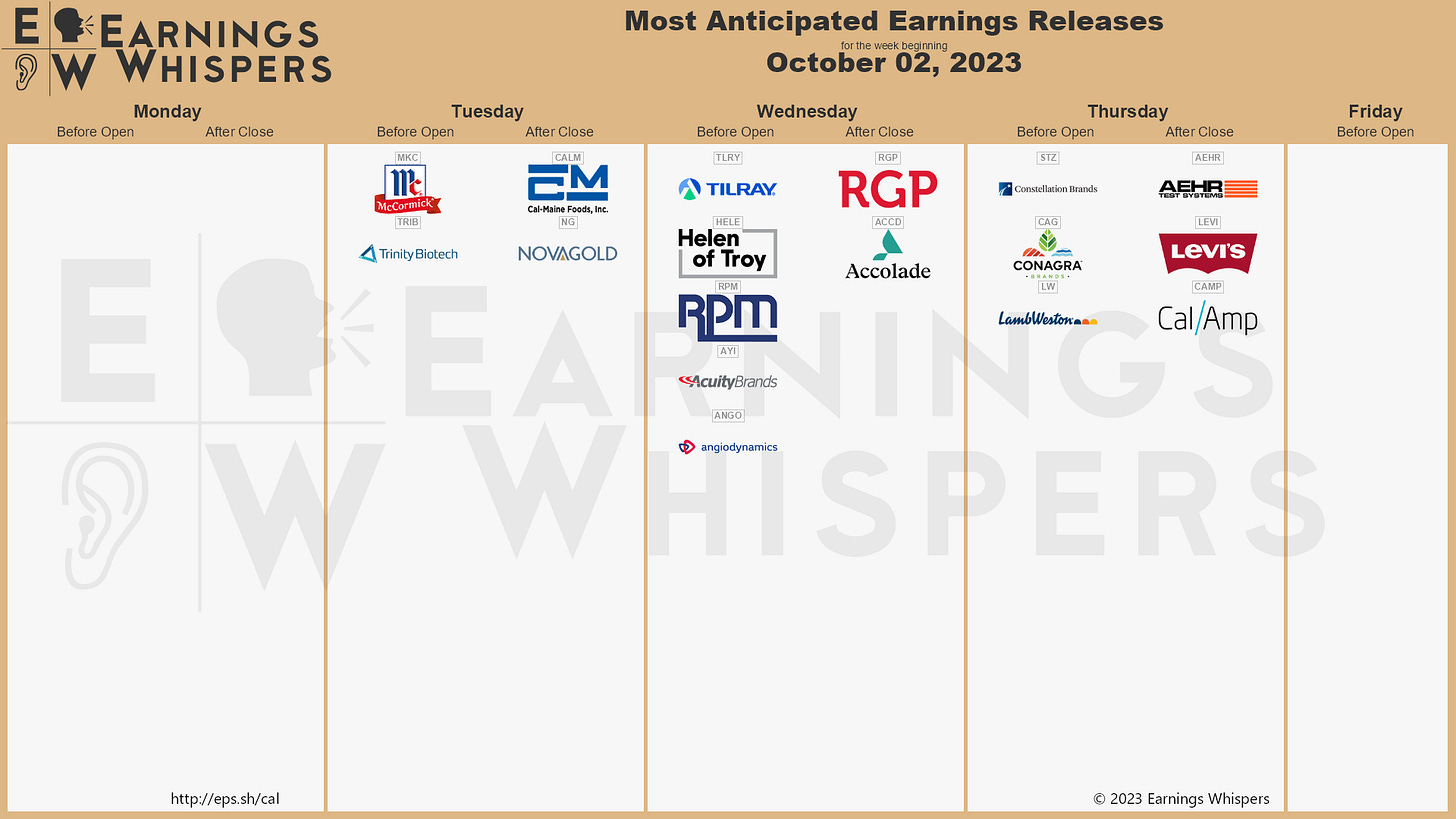

Earnings Calendar (02Oct2023)

The Q3/2023 earnings season starts in the coming week. Personally, I am looking at the earnings of Levis, RGP and McCormick with interest.

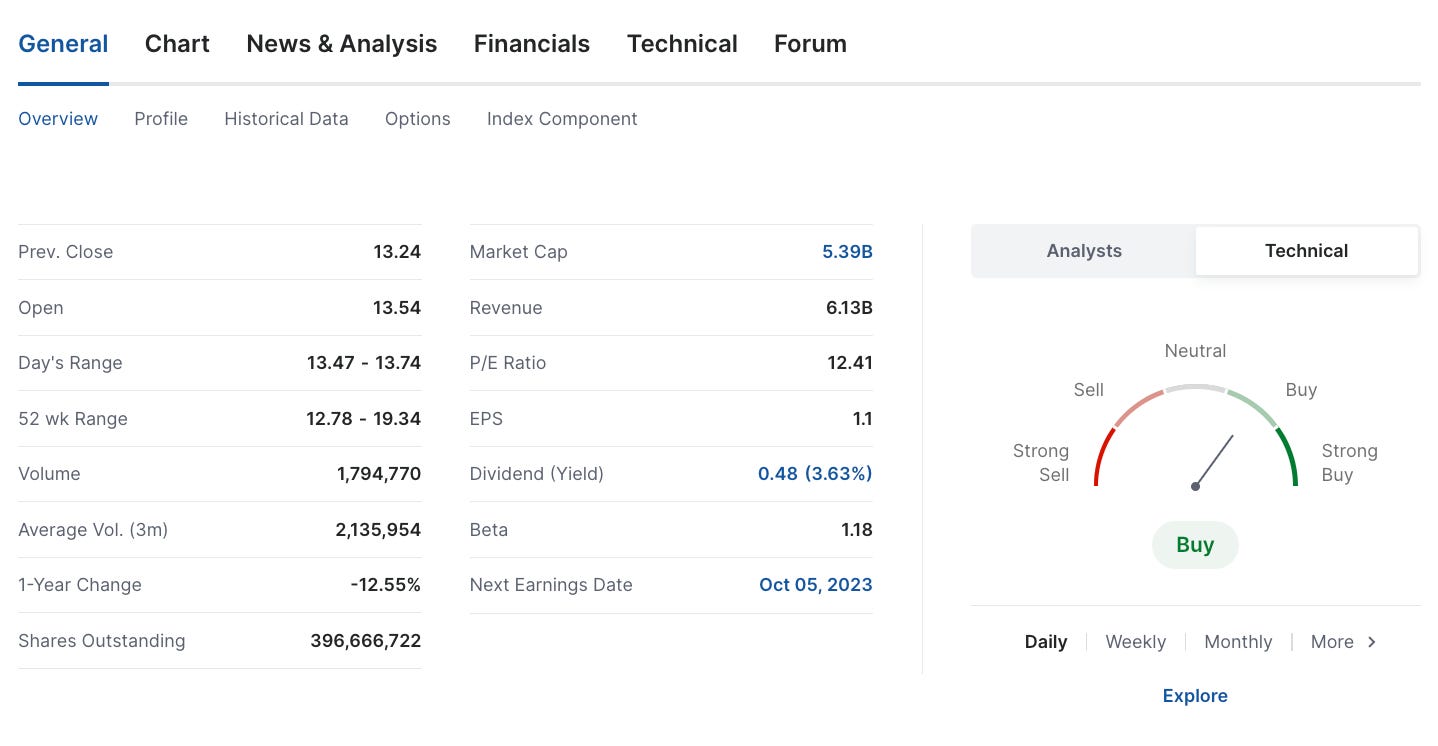

Performance of Levi

Levi is ranging along the bottom. The current price of 13.59 is near the 52-week low of 12.78.

The current price is down 12.55% from a year ago. Investing has rated the stock with a “Buy” setting.

For the coming earnings, the forecast of the EPS and revenue are 0.2713 and 1.55B respectively. Will Levi be able to break out from the current range?

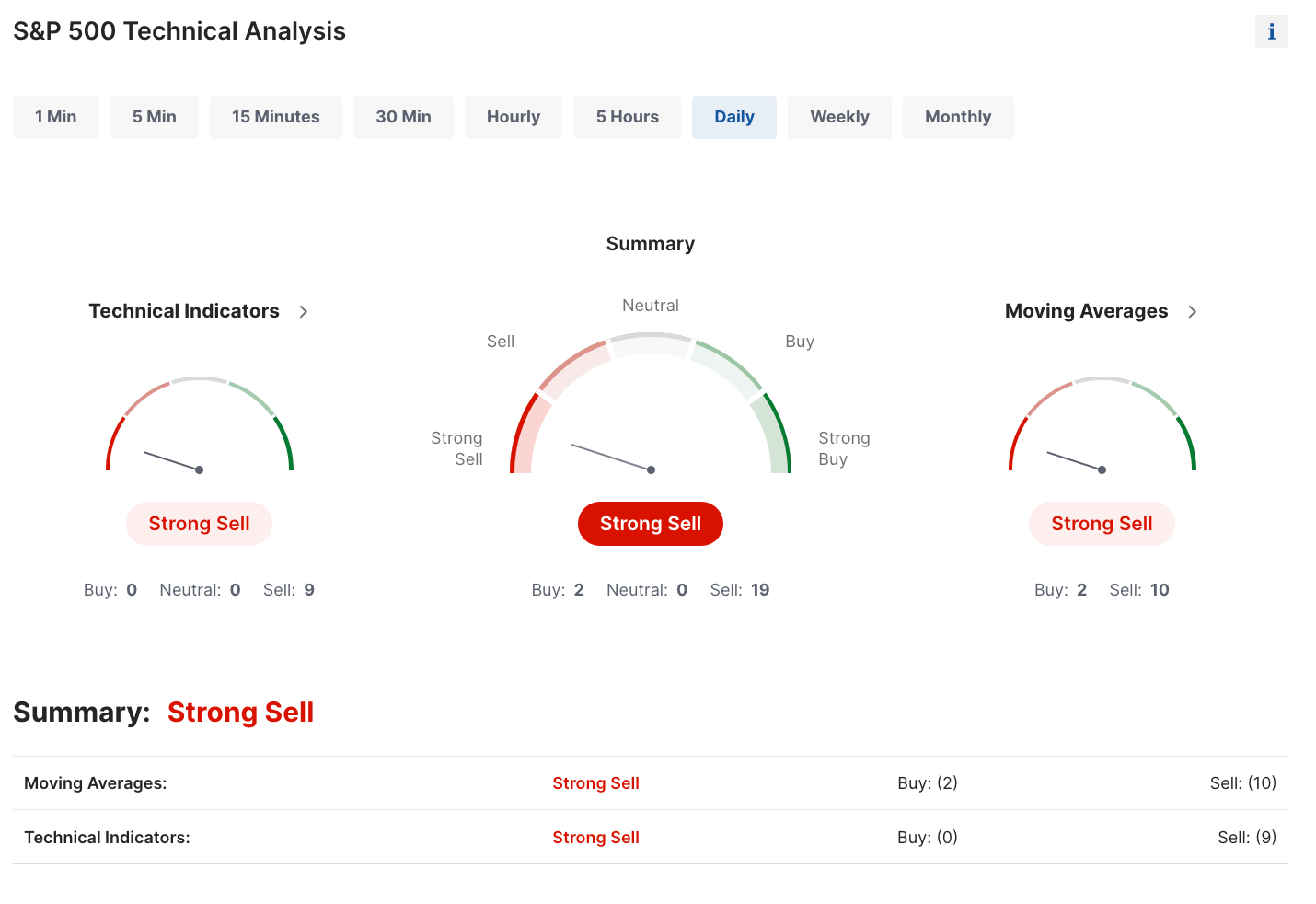

Market Outlook - 02Oct2023

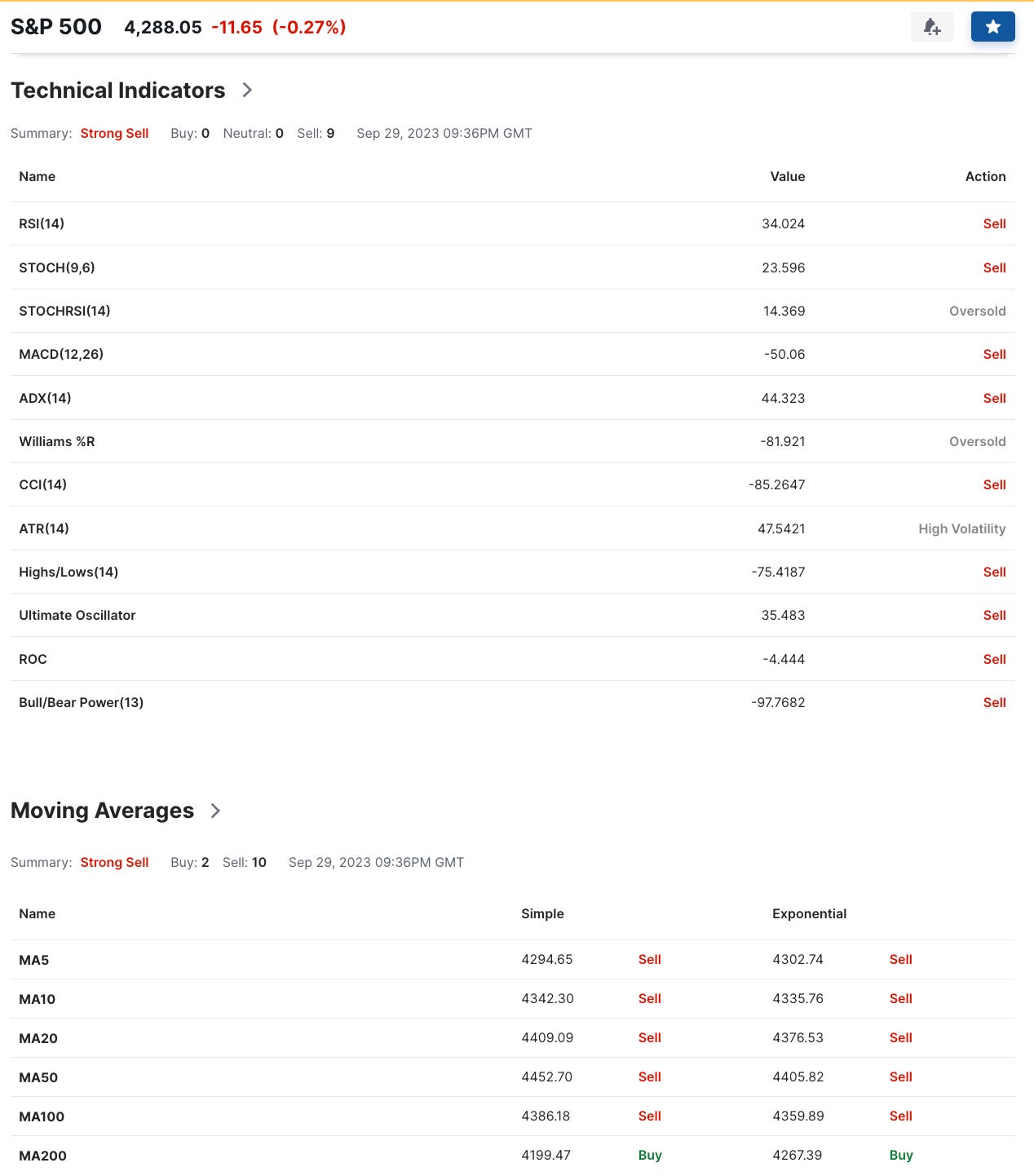

Technical observations of the S&P500 1D chart:

The Stochastic indicator is on an uptrend.

The MACD indicator is on a downtrend.

Moving Averages (MA). The MA50 line has started a downward trend and the MA200 line is on an uptrend. With the last candles below the MA50 line and above the MA200 line, this can be interpreted as an uptrend in the long term. For the mid-term, it is on a downtrend.

Exponential Moving Averages (EMA). All the 3 EMA lines have indicated a downtrend.

From the 1D technical indicators above, there are a total of 2 (Buy), 19 (Sell) and 0 (Neutral). Investing recommends a “STRONG SELL” recommendation based on the technical indicators above (1D chart for S&P500).

This week should be a downtrend for the S&P500.

News and my thoughts from the last week (02Oct2023)

With all the recent disasters and extreme weather, how is the Insurance industry holding up?

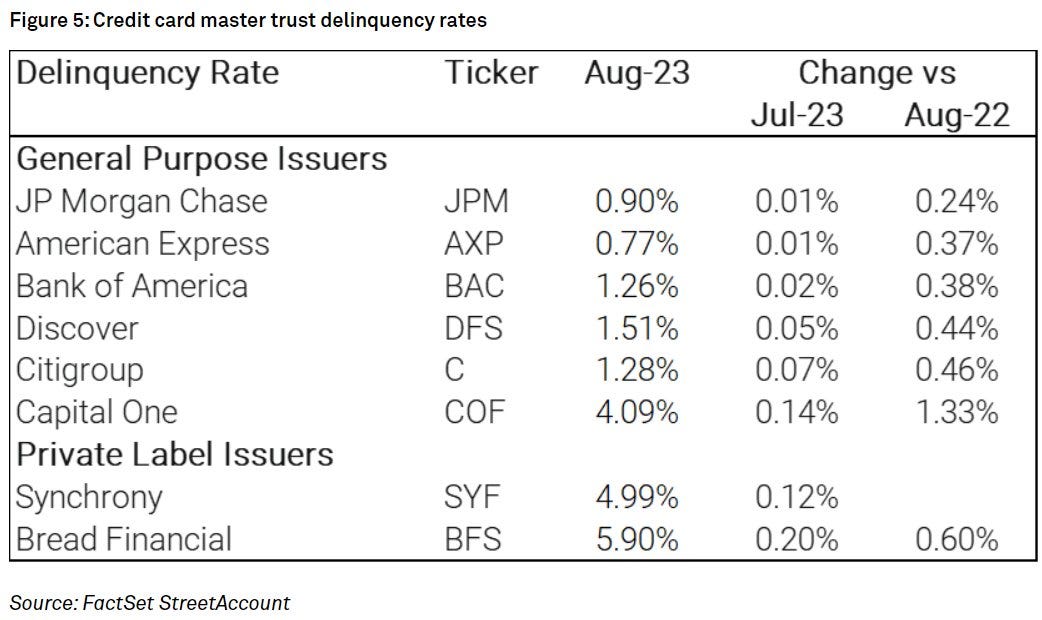

Yahoo Finance > Outstanding credit card balances topped $1 trillion this year for the first time ever. According to Bankrate, the average APR this week was 20.71.%

"There are 2 kinds of economists. Those who know that they do not know and those who do not know that they do not know." - Larry Summers

CNBC > The most recent contract proposal by automaker Stellantis to the UAW union could lead to the closure of 18 U.S. facilities, direct new investments, and repurpose an idled vehicle assembly plant in Illinois.

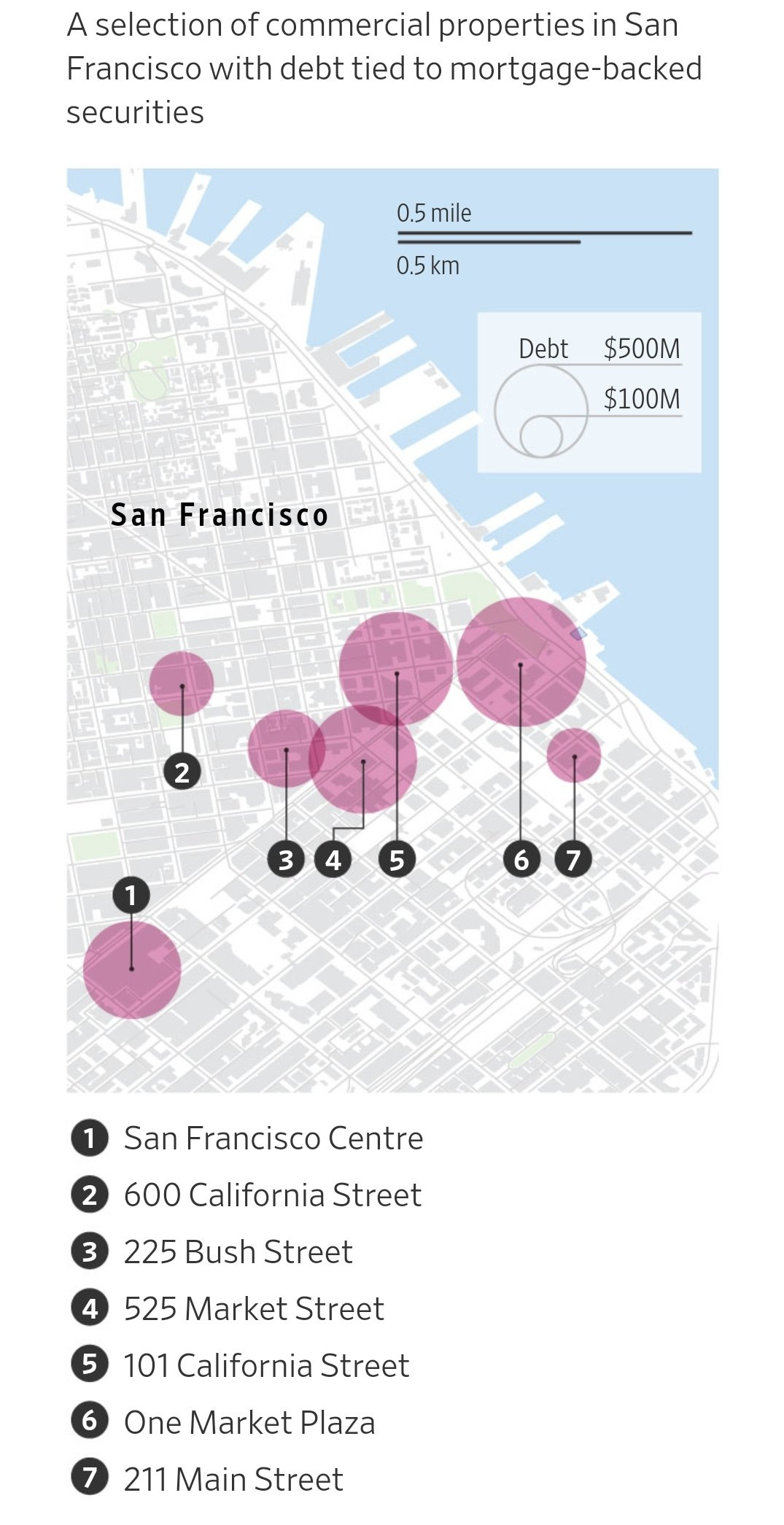

Among them is 650 California Street, a 34-story office building that has defaulted on its mortgage. Further on is 101 California, whose second-biggest tenant left last year and whose biggest is slashing staff and office space.

Yahoo Finance > USA Today reports that around 804,000 people have had their outstanding student loan balances cleared. The forgiveness came after the U.S. Department of Education discovered that it had miscalculated the number of loan payments.

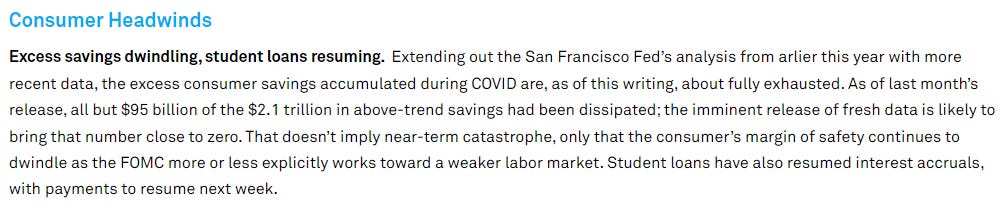

Yahoo Finance > Consumer spending in the US could fall by as much as $9 billion each month, according to a July report by Oxford Economics. GDP growth could fall by 0.1% in 2023 & 0.3% in 2024, increasing the probability of a recession.

MSN > The country’s cross-border capital investment reached US$21.8b in 1H23. Singapore topped the list of the world’s leading sources of capital investment in 2023.

SG emerges as the world’s leading source of capital investment

CNBC > Ships are faking their locations to engage in illicit activity — and rising numbers appear to be doing so to trade goods that are likely to be worth billions of dollars.

Palantir has good products. Can anyone advise if the business is scalable?

When considering exports of all types of cars, China’s have already surpassed Germany’s, and are on track to surpass Japan’s this year as the largest car exporter globally, according to Moody’s.

26 bank acquisitions quarter-to-date. One noteworthy trend is the flurry of bank acquisitions by credit unions, of which there have been four this quarter, including three within the past month.

Yahoo Finance > The consumer confidence index fell to 103 in September from August's 108.7. The Expectations Index fell to 73.7 where a figure below 80 typically signals a recession within the next year.

NEW YORK (Reuters) -A U.S. government shutdown would harm the country's credit, rating agency Moody's said on Monday.

Australia's homelessness and housing crisis. Can this be salvaged?

BYD replaces Ford as the world's 4th best-selling car brand in Aug, TrendForce says. BYD's sales continued to grow in China, while Ford's sales declined in Europe and the US.

Yahoo Finance > Pending home sales for August plunged 7.1% from the month before, On a yearly basis, pending transactions were down by 18.7%. Housing activity has been smothered by expensive mortgages, rising prices & low inventory.

The bigger problem is not de-dollarization but it is the USA entering a debt crisis. Isn't it ironic that the biggest economy is unable to spend within its means and has to borrow from the rest of the world to fund its fiscal mismanagement?

My investing muse - Government shutdown, Q2 wrap up & Q3 outlook

US Government shutdown

Here are some news about the US government shutdown:

CNBC > House Republicans cancel planned recess as government shutdown appears likely

FT > US lawmakers have warned that a government shutdown is increasingly certain as hopes dwindle of a last ditch compromise to resolve a budgetary stand-off in the world’s largest economy.

Internal divides lead to a potential government shutdown. How much will the people suffer due to the government? Is a change needful?

As per the CNBC news article, the House Republicans cancelled a planned 2 weeks recess as they failed to pass a short-term spending bill. Thus, it is likely that part of the US government would be shut down.

This is reported by another CNBC article that summarized the impact of this government shutdown:

A federal government shutdown will start Oct. 1 unless Congress passes spending legislation.

If the government shuts down, nonessential functions would cease.

Federal workers wouldn’t get paychecks, households may not receive some federal benefits and customer service for student loan borrowers and others may be delayed.

The potential impact will grow the longer a shutdown persists.

As I look at the situation, I am frustrated as many families would be affected by this shutdown. One of the topics that have led to this was the security of the Southern border. Funding of Ukraine is another area of concern.

One of the things that puzzled me was this - how can a superpower like the USA come to this stage? This could not be the issue of a single administration.

My Asian upbringing would not allow me to borrow money to fund my living, emphasising the importance of spending within my means.

The Chinese have an idiom / saying “打肿脸充胖子”

to swell one's face up by slapping it to look imposing (idiom); to seek to impress by feigning more than one's abilities

How could we address the debt mountain in the USA?

My limited layman's view would require me to work on my income and curtail my expenses. Let us review the system for waste, driving down costs, prioritising investments and looking at means to increase the income and the sources for income. It is time to review the needs and wants.

A Ponzi scheme is a fraudulent investing scam which generates returns for earlier investors with money taken from later investors.

The situation with the US treasuries is beginning to look like a Ponzi scheme. We had a few close calls with the US coming to default and the frequency is getting more common. This is not becoming for the USA, the world’s superpower. If the #1 needs to borrow from the rest of the world to fund its spending (deficit), what does it say about the #1? When the US economy is affected, it will ripple through the rest of the world with USD being the global reserve currency. The world needs the US to get out of this debt cycle and continue to work together with others to steer itself from a pending recession. This includes key global partners like China.

(UPDATES) This is the latest update as per 9.06am SGT, 01 Oct 2023 from CNBC:

It seems that a shutdown was adverted where the US government is funded for the next 45 days.

Q2 wrapup & Q3 guidance (FACTSET)

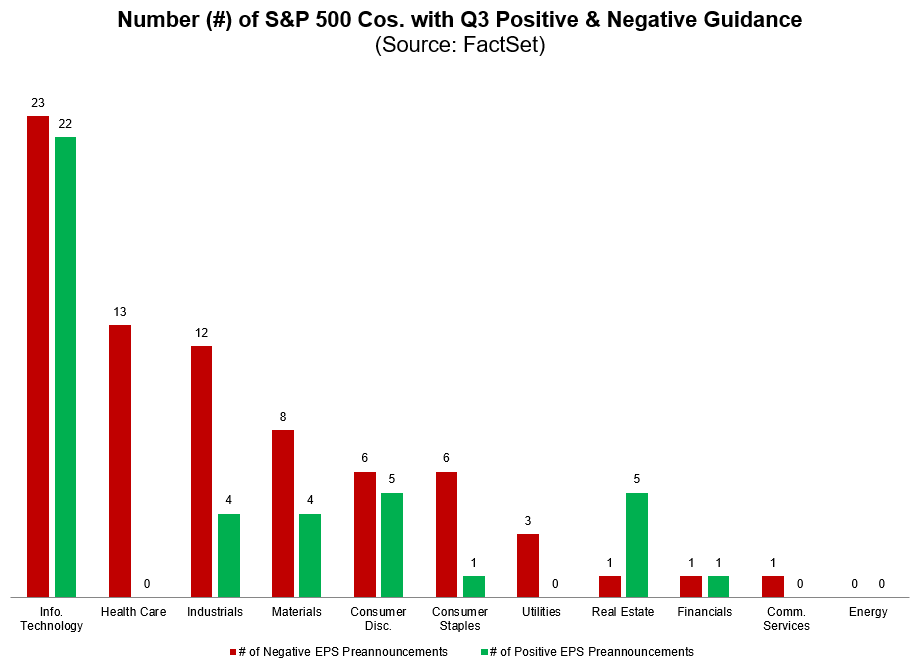

64% of the $SPX companies that have issued EPS guidance for Q3 2023 have issued negative guidance, which is equal to the 10-year average. (Source: FactSet)

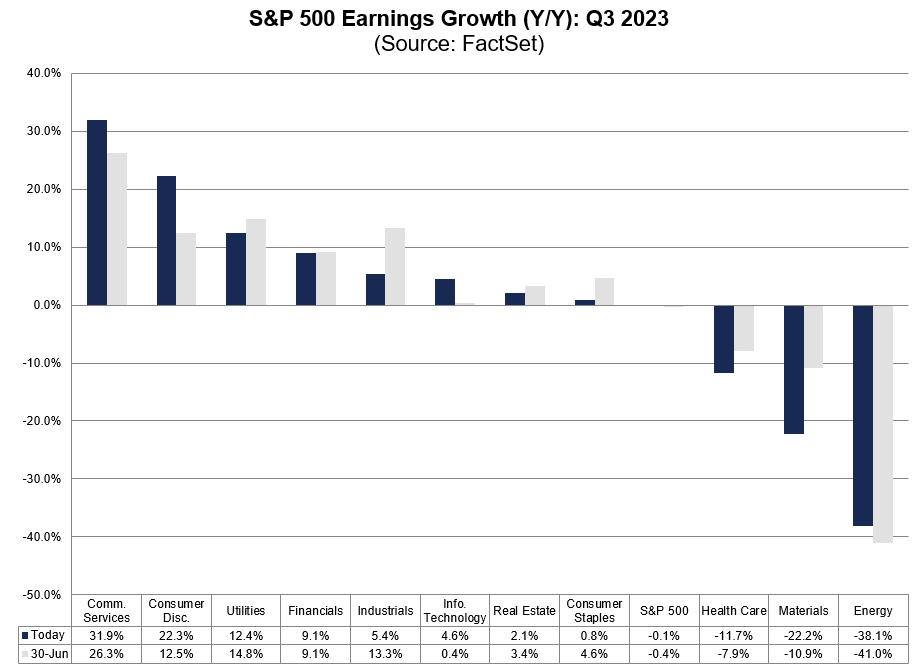

$SPX is expected to report a Y/Y earnings decline of -0.1% for Q3 2023, which would be the fourth straight quarter of Y/Y earnings declines for the index. (Source: FactSet)

From the inputs above, dark storms seem to cloud the coming Q3 earnings season. It is a forecast, not a result. We should manage the risk exposure to the rewards with options like hedging.

Conclusion

The US is now a country raided by strikes which started in Hollywood and followed by the automotive union and the latest, healthcare.

With the aversion of a government shutdown for the next 45 days, there could be some political fallout as Speaker McCarthy turned out with a bipartisan bill. This has raised concerns with the GOP.

This is one food for thought that I would like to share:

“Savings are not what we are left with at the end of the month but rather what we have set aside once we receive our income. Savings should be first and not what remains.”

Savings are the first step towards wealth accumulation. Let us try to save as much as possible and set up an emergency fund that would help us tide over 6 months should we be without income.

Let us consider hedging and try to save as much as possible.

Comments

Post a Comment