How to invest with wars & rumours of wars?

News and recent topics of interest

We have been bombarded by news arising from the recent Israeli-Gaza conflict. Amidst these, we have earthquakes hitting Afghanistan and Morocco. With Israel hitting Hezbollah’s positions in Lebanon and 2 airports in Syria, the conflict has spread with some US bases in Iraq & Syria being “attacked”.

My main source of news comes from X (previously known as Twitter). The other news of interest includes China/HKG developments. The news sources include CGTN, SCMP, CNBC, CNN, Fox, WSJ, BBC, Reuters & Al Jazeera. Mainstream Media (MSM) have been late in updates and usually carry some bias. Thus, I recommend reading all news with a good pinch of salt.

As part of my learning, my recent podcast/YouTube diet includes the following:

- The All in Podcast > I love the 4 of them. I do see some bias but very enriching in general.

- Lex Friedman > I have listened to his interview with Israeli PM (Mr Benjamin), a Palestinian Poet (so that I understand some historical backgrounds from both sides as I have Jewish friends) & Walter Isaacson about his recent book on Elon Musk.

- Walter Isaacson's podcast

- Valuetainment Youtube channel by Patrick Bet-David

- Clear Value Tax Youtube channel and few others.

Change in my investing approach

I have moved from day trade to some form of value investing (Pabrai, Buffettm Munger, Peter Lynch). Now, I am largely in the Dalio/Druckenmiller camp and started trading some crypto.

I remain bullish for Tesla but have not bought any stocks for the last 2 years due to Macro. I have been loading up my dividend/defensive stocks for the last 2 years (mostly HKG stocks) and treating them more like a Fixed Deposit.

Let us invest in the way that fits us as our outlook, metrics, risk-reward, and time horizon are all different.

Bullish for oil companies

From the above article, here are some of the quotes from Elon:

“Realistically I think we need to use oil and gas in the short term, because otherwise civilization will crumble,” Musk said on the sidelines of an energy conference in the southern city of Stavanger.

Asked if Norway should continue to drill for oil and gas, Musk said: “I think some additional exploration is warranted at this time.”

“One of the biggest challenges the world has ever faced is the transition to sustainable energy and to a sustainable economy,” he said. “That will take some decades to complete.”

He said offshore wind power generation in the North Sea, combined with stationary battery packs, could become a key source of energy. “It could provide a strong, sustainable energy source in winter,” he said.

I have written an article stating the reason why I am bullish for oil companies as many of the derivatives from oil as a base product remain essential to our economies.

Thus, my dividend/defensive stocks are state-owned oil companies listed in Hong Kong. The US is building 1 oil refinery in the next 4 years (ExxonMobil) compared to China is building 21. China is on a drive to build about 20+ nuclear reactors, moving towards sustainable energy. China is expected to have more oil business from OPEC+ namely Russia and intra-Asia. 5 years later, China is expected to benefit greatly from these infrastructural investments.

Dividend Stocks

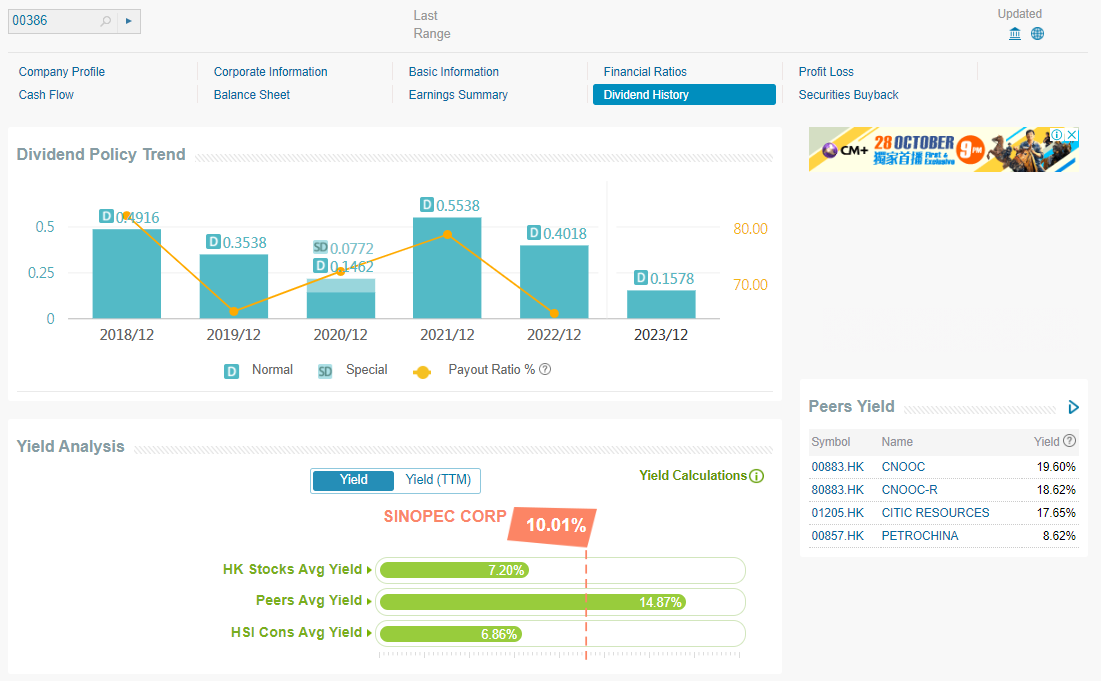

The dividend stocks (HKG) in my portfolio are 386.HK (Sinopec as per screenshot), 857.HK (used to be known as PetroChina), 883.HK (CNOOC). I have been holding to them for over 3 years.

As an overview, these are the dividend yields (annualized):

Other areas of (investing) interest

Some other opportunities that I am exploring

- We have a quiet food crisis due to the weather and recent wars. Thus, I have put in a small position into $DBA. If we noticed, we have to buy rice from India and Vietnam and less from Thailand to Singapore.

The US has an electrical grid/power supply bottleneck - thus, infrastructure and energy are of interest. They will start to experience rolling blackouts in different parts and the EV will add to the load.

Supply Chain bottleneck - check out the Panama Canal and the over-supply of container vessels.

The war should be good for defence companies - and more budget has been allocated to defence (as per Japan and Germany). but I think that it is too late to buy now.

The next country of growth in SEA is Vietnam which has benefitted from the exodus of companies from China.

India is not expected to do as well despite being the most populated.

The US plans to set up their own chip plants are facing issues with regard to raw materials, skilled workers, and supply chains. Despite the efforts to re-shore, on-shore, and near-shore, USA may not be as price competitive. Their current supply chain infrastructure needs investing.

In this climate, I recommend caution. Let us spend within our means and invest with what we can afford to lose. Let us do our due diligence so that we are able to make the best out of the various wars, and crises heading our way.

Comments

Post a Comment