Preview of the week starting 11Sep2023 - the flight of Adobe

Public Holidays

No public holidays for Hong Kong, Singapore & China in the coming week.

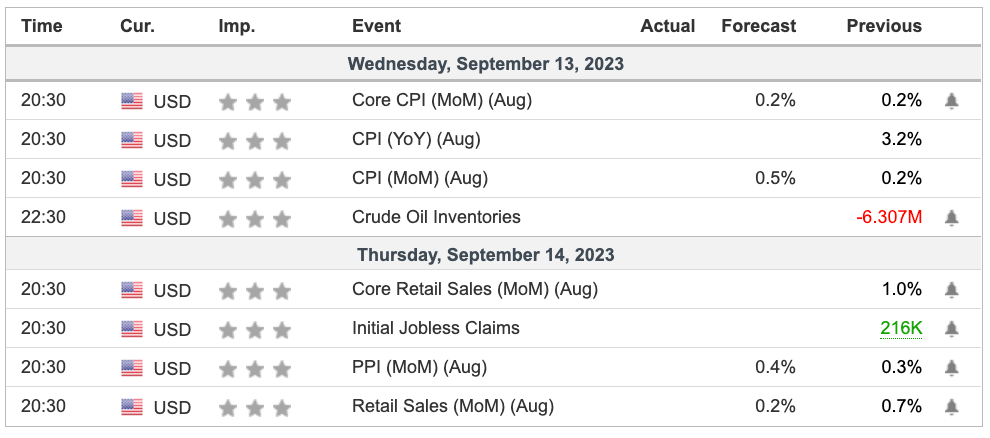

Economic Calendar (11Sep2023)

Notable Highlights

CPI - This will be the most watched macro news for the week as this is the indicator representing inflation. This data will be part of the Fed’s consideration for its coming rate hike. Though the PCE is the preferred indicator, this is still an important reference point. Even the forecast (MoM) points to a CPI increase by 0.4%.

PPI is an important reference coming to inflation. While most of us pay attention to CPI, PPI is the inflation indicator that reveals how inflation hits the producers. The PPI precedes CPI as inflation is passed on from the producers to the consumers. An increase in PPI can imply more CPI in the coming weeks.

Retail Sales & core retail sales data are good indicators of how consumers are behaving. A higher figure implies more buying.

Jobless claims. Initial jobless claims will be announced on Thursday. This would form critical data points for the Fed to decide on the next interest rate adjustment. This is part of the data consideration for the Fed in their coming interest rate decision.

Crude Oil Inventories can be seen as forward indicators of market demand and consumption. If the trend of excess inventories continues, this implies demand erosion that can lead to reduced production & weakening consumer spending.

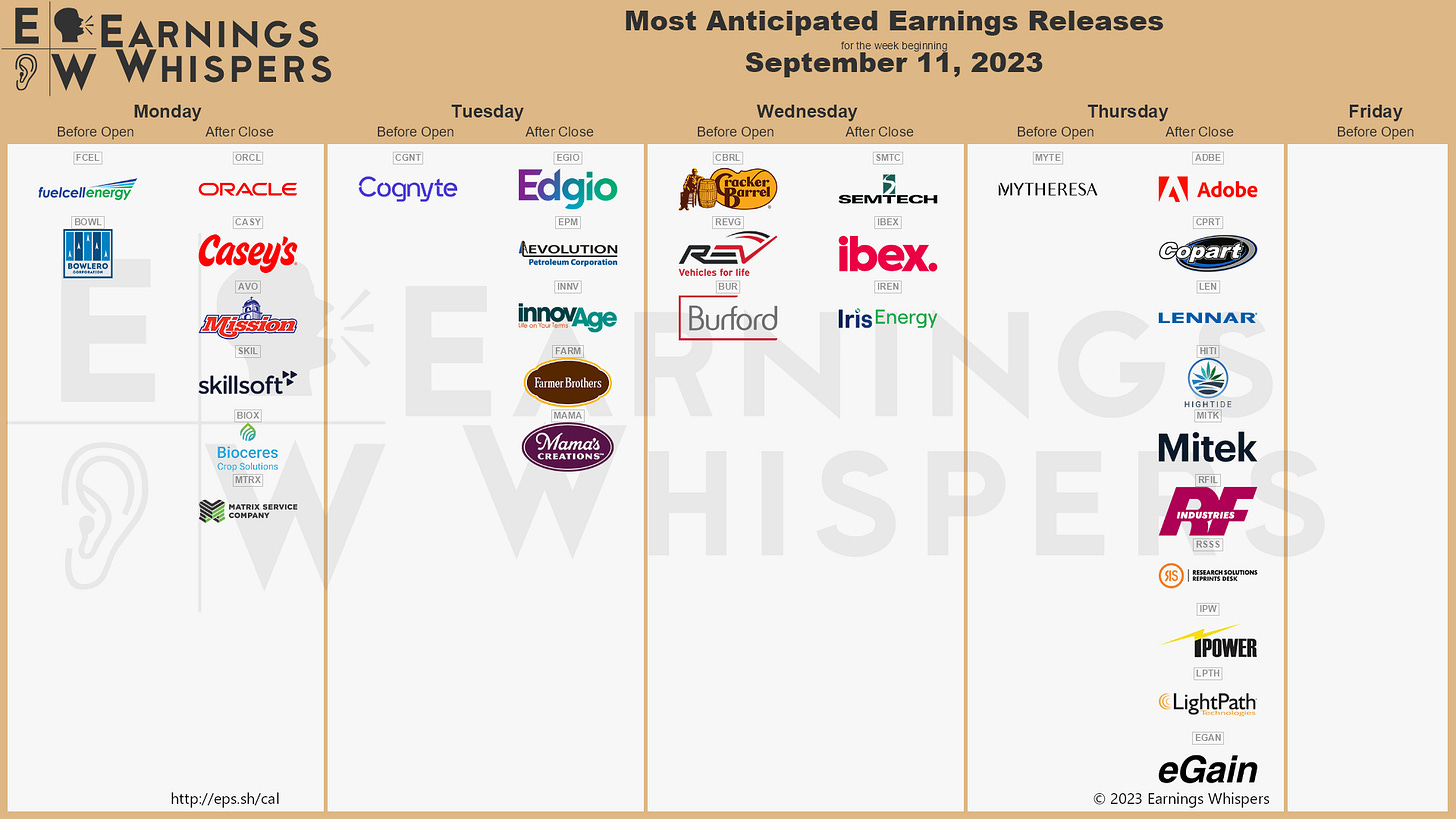

Earnings Calendar (11Sep2023) - the flight of Adobe

In the coming week, we have a few earnings of interest namely Oracle and Adobe. Let us look at Adobe in detail.

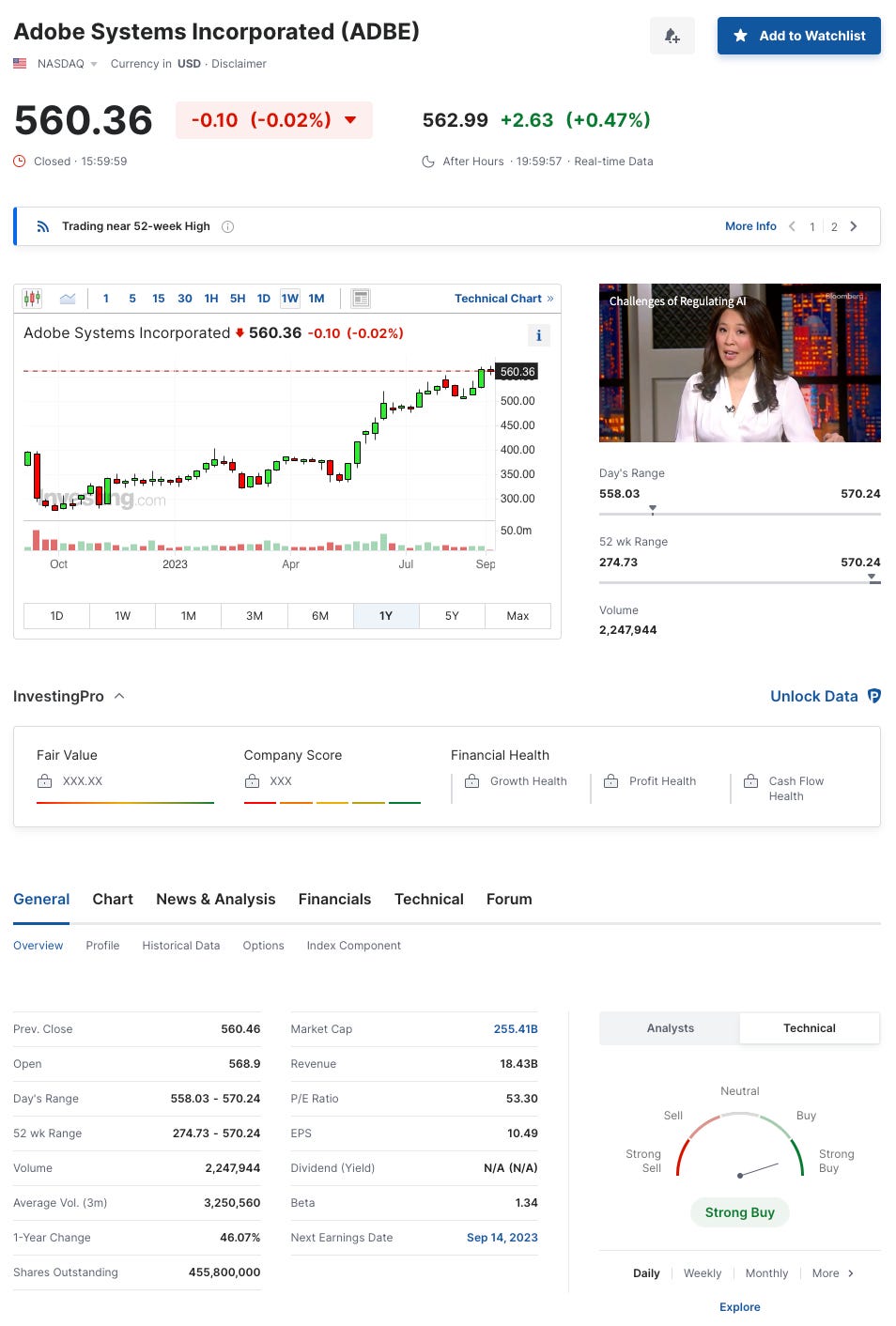

Adobe’s recent performance

In the last year, Adobe’s stock has surged an impressive 46.07% and currently stands at a P/E ratio of 53.30 and EPS of 10.48.

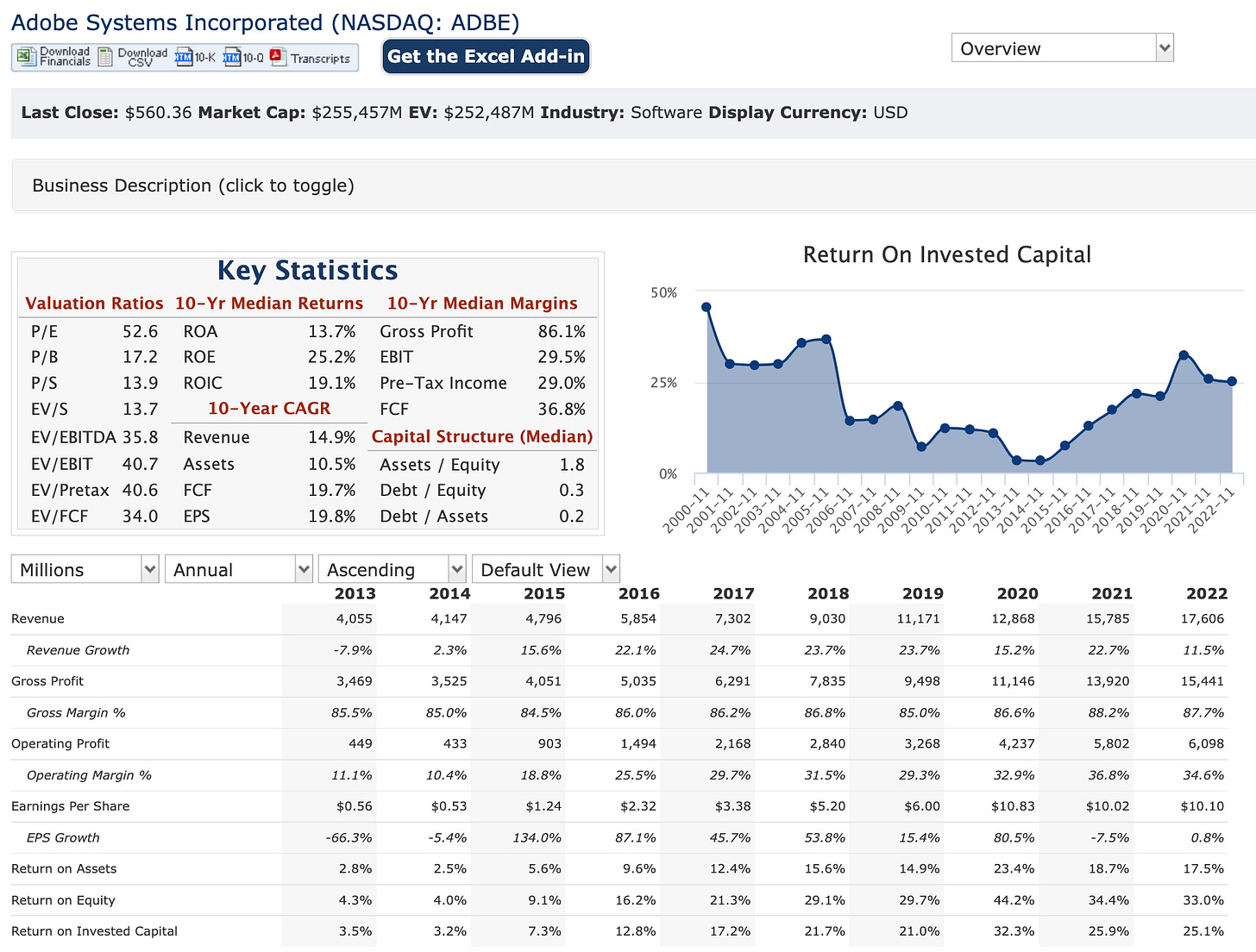

From the above, we can see an impressive growth of the business over the last 10 years. Revenue has surged 4x from $4B (2013) to $17.6B (2022). Operating profit has surged from $449M (2013) to $6,098M (2022) - this is a good 13.5x in terms of profitability. EPS’s growth is impressive from $0.56 (2013) to $10.10 (2022) - a solid 18x. To qualify a business, we will also need to look at the balance sheet, cash flow and identify the various competitive advantages that they have (moat). However, it is looking good at this stage.

For the coming earnings, the forecast EPS and revenue are 3.97 and 4.87B respectively. Can the flight of Adobe continue?

Market Outlook - 11 Sep 2023

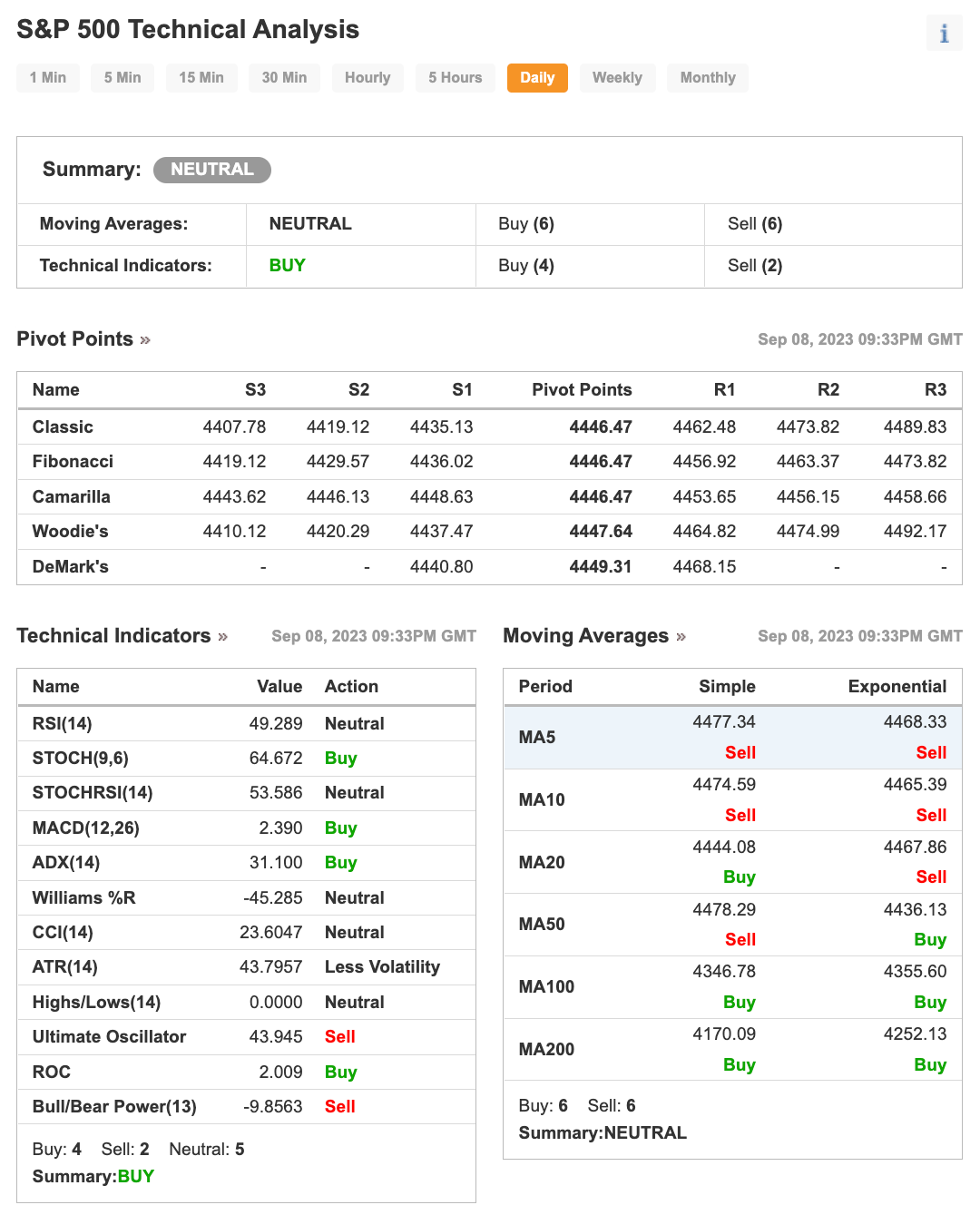

Technical observations of the S&P500 1D chart:

The Stochastic indicator is on a downtrend following a top crossover confirmation earlier in the week.

The MACD indicator is on an uptrend but looks to complete a crossover for a downtrend in the coming days.

Moving Averages (MA). Both MA50 & MA200 lines are on an uptrend. With the last candle below the MA50 line and above the MA200 line, this can be interpreted as a downtrend in the mid-term and an uptrend in the long term.

Exponential Moving Averages (EMA). 2 of the 3 EMA lines have converged and this implies a reversal. To confirm a reversal, we need all 3 EMA lines to converge, in this case showing a downtrend.

From the 1D technical indicators above, there are a total of 10 (Buy), 8 (Sell) and 5 (Neutral). Investing recommends a “NEUTRAL” recommendation based on the technical indicators above (1D chart for S&P500).

In conclusion, I do think that this week should be a downtrend for the S&P500.

News and my thoughts from the last week (11Sep23)

There are signs of improvement in the logistics market. Could this be seasonal?

FreightWaves > Descartes: July ocean imports up 5% vs. June, flat vs. July 2019. Imports to all U.S. ports totaled 2,187,810 TEUs in July. That’s down 14% YoY, up 5% sequentially from June & unchanged versus July 2019.

CNEVPost > BYD takes 4.7% global share in Jul to become 5th largest carmaker. BYD's sales are still largely coming from China for now, and will further challenge the top players when sales improve in overseas markets, TrendForce said.

The Kobeissi letter > Delinquencies on auto loans, credit cards and consumer loans just hit their highest levels since 2012. As both rates and prices rise rapidly, delinquency rates are skyrocketing. The average new car now costs $48,300, up from $37,700 just 4 years ago. The average used car is now selling for an alarming $27,000. In 1 month, student loan payments on $1.6 trillion of debt will resume. People are "fighting" inflation with debt they can't afford.

USA 1114 bank branch closures

WSJ > Companies in the index are trading at about 19 times their projected earnings over the next 12 months, according to FactSet. That is up from a multiple of roughly 16.8 at the start of the year and above the 10-year average of 17.7.

Carfans > From carfans

Looks like BYD revealing tightening leash and squeezing out Honda/Toyota here. BYD's dominance in sub 100k market can be seen in wkly registration. Honda lost 2/3 of its stores.Several models are finished. Chinese customers abandoning Japanese cars looks more likely by the day. The Fukushima release has only accelerated demise of Japan auto inc in China. IIRC, almost 20% of Japanese economy depends on auto industry. What happens when all-except Toyota exits China market? Which looks quite likely.

US household debt reaches $17 trillion in Q2 2023

WSJ > BYD, China’s Tesla, Is Coming for the World. Around one in three cars sold in China this year was an EV. Its 2023 H1 revenue grew 73% from a year earlier and expanded its gross margin to 18.5% from 13.5% a year ago.

Does the US have the intent or means to repay the debt?

NYPost > This year, credit card delinquencies have hit 3.8%, while 3.6% have defaulted on their car loans, according to credit agency Equifax. Both figures are the highest in more than 10 years.

Business insider > Roku cut 10% of its workforce amid a layoff wave expanding beyond tech.

Exports in U.S. dollar terms fell by 8.8% in August from a year ago. That’s better than the 9.2% drop forecast by a Reuters poll. Imports in U.S. dollar terms fell by 7.3% in August from a year ago, better than the 9% decline forecast by Reuters.

Watcher Guru > The U.S. dollar reserves stood at 72% in 2002. In 2023, the share of the U.S. dollar in global reserves has fallen to 59%. In 21 years, the greenback has dipped by 13% in the global markets, while other currencies are rising.

My investing muse - oil, Apple & Huawei

Oil and the OPEC+ impact

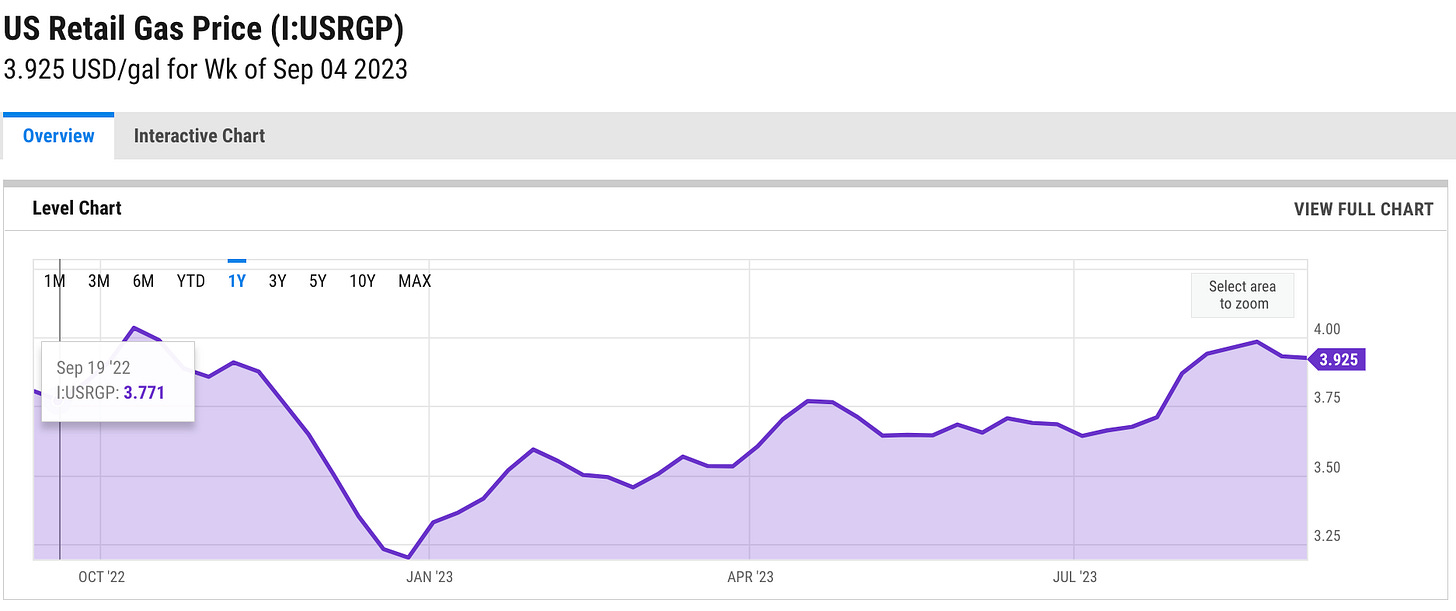

From Y Chart:

US Retail Gas Price is at a current level of 3.925, down from 3.931 last week and down from 3.938 one year ago. This is a change of -0.15% from last week and -0.33% from one year ago.

The US Retail Gas Price is the average price that retail consumers pay per gallon, for all grades and formulations. Retail gas prices are important to view in regards to how the energy industry is performing. Additionally, retail gas prices can give a good overview of how much discretionary income consumers might have to spend.

Since Jan 2023, US retail gas prices are on an uptrend. This sounds like “inflation inbound”.

From the Crude oil price chart, we see a recent surge in oil prices as OPEC+ declared production cuts.

In the recent Reuters news, it was reported:

This week, OPEC member Saudi Arabia and Russia extended their voluntary supply cuts of a combined 1.3 million barrels per day to the end of the year.

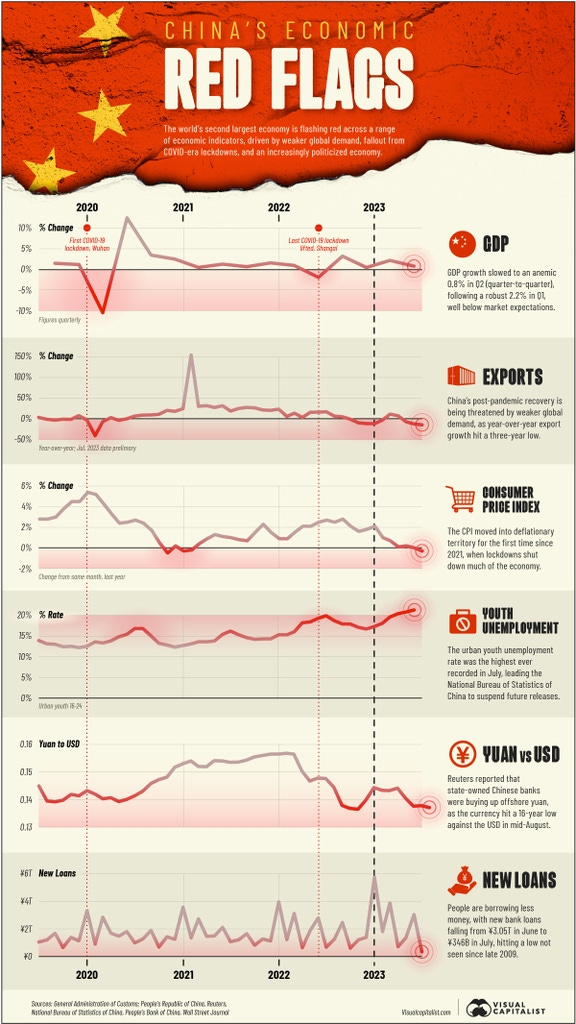

Data on Thursday showed overall Chinese exports and imports fell in August, as sagging overseas demand and weak consumer spending squeezed businesses.

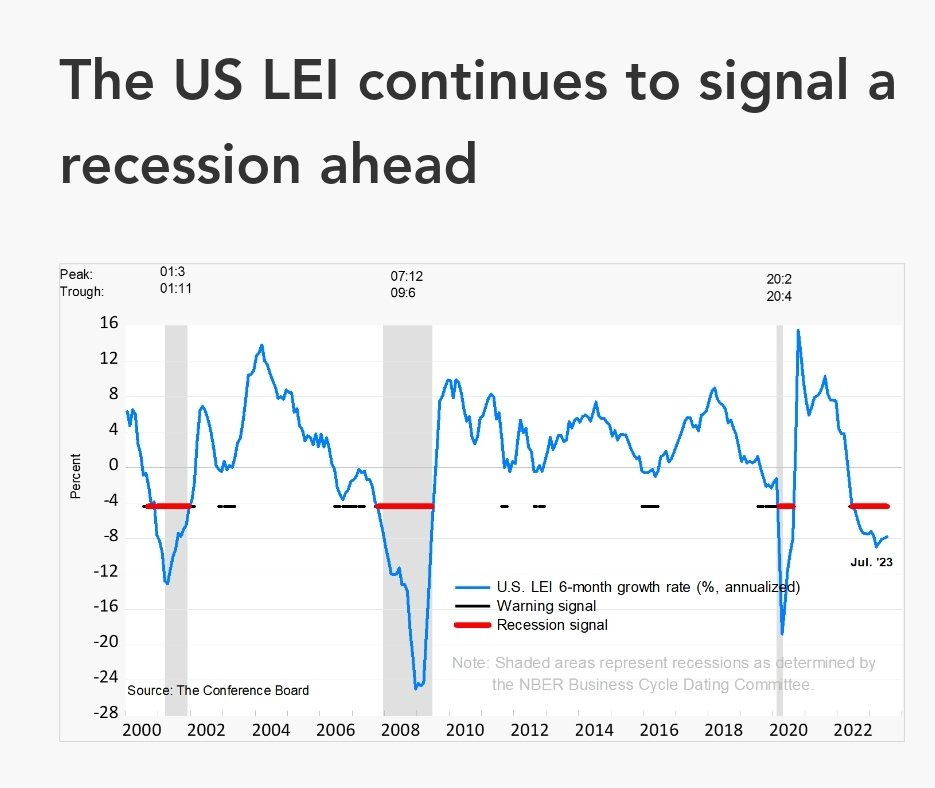

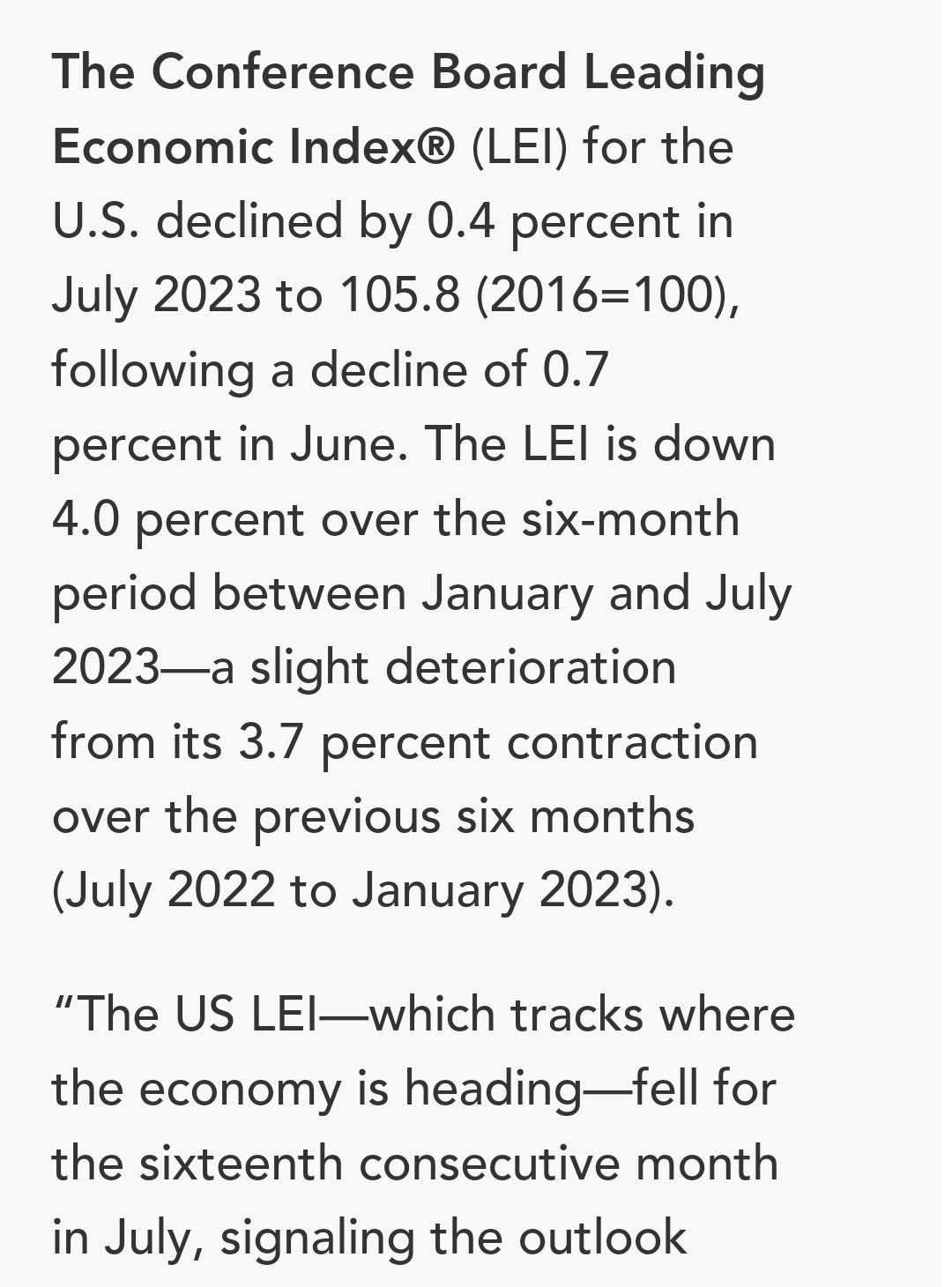

With the above, there is a possibility of inflation creeping up following the crude oil production cuts. It starts with oil prices going up. However, there are concerns about the China economy as a series of bankruptcies threaten the real estate market. Real estate accounts for one-third of China’s GDP and could be the reason causing recession for the world’s biggest factory. More impact on oil can have inflationary impacts. We are still awaiting news on the impact of extreme weather on the agriculture harvest and the energy grids. If the impact is significant, all these have some inflationary impact though it could be shortlived.

Huawei and Apple

The quiet launch of Huawei’s Mate 60 PRO phone is making huge waves in the USA. The USA was left puzzled on how Huawei was able to launch this phone with 5G capabilities despite the sanctions in place. As such, some of the US lawmakers are calling for more sanctions.

China announced an Apple’s iPhone ban for government employees. This has led to Apple losing $200B in 2 days. This could rippled to other sectors as Apple and Huawei were caught in the crossfire of trade sanctions.

As the whole world is staring at a potential recession, we need the 2 biggest countries to be working together. Yet, there are notable disputes and accusations raised.

With this week’s CPI, we should expect more volatility in the coming days. There is money to be made in both bull and bear runs. Let us continue to shortlist great companies that we can buy at discounts.

Comments

Post a Comment