Preview of the week of 04Sep2023 - can C3 AI surge?

Public Holidays

No public holidays for Hong Kong, Singapore & China in the coming week.

The USA is closed on 4 September 2023 (Mon) for Labor Day. Thus, the USA market will be closed on Monday and open from 5th Sep 2023 onwards.

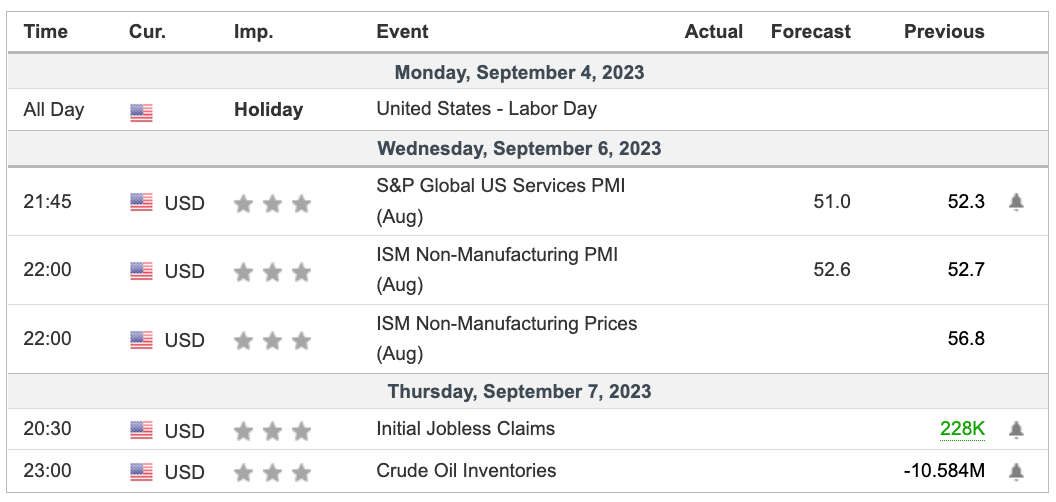

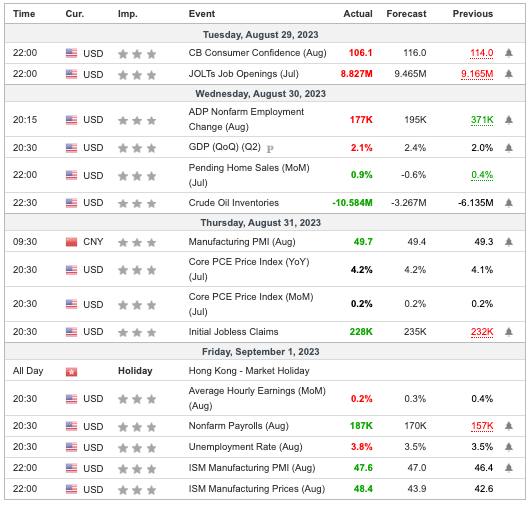

Economic Calendar (04Sep2023)

Notable Highlights

PMI. S&P Global US Services PMI and ISM Non-Manufacturing PMI will be released in the coming week. These will give us some insights on how non-manufacturing/services industries are doing in the USA.

ISM Non-Manufacturing Prices will also be released which we use as a reference for the inflationary pressures faced by non-manufacturing players in the USA.

Jobless claims. Initial jobless claims will be announced on Thursday. This would form critical data points for the Fed to decide on the next interest rate adjustment. This is part of the data consideration for the Fed in their coming interest rate decision.

Crude Oil Inventories can be seen as forward indicators of market demand and consumption. If the trend of excess inventories continues, this implies demand erosion that can lead to reduced production & weakening consumer spending.

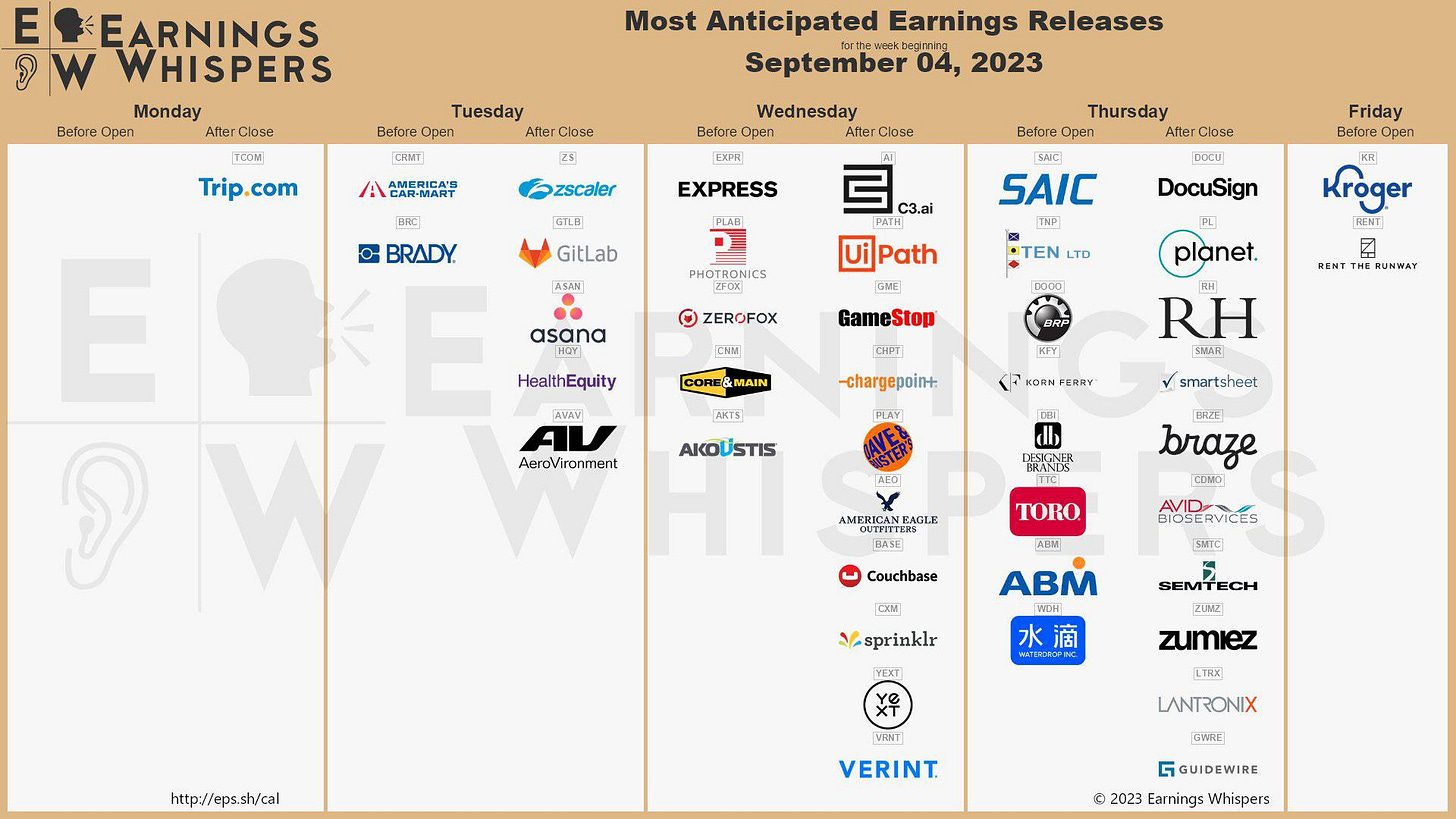

Earnings Calendar (03Sep2023)

For the coming week, there are a few company earnings of personal interest for me namely, Kroger, C3 AI & UI Path.

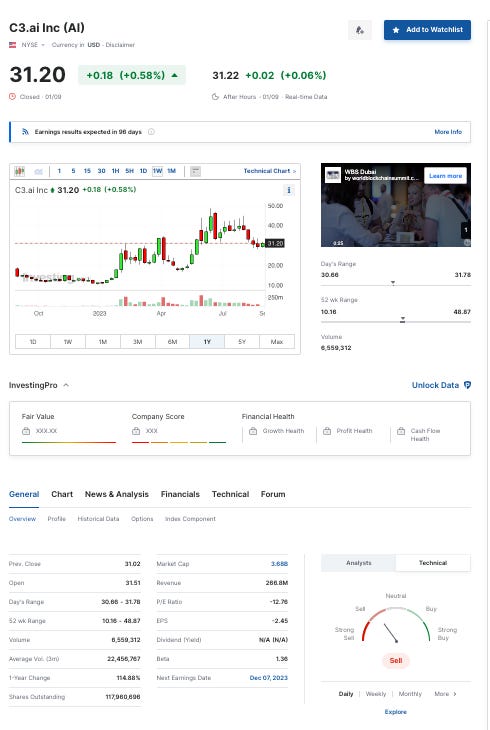

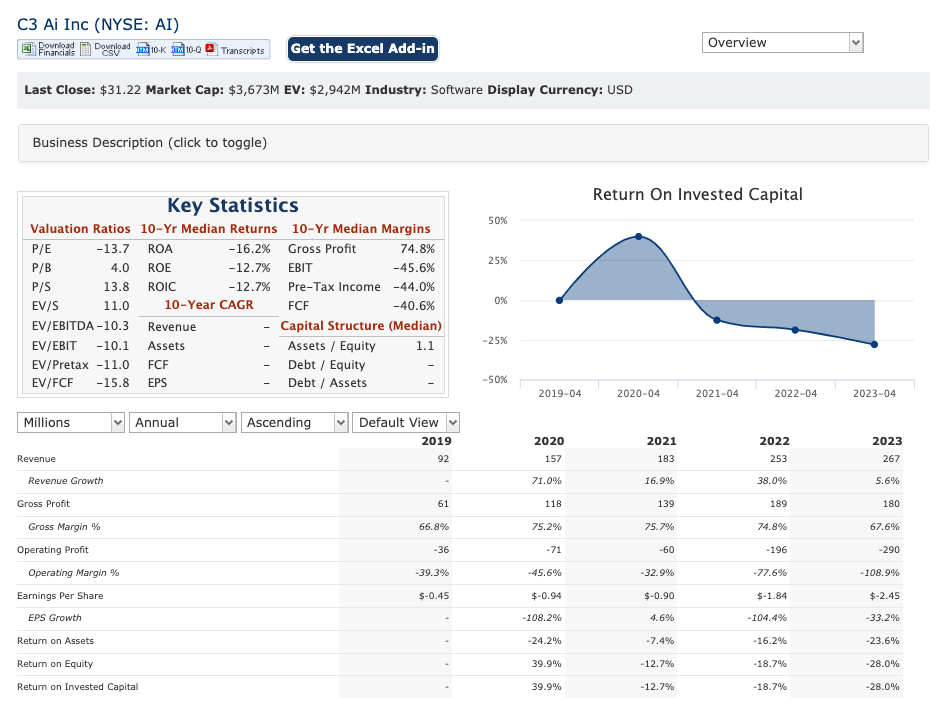

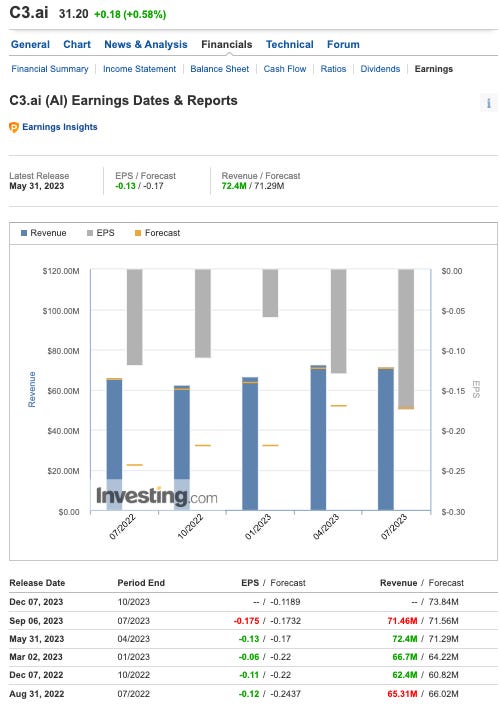

Let us look into C3 AI.

C3 has a “sell” rating as per the above but has made a 114% gain in 1 year.

Since 2019, we have seen a constant growth in revenue. However, the business remains unprofitable.

For the coming earnings, the forecast stands at -0.1732 and 71.56M for its EPS and revenue respectively. Will C3 AI be able to ride the AI hype to post good earnings?

Market Outlook - 04 Sep 2023

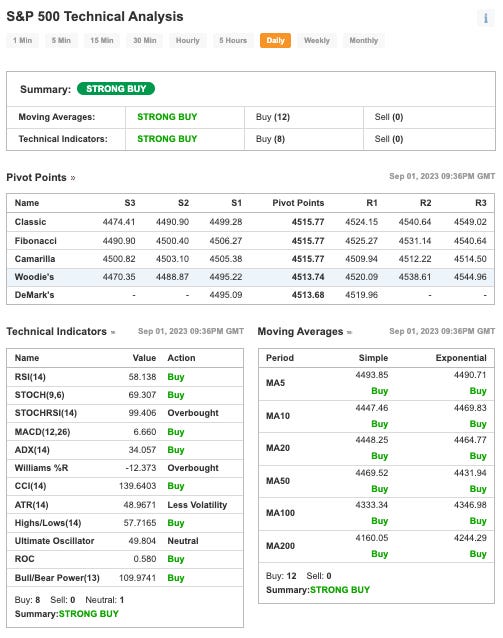

Technical observations of the S&P500 1D chart:

The Stochastic indicator is on an uptrend. There is a potential crossover (for a reversal) but there is no confirmation as the crossover is yet completed.

The MACD indicator is on an uptrend.

Moving Averages (MA). Both MA50 & MA200 lines are on an uptrend. With the last candle being above both the MA50 line and the MA200 line, this can be interpreted as an uptrend in the mid-term and in the long term.

Exponential Moving Averages (EMA). All 3 EMA lines have converged and are on an uptrend.

From the 1D technical indicators above, there are a total of 20 (Buy), 0 (Sell) and 1 (Neutral). Investing recommends a “STRONG BULL” based on the technical indicators above (1D chart for S&P500).

My thoughts

The various indicators point to an uptrend in the coming week though a short correction is possible as per stochastics.

News and my thoughts from the last week (04Sep23)

<Freightwaves> Recent rate action further undermines hopes that the goods inventory overhang amassed during the pandemic has wound down and restocking will lead to a better-than-normal peak season.

<WSJ> Some skipping insurance say they are doing so because they can no longer afford the rising premiums. The national average for home insurance based on $250,000 in dwelling coverage increased this year to $1,428 annually, up 20% from 2022.

Apollo trials driverless taxi from Wuhan Tianhe Internatonal Airport.

<Twitter user The Kobeissi Letter> China just announced some massive tax cuts. This new policy cuts taxes on stock trading by 50%. The last time this happened? In 2008. These tax cuts follow a “surprise” rate cut last week, their biggest since 2020. Meanwhile, Evergrande just filed bankruptcy and China’s HY real estate index is down 80%. Is China on the brink of a credit event?

<Twitter user The Kobeissi Letter> JUST IN: 26% of all single family home sales in the US during the month of June were purchased by investors. Investors are buying and renting single family homes. Meanwhile, median rent prices in the US are approaching $2,000/mo as buying becomes unaffordable. The housing market is forcing buyers out.

<CNBC> Regional banks face another hit as regulators force them to raise debt levels. The requirements will create “moderately higher funding costs” for regional banks.

<WSJ> What’s Behind $1 Trillion in Credit-Card Balances?

Credit-card interest rates have hit record highs, with the current average rate at 22.16%, up from 16.65% a year ago, adding about $25 a month in interest on an average credit-card balance of $5,733.

<CNBC> Category 4 Hurricane Idalia projected to hit Florida with 'catastrophic' storm surge

Idalia was projected to come ashore as a Category 4 storm with sustained winds of at least 130 mph (209 kph) in the lightly populated Big Bend region.

<CBS News> Another reason for companies to post unreal openings could be to create an image of health — something particularly prevalent in the world of venture-backed startups eager to demonstrate their strength. This may distort some of the job data.

<CNBC> China's factory activity shrinks for a fifth straight month in August

<CNBC> How China became the king of new nuclear power, and how the U.S. could catch up. China has 21 nuclear reactors under construction which will have a capacity for generating more than 21 gigawatts of electricity.

<CNBC> 61% of adults live paycheck to paycheck — inflation is still squeezing budgets

<CNBC> Unemployment rate unexpectedly rose to 3.8% in August as payrolls increased by 187,000. Transportation and warehousing lost 34,000 and information declined by 15,000. The logistics usually expects a peak at Q4 with Christmas & Thanksgiving weekend. Reduction of manpower leading to a busy Q4 can be a concern if the sales is expected to be muted.

<Twitter user The Kobeissi Letter> Average monthly payment for a new car in the U.S. hits a fresh all time high of $733.

This is up 33% from the average of $550 in 2019 and on track to cross $750 by the end of 2023. Meanwhile, the average interest rate on a new car loan just hit a record 9.5%. Owning a car has become a luxury.

My investing muse

The week ended with a drop in CB Consumer Confidence, JOLTs Job Openings, ADP Nonfarm employment change and an increase in unemployment from 3.5% to 3.8%. Manufacturing PMI continues to point to a contractual in domestic manufacturing in the USA.

It is not all bad news as we received a breather in bigger bigger-than-expected drawdown in crude oil inventories (that implies an increase in production).

The market seems sandwiched between good and not-so-good news with the market largely hopeful for a sooner Fed pivot (where interest rates should be cut). The Fed does not think like the market and needs to do its bit to balance employment and inflation with its main tool of interest rate. The jobs, unemployment and inflation data would guide them in their decisions. The latest PCE (YoY) reaches an expected 4.2%. It can be within the expectation but it is also a gain from last month’s 4.1%. This implies that the inflation has remained stubborn despite the recent efforts. It takes time for the interest rate impact to flow into the market. The Fed does not need to overreact but to be slow to react can be equally dangerous.

The US and many parts of the developed world are facing a “Cost of living crisis”. This forced changes in expenditure, credit card leverage and more. So long as their household incomes are unable to catch up with their expenditure, this could lead to a cycle of debts with family turning to credit for their living needs.

Conclusion

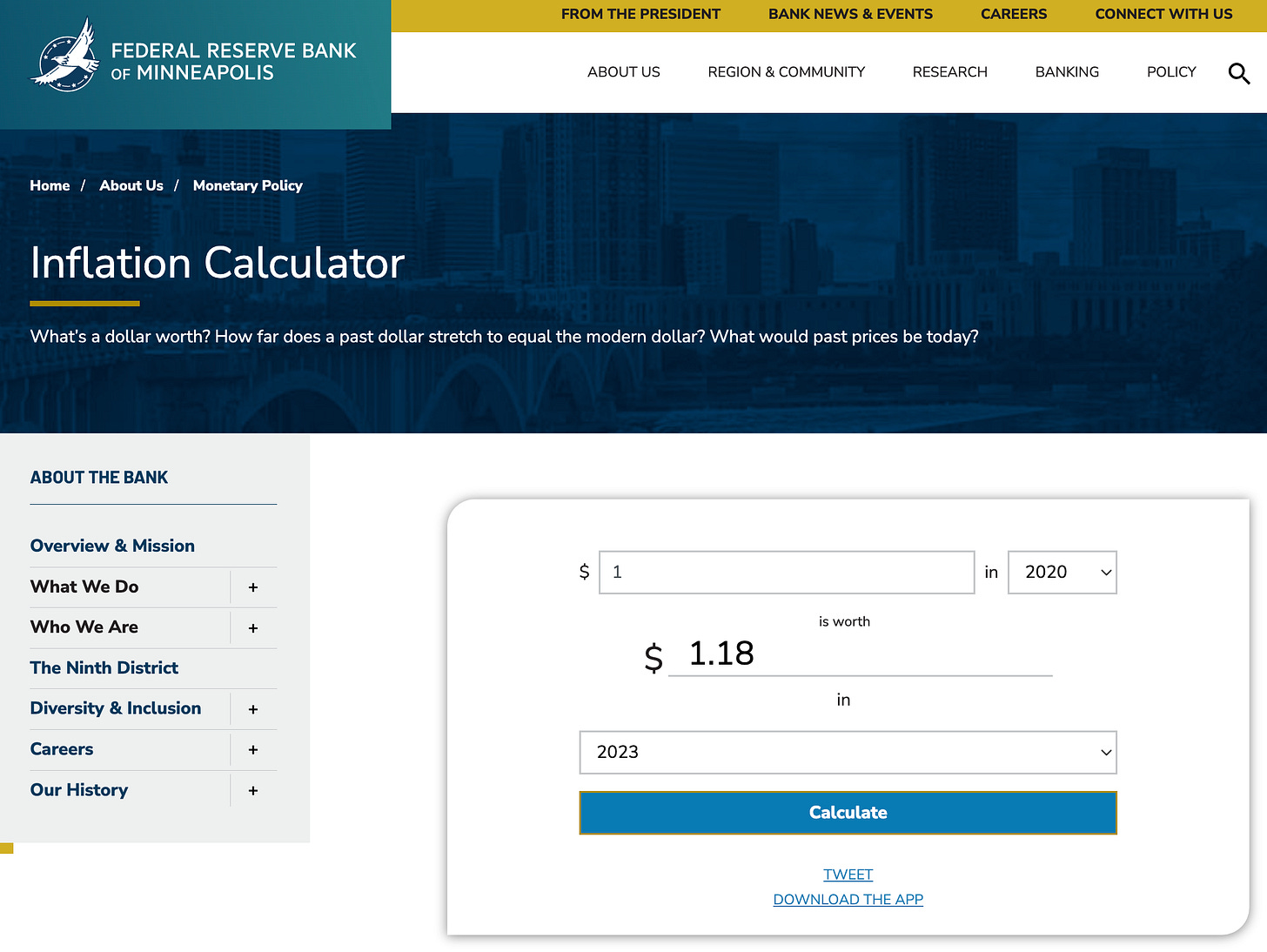

From 2020 to 2023, we have an accumulated inflation of 18% as per the inflation calculator above from the Federal Reserve Bank of Minneapolis.

There will be a mix of good and bad news from the market. Despite the GDP (QoQ) has dropped from an initial (first) estimate of 2.4% to 2.1%, this remains a strong indicator of the economy. There is still money to be made from the market. However, there are also signs of weaknesses that should lead us to consider hedging.

Let us continue to exercise caution as we reach the end of the earnings season. While there are exciting developments in AI and in companies like Tesla, there are also cautionary signs of unemployment and inflation.

Let us make sure that we have some powder that can be handy should the market turn for the worse.

Comments

Post a Comment