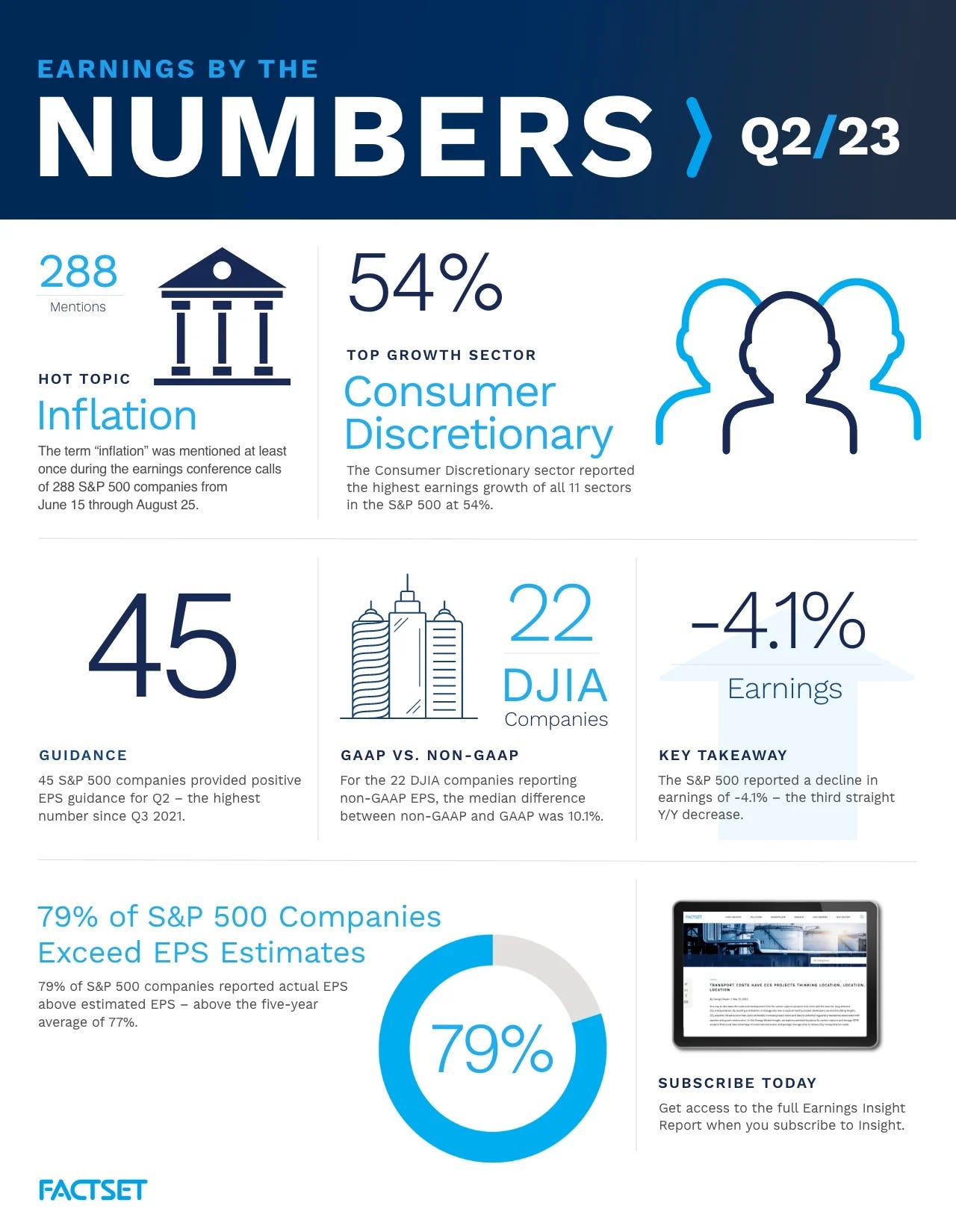

Factset S&P500 Q2/23 Earnings summary by numbers

Factset has published a good overview as of 31 Aug 2023 for the S&P500 Q2/2023 earnings season:

Here are some of the highlights:

Inflation was mentioned 288 times and remained a topic of concern for the market. Should interest rates continue to rise, we can expect funds to move towards the bond market and out of the high-growth stocks.

Out of the 11 business sectors, Consumer Discretionary has gained the most at 54%.

45 S&P500 companies have provided positive EPS guidance for Q2. It is the most positive since Q3/2021 and represents more companies having a more bullish outlook. Personally, this is good news. With less than 10% of the businesses, this can be limited to certain sectors with the rest of the sectors being neutral, less bullish or even bearish towards the market outlook.

79% of the companies have actual EPS above estimated EPS. This can be read as good news, with more companies beating the market expectations. However, beating EPS can be done if the estimate is lowered. This is something that we need to look into - the amount of drop in EPS estimate.

22 companies reported using non-GAAP EPS. The average difference between non-GAAP and GAAP is about 10.1%. This implies that the EPS could be “inflated”. While the choice of methodology is up to the company, this usually inflates the profitability of the business. I prefer to hold all with a tougher GAAP.

What is of most concern is that the S&P500 (YoY) has a 4.1% decline in earnings.

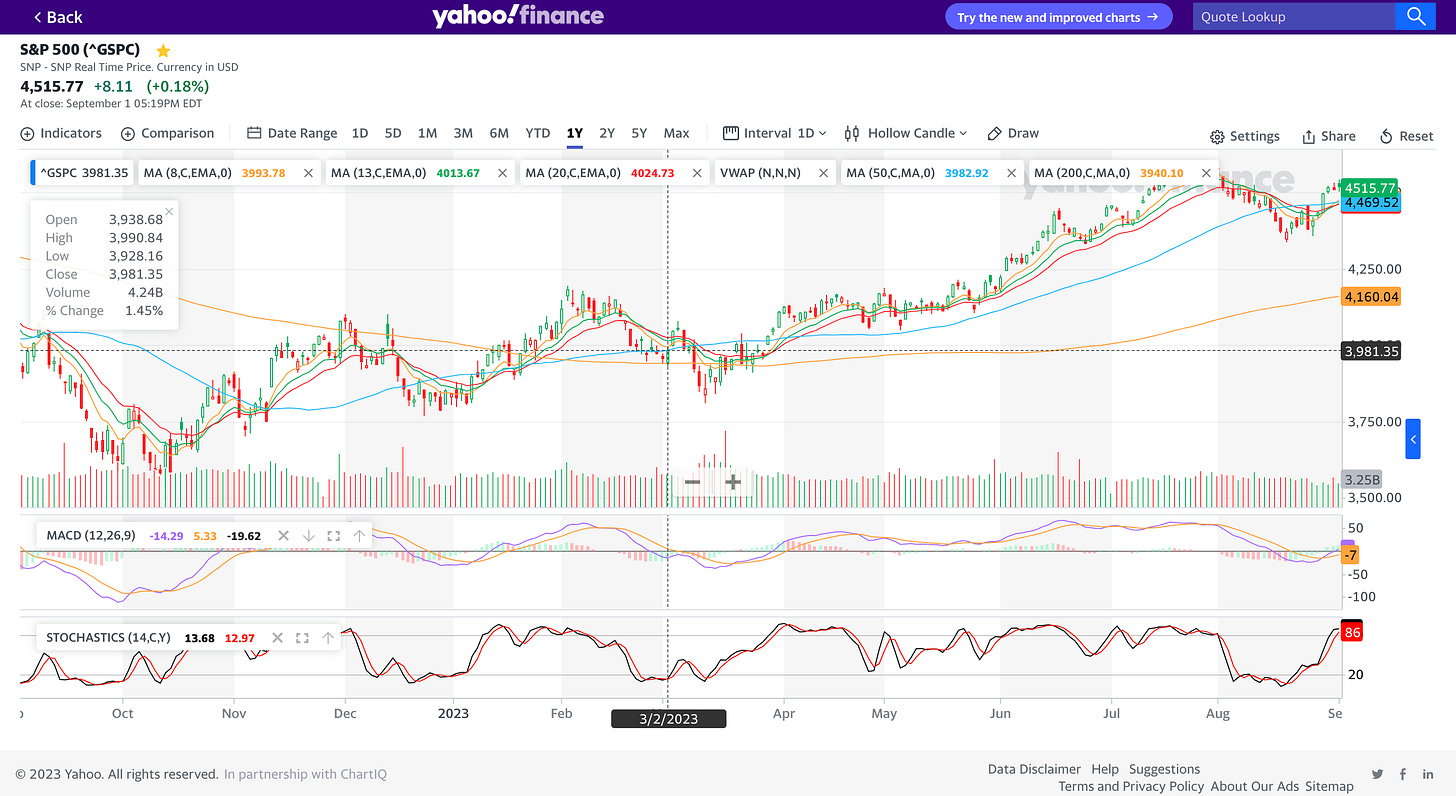

On the last day of Q2/2023, the S&P500 1D chart closed on 30 June 2023 at 4,450.38. If S&P500 Q2/2023 earnings have declined by 4.1% for Q2/2023, where should S&P500 be?

While there is a group of companies perking up the S&P500 with their earnings, let us not lose sight of the S&P500 that are experiencing a decline in their EPS (earnings). What does this speak of the market and economy of the USA?

This is not just a YoY decline in terms of EPS. This is the 3rd straight YoY decline for the S&P500. Thus, it is prudent that we exercise caution under such a climate. Is there a divergence between falling EPS and a rising S&P500? It is important that we research so that we can best navigate this volatile market.

Comments

Post a Comment