Which companies with high debts are at risks?

With the “high interest-rate” environment, I plan to screen for companies which may be at risk. However, these can be at risks of going under or can be turnaround plays.

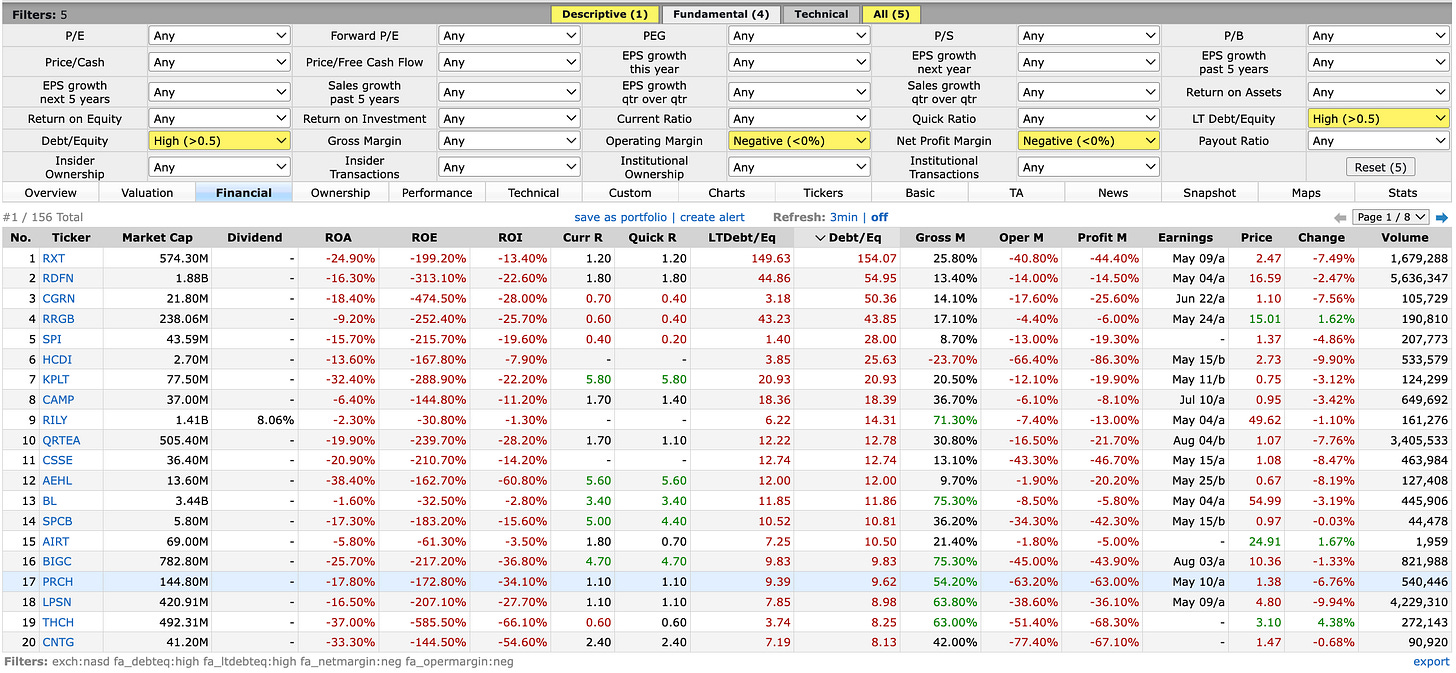

Thus, I look into both NASDAQ & NYSE with the following criteria:

High Debt/Equity (more than 0.5)

Operating Margin (negative)

Net Profit Margin (negative)

High LT Debt/Equity (more than 0.5)

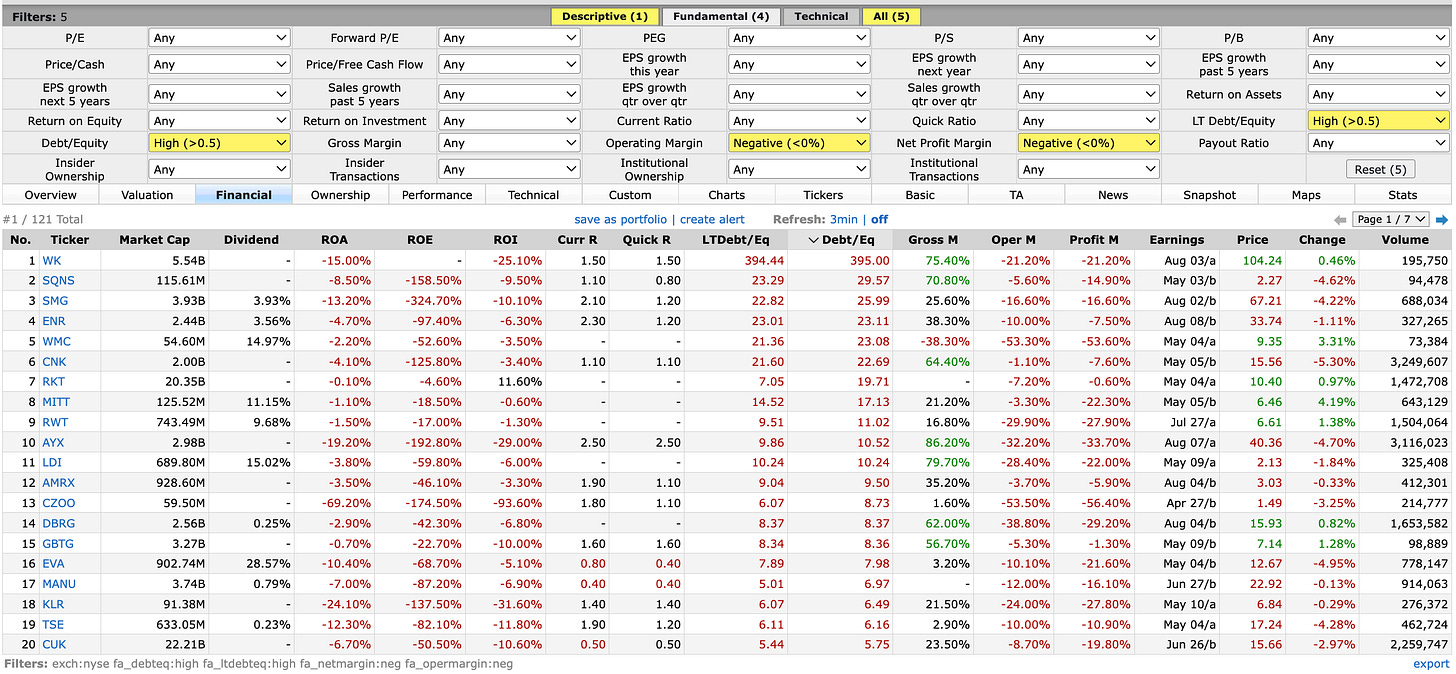

The results were sorted according to their Debt/Equity in descending order. The higher this number, the worse debt situation the company is in.

The same criteria were applied to companies in NYSE

When the results were out, it is not surprising that most of these companies have negative ROA, ROE & ROI.

These are the definition of ROA, ROE & ROI from Investopedia.

Conclusion

With such high-interest rates, companies with higher debts will run at a greater risk of going under. Let us review our current portfolio to identify stocks with excessive debts. The current bull run may allow us to take profits or stop losses. We need to confirm if these holdings have the means to turn things around or if they have lost their edge and are unlikely to break even.

When we research stocks, companies without debts will find it difficult to go under. Debt/Equity and LT Debt/Equity can be important considerations for us.

Comments

Post a Comment