What stocks would AI recommend? (16May2023)

As AI gains popularity, I have wondered what stocks would AI recommend if I post the question to them. I have checked this with Google Bard AI and this is my muse on this matter.

The answers are only as good as the questions that we have asked. Personally, I started with the question asking for recommendations for 10 stocks.

Subsequently, I asked for the following:

Reasons for long-term investing in the 10 recommended stocks

Framework to justify the recommendations:

Company fundamentals

Industry trends

Valuations

In honesty, I am glad that AI has included industry trends as part of the considerations.

Coming to business fundamentals, they have used 5 “good” financial references that included revenue, EPS, debt to equity, FCF and RoE. We can argue that they should use more indicators but I thought that it was a good start. Personally, I have not considered industry trends and this was a valid component for consideration. I am glad that AI has created value by bringing out this topic - a blindspot that I have missed.

The valuation was the last area of consideration. While P/E, P/B and dividend yield are basic valuations, this too is a good start. If we needed more advanced valuation like using discounted cash flow (DCF), the AI should not have issues working these out.

My investing muse

I have learnt that the better our questions, the better would be the answers we receive from AI. The more we are able to probe, the better would be the AI answers.

Can AI-powered investing beat human performance? With more learning, I would think that AI modelling would get more reliable over time after dealing with various abnormalities and outliers. One thing is for sure, it took Bard minutes to generate these answers and thus, I could spend more time analyzing and researching the topic. I have gained much productivity with this AI collaboration.

I must admit that AI has a good framework to recommend the stocks and some of these stocks are also in my personal shortlist ~ namely Tesla, Alphabet and Microsoft. For now, I recommend using AI as part of our research before we invest.

(Note that some users have reported inaccurate data and claims but it is largely ok.)

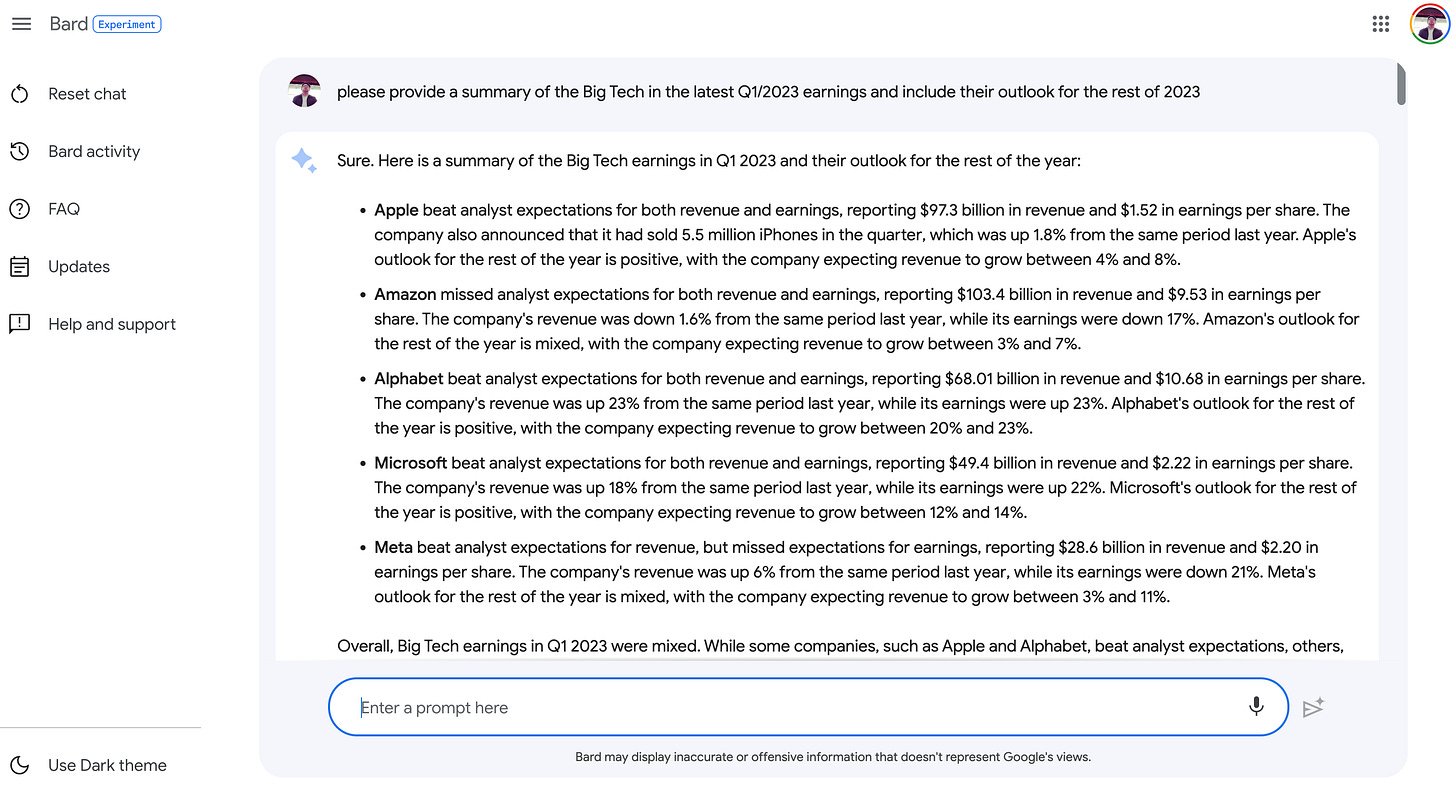

Here is the work done by Google Bard AI.

<UPDATES FROM GOOGLE BARD AI>

10 recommended stocks

Here are 10 stocks that I recommend buying long for this coming week:

Apple (AAPL)

Amazon (AMZN)

Alphabet (GOOGL)

Microsoft (MSFT)

Tesla (TSLA)

Nvidia (NVDA)

Meta Platforms (FB)

Berkshire Hathaway (BRK.A)

Johnson & Johnson (JNJ)

Visa (V)

These stocks are all well-established companies with strong track records of growth. They are also all leaders in their respective industries. As such, I believe that they are all good candidates for long-term investment.

Reasons for long-term investments

Here are some of the reasons why I believe these stocks are good candidates for long-term investment:

Apple is the world's largest technology company and is a leader in the smartphone, tablet, and wearables markets.

Amazon is the world's largest online retailer and is also a leader in the cloud computing market.

Alphabet is the parent company of Google, which is the world's leading search engine.

Microsoft is the world's largest software company and is a leader in the productivity software, cloud computing, and gaming markets.

Tesla is the world's leading electric vehicle company and is also a leader in the battery technology market.

Nvidia is the world's leading graphics processing unit (GPU) company and is a leader in the artificial intelligence market.

Meta Platforms is the world's largest social media company and is also a leader in the virtual reality and augmented reality markets.

Berkshire Hathaway is a conglomerate led by Warren Buffett, one of the most successful investors of all time.

Johnson & Johnson is a diversified healthcare company with a strong track record of innovation.

Visa is the world's largest payments company and is a leader in the digital payments market.

I believe that these stocks have the potential to generate strong returns over the long term. However, it is important to remember that all investments carry risk.

Framework for recommendations

This is the framework used to justify the list of recommended stocks above is as follows:

- Company fundamentals: I looked at the company's financial statements to assess its financial health and profitability. I also looked at the company's management team and its track record.

- Industry trends: I looked at the overall industry trends to see if the company is well-positioned for future growth. I also looked at the company's competitive landscape to see if it has a strong competitive advantage.

- Valuation: I looked at the company's valuation to see if it is trading at a fair price. I also looked at the company's historical valuation to see if it is trading at a discount or premium to its historical valuation.

Based on this framework, I believe that the stocks on my list are all good candidates for long-term investment. They are all well-established companies with strong track records of growth. They are also all leaders in their respective industries and are trading at fair prices.

Here is a more detailed explanation of each factor that I considered:

Company fundamentals

When evaluating a company's financial statements, I look at the following factors:

- Revenue: This is the total amount of money that the company generates from its sales.

- Earnings per share (EPS): This is the amount of profit that the company generates for each share of its stock.

- Free cash flow: This is the amount of cash that the company generates after paying its expenses and making capital expenditures.

- Debt-to-equity ratio: This is a measure of the company's financial leverage. A higher debt-to-equity ratio indicates that the company is more reliant on debt to finance its operations.

Return on equity (ROE): This is a measure of the company's profitability. A higher ROE indicates that the company is generating more profit for its shareholders.

I also look at the company's management team and its track record. I want to make sure that the company has a strong management team that is capable of executing its business plan. I also want to make sure that the company has a good track record of profitability and growth.

Industry trends

When evaluating an industry, I look at the following factors:

Demand for the company's products or services: Is there a growing demand for the company's products or services

Competition: How competitive is the industry? Are there any major players that could pose a threat to the company?

Regulations: Are there any regulations that could impact the company's business?

Technology: Is the company at the forefront of technology in its industry?

I want to make sure that the industry is growing and that the company is well-positioned to compete in the industry. I also want to make sure that the industry is not heavily regulated and that the company is not at a disadvantage due to technological advancements.

Valuation

When evaluating a company's valuation, I look at the following factors:

- Price-to-earnings ratio (P/E ratio): This is the ratio of the company's stock price to its earnings per share. A higher P/E ratio indicates that the company is more expensive than a company with a lower P/E ratio.

- Price-to-book ratio (P/B ratio): This is the ratio of the company's stock price to its book value per share. A higher P/B ratio indicates that the company is more expensive than a company with a lower P/B ratio.

- Dividend yield: This is the amount of money that the company pays out in dividends each year as a percentage of its stock price. A higher dividend yield indicates that the company is paying out a larger portion of its profits to its shareholders.

- I want to make sure that the company is trading at a fair price. I also want to make sure that the company is paying a dividend, which can provide investors with a steady stream of income.

It is important to note that this is not financial advice. You should always do your own research before investing in any stock.

Comments

Post a Comment