What does the latest FOMC meeting minutes (24May2023) tell us

FOMC has released the minutes of its 02-03 meeting on 24 May 2023. Here are my thoughts on this matter.

My investing muse

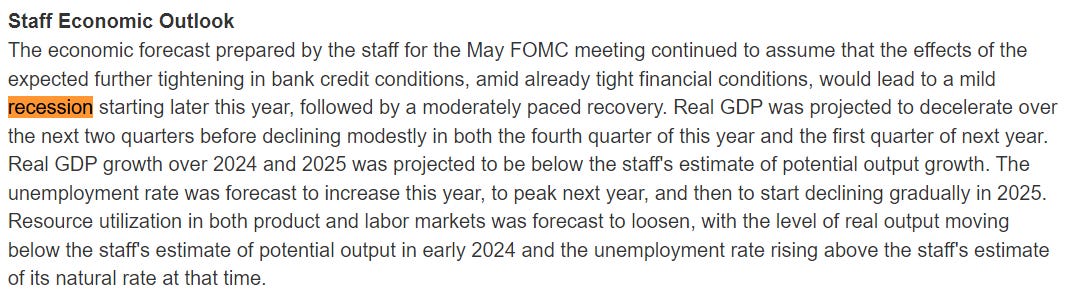

The Fed is expecting a recession and the unemployment rate forecast is expected to increase. Real GDP is projected to decline. The government has given their outlook for the coming months and the recession could be “mild”.

I am not sure if we need to wait that long as the debt ceiling crisis looms. Different news sources have already suggested that the Fed would run out of funds by early June 2023. The debt ceiling will eventually be raised. Global concerns surround the magnitude and extent of collateral damages that will ripple through the US and cascade to the international market. Fitch Ratings has put the US long-term foreign-currency issuer default rating (IDR) as negative.

With the decline of the USD as a global reserve currency (to the recent 47%), who else could step up to buy the new USD bonds and treasury bills needed to raise the money needed by the US. There will be a time lapse before the funds reach the US coffers.

FOMC suggested that there are more interest rate hikes expected and tonight’s PCE data will bring important reference on how the Fed could act to deal with the sticky inflation.

We should not be surprised if inflation remains sticky. We should not be surprised if there are some more interest rate hikes to come should data affirm the sticky inflation. This would have an impact on the banks, citizens who are behind in their credit card debts, businesses that need credit for cash flow, real estate and more.

It is too early for me or anyone to call an outcome. Let the data speak for itself as more is unveiled. For now, I recommend prudence as the macro environment is sitting on weakening fundamentals.

Source: https://www.federalreserve.gov/monetarypolicy/fomcminutes20230503.htm

Here is a summary of the latest FOMC meeting minutes ~ by Google BARD:

- The Federal Open Market Committee (FOMC) released the minutes of its May 2-3 meeting on Wednesday, May 24, 2023. The minutes provide insight into the discussions that took place at the meeting and the decisions that were made.

- The FOMC decided to raise the target range for the federal funds rate by 50 basis points, to a range of 0.75% to 1%. This was the largest rate hike since 2000. The FOMC also signaled that it expects to continue raising rates at a rapid pace in the coming months.

- The minutes of the meeting show that the FOMC is committed to bringing inflation under control. The committee members expressed concern about the high level of inflation and the risk that it could become entrenched. They also noted that the labor market is very strong, and that there is a risk of a wage-price spiral.

- The FOMC's decision to raise rates is a sign that it is taking inflation seriously. The committee is likely to continue raising rates in the coming months, and this could lead to a slowdown in economic growth. However, the FOMC is hoping that by raising rates, it can bring inflation under control without causing a recession.

Here are some key takeaways from the FOMC meeting minutes:

- The FOMC is committed to bringing inflation under control.

- The committee expects to continue raising rates at a rapid pace in the coming months.

- The FOMC is concerned about the risk of a wage-price spiral.

- The FOMC's decision to raise rates is a sign that it is taking inflation seriously.

- The committee is likely to continue raising rates in the coming months, and this could lead to a slowdown in economic growth.

- The FOMC is hoping that by raising rates, it can bring inflation under control without causing a recession.

Comments

Post a Comment