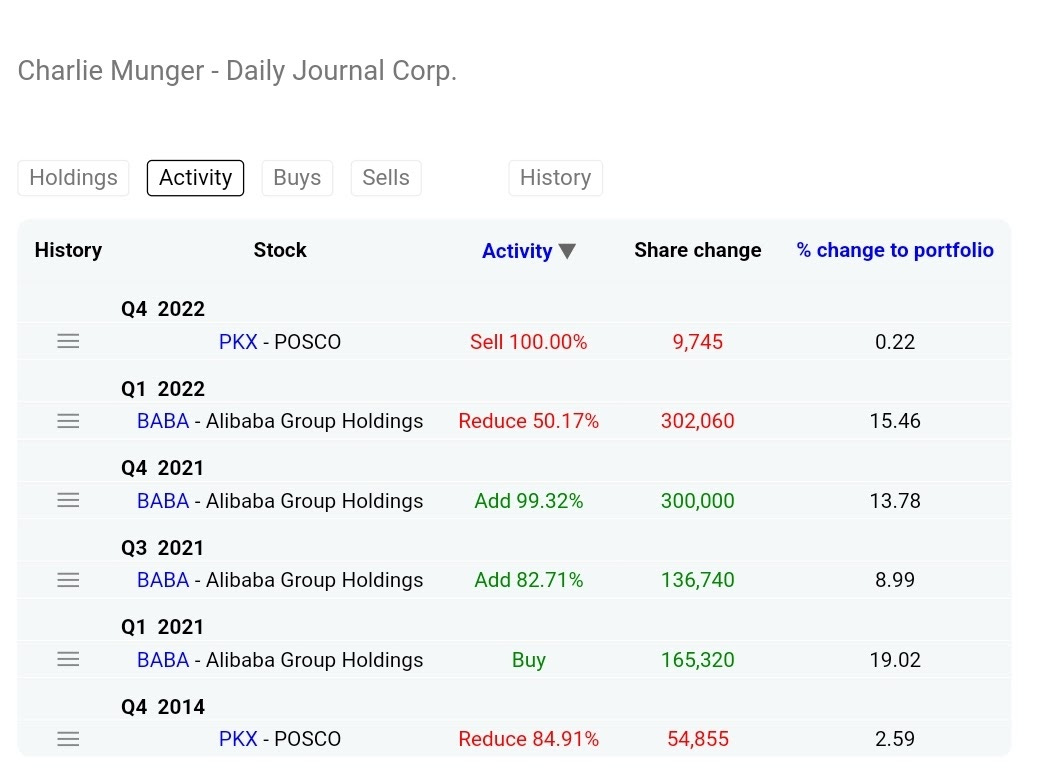

Update to Charlie Munger's portfolio ~ Q1/2023 > did he sell off his banking stocks? (04Apr2023)

Mr Charlie Munger has updated his Q1/2023 portfolio as of 4th Apr 2023 for his company Daily Journal Corp.

The portfolio of Mr Charlie Munger remains the same as last quarter without any activities in Q1/2023.

In the previous quarter (Q4/2022), Mr Munger sold off 100% of a small holding PKX - POSCO. Various ones are watching out for his holdings in Alibaba. Does this mean Alibaba is a safe investment now?

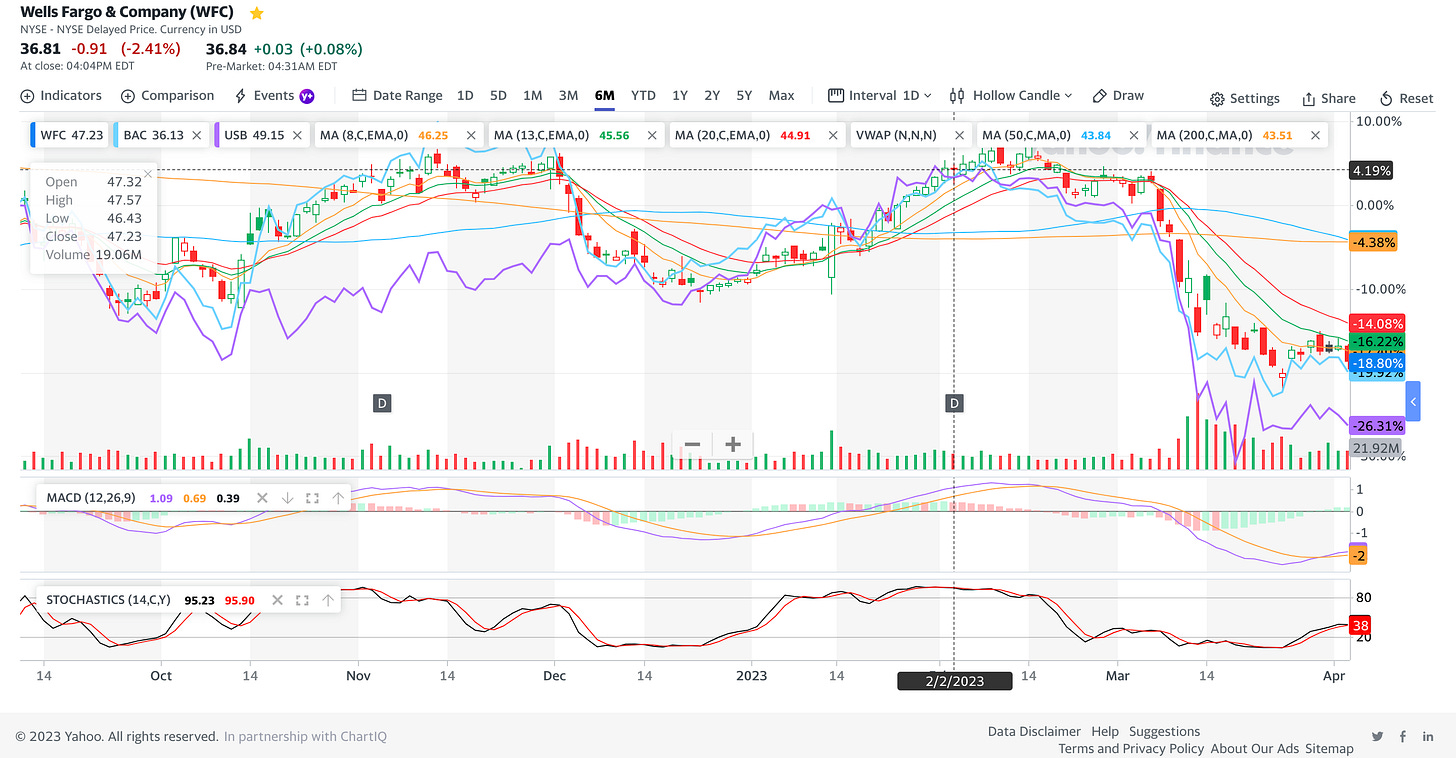

What is interesting is that he continues to hold 3 other bank stocks - WFC (Wells Fargo), BAC (Bank of America) and USB (US Bancorp) despite the recent banking saga.

Does this represent confidence in the banking system or it is confidence limited to these 3 banks in his portfolio? This can bring some relief to the market watchers as Mr Munger did not sell off the bank stocks. It is interesting that Mr Munger did not take advantage of the drop in banking stock prices to add to his position.

My investing muse

It is important that we continue to do our own due diligence and not invest or trade based on borrowed convictions. So long we monitor the performance and the fundamentals of the stocks, we would be in a stronger position to take advantage of the developments. For value investors, we shortlist stocks after we qualify them and take our positions when the prices hit our “fair” valuation. In the case of the banking stocks, it could be that they have not reached “fair valuation”.

As per the 1D chart above, I have added BAC & USB to the 1D chart of WFC. We note the steep drop in the price of all 3 banks following the SVB & SBNY crisis. Their prices are ranging sideways.

Personally, the banking sector may have more underlying issues. Thus, it can be a safer call to have the assurance of an adequate resolution first before investing. Let us do our research before investing.

Comments

Post a Comment