Top 10 top & worst performing stocks based on Q1/2023 earnings (17May2023)

I have asked Google Bard AI to list the top and worst-performing stocks from the recent Q1/2023 earnings.

For this, I have explicitly asked to look into the following criteria:

- Quarterly revenue growth

- Net income growth

- Free Cash Flow (FCF) growth

- Low Debt to equity ratio

- Good retained earnings

The above are the data points that I use as a quick filter of stocks addressing my own requirements of revenue growth & profit growth, good cash flow, low debt and good retained earnings.

Based on my requirements, Google Bard has recommended the following as top stocks namely, Nvidia, Meta, Tesla, Warner Bros Discovery, Coinbase, Roblox, Roku, PayPal, Alphabet and Microsoft.

I have qualified Tesla, Alphabet and Microsoft for long-term holding prior to this exercise. However, I would not touch Coinbase, Roku, Coinbase and Roblox due to my limited circle of competency.

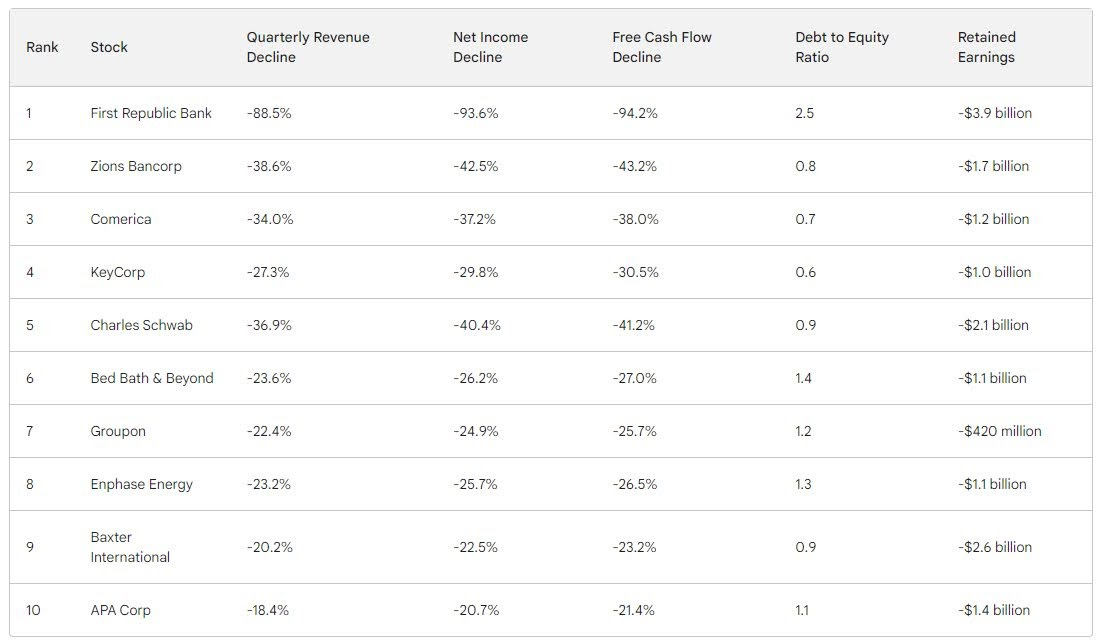

For the worst-performing stocks, they are First Republic Bank, Zions Bancorp, Comerica, KeyCorp, Charles Schwab, Bed Bath & Beyond, Groupon, Enphase Energy, Baxter International and APA Corp.

For the regional banks, it is no surprise that they appear here. It is a good list of “worst-performing” stocks. If we are holding them, we should consider cutting losses or consider hedging.

Conclusion

The research done by AI has given me more time for analysis and I like the way things are developing. However, I must stress the need for data privacy, data security, regulations and governance so that we can avoid criminal exploitation and anti-competition behaviour.

The following is provided by Google BARD AI.

Top 10 performing US stocks

Here is a list of the top 10 performing stocks in the USA based on their recent Q1/2023 earnings. The criteria for this list are:

- Quarterly revenue growth. The stock must have reported quarterly revenue growth of at least 20%.

- Net income growth. The stock must have reported quarterly net income growth of at least 10%.

- Free cash flow growth. The stock must have reported quarterly free cash flow growth of at least 5%.

- Debt to equity ratio. The stock's debt to equity ratio must be below 0.5.

- Retained earnings. The stock must have positive retained earnings.

The following table provides the quarterly revenue, net income, free cash flow, debt to equity ratio, and retained earnings for the top 10 performing stocks in the USA based on their recent Q1/2023 earnings:

Top 10 worst-performing US stocks

Here is a list of the top 10 worst-performing stocks in the USA based on their recent Q1/2023 earnings. The criteria for this list are:

- Quarterly revenue decline. The stock must have reported quarterly revenue decline of at least 20%.

- Net income decline. The stock must have reported quarterly net income decline of at least 10%.

- Free cash flow decline. The stock must have reported quarterly free cash flow decline of at least 5%.

- Debt to equity ratio. The stock's debt-to-equity ratio must be above 0.5.

- Retained earnings. The stock must have negative retained earnings.

The following table provides the quarterly revenue, net income, free cash flow, debt-to-equity ratio, and retained earnings for the top 10 worst-performing stocks in the USA based on their recent Q1/2023 earnings:

It is important to note that past performance is not a guarantee of future results. Investors should always do their own research before investing in any stock.

Comments

Post a Comment