The rise of BRICS (26Apr2023)

With the recent Ukraine conflict, the world has seen changes in relationships shaped by political and economic restrictions. With sanctions applied on Russia, the economic partnership between Europe and Russia has been replaced by other players, notably China.

In the article below, China RMB is already the most popular currency in Russia.

An extract from the article:

The Chinese yuan has surpassed the US dollar as the most traded currency in Russia, largely because of sanctions imposed on Moscow after it invaded Ukraine 14 months ago.

Russian companies and the government have been forced to undertake foreign trade transactions in currencies of allies such as China and India, which have declined to support sanctions imposed by Washington, the European Union and other nations because of the strong reaction to the first conflict in Europe since World War II.

The behaviour & actions of the US has caused itself to be distant from several countries. The US has gotten into trouble with news of spying on both enemies and allies.

With de-dollarisation, USD (as a global currency) has dropped from 73% of global use to a recent 55%. Recently, there is the news of a new non-US-led alliance. There is the recent news of 19 countries asking to join BRICS.

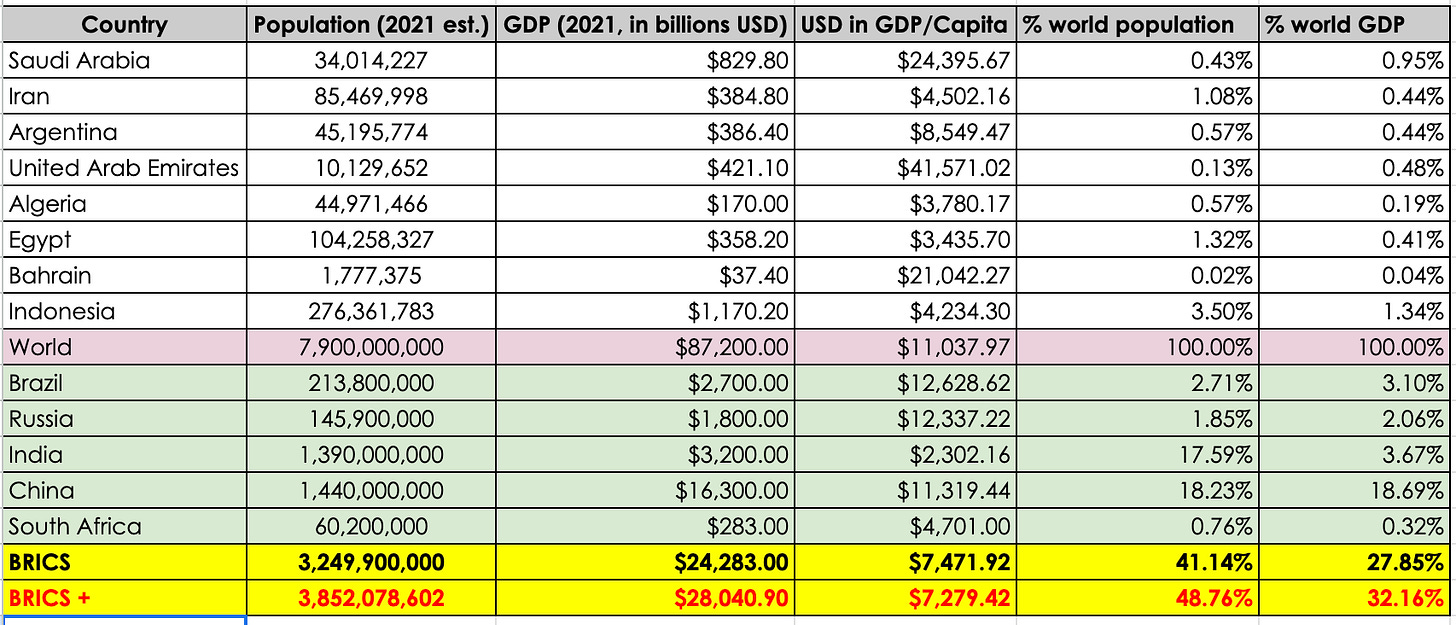

Saudi Arabia & Iran are among the countries who asked to join BRICS with Argentina, the United Arab Emirates, Algeria, Egypt, Bahrain & Indonesia, along with two nations from East Africa and one from West Africa.

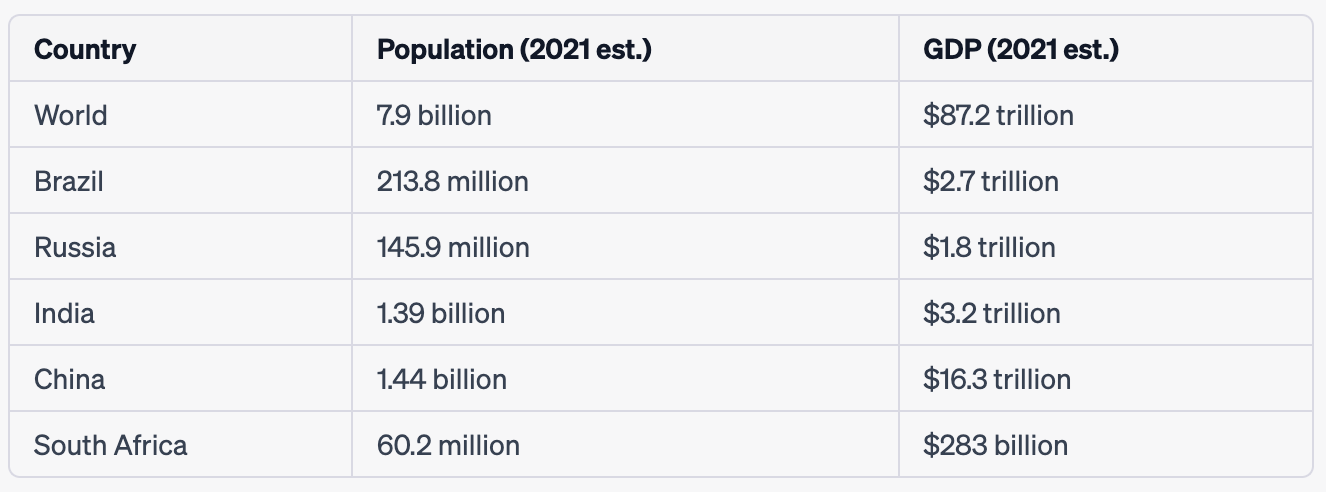

What is the current status of BRICS?

The table above shows the population and GDP of BRICS and the whole world.

With the list of known countries wanting to join BRICS, this alliance would end up being a sizeable market.

For ease, let us call the new alliance of BRICS and the new additional countries BRICS+.

Despite the 3 unknown countries wanting to join BRICS, BRICS+ would end up a near 48.76% of the world population and 32.16% of the world GDP based on 2021-2022 data.

This would account for almost half of the world’s population and about one-third of global GDP. The average GDP per capita for the world is about USD$11,037. It is USD$7,471 and $7,279 for BRICS and BRICS+ respectively.

There are talks about trading in non-USD currencies and setting up trade/economic partnerships. It will be interesting how things unfold. With half of the world in BRICS+, it will be a region that we need to look out for. The US & its allies will not collapse overnight and the USD will not lose the world’s reserve currency suddenly. However, we cannot deny the erosion of the US’s global position. From proxy wars, and sanctions to claims of spying, the US has found itself fighting on several fronts, including domestic.

It is time for us to consider researching BRICS+ and see how we can better hedge our portfolios.

Comments

Post a Comment