The latest Federal deficit report (July 2023)

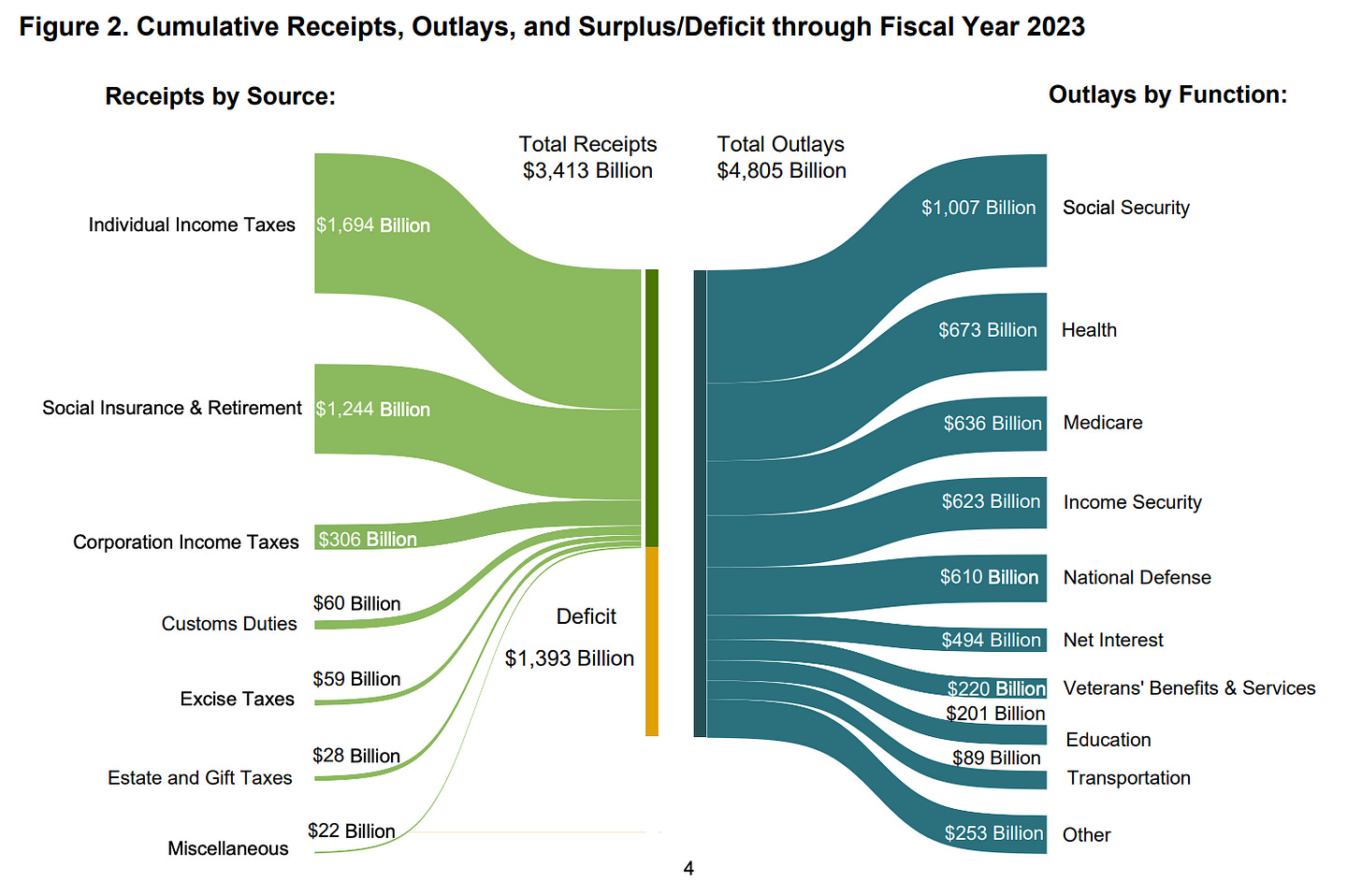

From the latest treasury report, the total receipts stand at $3,413 billion and the total outlay stands at $4,805 billion.

This meant that there is a fiscal deficit of $1,393 billion as of the end of June 2023. For Fiscal Year 2023, it starts from Oct 2022.

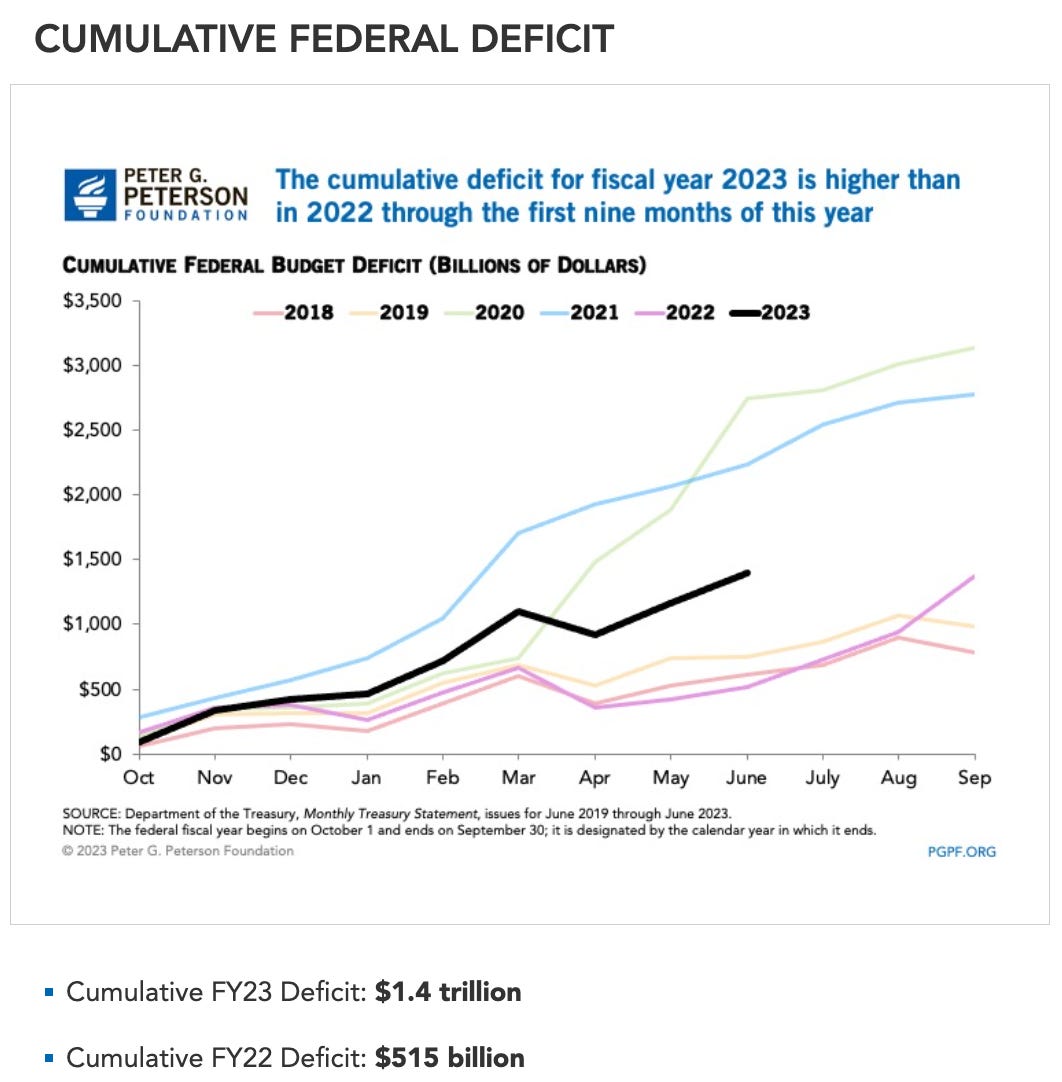

Now, let us look at the deficit.

FY23 has hit a cumulative deficit of $1.4 trillion as of June.

From PGPF:

The federal government ran a deficit of $228 billion in June 2023, a $139 billion increase from the deficit of $89 billion that was recorded in June 2022. However, because July 1, 2023, fell on a weekend, certain payments that would have occurred then were shifted into June. Excluding the effect of that shift, the deficit would have been $139 billion in June 2023, and the year-over-year difference would have been a $53 billion increase.

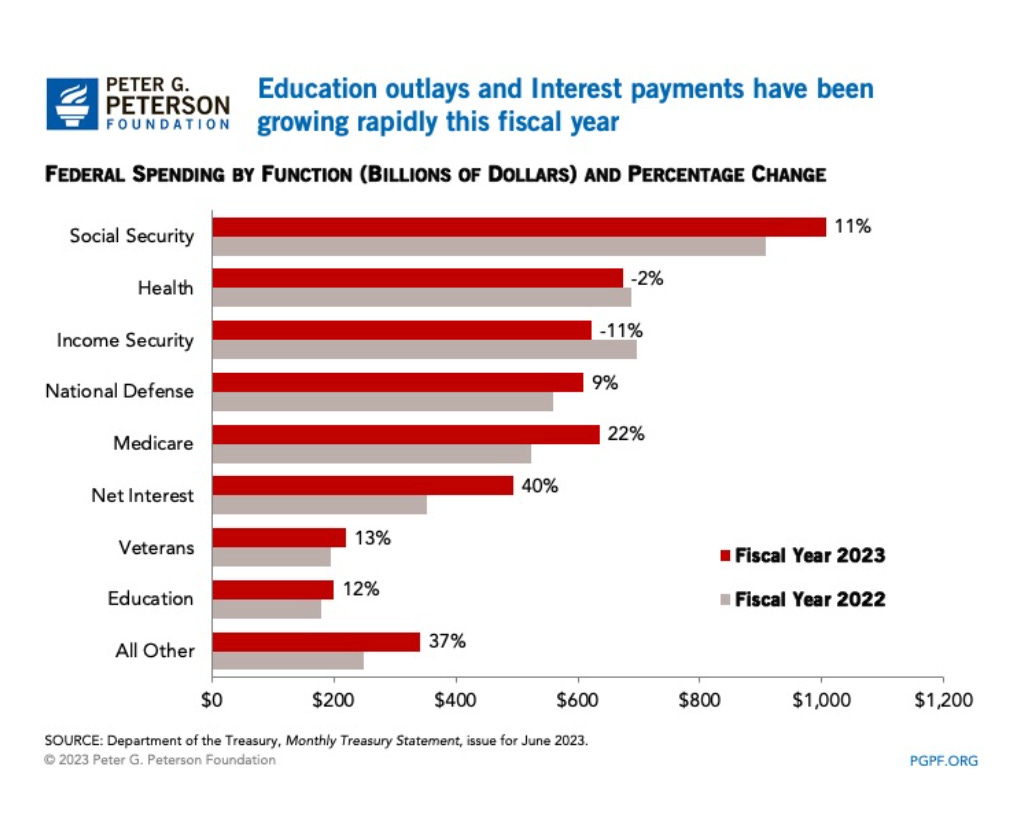

For the first eight months of FY23, total outlays were $4.8 trillion, $455 billion higher than the same period in the previous year (not adjusting for timing shifts). The largest categories of growth in outlays were interest payments ($141 billion larger in 2023), Medicare ($113 billion), higher spending for Social Security ($98 billion), and a reduction in receipts from the auction of licenses to use the electromagnetic spectrum (which are recorded as offsets to spending and are down by $81 billion).

Observations:

There is a drop in spending (comparing FY2023 with FY2022) for health and income security.

The rest of the categories have seen an increase in spending in the range of 9% to 40%.

The top 3 items with the most increase (in percentage) are:

Medicare at 22%

All Otherat 37%

Net interest at 40%

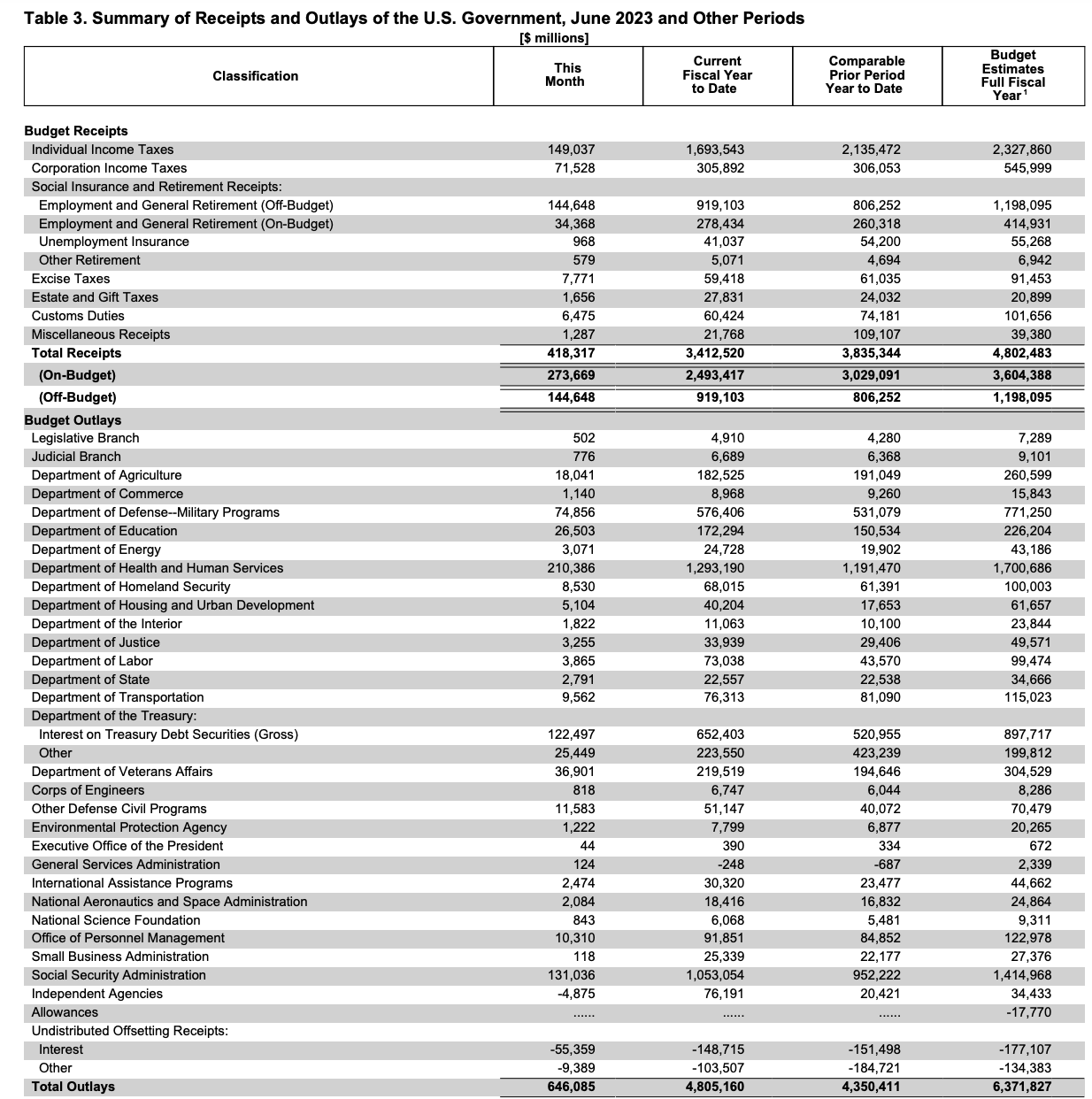

From the Table above, we have the following observations:

Total receipt till June 2023 stands at $3,412 billion, compared to $3,835 billion for the same period ending June 2022.

Total expected receipts for the full fiscal year (ending Sep 2023) is $4,802 billion.

Total outlay till June 2023 stands at $4,805 billion, compared to $4,350 billion for the same period ending June 2022.

Total expected outlay for the full fiscal year (ending Sep 2023) is $6,371 billion.

This implies that the expected deficit for the full fiscal year would be about $1,569 billion.

Interest on Treasury Debt Securities (Gross) is $122 billion (for the month of June 2023). FY23 YTD is $652 billion compared to $520,955 for the same period for FY22. The estimated amount for the full fiscal year (ending Sep 2023) is $897.717 billion.

This suggests that there will be another $245 billion to be paid out for “Interest on Treasury Debt Securities” by September 2023. This implies that there will be more interest to be paid out as the deficit remains.

The total “Interest on Treasury Debt Securities” for the full FY23 (at $897 billion) will be bigger than the total amount spent by “Department of Defense--Military Programs” at $771 billion. This will be the second biggest item in outlay.

So long as there is a deficit, the amount paid for interest on treasury debt securities will continue to rise. With some of the expiring treasury debt securities re-financed at the current high-interest rate environment, the burden on interest would be compounded.

Conclusion

The US government needs to seek ways to spend within its means. They need to look into improving their revenue and reducing their outlays.

In the recent AP news article dated 12 June 2023, it was cited that:

An Associated Press analysis found that fraudsters potentially stole more than $280 billion in COVID-19 relief funding; another $123 billion was wasted or misspent. Combined, the loss represents 10% of the $4.2 trillion the U.S. government has so far disbursed in COVID relief aid. That number is certain to grow as investigators dig deeper into thousands of potential schemes.

Billions of aid were lost to frauds, waster or misspent. The combined estimate is about $403 billion from the $4.2 trillion Covid relief aid.

With more deficits expected, the US would see itself in a cycle of debt. $897 billion were spent paying interest on treasury debts. These could have been spent on the citizens, improving infrastructure, education, healthcare and more. Is it not worrisome that the US has to raise new debts to pay off the interest on the existing ones?

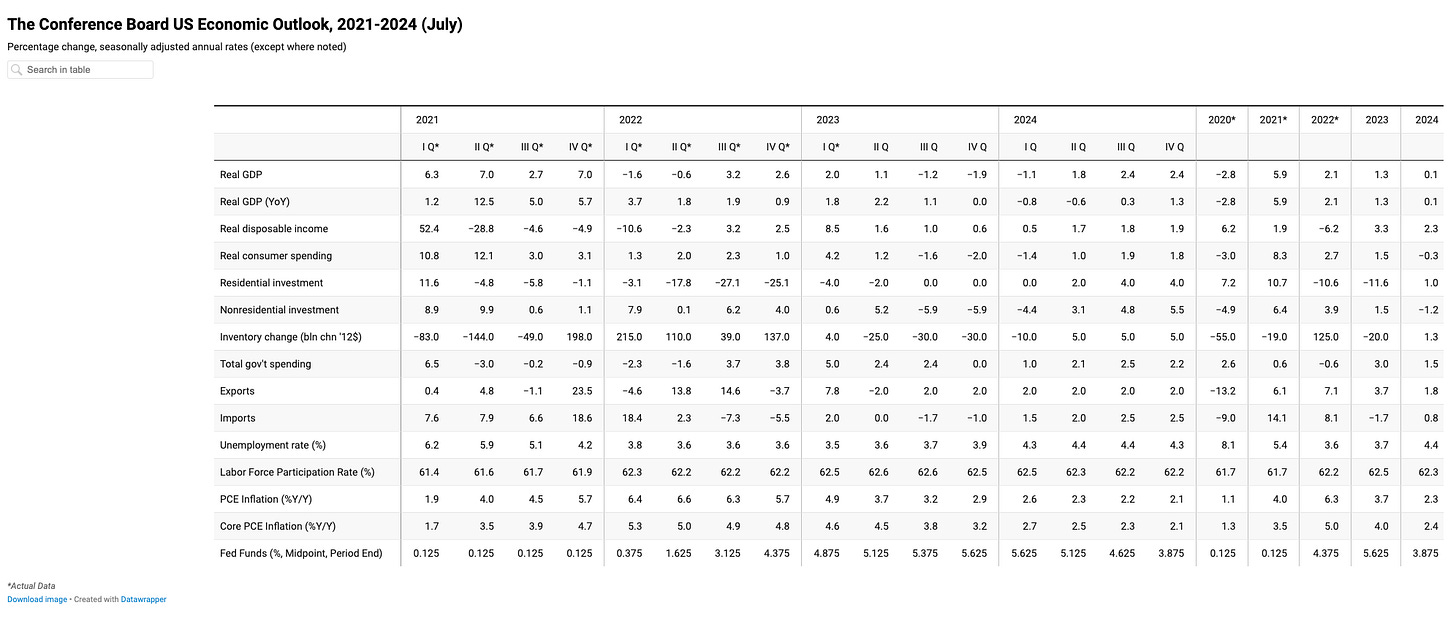

From the latest CBO report on US GDP forecast on 14 July 2023:

Several factors have impacted our forecast this month, including the more gradual role out of student loan repayment, an additional 25 basis point rate hike in Q3 2024 forecast, and stronger-than-expected business investment in recent months. We now forecast that US GDP will expand by 1.1 percent (vs. 0.6 percent) in Q2 2023. However, the headwinds to future growth persist. We now project that the US economy will grow by -1.2 percent in Q3 2023, -1.9 in Q4 2023, and -1.1 in Q1 2024.

Looking to 2024, we expect the volatility that dominated the US economy over the pandemic period to diminish. In the second half of 2024 we forecast that overall growth will return to more stable pre-pandemic rates, inflation will drift closer to 2 percent, and the Fed will bring rates back below 4 percent. However, due to an aging labor force we expect tightness in the labor market to remain an ongoing challenge for the foreseeable future.

With CBO expecting a technical recession in the coming months, the expected revenue may not be realized. It can be trying for the US to get more buyers to fund their deficit. This will leave the US with the option of money printing which has an inflationary impact.

Let us monitor closely as this fiscal mismanagement can have dire consequences on the economy as government spending accounts for about 38% of the US GDP as per Statista.

Comments

Post a Comment