The impact of US Store Closures in 2023 (08May2023)

Business Insider has provided an article listing store closures by some of the leading retail players in the USA.

Here is an extract from their news article dated 3rd May 2023:

More than a dozen major retailers have said they will close US stores in 2023, a combined total of over 2,100 locations.

Amazon, Bath & Body Works, Walmart, and Foot Locker are among the chains shutting down stores.

Bed Bath & Beyond is planning to close 896 locations — the most of any retailer on the list.

Some of the ones listed with store closures:

- Bed Bath & Beyond: 896 stores

- Foot Locker: 545 stores

- Tuesday Morning: 487 stores

- Bath & Body Works: 50 stores

- Gap and Banana Republic: 46 stores

- Walmart: 22 locations

- Party City: 31 stores

- Best Buy: 20 stores

- Amazon: at least 8 stores

- Big Lots: 7 stores

- The RealReal: 6 stores

- Macy's: 4 stores

- Target: 4 stores

- JCPenney: 2 stores

While some are trying to pivot into e-commerce & with a lesser reliance on retail outlets, most have cited worsening economic conditions as one of the reasons.

What could be the consequences following the store closures?

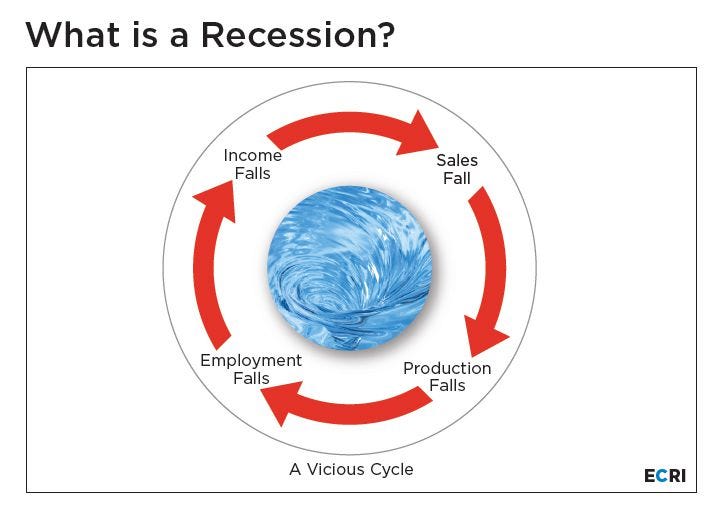

As per the diagram above from Investopedia, we can expect the following with these store closures:

- Employment Falls

- Income Falls

- Sales Falls

- Production Falls

- and the cycle continues till a bottom is reached for the recession

Should this cycle continues, we should see the economy entering a recession.

Apart from the above, we can also expect this to affect the following:

- Commercial Real Estate (CRE) - closures of these outlets mean loss of rental revenue. With these added to the existing CRE inventory, the price of CRE should drop further due to increasing supply.

- Banking & insurance - the business closures should cause a loss of revenue for banks & insurance that typically support these businesses.

- For some of the towns losing their leading grocery stores, the citizens may need to turn to e-commerce or drive further to other alternatives.

- Jobs loss - this implies that some of the local residents could lose their jobs. If there are other jobs available at similar remuneration & requirements, the locals could switch to them. But there is a chance of some of them may not find jobs quickly. Job losses would require affected ones to tighten their household spending and some could turn to credit lines for their essentials.

- Relocation - in search of jobs, better quality of life and other personal reasons.

- Macro - in the end, these should show up in various (macro) economic indicators like GDP, unemployment and inflation.

This is a good indicator coming to unemployment and this should help us to understand the economic functions better. Let us exercise caution and research before investing.

Comments

Post a Comment