Review of latest Microsoft Earnings (25Jul2023)

Microsoft has released its Q4/2023 earnings (for the quarter ending 30 June 2023).

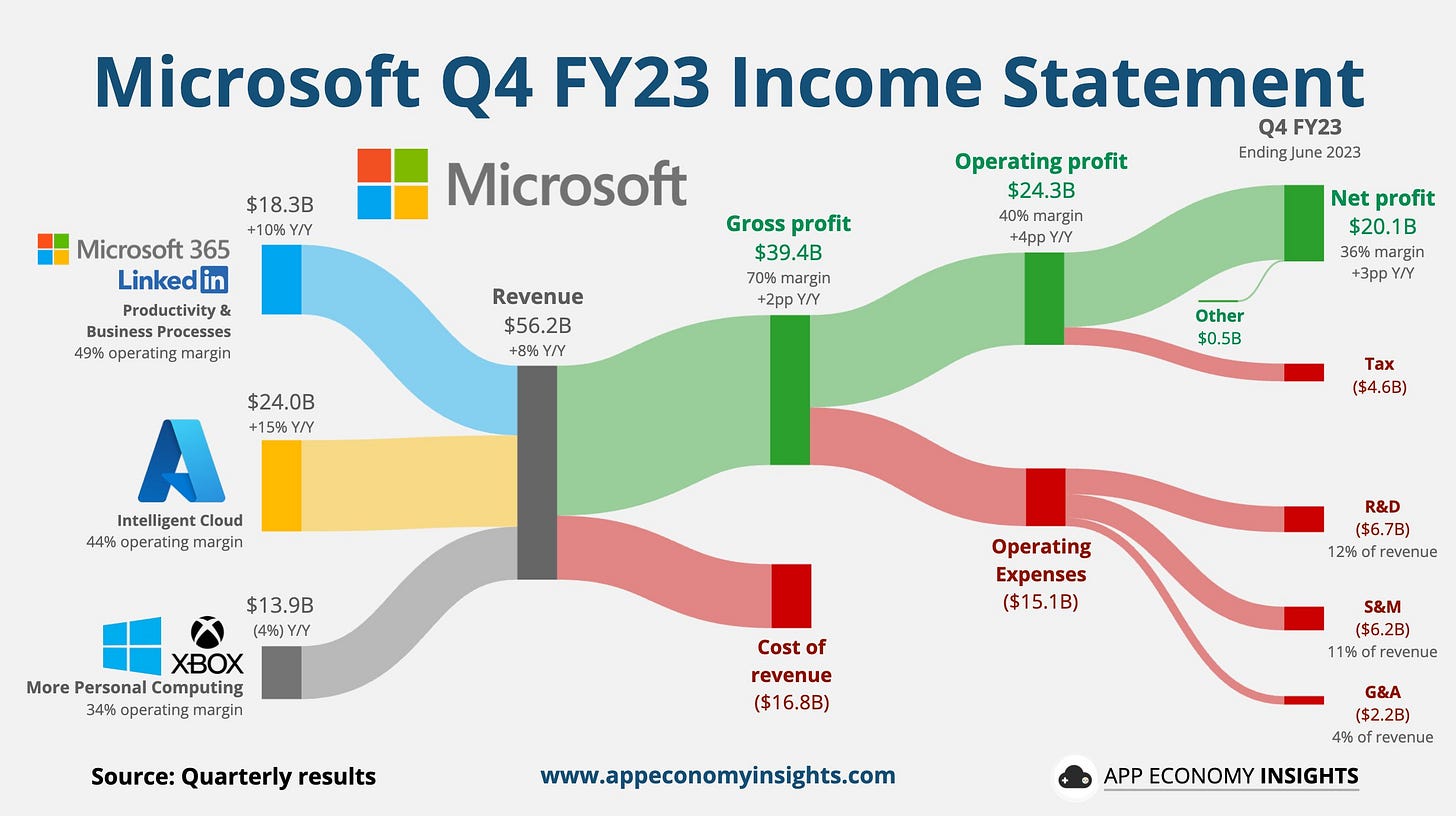

This is an excellent summary of its earnings by Twitter user EconomyApp:

Microsoft Q4 FY23 (ending in June):

Revenue +8% Y/Y to $56.2B ($0.7B beat)

Gross margin 70% (+2pp Y/Y)

Operating margin 43% (+4pp Y/Y)

EPS $2.69 ($0.14 beat)

Azure +26% Y/Y (+27% fx neutral).

Microsoft continues to do well with growing revenue. Its YoY net income of $72.3B is a stellar performance. Compared to a year ago, there is a slight dip in annual net income of 0.52%.

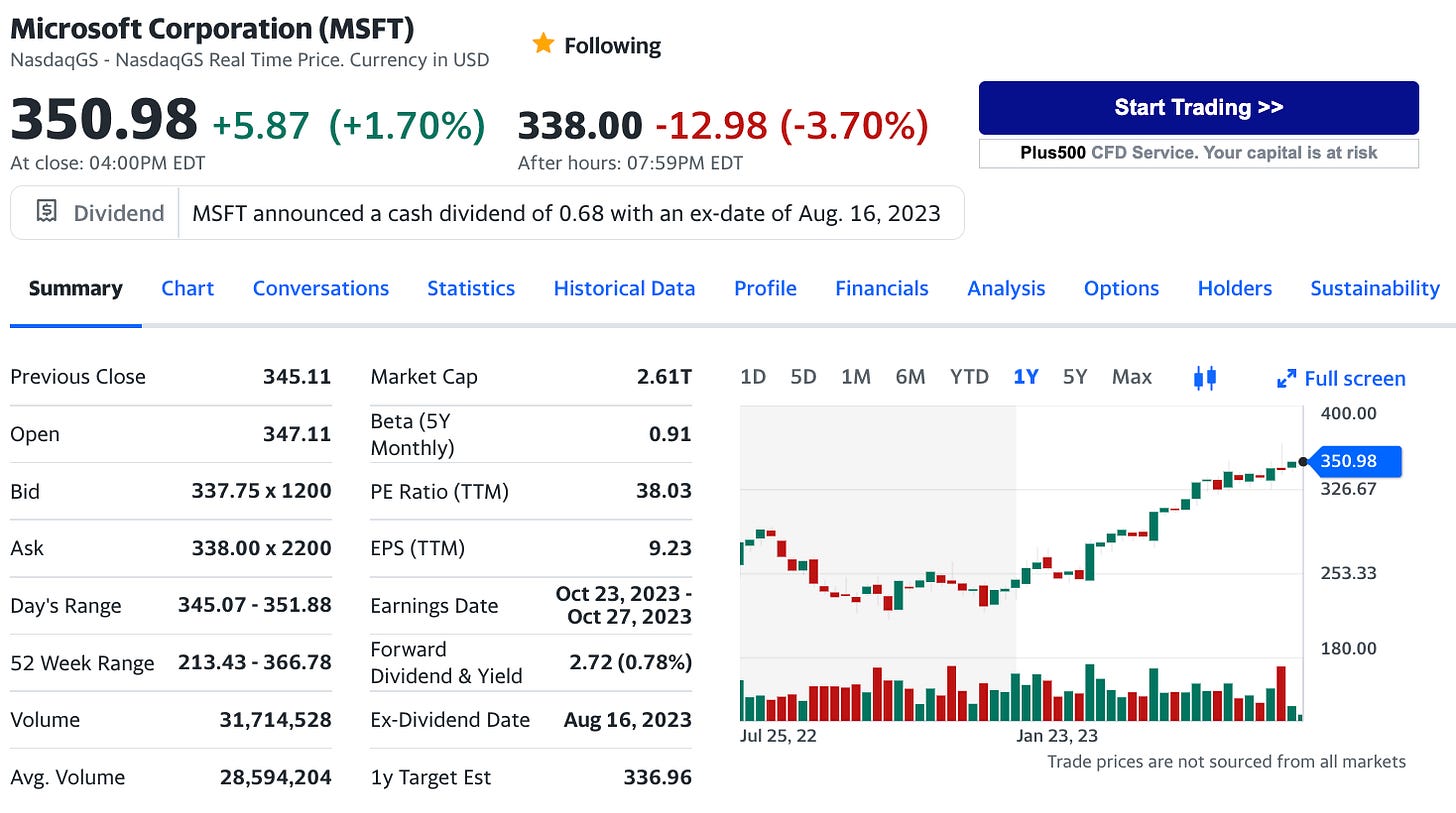

The concern of “profitability” has led to a 3.70% after-hours drop in Microsoft’s stock price.

Now, let us do a deep dive into the earnings:

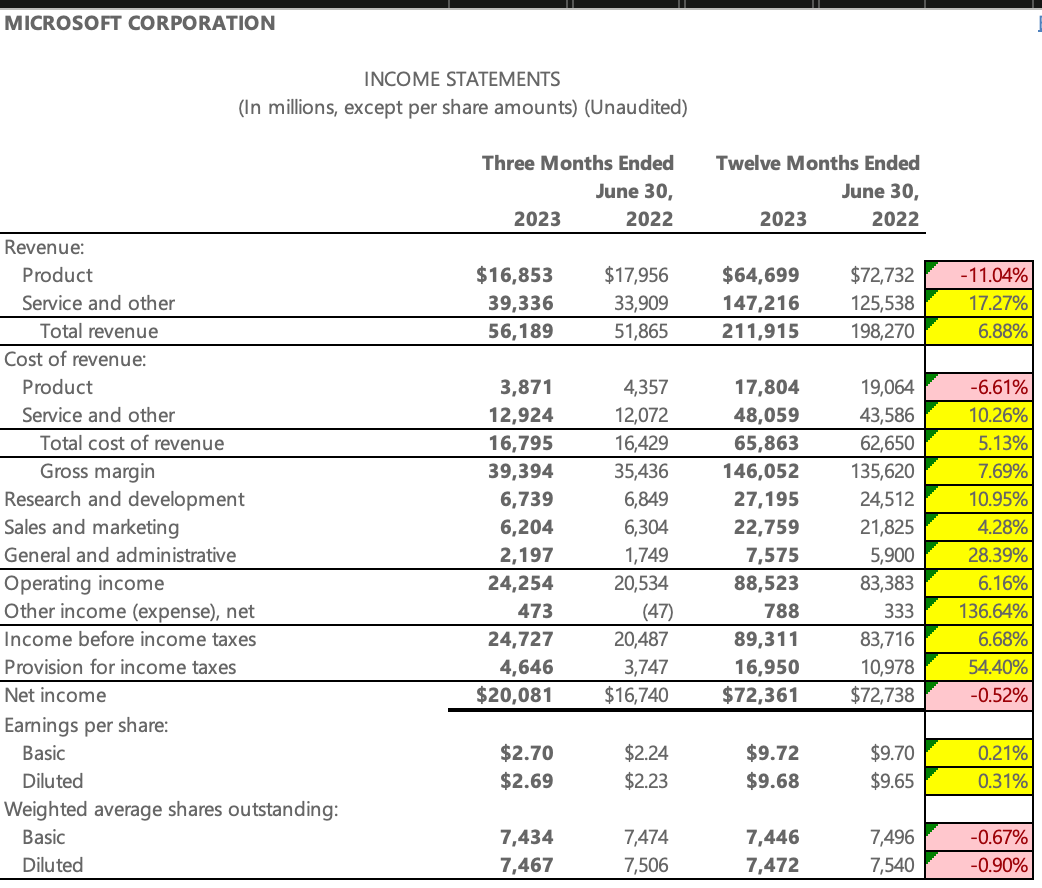

Income Statement

Observations (income statement) YoY:

Annual total revenue has gained 6.88%

The Annual total costs have gained 8.00%

Thus, the Net income has dropped by 0.52%

Note that the gain in expenses is more than the gain in revenue. Despite this, this is a solid net income of $72.3B for the year (2023, ending 30 Jun 2023).

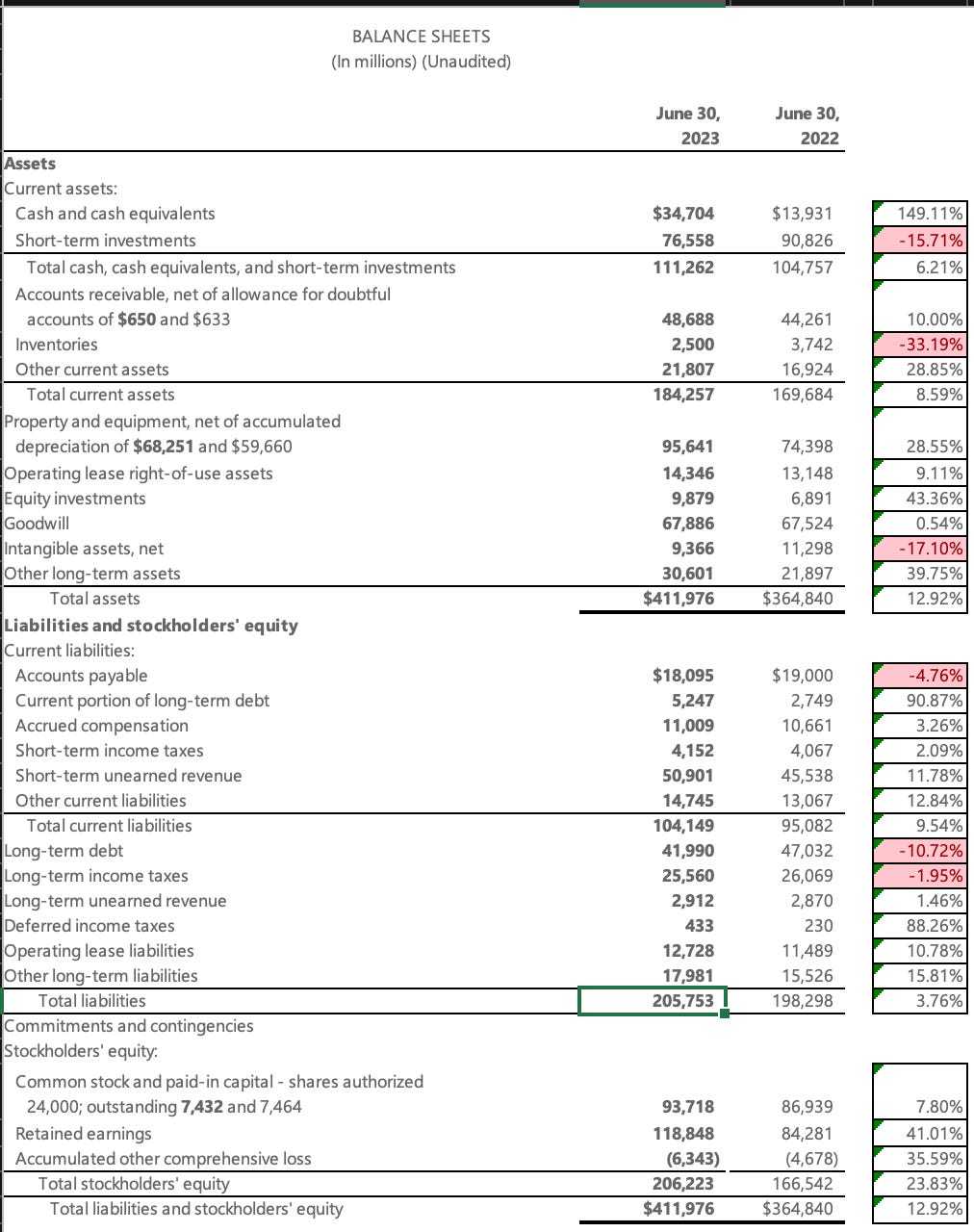

Balance Sheet

Observations (balance sheet) YoY:

Total assets gain by 12.92%

Total liabilities gain by 3.76%

It is good that there is more gain in assets compared to liabilities

Total shareholders’ equity gain by 23.83%

Retained earnings grew from $84.2B to $118.8B (a solid 41.01%).

It is good to see a drop in inventory ($3.7B to $2.5B), a drop of 33%.

Overall, it is a solid balance sheet.

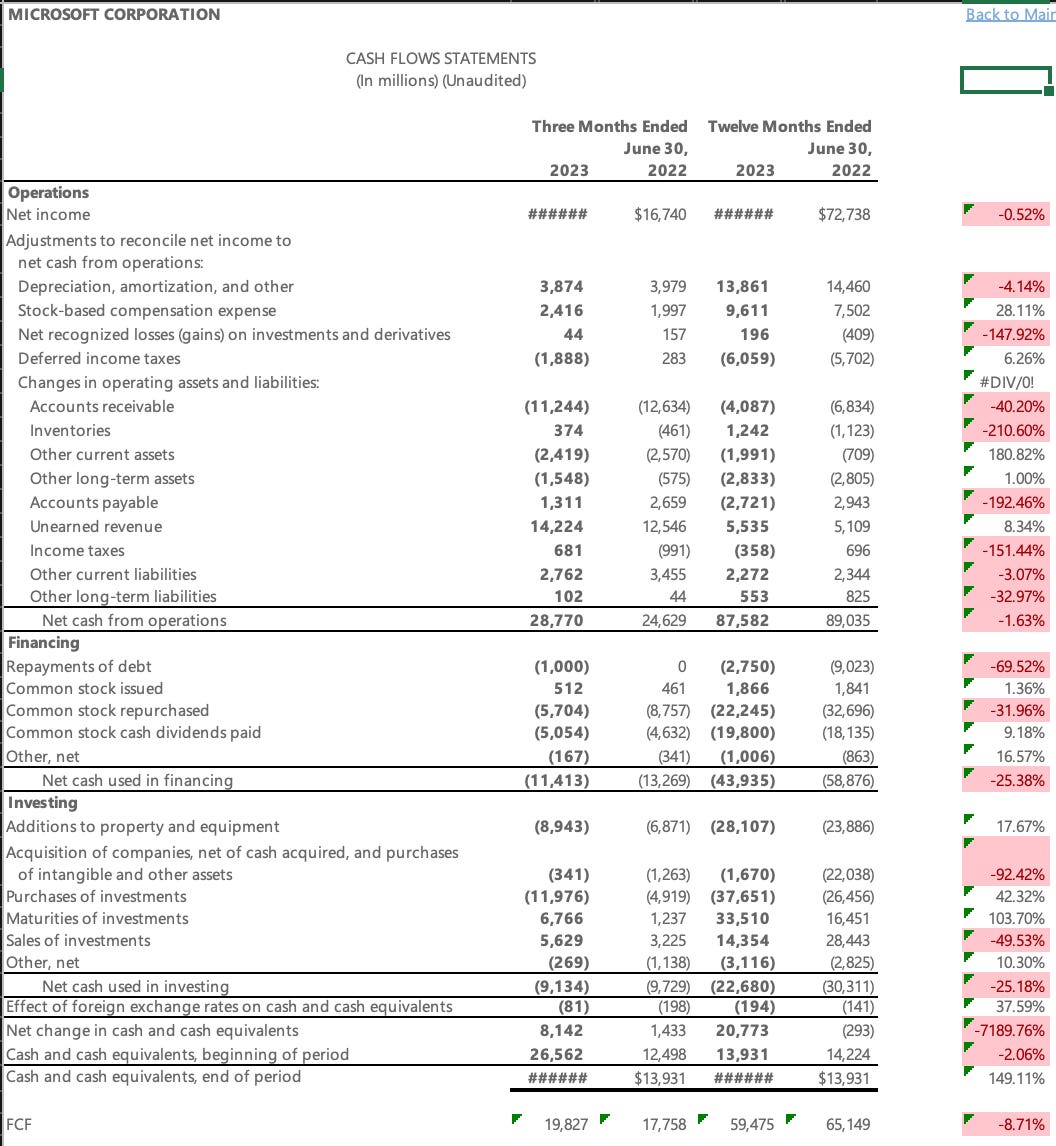

Cash flow statements

Observations (Cashflow statement) YoY:

Net cash from operations fell from $89B (2022) to $87.5B (2023), a drop of 1.63%

CAPEX increased from $23.8B (2022) to $28.1B (2023), an increase of 17.67%

FCF fell from $65.1B (2022) to $59.4B (2023)

It is good to see the repurchase of common shares and the repayment of debts.

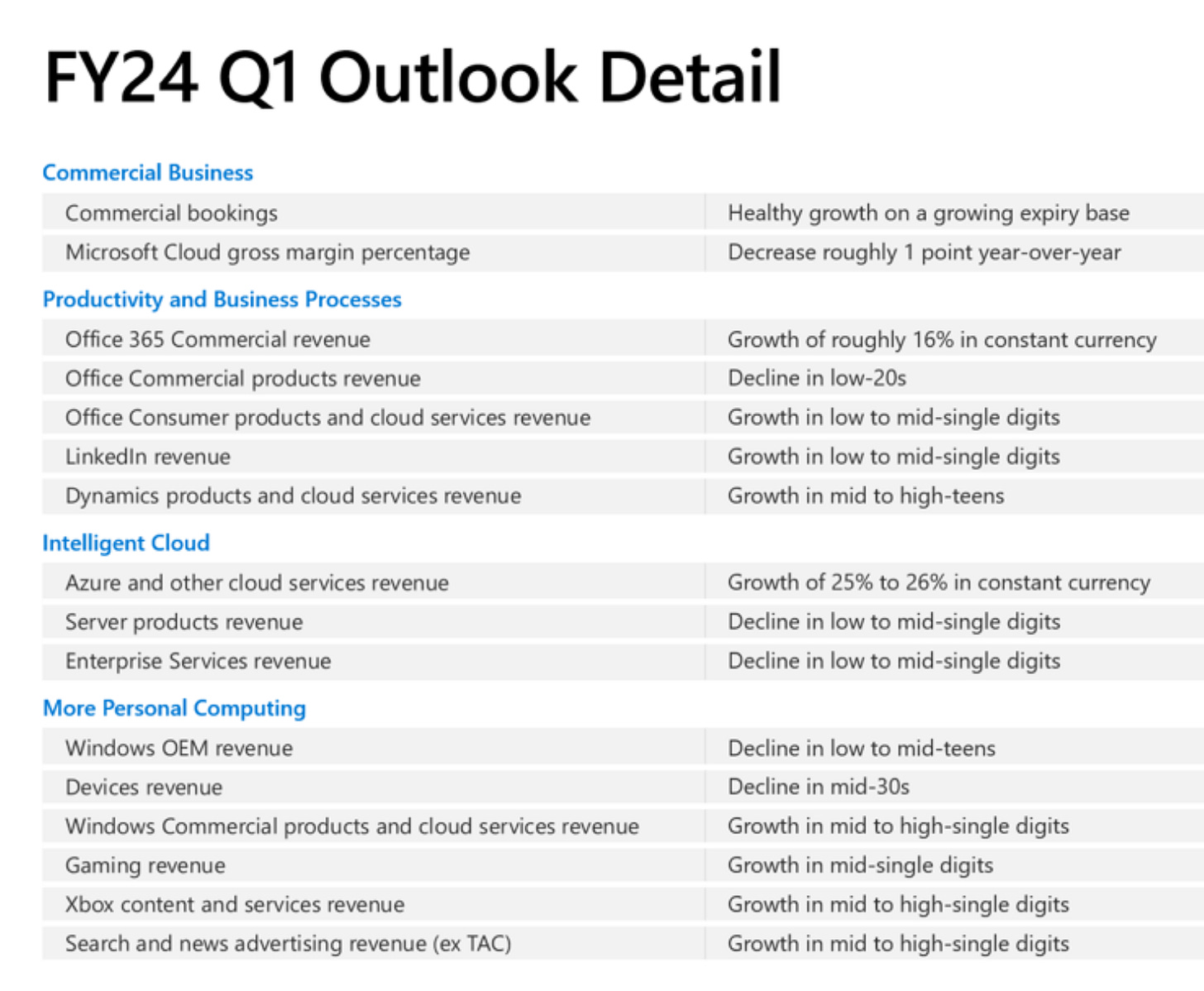

Outlook of Microsoft

The following are screenshots from Microsoft’s outlook pptx shared during the earnings call.

Observations:

For the few product categories of commercial business, productivity & business processes, Intelligent Cloud and More Personal Computing, both growth and decline are expected in their sub-categories.

This is a good overview we can reference as a benchmark for the future earnings.

The decline of “Office commercial products revenue” is “worrying” by 20%.

We can also expect some decline in the offerings of “server products revenue”, “enterprise services revenue”, “Windows OEM revenue” and “Devices revenue” (at a mid-30 %).

Thus, the hardware/product offering looks to be in the worst decline.

While most offerings are expected to grow, the ones with the best-expected growth are “Office 365 commercial revenue” (about 16%) and “Azure and other cloud services revenue" (about 25%-26%).

Conclusion

Overall, this is a solid earnings beat for Microsoft. There is solid profitability & balance sheet but we should note the decline in profitability and free cash flow (FCF). Given the outlook, it is possible that the company face some trying times ahead. This remains a stock with strong fundamentals, good profits and one to be added to our shortlist.

Let us do our due diligence before investing.

Comments

Post a Comment