Quick analysis of NIO ~ 13Jul2023

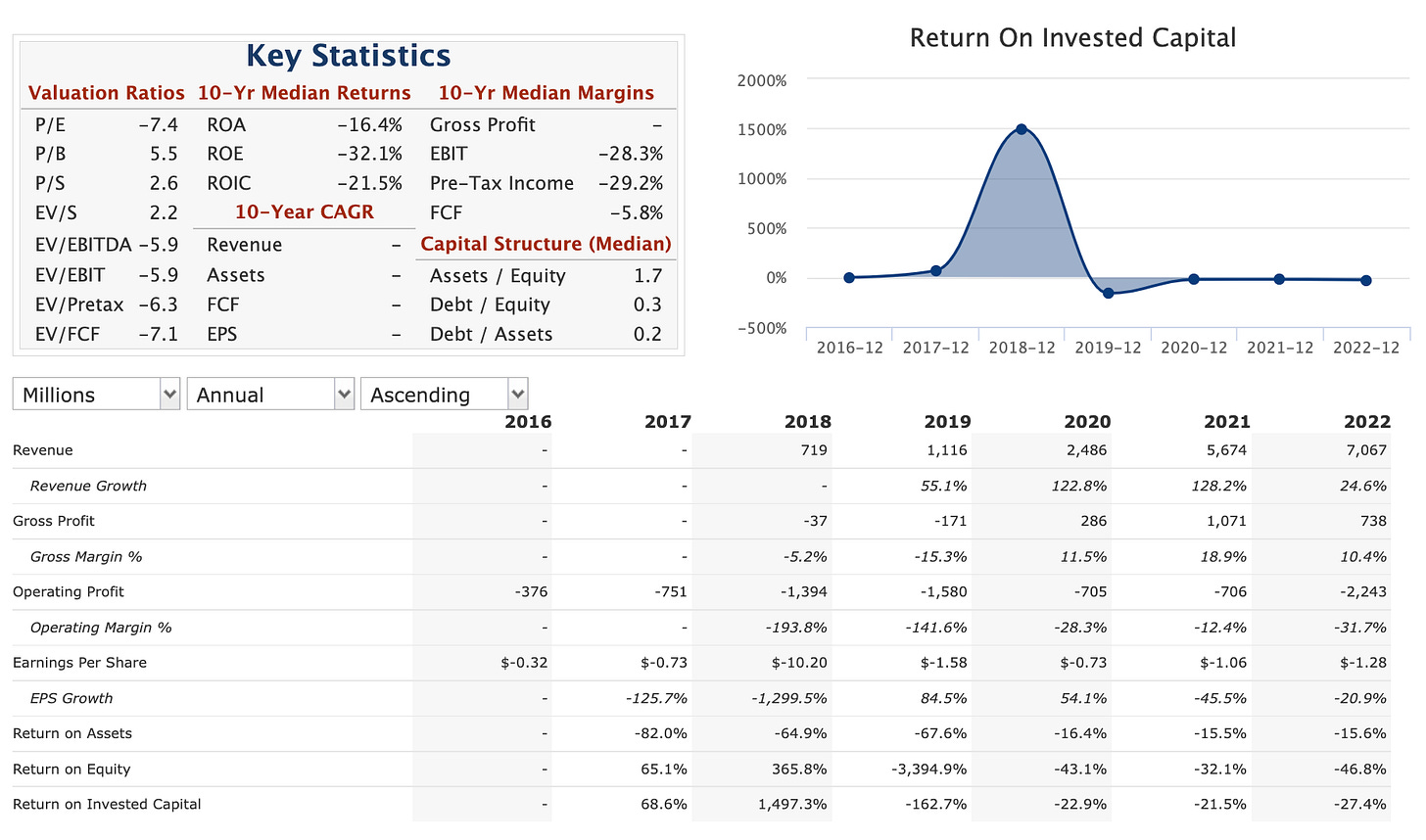

Below is a summary of the earnings of NIO compiled:

Observations:

There is constant growth in the annual revenue.

The gross margins are between -15.3% (loss) to 11.5%.

However, the company is not making money with EPS in negative since 2016.

For EPS, it would be encouraging to see the narrowing of losses over time. However, it is not so for NIO.

The latest return on assets, return on equity and return on invested capital are all negative (2022).

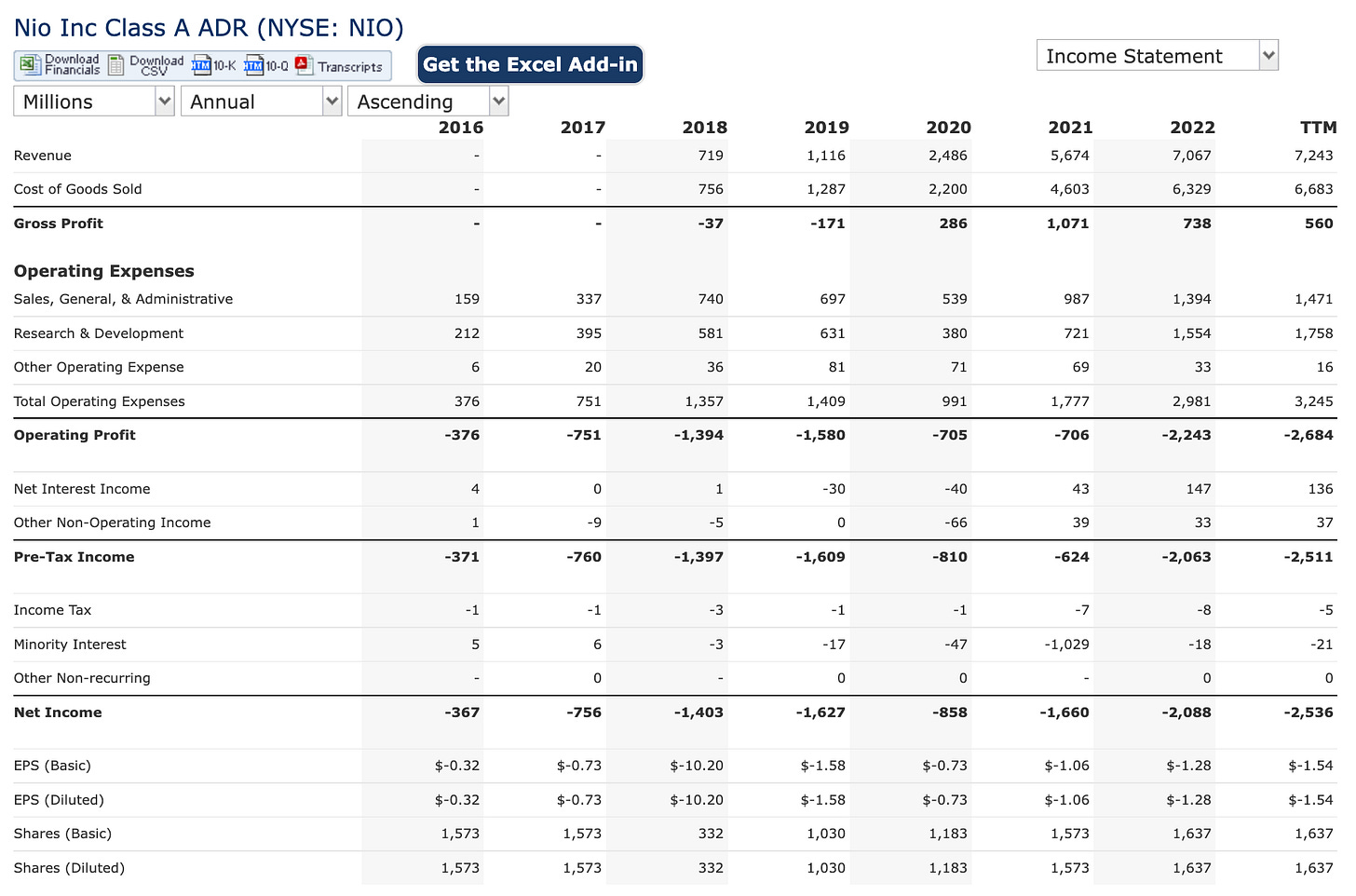

Income Statement

Observations:

Shares dilution in last few years

Growing revenue is good but the net income has never broken even since 2016 (despite the government grants).

With growing revenue, there is also a growing net loss. This is NOT trending in the right direction.

EPS is trending in the wrong direction - worsening since 2020.

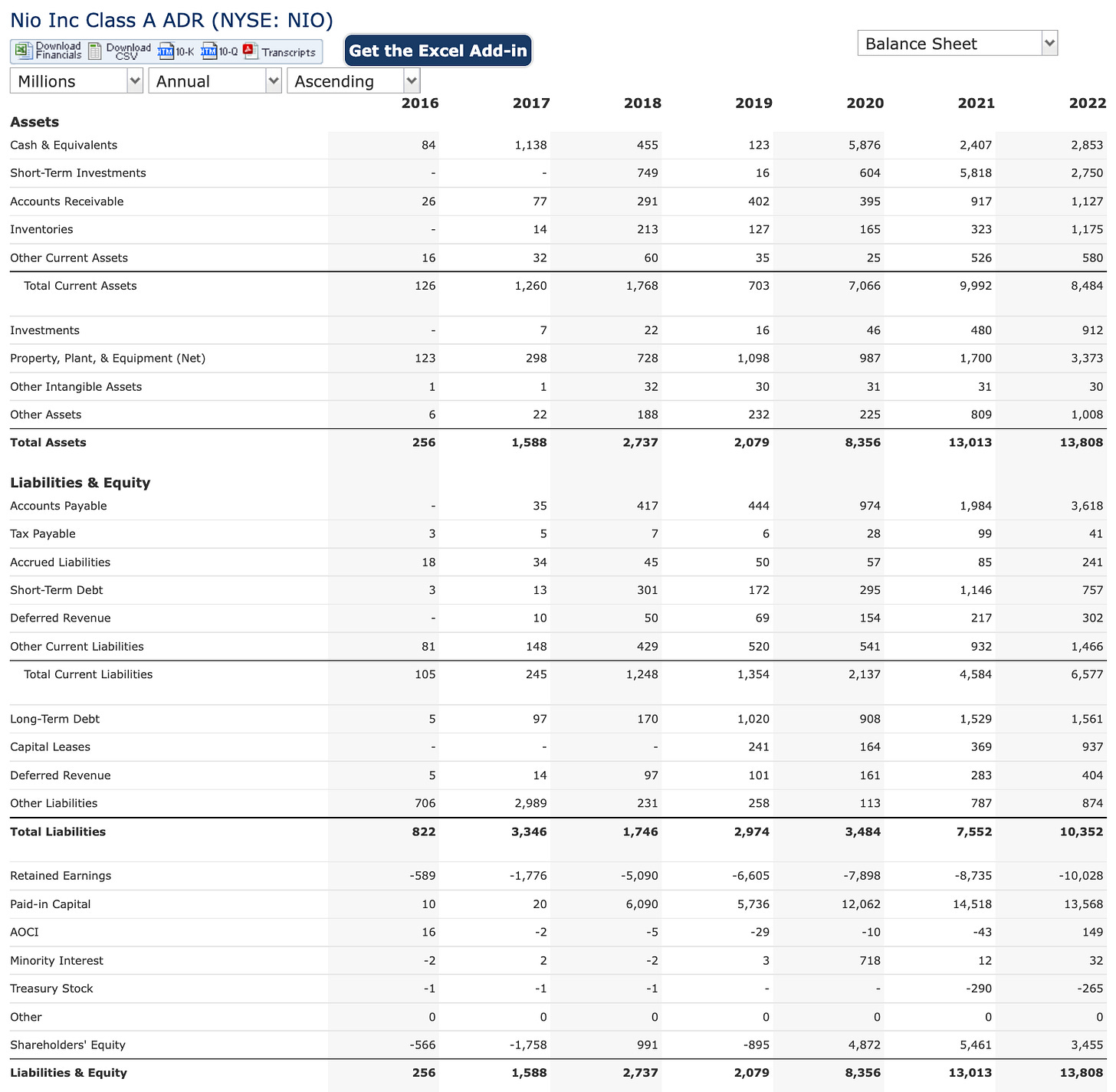

Balance Sheet

Observations of Balance Sheet:

Total assets are growing but total liabilities are also growing too.

There is a dip in shareholders’ equity from 2021 to 2022.

Retained earnings have hit a (loss of) USD$10B as of 2022.

Retained earnings (RE) are the amount of net income left over for the business after it has paid out dividends to its shareholders.

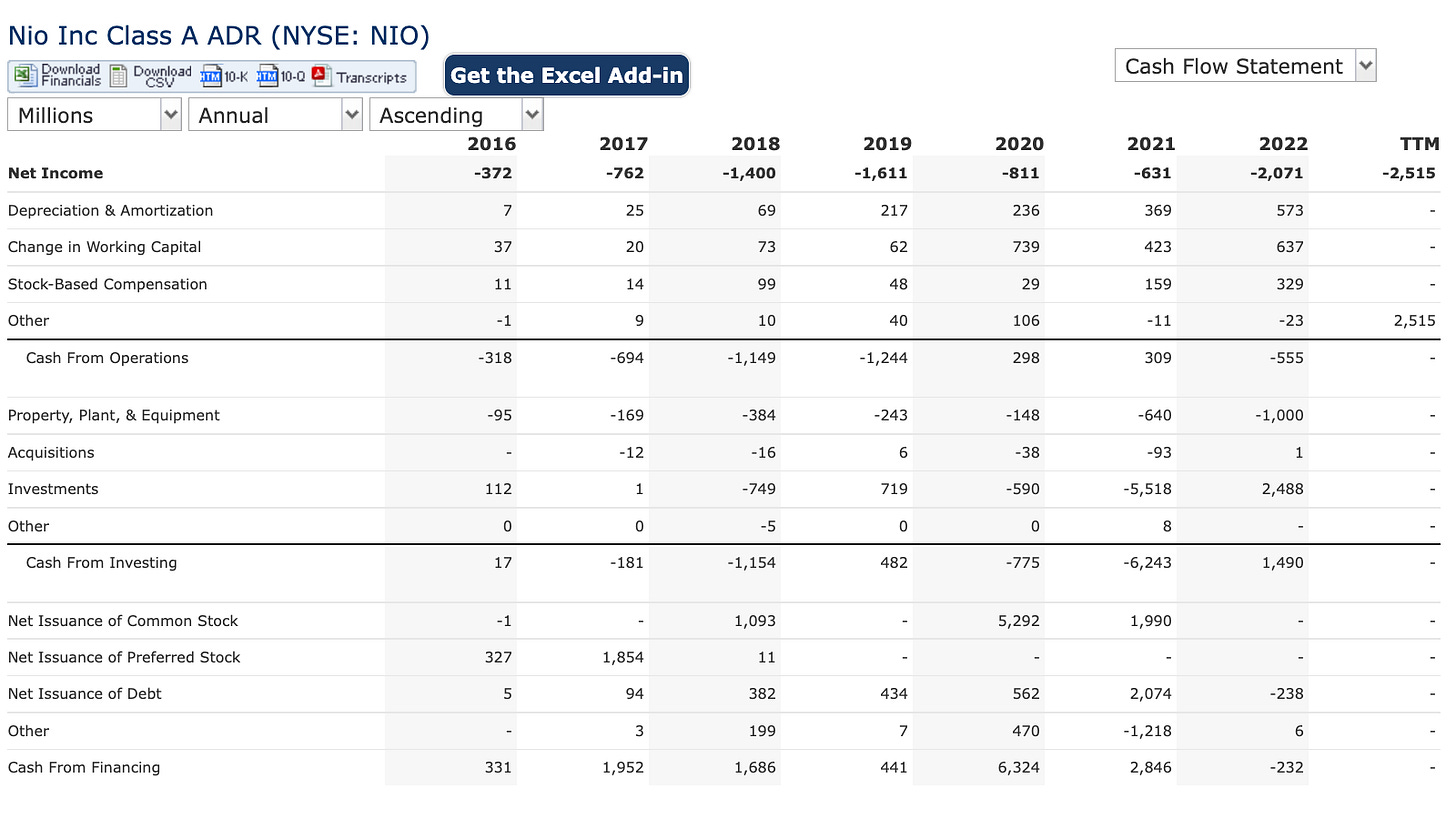

Cash flow statements

Observations from cash flow statements:

It is not acceptable if cash from operations is negative.

The only year when free cash flow (FCF) is positive is 2020. For all other years, the FCF are in negative territory.

From 2cFO:

Free cash flow is important to investors and business analysts because it shows how much cash your company has at its disposal. They often assess your free cash flow to determine whether your company has enough cash to repay debts, issue dividends and buy back shares.

Considerations:

NIO is an exciting EV maker. However, the continuous losses, lack of FCF and shares dilution are my red flags. Until the business can start making net profits, I prefer to be a spectator and not an investor.

Is there a chance that I miss a great run for the business? Yes, but I rather go in late with lesser profits. There are also other better options in the market.

Comments

Post a Comment