Q1/2023 Bank earnings started the earnings season with beat! (14 Apr 2023)

3 of the Big 4 banks (JP Morgan, Citibank & Wells Fargo) have released their earnings with BlackRock before the opening of 14 Apr 2023 market.

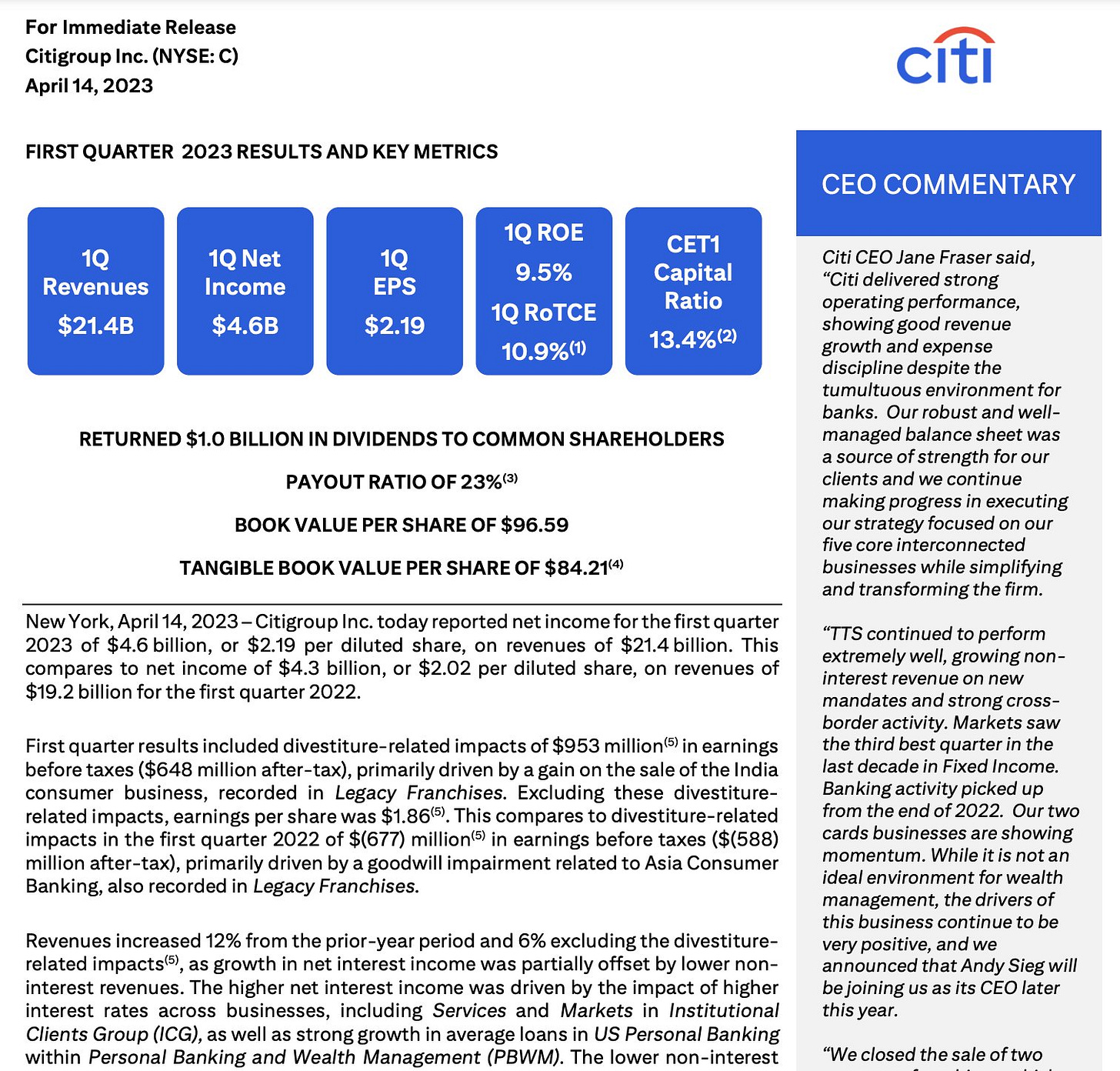

Citibank

Citibanks beats both revenue and EPS estimates.

EPS 2.19 versus estimate 1.7

Revenue 21.4B versus estimate 20.05B

JP Morgan

JPMORGAN 1Q ADJ. EARNINGS PER SHARE $4.10, EST. $3.41

JPMORGAN 1Q REV. $38.34B, EST. $36.19B

Wells Fargo & Co

Earnings per share: $1.23 per share GAAP versus 90 cents a year ago and $1.13 expected.

Revenue: $20.73 billion versus $20.08 billion expected.

The bank’s shares were up more than 3% in premarket trading after the earnings report.

Wells Fargo increased its net income by more than 30% to nearly $5 billion in the first quarter from a year ago. The bank's net interest income increased 45% on the back of soaring interest rates.

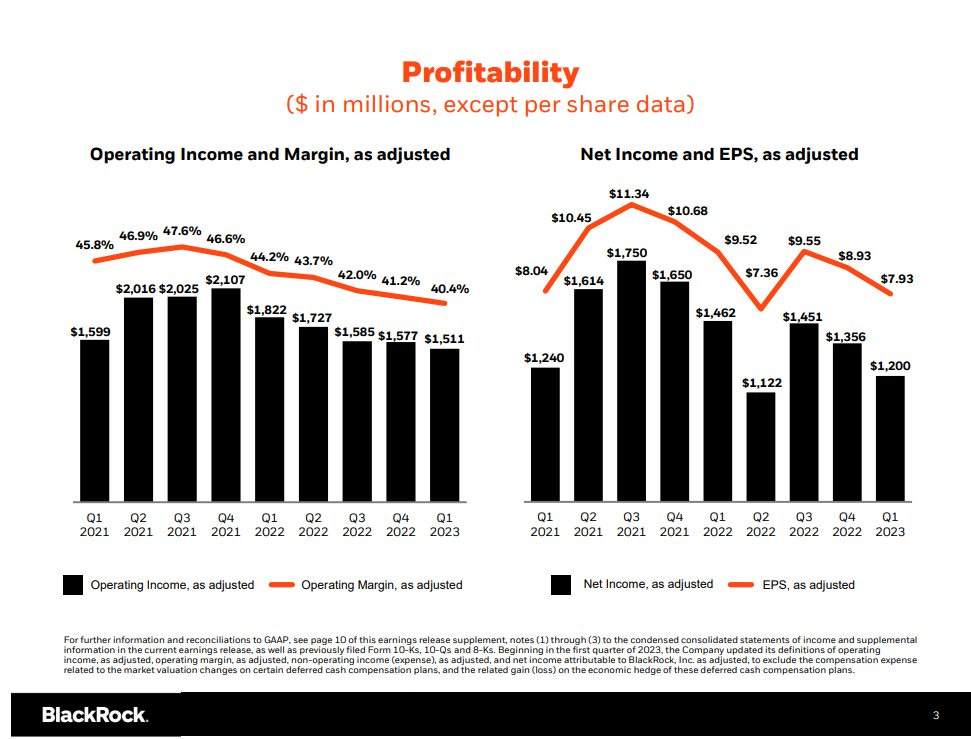

BlackRock

BlackRock 2023Q1 earnings are out:

• Revenue met estimate at $4.24B

• Adj EPS beat estimate at $7.93

• AUM exceeded estimate at $9.09T

• Net inflows missed estimate at $11.32B

• Net outflows were lower than estimate at $6.79B

From the above, only BlackRock has disappointed with their earnings compared to the banks.

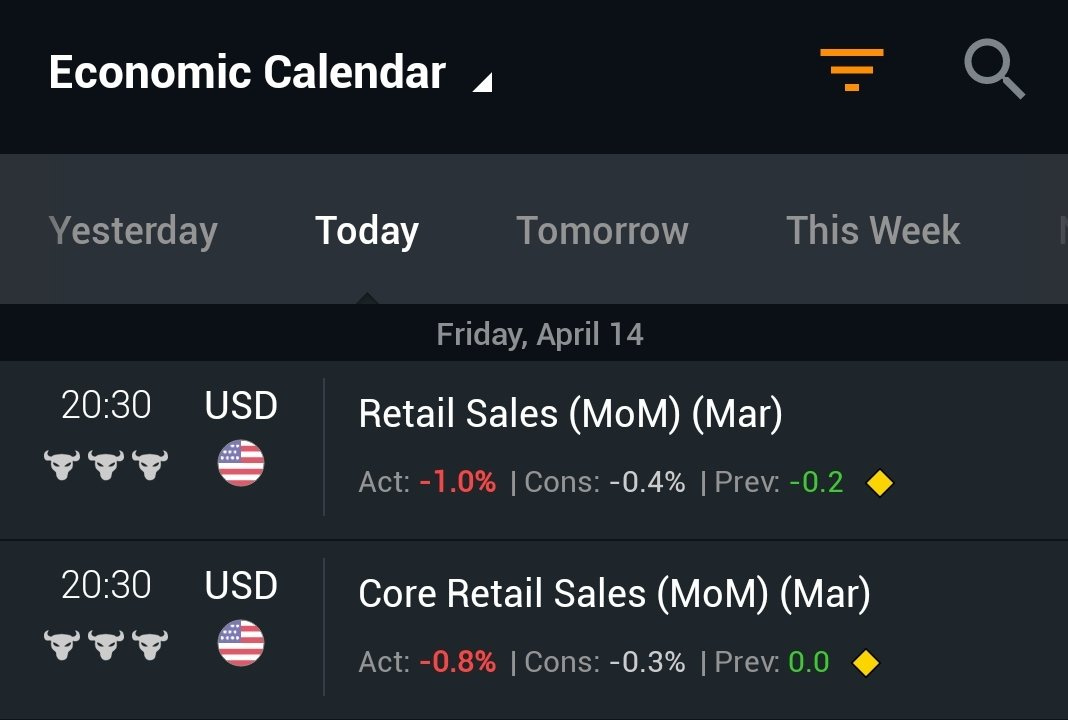

Other Economic Updates

Retail Sales (MoM) and Core Retail Sales (MoM) came out disappointing compared to the forecast. It looks like there is lesser consumption (demand erosion) in the US economy.

My investing muse

As per the earings, the big banks have benefitted from the recent bank run. This spells the demise of the smaller/regional banks eventually as the market would be left with the bigger banks. Now, these are known as the Big 4. The consideration would be if the big banks would end up “too big to fail” or “too big to save”.

Despite the good earnings of the big banks, it is unlikely to represent the rest of the sector. We have read reports of record deposits leaving the regional banks - some of these ended up in the Big 4 and some ended as cold hard cash in the hands of their owner. The contingency of the banks is yet over and we would know a better picture after we get updates of the rest of the earnings of these non-Big 4 banks.

The disappointing retail sales may dampen the market as this implies lesser consumption going forward. This season’s earnings would set the tone for the rest of the year as a “mild recession” could appear.

Let us continue to do our due diligence.

Comments

Post a Comment