Q1/2023 13F portfolio updates of some super investors ~ what did Buffett, Munger, Gates, Ackman & Burry sell & buy (16May2023)

In the world of investing, I believe that most of us have our own heroes or gurus. It would not be a surprise to start our investing journey with materials from some of our investing heroes. I started out as a reckless trader ~ making textbook mistakes.

“Fortunate does not always favour the brave and defeat awaits our folly.” - Benson Kong

It will not be surprising if we are starting learning with icons like Warren Buffett, Charlie Munger. For a season, I was following “cloning” ~ advocated by Mohnish Pabrai. I do not think that it is the only strategy but we can take some of our references from our investing heroes. Before we blindly copy their buys and sells, let us do our research and due diligence.

Here are some of their 13F filing (for US equities) for Q1/2023 ~ with a focus on their buy & sell activities.

We buy for one reason but could sell for a million reasons. Not every sale should be treated with concern or negativity.

I have shared my observations about their Q1/2023 activities but these are for “entertainment” purposes only. Do not treat them as financial advice. I do not know them personally and these are some of my observations and thoughts.

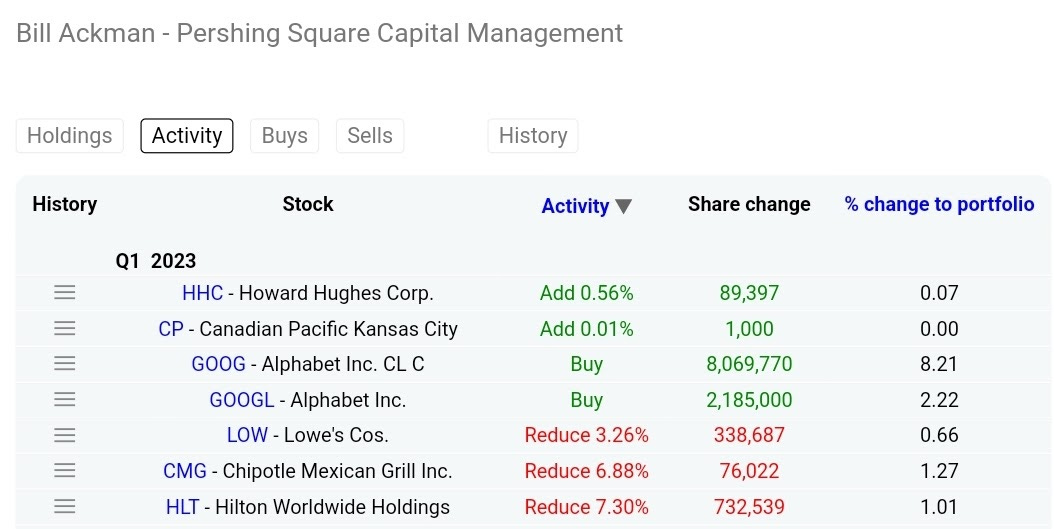

Bill Ackman is quite a controversial figure.

Personally, Google has always been one of my favourite Big Tech companies. The recent development of Google Bard AI has caused quite some stir and this looks to be a worthy competitor to ChatGPT.

For HLT & CMG, these are not complete exits of the positions but it could just be profit-taking.

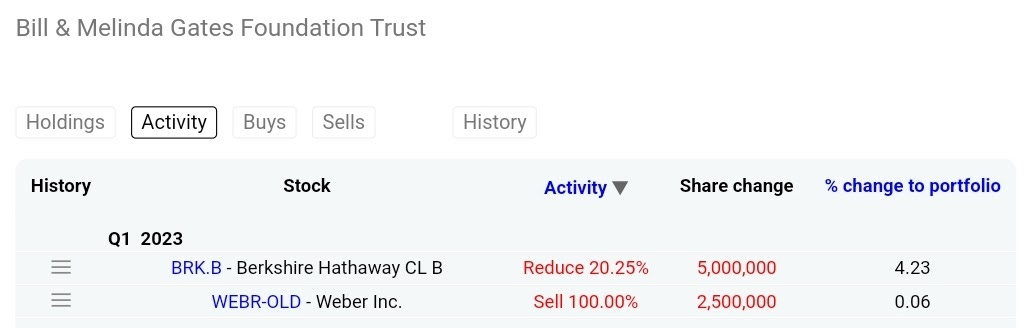

It is interesting that they have sold off a good 20% of their Berkshire shares. Berkshire remains one of the best capital allocators in the market. Their recent years’ performances have been interesting with short duration exit of TSM ~ due to geopolitical concerns about Taiwan.

It is interesting that Mr Pabrai has sold off some of his Micron holdings (15%). This is a company that he has held on for years.

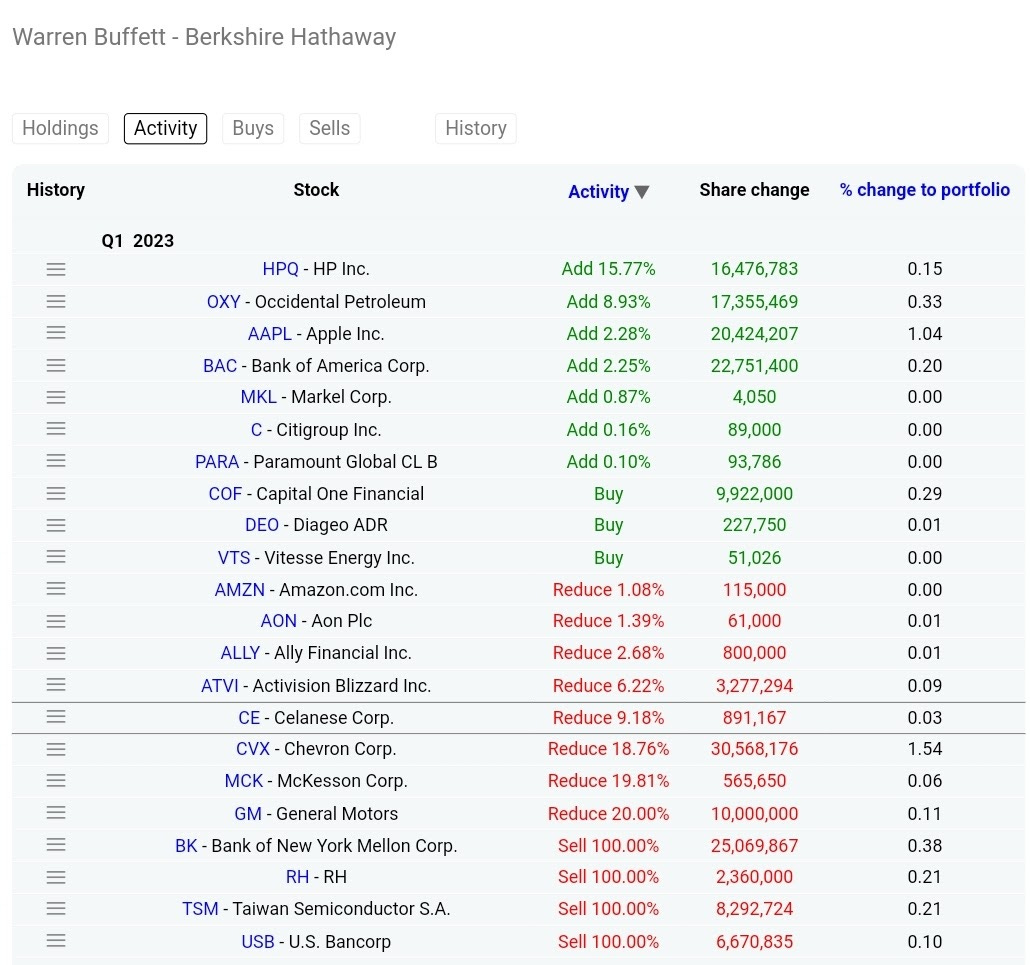

It is interesting that he has exited TSM. During the recent shareholders’ meeting, he expressed his geopolitical concerns for Taiwan.

He has exited his positions in USB & BK (2 banking stocks) totally and this could be a good barometer for the smaller (regional) banks in the US.

He has reduced his holding in Chevron by 18.7% and has invested more in Occidental. This speaks of the “long” runway of such oil and gas companies and to an extent, our dependence on oil and its range of products.

His investment into HP Inc was something unexpected but it is not surprising.

Despite the recent bank crisis, he has added his shares of some of the bigger bank stocks like Bank of America, Citigroup and has added a new position Capital One Financial.

Notably, he has been selling his shares in GM and also BYD. This does not look too good for the automotive industry.

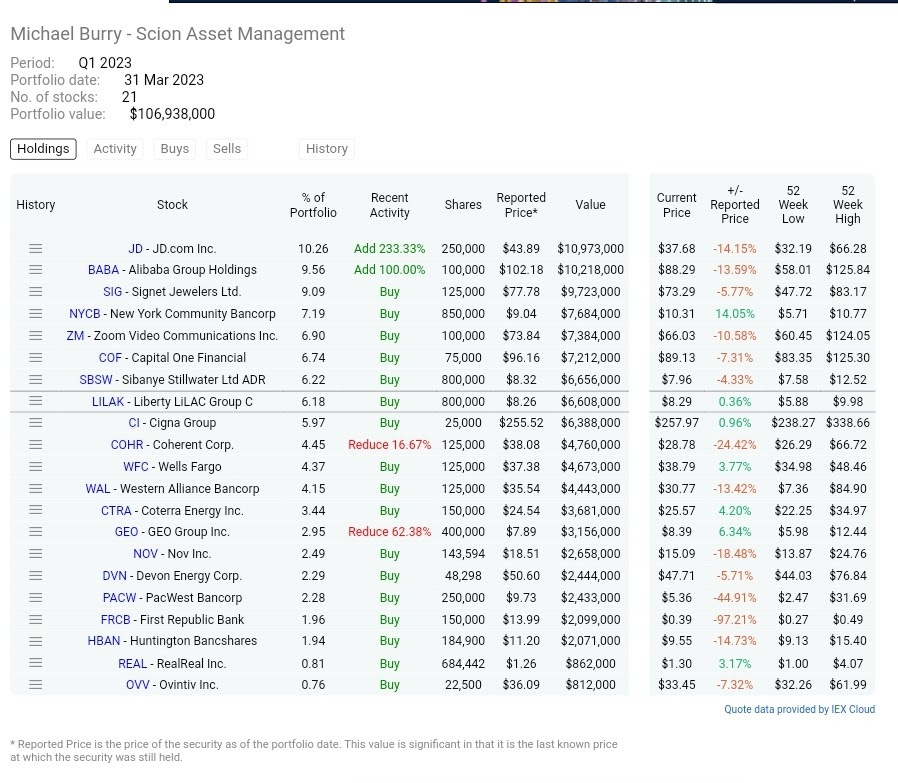

It is interesting to find Burry adding his positions in JD.com & BABA > both e-commerce giants in China.

Despite the bank crisis, he has added to a number of banks like NYCB, Capital One Financial (same as Mr Buffett), Wells Fargo, PacWest & First Republic Bank.

PacWest has seen one of the biggest drops in share prices following the recent bank runs and this is something of interest. As we are in May 2023, it is possible that Burry could have already exited some of his banking positions.

What is interesting was the 62% reduction of his holdings in GEO - one of the biggest private operators of prison and prison services in the USA.

My investing Muse

It seems that some are exiting the smaller banks and heading towards the biggest banks. Yet, there are also investments into smaller banks. How will the banking crisis unfold? Personally, I have a small position in one of the US big banks. I have an issue understanding their operations which became evident during the recent bank runs. I realized that there is so much more that I do not know. For now, I do not think that I am adding more to the banking stocks.

It is interesting to note that Burry has invested into Chinese players like JD and BABA. It is also interesting to note that Mr Buffett has exited his TSM concern due to geopolitical tensions involving China, US & Taiwan.

My recent user experience with both ChatGPT and Google Bard has been good, with Google having an edge. This does not imply my endorsement and I recommend all to try these AI platforms for yourselves. Thus, I think that Mr Ackman’s recent Google investments can prove to be quite a shrewd call.

My recommendation is to do research on the companies that we wish to invest in. This should grant us the conviction to hold (or even add) should the stock price go in contrary directions. We cannot invest based on borrowed convictions.

In lieu of the macro conditions, I am not adding to any of my shortlisted stocks for long-term investment. I am trying to trade to take advantage of the coming downturn which can take months to realize. I would start to invest in my shortlisted stocks after there is blood on the street. Let us do our own due diligence.

Comments

Post a Comment