Preview of the week (28 Aug 2023) - is NIO a good EV buy?

Public Holidays

No public holidays for Hong Kong, the US & China in the coming week.

On the 1st of September 2023, Singapore declared a public holiday as the nation goes to vote for a new president.

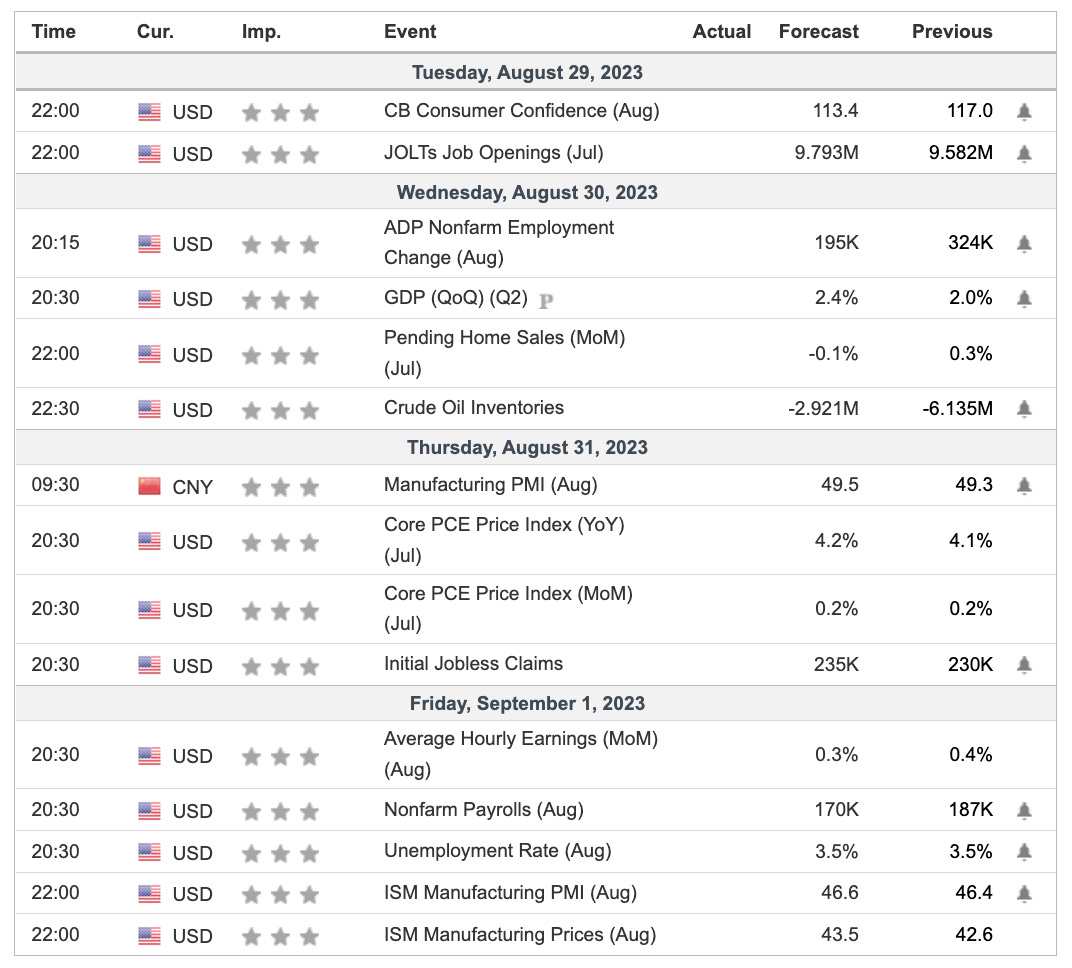

Economic Calendar (28Aug2023)

Notable Highlights

- PCE price index. The Core PCE index (YoY & MoM) should be the most important economic data for the coming week. This is the preferred reference of inflation for the US Fed and will be an important reference for the coming interest rate decision in September 2023.

- Consumer Confidence - This can be an important watermark coming to consumption.

- Home Sales. This will be a good reference for the home and housing market. Several have spoken about a crash but the high interest rates have led to lower transactions.

- GDP Q2 data - An update will be provided for the Q2 GDP of the USA.

- PMI. China updates with manufacturing PMI. As the world’s factory, this can be a good forecast for global consumption. The US will share similar data in ISM Manufacturing PMI and ISM Manufacturing prices. These are good references USA manufacturing sector - whether it contracts or grows.

- Jobless claims. Initial jobless claims will be announced on Thursday. This would form critical data points for the Fed to decide on the next interest rate adjustment. This is part of the data consideration for the Fed in their coming interest rate decision. The unemployment rate will also be released in the coming week, another important reference for the Fed.

- Jobs & Payroll related. JOLTs Jobs openings will reveal the number of job openings, a barometer of the job market in the USA.

- Crude Oil Inventories can be seen as forward indicators of market demand and consumption. If the trend of excess inventories continues, this implies demand erosion that can lead to reduced production & weakening consumer spending.

Earnings Calendar (28 Aug 2023) - is NIO a good EV buy?

This is another week of earnings with some of the ones with personal interests in the likes of NIO, HP, Salesforce and UBS.

Now, let us look at NIO, one of the rising EV stars from China.

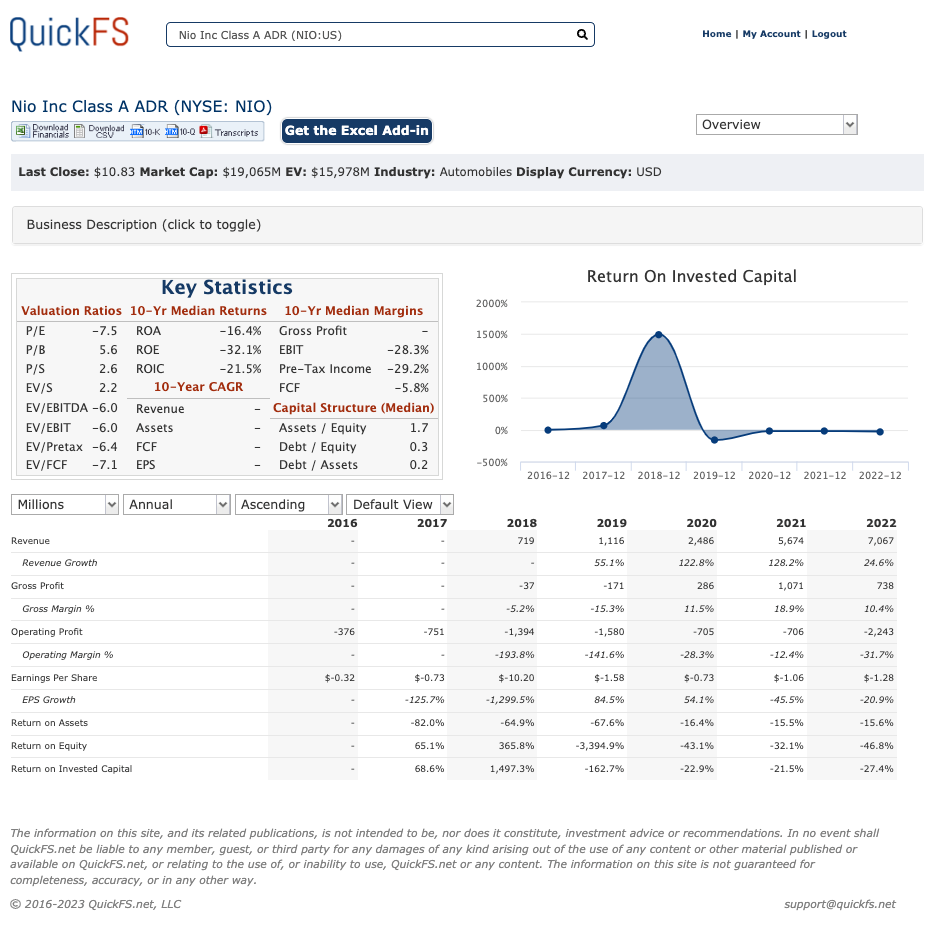

Performance of NIO

Personally, I have already sold out my positions in NIO years back. Despite rising annual revenue, there has been no operating profit as the company continues to suffer losses since 2016. Losses in 2022 have surged to over $2.243B from the region of $706 in 2020 and 2021.

As such, I prefer to monitor the business and hope to see them achieving profits soon.

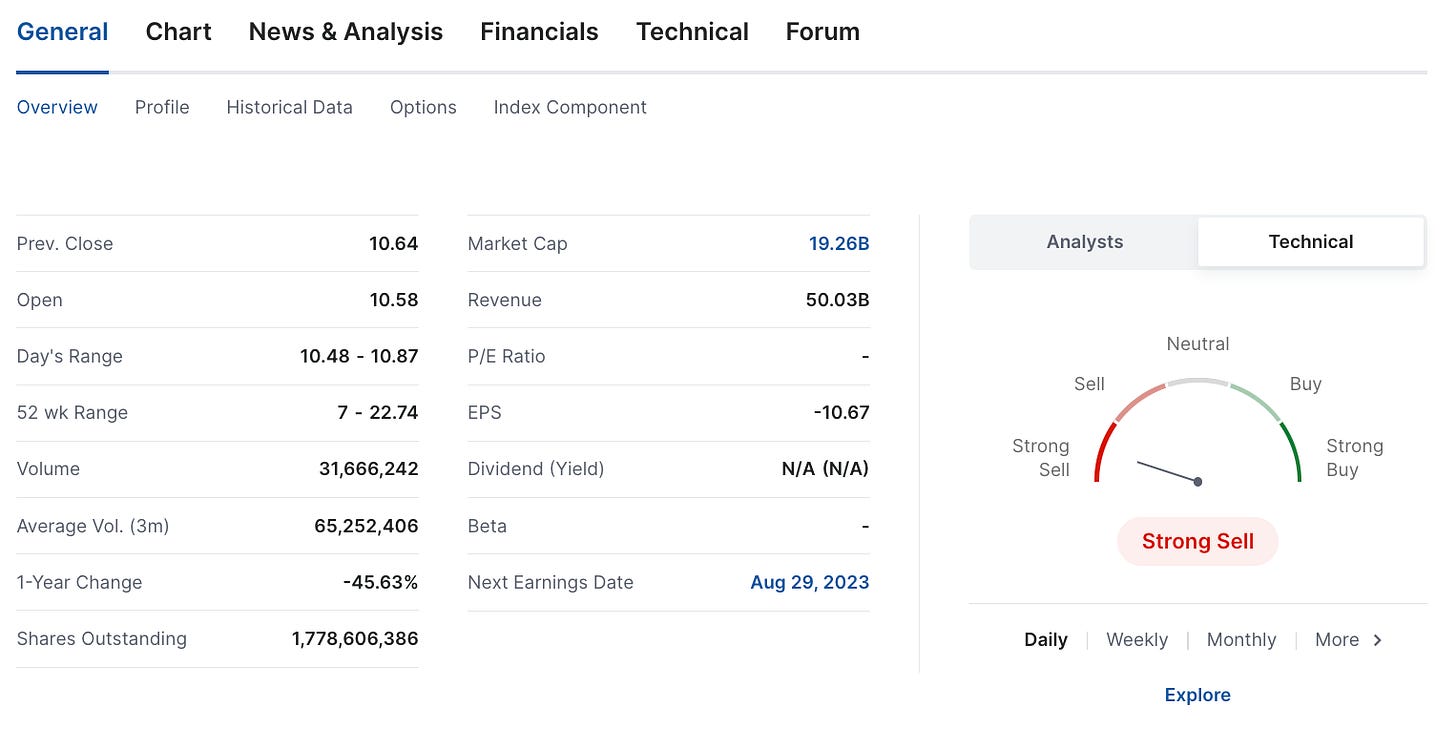

NIO has fallen by over 45% from a year ago. The last price of $10.83 (as of 25 Aug 2023) is above the 52-week low of 7 but remains a distance from the 52-week high of 22.74.

For the coming earnings, Investing has a forecast of -2.96 and 9.16B for its EPS and revenue respectively. We should note that Investing’s forecast is expecting a bigger EPS loss and a drop of over $2.8B in revenue compared to the previous quarter. For the EPS, it is expected to be the biggest EPS loss in recent quarters. This is not trending in the right direction. Personally, I would prefer to monitor instead of investing in NIO.

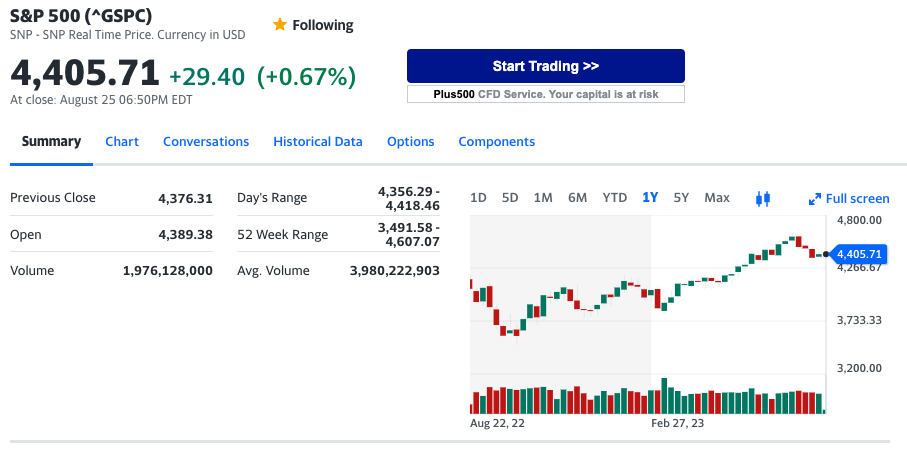

Market Outlook - 28 Aug 2023

From the chart above, we should note that the volume of S&P500 at 1.97B is much lower than the average trading volume of 3.98B. This is a loss of strength for the current trend.

Technical observations of the S&P500 1D chart:

- The Stochastic indicator is on an uptrend. There is a potential crossover (for a reversal) but there is no confirmation as the crossover is yet completed.

- The MACD indicator is on a downtrend but a bottom crossover looks to take place soon. It is possible for MACD to range sideways along the bottom too. Let us monitor.

- Moving Averages (MA). Both MA50 & MA200 lines are on an uptrend. With the last candle being below the MA50 line and above the MA200 line, this can be interpreted as a downtrend in the mid-term and an uptrend in the long term.

- Exponential Moving Averages (EMA). All 3 EMA lines have converged and are at a current downtrend. The EMA lines are spreading downwards in a fan-like spread. The EMA lines need to converge for the current downtrend to reverse. There is a chance for a reversal of the current trend as the EMA lines look to be spreading sideways.

From the 1D technical indicators above, there are a total of 7 (Buy), 16 (Sell) and 0 (Neutral). Investing recommends a “SELL” based on the technical indicators above (1D chart for S&P500). It is possible that we may see a downtrend as implied by MACD.

My thoughts

The various indicators point to a downtrend in the coming week though a short rally is possible.

News and my thoughts from the last week - bad loans, debt, debt ceiling

- Should Nvidia's earnings disappoint, the drop could be big.

- <CNBC> Rice prices surged to their highest in almost 12 years, after India’s rice export ban and adverse weather conditions dented production and supplies of Asia’s primary staple food, according to the UN’s food agency.

- <CNBC> Is nuclear energy the answer to a sustainable future? Experts are divided. Personally, the safety, security & emergency response must be robust. Building these in earthquake zones is unwise.

- <Reuters> S&P downgrades multiple US banks citing 'tough' operating conditions

- Investing & trading are tools to gain time & knowledge through the medium of money. I have found myself to be more emotional, less rational, and lacking discipline & wisdom on my way to being a better investor & person.

- <Reuters> Texas power prices soared 6,000% on Thursday (17Aug23) as a fresh heat wave is expected to shatter temperature records in the coming days. Is this legal?

- <Yahoo Finance> Nvidia sales doubled YoY to $13.5 billion in the latest completed quarter, leaving a net profit of $6.2 billion, 843% YoY increase. The boom in AI is still going strong with revenue in the current quarter would ramp up further to $16 billion.

- <CNBC> “Persistent deflation in China would likely spill over to developed markets, as a weaker yuan and an elevated inventory-to-sales ratios lower the cost of Chinese goods abroad,” said Pimco economists.

The P/E compression of Nvidia looks impressive. it was 113 as per 23 Aug 2023. This should get even better after the earnings. Is this fair value? Or is there even more P/E compression to come?

- AI is driving the market rally today with Nvidia leading the charge. Let us keep a look out for curve balls from Jackson Hole. We should get some indication about a rate hike or pause from Powell.

- If we assign fiscal breakeven as a mandatory requirement for politicians to be re-elected, I think that USD will have a chance to remain the global reserve currency. They are borrowing money from the future to pay for their present fiscal mismanagement.

- I don’t see BRICS as a new bloc. It is a different one.

- It is not to dethrone any but to establish meaningful partnerships amongst the members. Let us focus on value creation.

- A recession comes in bits and pieces. Then, it turns into a collapse in phases, in varying degrees. When things break, it does not break evenly. By the way, I doubt that a recession will happen tomorrow. Just saying my thoughts aloud.

- Can there be one point when quality and excellent customer service are no longer adequate to save the business?

- <CNBC> Affirm shares rocket 28% after better-than-expected results and strong guidance. It is making profit using non GAAP but making a loss using GAAP. Check what they tell us.

My investing muse - debts, inflation & layoffs

The news over the last week has reminded me of the concerns in the market.

Debts

- In July 2023, the public debt of the United States was around 32.61 trillion U.S. dollars, around two trillion more than a year earlier, when it was around 30.6 trillion U.S. dollars.

- <Dailyhodl> US Banks Suffer $18.9B in Losses As JPMorgan Chase & Capital One Take Big Hits From Bad Loans. Banks are preparing for loan losses to continue rising, and have already set aside $21.5B for future potential losses. The government’s FiscalData platform shows that $116 billion has been added to the country’s total public debt since the start of August, bringing the grand total to $32.7 trillion.

- <Business Insider> There's around $1 trillion of private debt that's headed for default. Most have been created by below-investment grade companies through high yield loans or bonds. Around $400B assets are considered "pre-distress," while $150B assets are "deeply distressed."

- <CNN> Moody’s warns that new credit card and auto loan delinquencies will both continue “rising materially,” peaking in 2024 at between 9% and 10%, compared with 7% pre-Covid.

- <Bloomberg> Landlords With $1.2 Trillion of Debt Face Rising Default Risks. Newmark sees defaults mounting for overleveraged owners. Offices account for biggest share of potentially troubled debt

The news does not imply that the market is going to collapse in the coming week. The right way to manage these is to monitor the development of these items. Should the debts continue to build up or compound, this would be red flags for us concerning the economy.

Inflationary pressures

- <CNBC> Fed Chair Powell warns 'we are prepared to raise rates further'. Seems that inflation remains sticky in the outlook

- <CNBC> The benchmark 10-year Treasury note yield hit a high of 4.34%, reaching its highest level since November 2007. This is notable as higher bond yields generally mean lower stock prices.

- <CNBC> UAW workers overwhelmingly vote to authorize strikes at GM, Ford, Stellantis. Demands include a 46% wage increase, restoration of traditional pensions, cost-of-living increases, reducing the workweek to 32 hours from 40 & increasing retiree benefits.

With the Fed “prepared” to raise rates, this implies a sticky inflation in the coming week. The 10-year treasury note yield has hit a high. Would this divert more funds from the other asset classes to bonds?

The UAW workers are negotiating with automakers like GM, Ford and Stellantis. In the case of a hopeful resolution, the new terms are inflationary in impact where the costs will be bore by consumers.

Some layoff news

- <WASJ> A new plan to trim expenses has Charles Schwab shares selling off. The stock is down 4.8% on Tuesday, after the brokerage firm said Monday it aims to save $500 million annually by reducing its office space & trimming headcount.

<FiercePharma> It was only last spring that Biogen started a round of layoffs that shrank the company’s headcount by nearly 900 people last year. Now, a fresh round of job cuts targeting 1,000 positions has kicked off at the struggling drugmaker.

<Business Today> Intel has announced a fresh round of mass layoffs in the US to cut down costs. The company has made 89 job cuts across its Folsom campus & 51 job cuts across its San Jose, California office.

<Insurance Business Mag> Insurance company GEICO has undergone another tranche of layoffs, employees have reported on social media. Several have taken to LinkedIn to confirm they were part of “mass” layoffs last week.

<Biospace> List of layoffs from Pharma. From Pfizer, Norvatis and Agenus.

We have been hearing more news of layoffs from various businesses with the pharmaceuticals being "more” noisy this week. Layoffs are one of the signs of recession, but not the only one. Let us monitor closely.

Conclusion

These news about debts, inflationary pressures and layoffs point to some (fundamental) issues in the market. With the latest Jackson Hole, the Fed has expressed a willingness to raise the rate should inflation remain sticky.

We look forward to the PCE data that would confirm how sticky is the inflation. There are various factors that add to the market volatility.

As usual, I recommend caution. It is a good time to qualify great companies so that we can buy them when they reach good discounted prices. Let us spend within our limits, avoid leverage and do our due diligence so that we can benefit in the coming market.

Comments

Post a Comment