Preview of the week 07 Aug 2023 - Will BABA fall?

Preview of the week starting 07Aug2023

Public Holidays

No public holidays for Hong Kong, the US & China in the coming week.

09 Aug 2023 (Wed) - Singapore celebrates National Day.

To my fellow Singaporeans, let us continue to pray for peace, progress and prosperity upon our land.

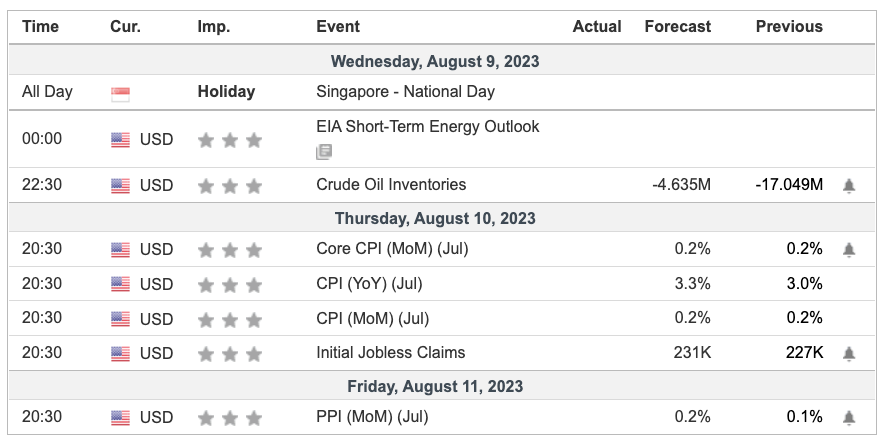

Economic Calendar (07Aug2023)

Notable Highlights

CPI - The consumer price index (CPI) data, an indicator of inflation will be revealed this coming week. Though PCE is the preferred Fed’s preferred indicator for inflation, this will still be part of Fed’s consideration for the coming interest rate decision.

PPI - The Producer Price Index (PPI) can be treated as a forward indicator of inflation. This is the “inflation” that affects producers which is usually passed on to the consumers. If the PPI trends lower, this can be seen as lesser inflation hitting the market. It is noted that the impact of this on the consumer is also dependent on the price elasticity of the products and services.

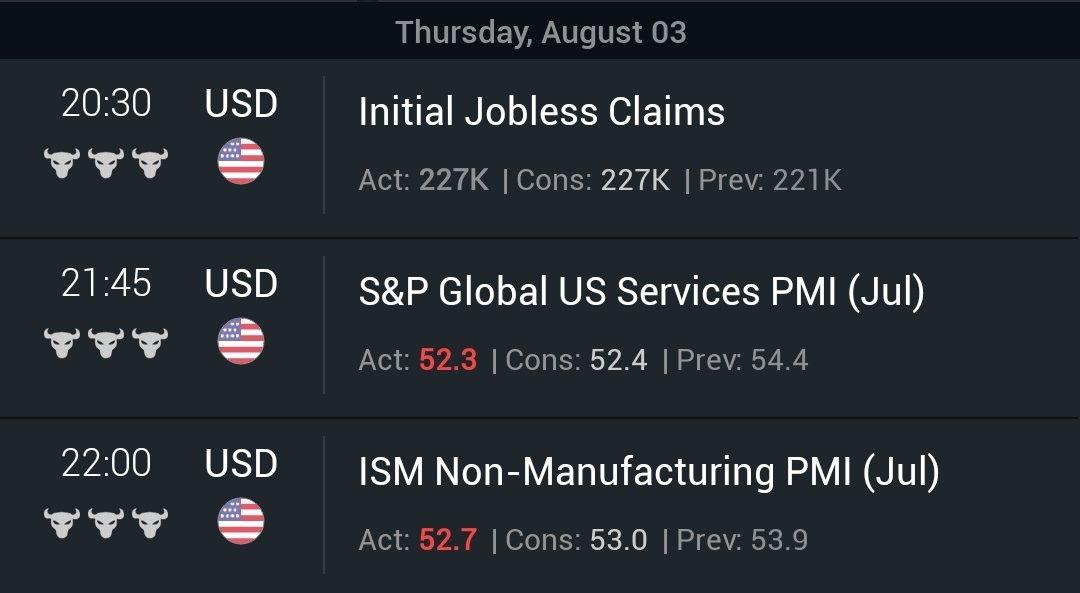

Jobless claims. Initial jobless claims will be announced on Thursday. This would form important data points for the Fed to decide on the next interest rate adjustment. This is part of the data consideration for the Fed in their coming interest rate decision.

Crude Oil Inventories can be seen as forward indicators of market demand and consumption. If the trend of excess inventories continues, this implies demand erosion that can lead to reduced production & weakening consumer spending. We have seen a record drawn down of the inventory previously that can be read as bullish. One report alone does not constitute a trend.

Earnings Calendar (07 Aug 2023) ~ is this the fall of BABA?

This is another big week of earnings for various sectors. Personally, there are a few companies of personal interest that include Tyson, Palantir, UPS, Rivian, Disney and BABA. Let us look at BABA in detail.

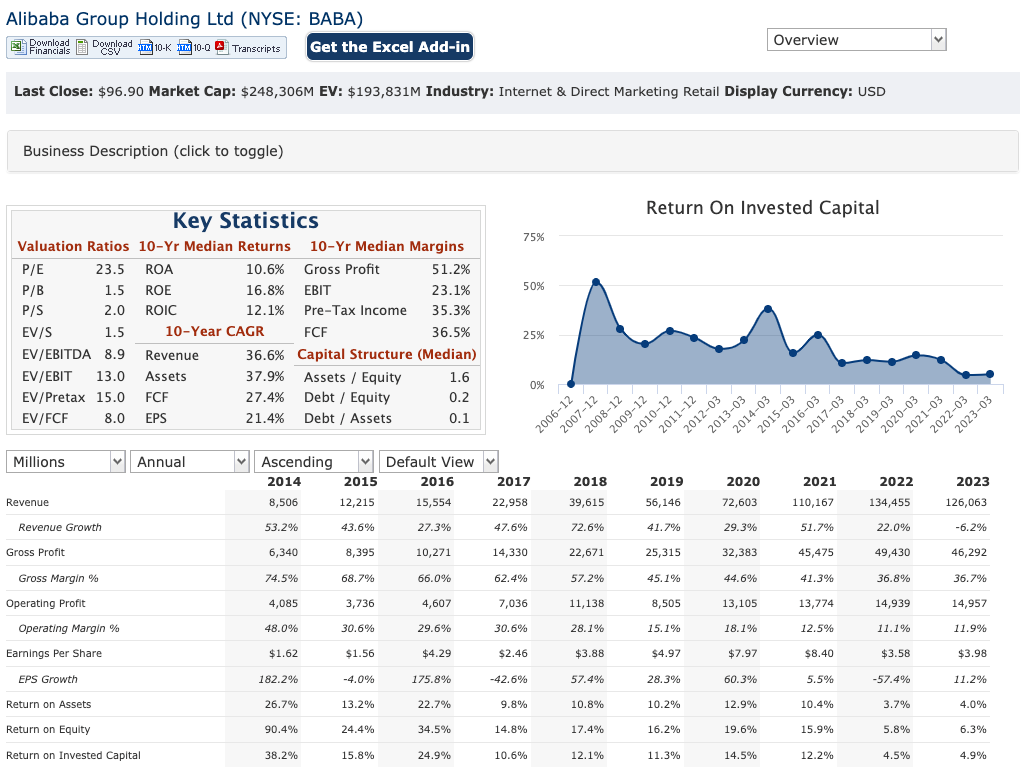

BABA’s performance

From the 10 years table above, BABA’s growth over the last 10 years has been impressive. However, the revenue has seen a drop and the operating profit has plateaued around USD$14.9B.

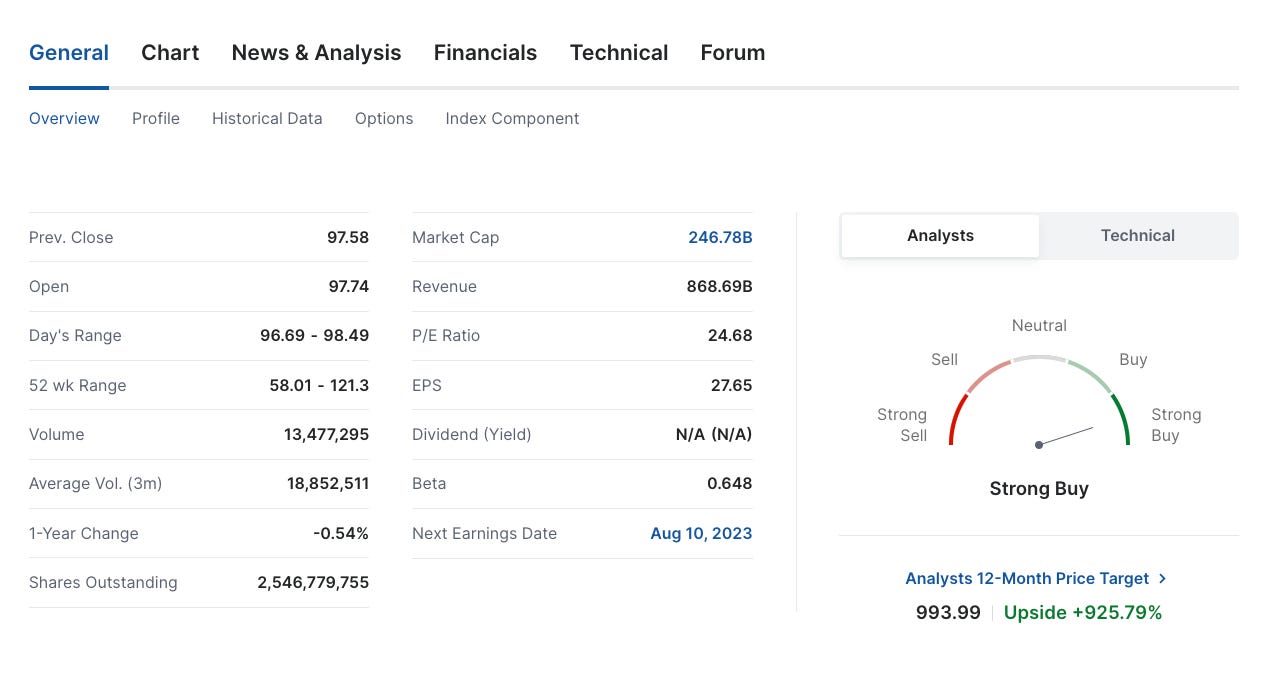

BABA’s price is lingering in the sub-100 region and has seen a 0.54% drop after a year.

For the coming earnings, the forecasted EPS and revenue of BABA (ADR) are 14.59 & 224.39B respectively. Will BABA fall or rise?

Market Outlook - 07 Aug 2023

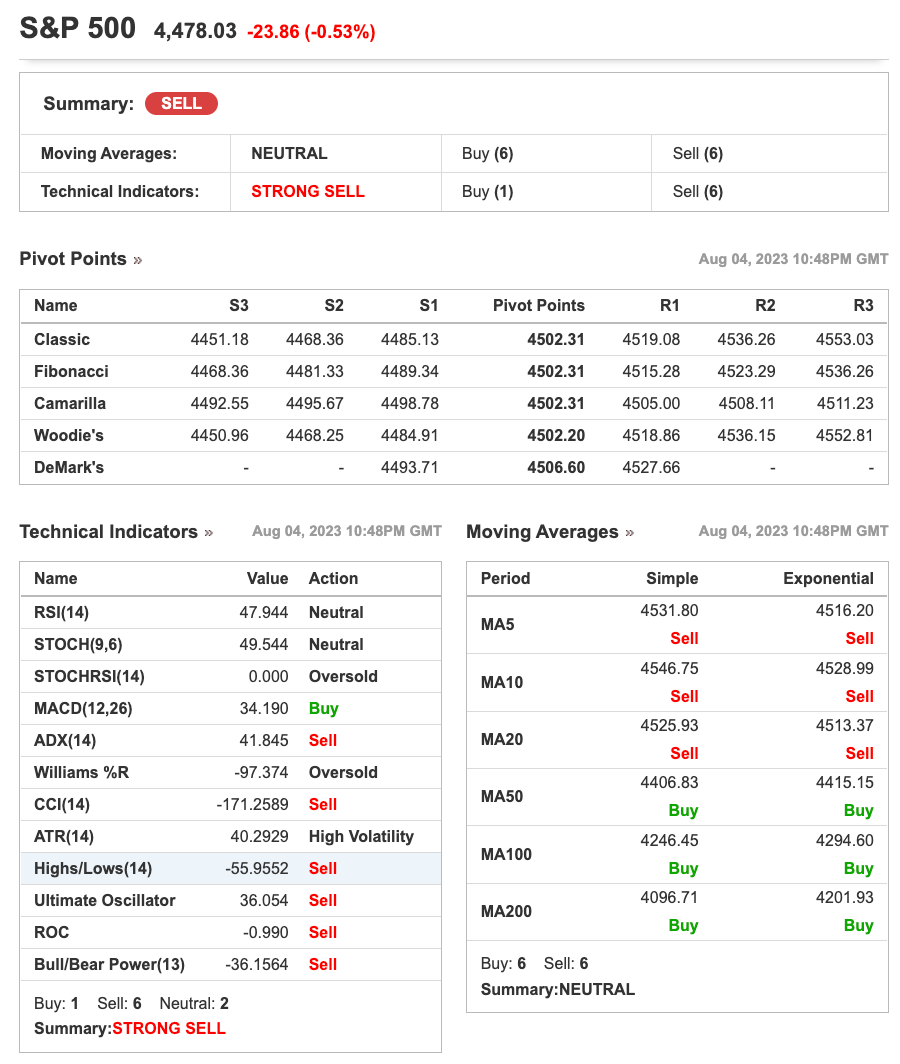

Technical observations of the S&P500 1D chart:

The stochastic indicator is on a downtrend.

The MACD indicator is on a downtrend but has completed a top crossover. The indicator seems to be ranging sideways too.

Moving Averages (MA). Both MA50 & MA200 lines are on an uptrend. With the last candle being above both the MA50 line and MA200 lines, this can be interpreted as an uptrend in the mid-term and the long term.

Exponential Moving Averages (EMA). The lines are on an uptrend though EMA 8 & 13 have converged, implying a potential reversal of the current uptrend. For confirmation, I need all 3 EMA (8, 13 & 20) lines converge.

From the technical indicators above, there are a total of 7 (Buy), 12 (Sell) and 2 (Neutral). Investing recommends a “STRONG SELL” based on the technical indicators above (1D chart for S&P500).

My thoughts

I think that the Fitch downgrade has a short-term impact on the stock market but the technical indicators point to a downtrend in the coming days.

News and my thoughts from the last week - CRE, Yellow & layoffs

"US trucking company Yellow shuts down operations -WSJ" (Reuters) -U.S. trucking firm Yellow ceased all operations on Sunday, the Wall Street Journal said citing notices sent to customers and employees.

Is it possible to have a GDP gain with lesser profits and more losses?

Could China be the lesser good and the US the greater harm for the world? Or is this the opposite?

<CNA> The assessment on the price and wage outlook came after the central bank's decision on Friday to tweak its bond yield control policy and allow long-term interest rates to rise in line with inflation

<Reuters> Global banks hold about half of the $6 trillion outstanding commercial real estate debt, with the largest share maturing in 2023-2026. U.S. banks revealed spiralling losses from property in their first half figures and warned of more to come.

Do not mistake consumption for investment. Is buying Pokemon cards considered consumption or investment - if you buy with intent to sell at a higher profit years later?

<CNBC> China’s official manufacturing purchasing managers index came in at 49.3, higher than June’s figure of 49.0. The PMI for non-manufacturing activity came in at 51.5, a slower rate of expansion compared to 53.2 in June.

The circumstances are pushing the development of AI and the future should be one that has both human creativity and AI.

<CNBC> Bankruptcy-bound trucking firm Yellow received $700 million in Covid pandemic relief loans three years ago. Yellow has repaid just $230 out of the $729.2 million in principal it still owes the U.S. Treasury.

<Reuters> The Teamsters local unions representing 340,000 workers at UPS voted 161-1 on Monday to endorse the agreement, estimated to be at $30 billion. It includes historic wage increases, one more paid holiday & air conditioning in delivery trucks.

<CNBC> Oil major BP posts 70% drop in second-quarter profit, raises dividend by 10%

<NASDAQ> Falling global consumer demand, soaring inflation and high inventories have dragged freight rates down from their pandemic highs, denting earnings of freight forwarders such as DHL, Kuehne+Nagel and Denmark's DSV

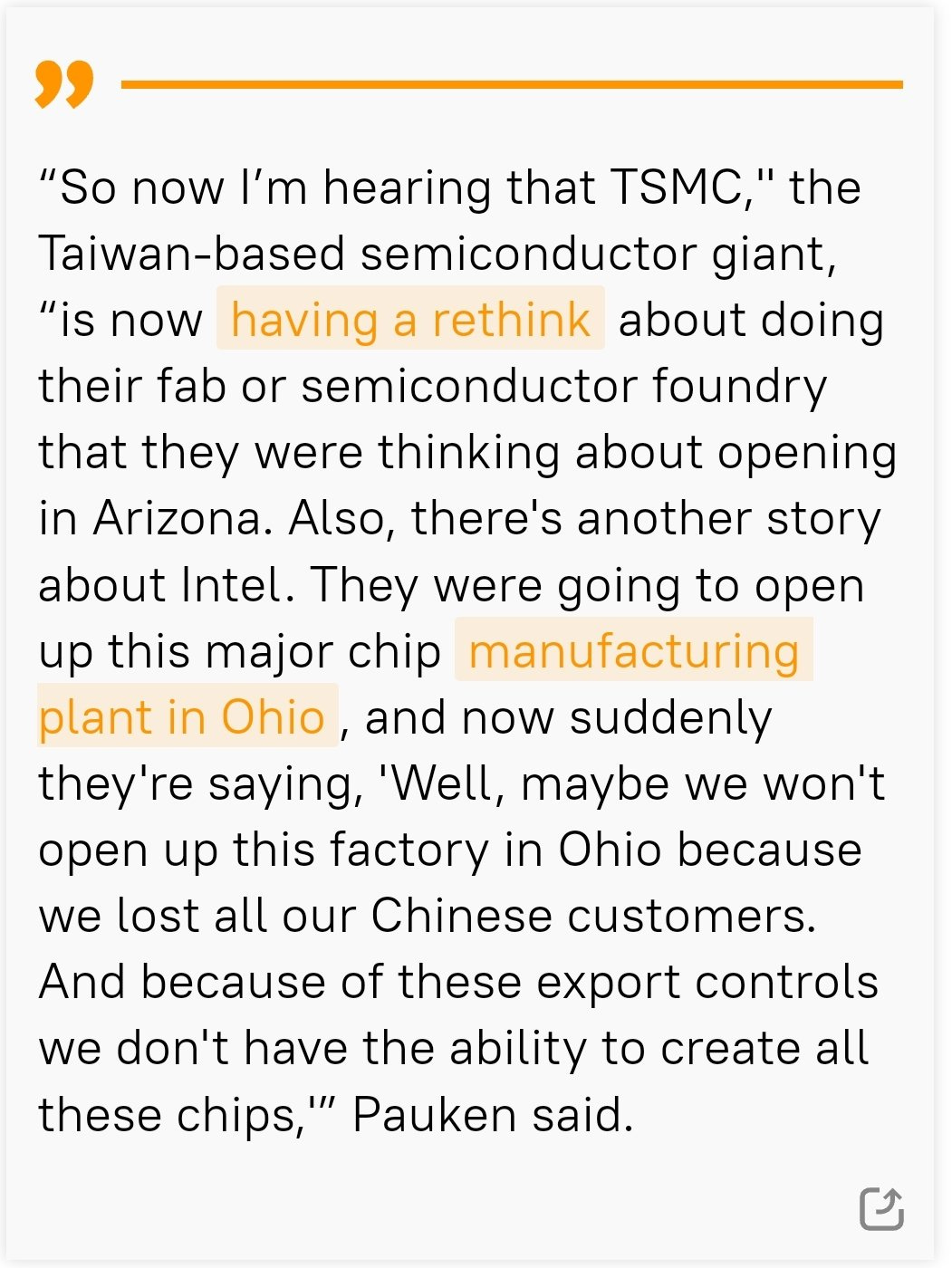

China’s Rare Earths Export Curbs May Sink US’ Microchip Manufacturing Ambitions

ISM Manufacturing PMI at 46.4 in July vs est 46.8 Indices: Dow up 0.20 %, S&P down 0.2 U.S. second-quarter earnings are now expected to fall 5.9% from a year earlier, Refinitiv data on Tuesday showed, compared with a 7.9% decline estimated a week earlier.

<Business Insider> Apple and Meta stocks have been the key drivers of the Nasdaq 100's July rally.

The two tech giants have seen their shares surge about 51% and over 165% so far this year, respectively.

<CNBC> world’s top 200 fintech companies.

CNBC partnered with independent research firm Statista to establish a transparent overview of the top fintech companies.

USA credit rating dropped to AA+ according to Fitch.

Is Moody and S&P going to revise their rating too?

<WSJ> Oil Prices Perk Up as Recession Worries Ebb, Supply Tightens. Oil prices have surged to the highest levels in three months, as the economic outlook improves and supply cuts from some of the world’s biggest producers start to bite.

<WSJ> CVS to Shed 5,000 Jobs in Cost-Cutting Push

<Freightwaves> Korean Air, the fifth-largest cargo shipping airline, said cargo revenue in the second quarter plunged 56% to $748.8 million, further illustrating how a weak freight market has impacted Asian carriers more than others.

Is a recession needful to reallocate the resources and human capital gained over the bull run?

Every resolved strike leads to inflationary costs impact on the market. It does not mean that the workers should be paid lesser. Could it be that the management was out of touch?

<Business Insider> According to MarketWatch data obtained from Trepp released on Tuesday, office-loan delinquency rates have touched 5% as more companies default on their commercial mortgage-backed securities.

Global warming has led to changes in travel and destinations.

With lesser domestic travel in the US, the local economy is expected to make lesser tourist dollars. Is revenge travel back?

we can make more money during the chaos.

<SP Global> May 2023 - CRE loan delinquency rate at US banks rises sharply

My investing muse

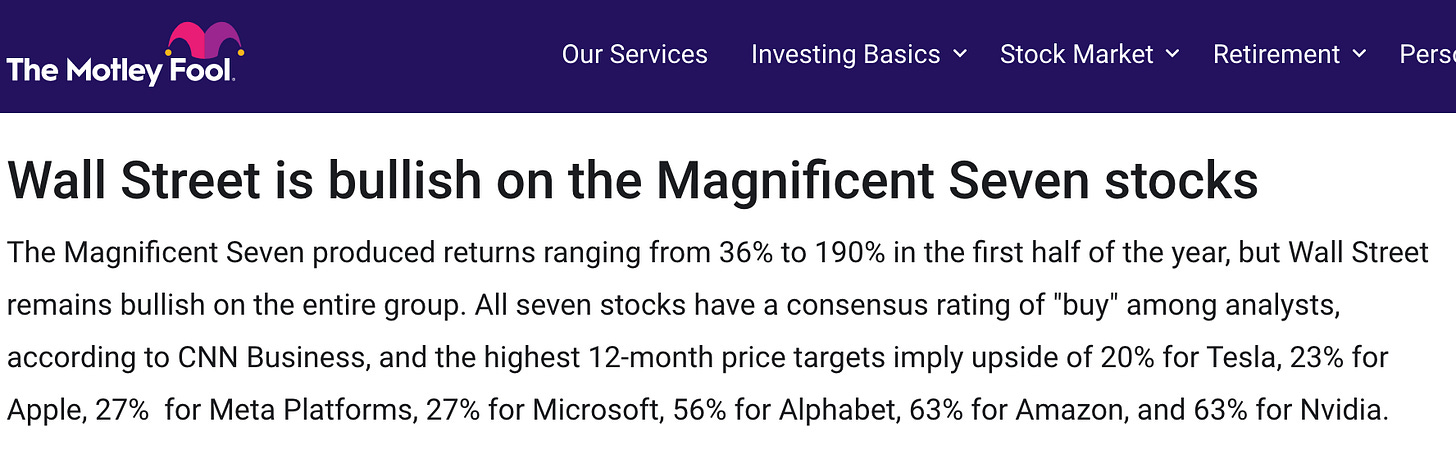

Fitch’s downgrade may have caused some market panic but its impact should be short-lived. This is not the first downgrade after all. Following the last downgrade, the market fell 17% but it recovered shortly after. However, the recent earnings of the Magnificent 7 have been mixed (Amazon, Apple, Alphabet, Nvidia, Meta, Tesla & Microsoft). These are the main stocks that have driven the S&P500’s climb in Q2 following their Q1/2023 earnings releases.

This is Motley Fool’s article on The Magnificent 7:

The S&P 500 soared 15.9% in the first half of 2023, and the “Magnificent Seven” stocks accounted for 73% of those gains.

Supply chain challenges are expected following the collapse of Yellow - one of the biggest players in the US trucking market. On top of this, UPS has averted a strike following an agreement to changes with the trade union. The agreement, estimated to be at $30 billion by the union, provides historic wage increases, one more paid holiday and air conditioning in the company's ubiquitous brown delivery trucks (Reuters).

There are some concerns with Yellow’s collapse and we can expect the “costs” of the new UPS agreement are expected to be passed on to the customers. This is inflationary in subsequent impact.

In the coming week, the CPI result will be announced and the forecast is expected the CPI to go up. For the market, an upward CPI trend can be bearish in nature as the Fed can remain hawkish in its approach and implementation.

Conclusion

At this point, the earnings have been mixed though it is more disappointing. The coming CPI and PPI releases are expected to bring some volatility to the market. Let us continue to exercise caution in the coming days.

Comments

Post a Comment