Let us take a closer look at Apple's recent earnings ~ is this all good news? (13May2023)

Here are some of the news extracts pertaining to Apple’s recent earnings:

From the various news headlines, most of the news points to good outcomes from the recent earnings. The only one is CNN which is not positive about the earnings.

Taking a quick glance, most of us will walk away thinking that the earnings will be stellar. Yes, the earnings are very good.

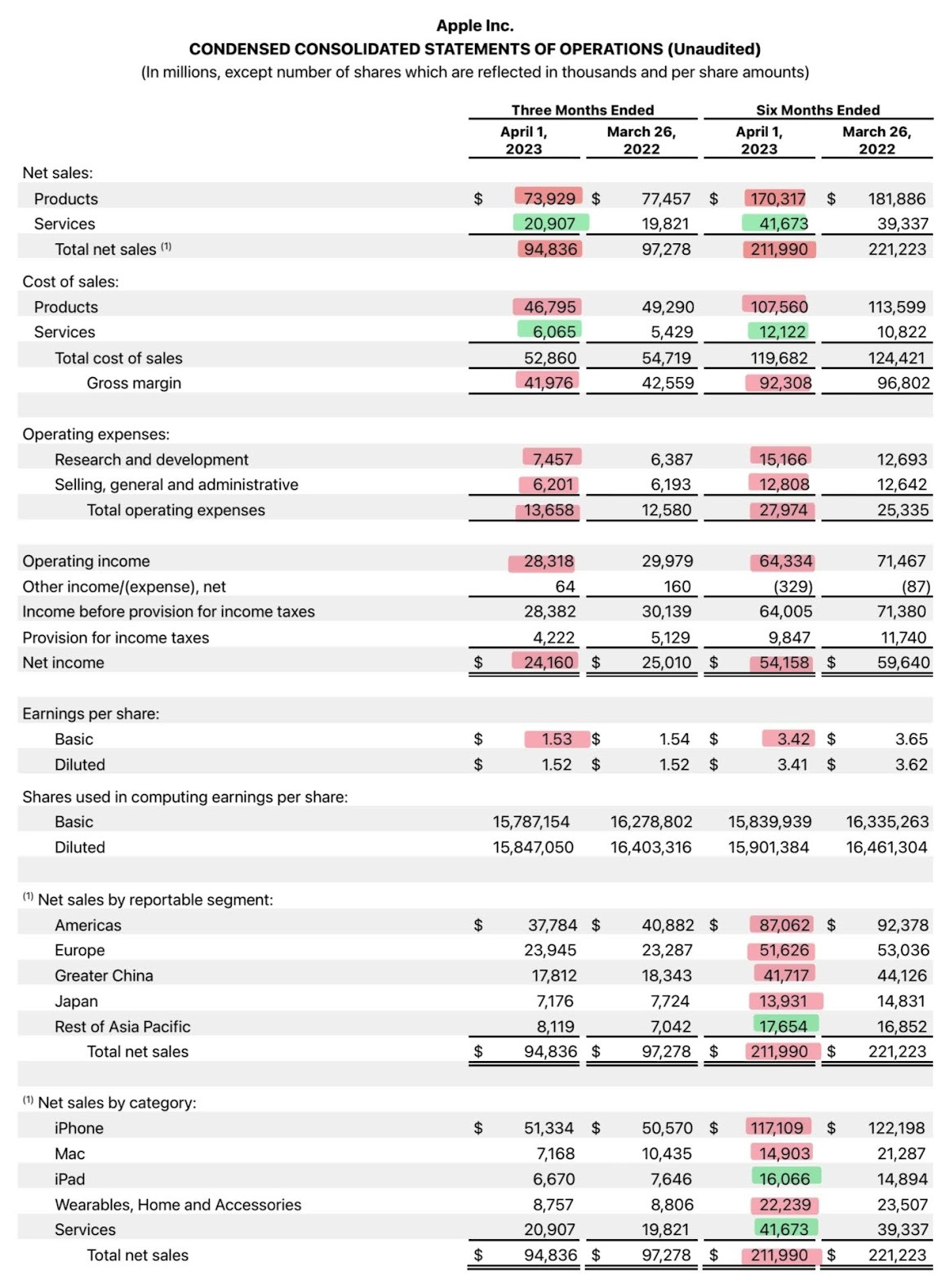

Observations from the earnings (based on 6 months ending 01 Apr 2023):

- Total net sales are $211.9B

- Total net income is $54.1B

- Both sales and EPS have beaten the market Forecast.

- EPS came out to be 1.52 compared to a forecast of 1.43

- Revenue came out to be 94.8B compared to a forecast of 92.9B

Any company will want to have a net income of $54B (after 6 months).

However, there are also some notable observations too (based on the period of 6 months, a year ago):

- Total net sales are lower - $211.9B compared to $221.2B a year ago (4.2%)

- Total net income is lower - $54.1B compared to $59.6B a year ago (9.2%)

- There is a drop of $9.3B (net sales)

- There is a drop of $5.5B (net income)

- EPS (basic) came out to be lower at 3.42 compared to 3.65 a year ago.

- The only region with growing net sales is the Rest of Asia. The other regions of the Americas, Europe, Greater China and Japan have clocked declining net sales.

- Though the net sales fell by 4.2%, the net income fell by 9.2%. The net income is dropping more than the decline in net sales.

There could be a declining trend for both revenue and net income. What we need to understand better. We are trying to understand whether the decline is due to:

- Apple’s offerings

- Macro ~ global demand

- A mix of both

Let us go beyond the news headline and look into the financial statements in detail. This is part of the due diligence that we should exercise.

Comments

Post a Comment