Is there a need for layoffs at Big Techs? (07Apr2023)

Highlights of Layoffs

There is much news of layoffs in the US.

This is a post from Twitter user The Kobeissi Letter:

Big Tech

Let us take a deeper look into Big Tech to better understand their employment and their financial performance. In this case, I am looking at Microsoft, Alphabet, Tesla, Apple and Meta (former Facebook) for the period between 2017 to 2021.

For the financial data, I have used ChatGPT for most of the data compilation.

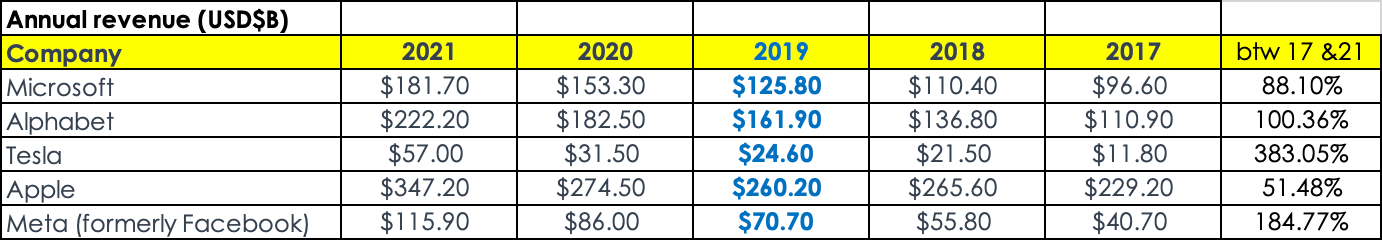

Revenue of Big Tech (2017 - 2021)

From 2017 to 2021, we have seen the following annual revenue growth of the above Big Tech:

- 88.10% for Microsoft

- 100.36% for Alphabet

- 383.05% for Tesla

- 51.48% for Apple

- 184.77% for Meta

However, a growing top line (annual revenue) does not always lead to profitability (annual net income).

This is an extract from my recent write-up on Amazon:

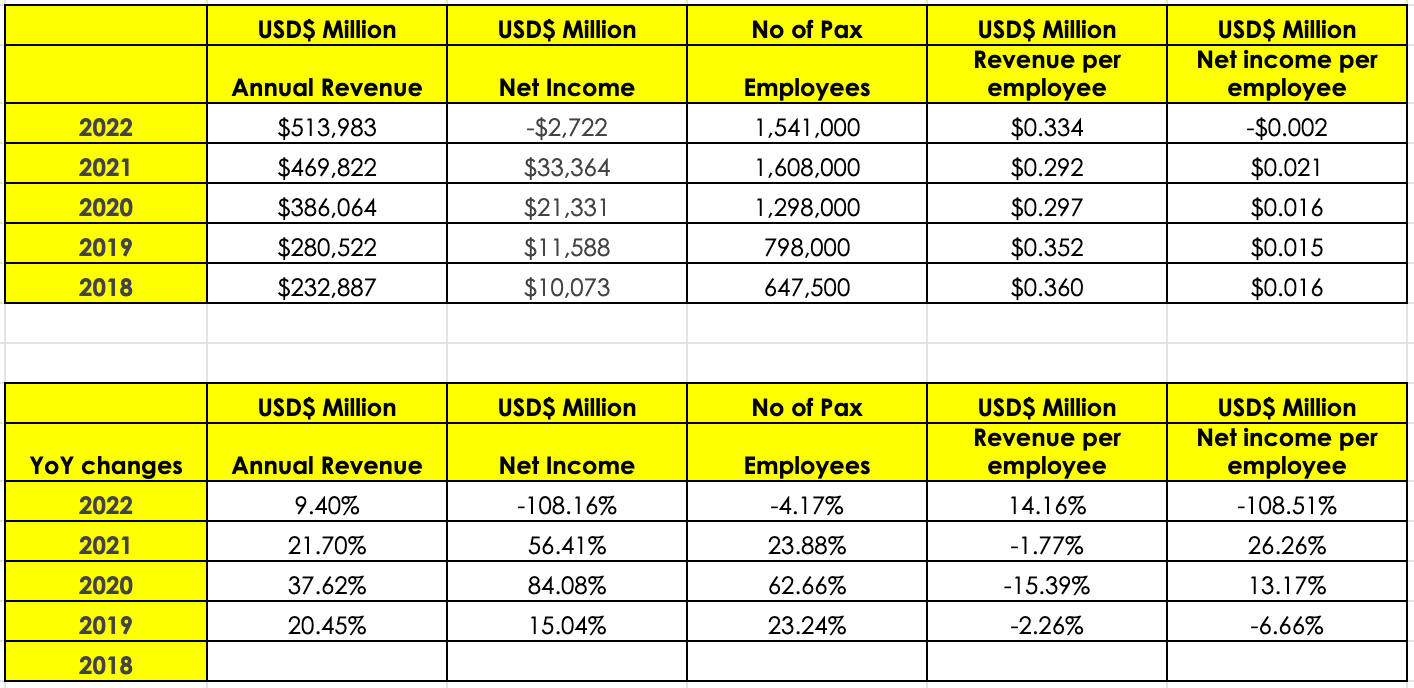

Analysis of Amazon’s revenue, net income and employees

Observations about Amazon’s performance (2018 to 2022):

- Revenue: 2018 to 2021 saw revenue growth above 20% but the growth from 2021 to 2022 was a far cry of 9.40%.

- Employees: Starting from 2018, the growth of the number of employees was 23.2% (2019), 62.6% (2020), 23.8% (2021). 2022 ended with a decline of 4.1% drop in total employees.

- Net income: The growth since 2018 was 15.0% (2019), 84.0% (2020), 56.4% (2021) and 2022 ended with a decline of 108.1% with a net income loss of $2.7B. The drop from $33.3B in 2021 to a loss of $2.7B in the following year is nothing less than shocking.

However, revenue does not always translate into profits. Thus, let us look into net income per employee data. In 2022, Amazon ended the year with a loss of $2.7B and for every employee, they incurred a net income (loss) of $2,000 per employee per year, compared to a net income (profit) of $21,000 per employee per year.

An increase in revenue does not always lead to an increase in net profits. Thus, let us look at the annual net income for the same group of Big Tech.

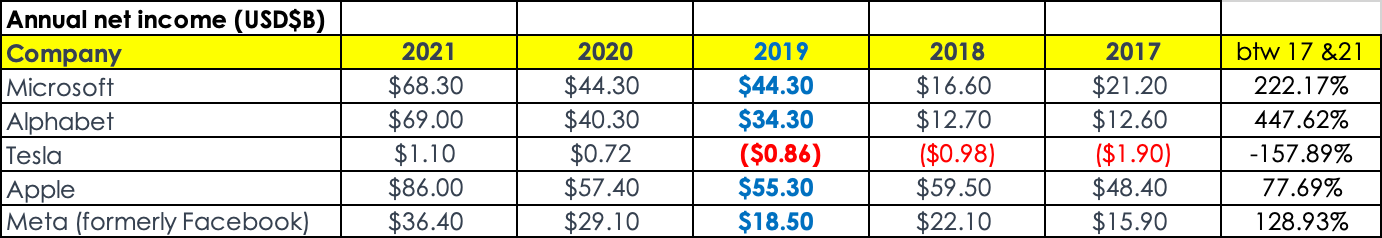

Annual Net Income & EPS of Big Tech

From the table above, we noticed the following about Big Tech’s annual net income from 2017 to 2021:

- Microsoft grew 222.17%

- Alphabet grew 447.62%

- Tesla grew 157.89%

- Apple grew 77.69%

- Meta grew 128.93%

Following net income, let us look into EPS (between 2017 & 2021) where we include any dilution of shares into consideration:

- Microsoft’s EPS grew 110.18%

- Alphabet’s EPS grew 195.32%

- Tesla’s EPS grew 147.42%

- Apple’s EPS grew 118.80%

- Meta’s EPS grew 157.33%

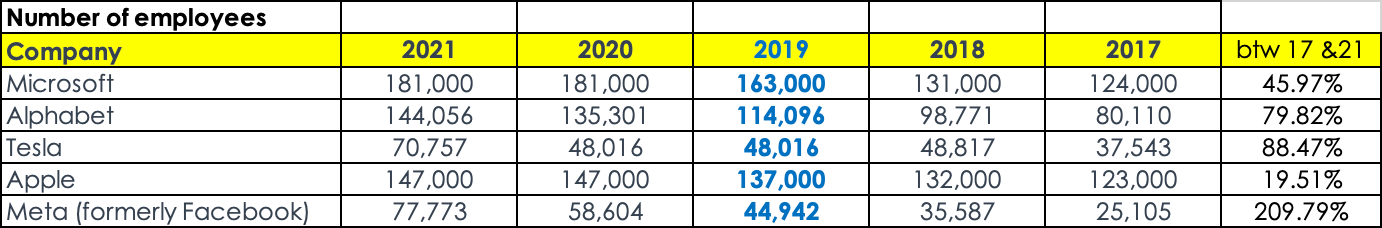

Employees of Big Tech

From the table above, we noticed the following about Big Tech’s total employees from 2017 to 2021:

- Microsoft grew by 45.97%

- Alphabet grew by 79.82%

- Tesla grew by 88.47%

- Apple grew by 19.51%

- Meta grew by 209.79%

From the 2 sets of data above, we have the following observations (for periods between 2017 to 2021):

- For Microsoft to increase its net income by 222.17%, it is supported by a 45.97% increase in manpower.

- For Alphabet to increase its net income by 447.62%, it is supported by a 79.82% increase in manpower.

- For Tesla to increase its net income by 157.89%, it is supported by an 88.47% increase in manpower.

- For Apple to increase its net income by 77.69%, it is supported by a 19.51% increase in manpower.

- For Meta to increase its net income by 128.93%, it is supported by a 209.79% increase in manpower.

- For Microsoft, Alphabet, Tesla and Apple, every staff (hiring) could lead to a better (annual) net income. Thus, the hirings do look to be “justified”.

From the list above, Meta seems to have “excessive” staffing compared to other Big Tech.

<Considerations> However, we understand that profitability does not stem from a single cost of manpower. There are costs of revenue, costs of goods sold, Research & development, marketing and administrative expenses incurred. There would be expenses in hardware, software, training, process and so forth. Over time, we can expect improvement in productivity, better asset utilization and resource optimization.

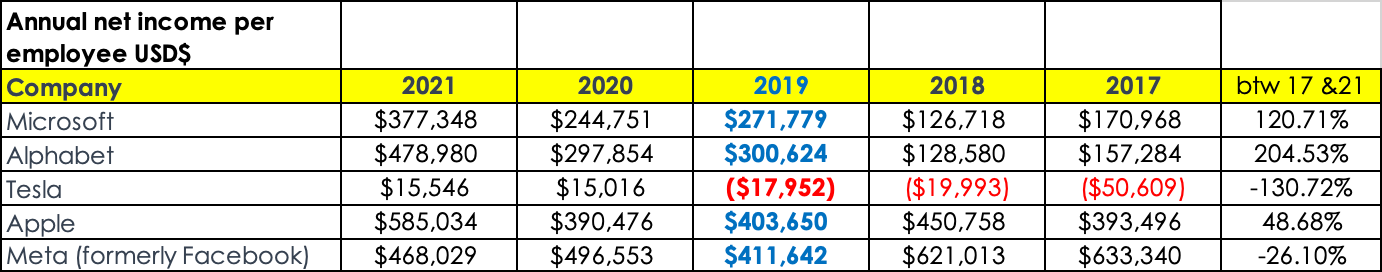

From the above data, I have established a new reference for annual net income per employee.

For every employee hired in 2021, Microsoft made an annual net income of about $377K, Alphabet $478K, Tesla $15K, $Apple $585K and Meta $468K. Before we get overly excited, let us note that Meta’s annual net income per employee was $633K in 2017 compared to $468K in 2021. This, the contribution per employee seemed to be dropping.

My investing muse

Amazon has more than doubled its employees (647,500 in 2018 to 1,541,000 in 2022). This did not lead to more profits. This could be a case of excessive hiring. In fact, it could be that all the above Big Tech (except Tesla) have excessive staff. Thus, the trimming of such overheads in lieu of the coming recession would be a prudent call.

Elon has made bold steps with Twitter in staffing cuts. Companies, investors and venture funds are watching from afar. If Elon makes this downsized Twitter work, there would be a bigger market-wide review of the “actual” number of staff we need. However, there would be cases of understaffing in certain functions and roles. If Elon is able to turn Twitter around, we could see rightsizing taking place in more companies.

It is time to trim the excess. The layoffs could come from recession, trimming, optimization or even AI disruption. Let us continue to create excessive values. Yet, the indomitable spirit of man would not be limited by layoffs. We could see new businesses and entrepreneurs emerging with new solutions. We could see the rise of new market leaders.

This is what we can learn about the 3 best things that Miles Davis did for John Coltrane:

Miles hired Trane

Miles fired Trane, and

Miles gave Trane a soprano saxophone

John Coltrane went on to be one of the leading jazz icons. I am not for layoffs but sometimes, it can bring forth the best of us to pen new chapters of innovations, adventure and breakthroughs.

Comments

Post a Comment