Is recession gone with improved PCE & good GDP?

Is recession gone with improved PCE & good GDP?

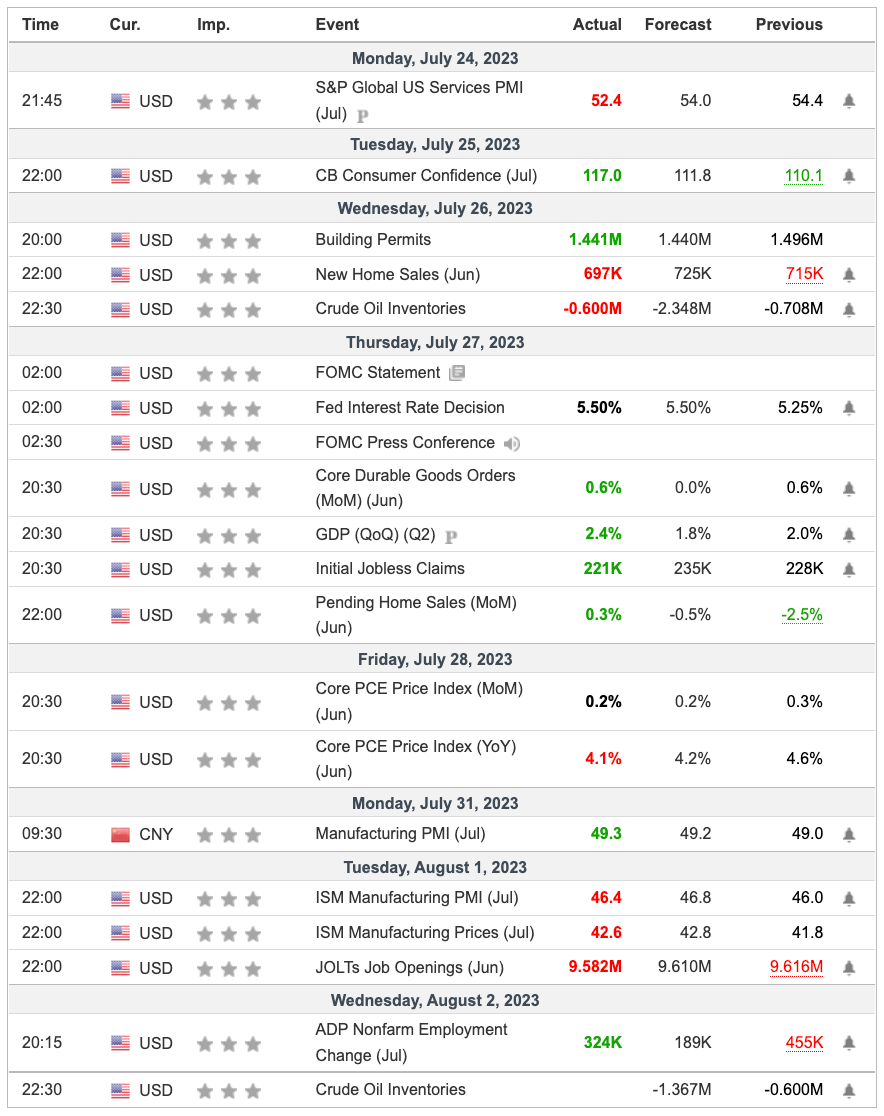

A 2.4% QoQ GDP points to economic recovery and the latest PCE at 4.1% (YoY) implies that inflation is weakening. The initial jobless claims came at a better 221K than the expected 235K. The latest JOLTs’ job openings dropped to a recent low at 9.582M. A weaker “ISM Manufacturing PMI” at 46.4 implies a contraction in the manufacturing sector. For the PCE, it implies that there is still inflation but at a lesser (expected) magnitude.

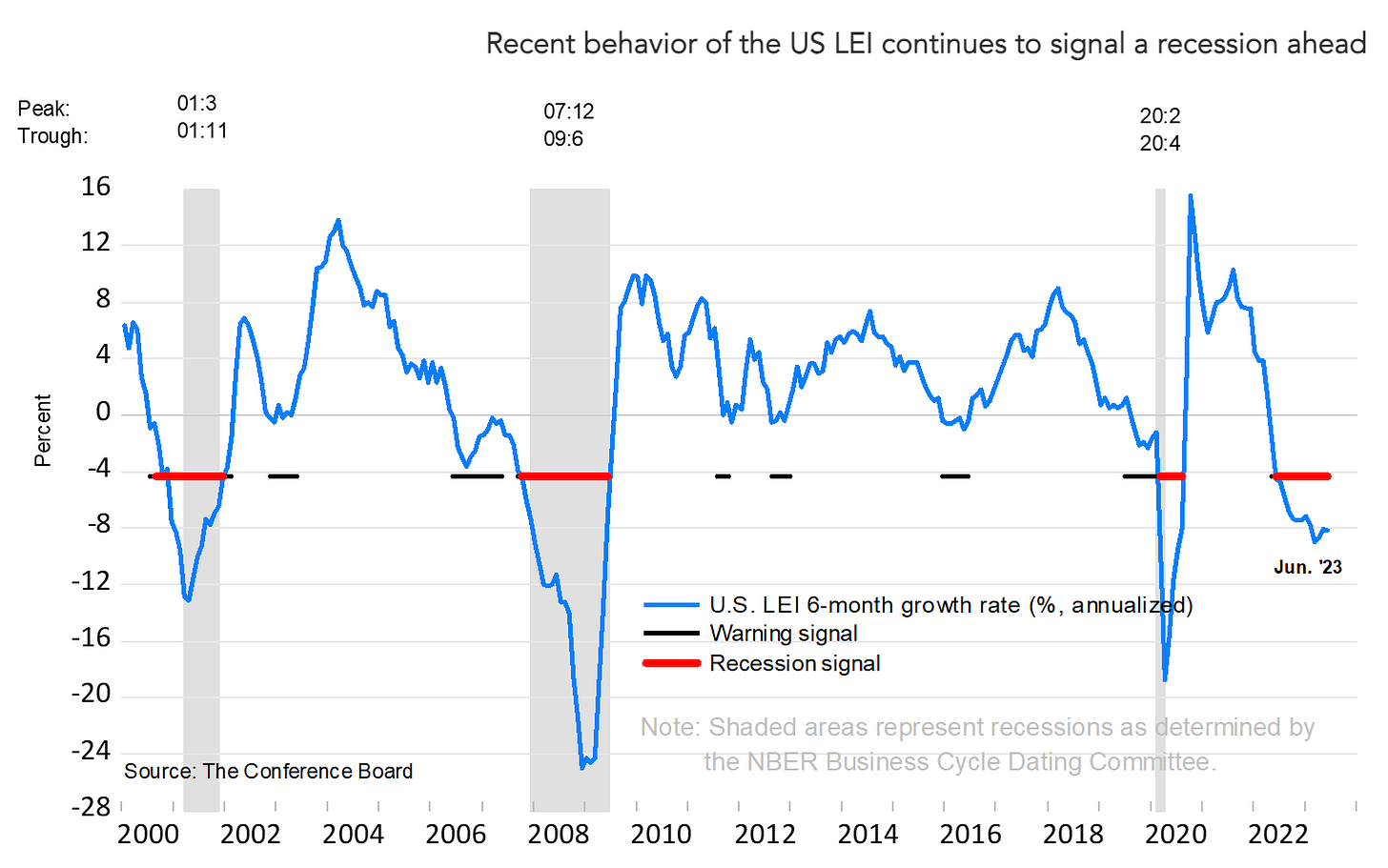

CBO Leading Economic Index

The Conference Board Leading Economic Index® (LEI) for the U.S. declined by 0.7 percent in June 2023 to 106.1 (2016=100), following a decline of 0.6 percent in May. The LEI is down 4.2 percent over the six-month period between December 2022 and June 2023—a steeper rate of decline than its 3.8 percent contraction over the previous six months (June to December 2022).

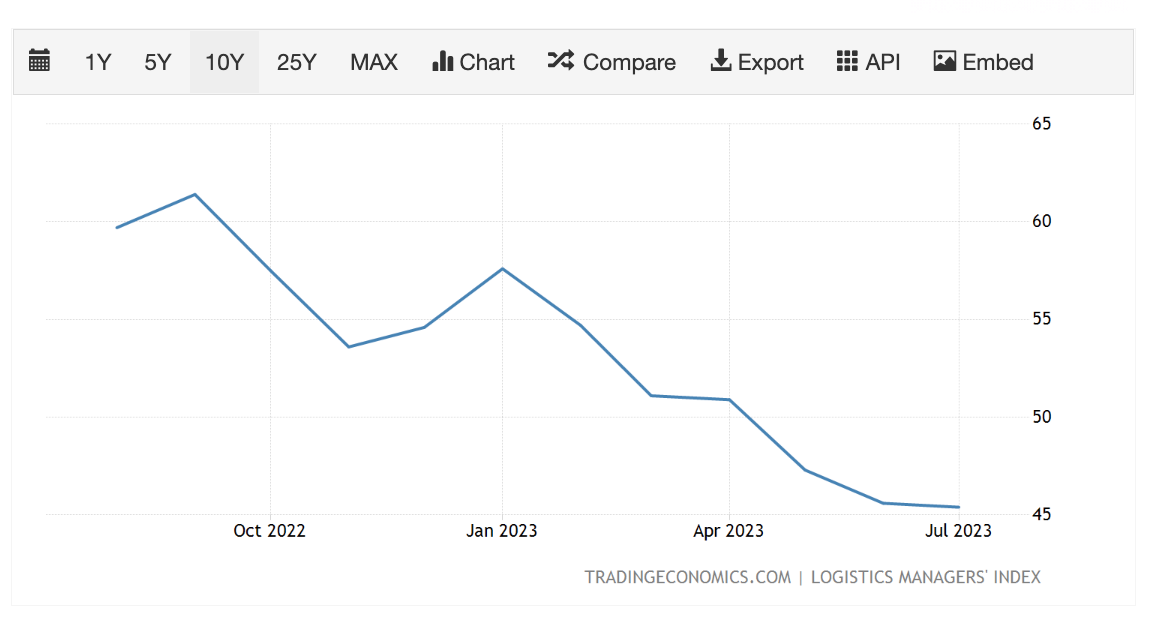

Logistics Manager Index

The Logistics Manager’s Index in the US fell to 45.4 in July 2023, marking not only a third consecutive month of contraction for the overall index, but also the fifth consecutive month it has reached a new all-time low. Inventory levels contracted at a record rate (-1 to 41.9), leading to lower growth for warehousing utilization (-4.3 to 52.5) and warehousing prices (-2.7 to 60.6), while warehousing capacity increased (+0.9 to 64.4). At the same time, growth for transportation capacity eased (-5.7 to 65.6) while transportation prices declined the least since April (2.8 to 35.6). "We continue to see very different outcomes for the overall economy and the logistics industry. This dichotomy is most clearly seen in employment figures. In the past we would expect to see transportation and warehousing ramping up hiring in late summer ahead of peak season. However, analysts do not see the same “urgency” towards hiring in the logistics industry so far this year", the LMI report showed. source: Logistics Managers' Index

My investing muse

The recent LEI, LMI and recent PMI (goods) are still not trending correctly. This week, we will see the PMI (services) that are likely to trend above 50 (implying growth). there is also an improvement in the shipping volume in July 2023. With Core PCE around 4.0%, it is still far from the Fed's target. So, I would say that the signs of economic recovery are there but we need more data to confirm.

From Factset, note that the blended earnings from S&P500 are on a downtrend ... for 2 quarters. From last quarter, the blended earnings total for S&P500 is down 9% (Factset).

What I would say is to give the economy more time. 1 month does not make a trend. Agriculture could be an opportunity due to the heat wave and flooding that is across the USA. Shipping rates have bottomed and are on a slight increase ... implying that inflation remains sticky as there is some recovery in the supply chain. The US debt ceiling has reached about 32.7T from 31.4T ~ this means that there is much more spending made by the government.

If we look at the recently reported agriculture (export), the USA is behind by a good volume too. Agricultural export inspection tonnage has dropped YoY:

16.9 million metric ton drop for corn

2.9 million metric ton drop for soybean

0.44 million metric ton drop for grain

The drop could be due to both supply and demand issues.

With the above, I recommend caution to monitor till we have more data that signals a recovery.

Comments

Post a Comment