Is Housing getting unaffordable in the US? (29Jun2023)

Over the last few years, we have seen a climb in inflation and recent house prices have hit record highs.

Is housing getting unaffordable in the US? Is the income sufficient to cope? For this article, let us focus on household income and home price growth.

Household income

This is the extract from a recent article dated 21 June 2023 from The Hill:

The typical U.S. family earns about $71,000 per year, according to the Census. Yet, the average American believes a family needs at least $85,000 in annual household income to get by, according to a recent Gallup poll.

According to this article, the typical US family is short of USD$14,000 per year. Is this why the total credit card debts in the USA have hit USD$988 billion?

Here is another news extract from The Hill dated 27 June 2023:

One-third of Americans with credit card debt say no one else knows how much they owe, according to a new report.

The nation’s credit card balance hovers around $1 trillion, and interest rates routinely top 20%. A typical American household now carries around $10,000 in card debt, by one recent WalletHub estimate. A rising share of cardholders carry a balance from one month to the next.

Multiple reports show American consumers sinking ever deeper into credit card debt. Rising card balances aren’t just about impulse buys: A survey by U.S. News & World Report found consumers using cards for unexpected expenses, medical emergencies and job loss.

The cost of living is proving to be a challenge for the typical American family. With the Fed predicting more rate hikes to follow, the debt will continue to weigh on them. This also implies that the inflation is likely to remain “sticky”.

US home prices

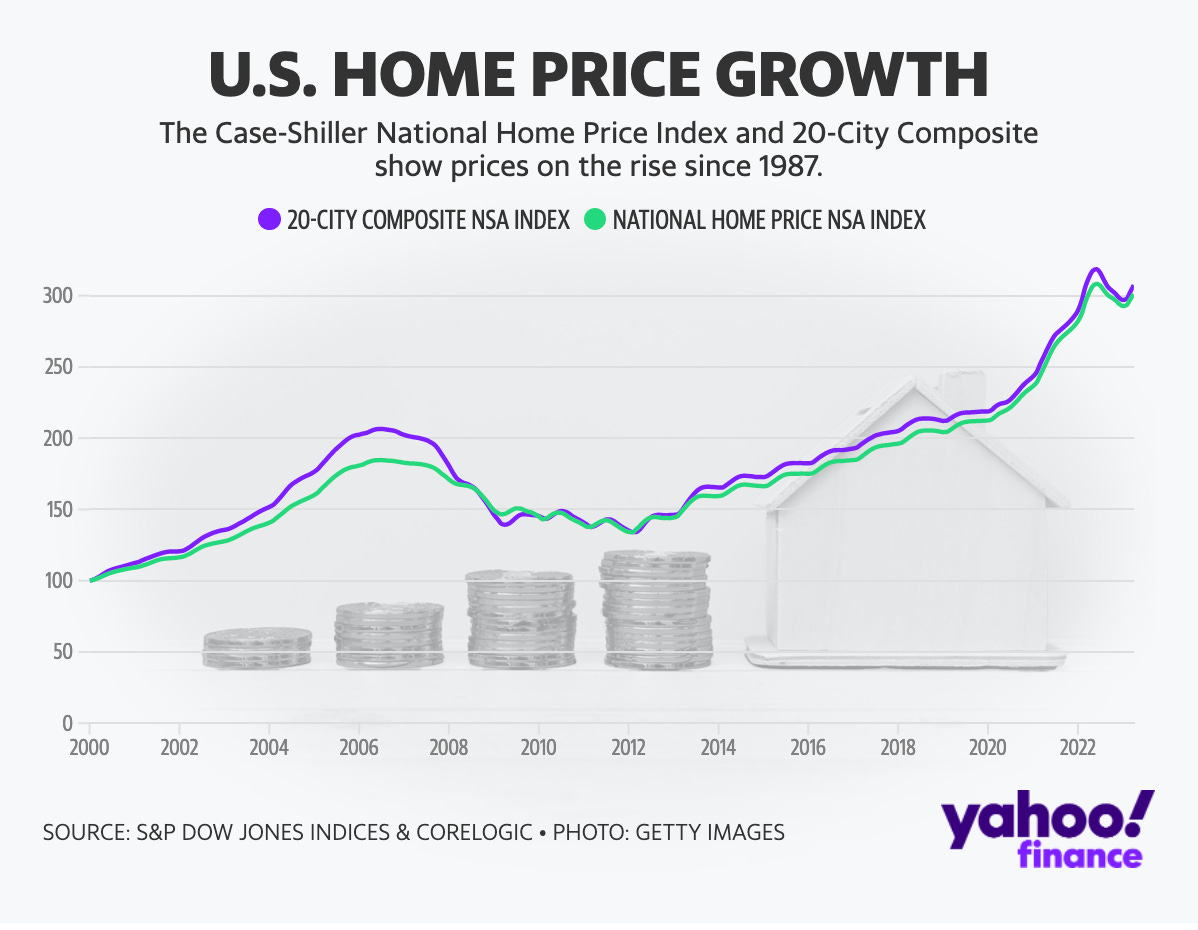

In the screenshot of the Yahoo Finance article dated 27 June 2023, we noted that the recent April prices have increased.

Here is an extract from the same news article:

Home prices grew for the third straight month in April, potentially cementing a recovery in values and reflecting a housing market that is sorely undersupplied.

The S&P CoreLogic Case-Shiller US National Home price index increased by 0.5% in April on a seasonally adjusted basis compared with the previous month, according to data released Tuesday. The index that tracks housing prices in the 20 biggest metros showed prices in April rose 0.9% on a seasonally adjusted basis over March, better than the 0.35% gain expected by economists surveyed by Bloomberg.

Similarly, the Federal Housing Finance Agency reported Tuesday that average US home prices grew 0.7% month over month in April on a seasonally adjusted basis.

It seems that home prices have started to increase (again) after the recent dip. Is this the reason why the Fed is anticipating more rate hikes?

My final thoughts

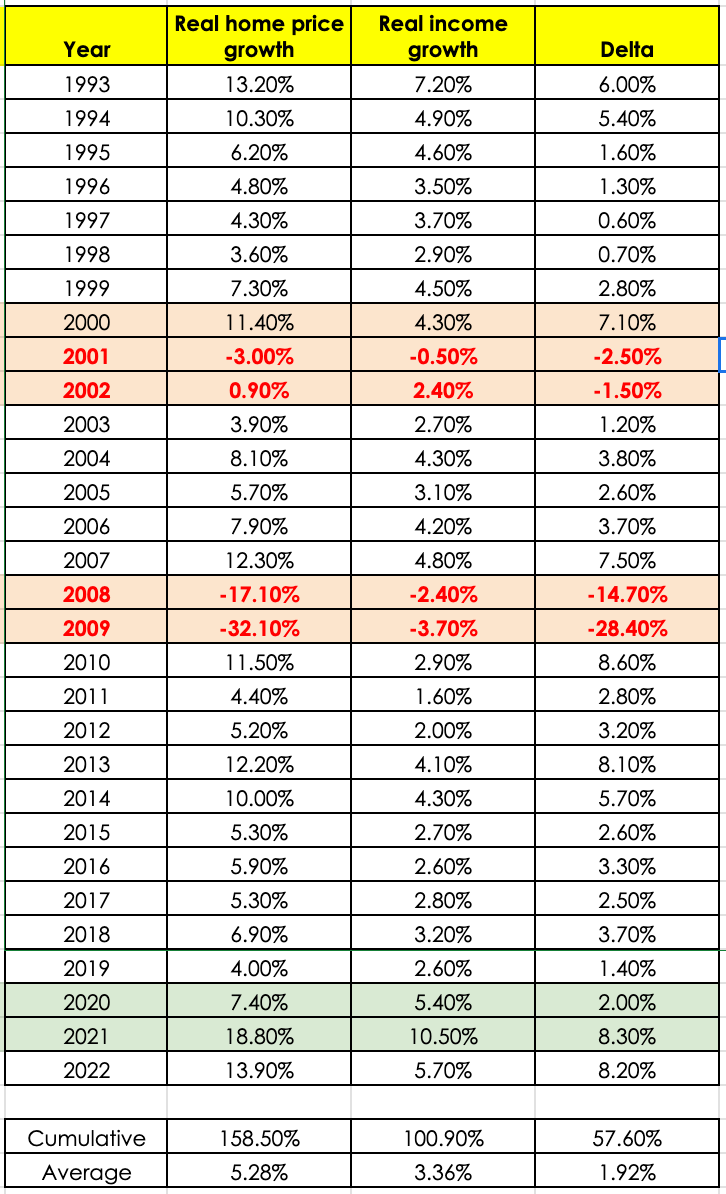

The rise in real income is not catching up with the real home price increase. This is causing housing to become more unaffordable. In some cases, family could have turned to credit facilities for their “cost of living”, causing more debt.

This is something that the government has yet to address adequately. With concerns of an approaching recession, this could get even worse in the coming months.

Research on real home price growth and real income growth

I have reached out to Google Bard to extract the real home price growth and real income growth for the last 30 years. This is what I have found. Note that we will be looking at real growth (that has included consideration of the current inflation).

Cumulatively, the real home price has grown 158.50% whereas the real income has grown by 100.90% for the last 30 years. There is a significant gap between real income and home price growth over the last 30 years.

Comments

Post a Comment